Recommended by Zain Vawda

Get Your Free Gold Forecast

XAU/USD Fundamental Backdrop

Gold struggled to remain above the psychological $1700 level on Friday as markets digested stronger than expected US job numbers. The precious metal still posted gains for the week in what was its best week since July. The precious metal continued its decline with a $12 drop in early trade today as rate hike expectations intensified once more.

Source: CME FedWatch Tool

The updated projections for the Fed’s rate hike path have seen a 18% increase over the past week for a 75bp hike at its upcoming November meeting. The recent job’s report seems to have solidified the Fed’s position in its fight against inflation. This follows last week’s comments by a host of Fed policymakers who had a simple message: rates hikes remain necessary in the fight against inflation for as long as it takes.

For all market-moving economic releases and events, see the DailyFX Calendar

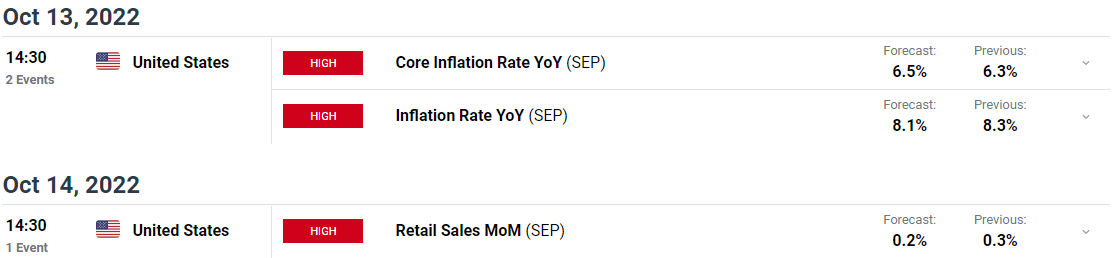

The year has proved interesting for the precious metal as the US Dollar has been preferred as a safe haven while unprecedented Treasury yield rates have played a massive part. The price of gold has already declined some 17% from its YTD highs while a new YTD low cannot be ruled out at this stage. Later this week we have US CPI as well as US retail sales with US CPI of particular interest as the core inflation rate is set to rise once more while the inflation rate YoY is set to decline. The prints from these two data points could serve to enhance the Fed’s conviction around rate hikes.

Later in the day we have Fed policymakers Charles Evans and Lael Brainard speaking. Should policymakers stick to recent rhetoric and not spring any surprises, it’s unlikely these speeches will change the overall sentiment of markets toward the dollar. US bond markets and most banks are closed today as the US celebrate Columbus Day which could result in less liquidity and volatility as we start the week.

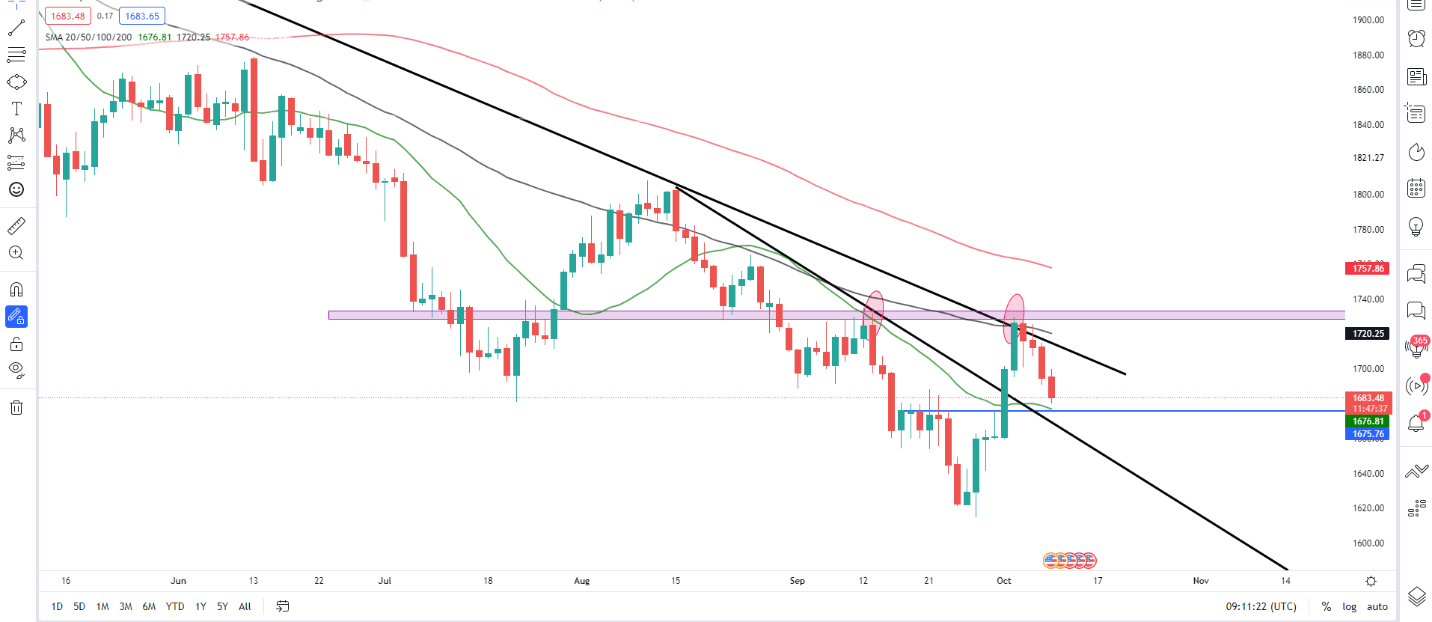

XAU/USD Daily Chart – October 10, 2022

Source: TradingView

From a technical perspective, we are seeing mixed signals for the precious metal. On the weekly timeframe last week’s close completed a morningstar candlestick pattern which indicates strong potential for further upside. On the daily timeframe price double-topped last week around the resistance area $1730 before pushing down. A bearish candle close on Friday below the $1700 psychological level confirming the mixed signals at play when looking at price action.

The 1700 key psychological level remains key with immediate support resting around the $1670-1675 area. The $1675 area lines up perfectly with the 20-SMA which could provide support in pushing price back toward the $1700 level. The YTD lows are back in sight with a break below the support area opening up the possibility of the precious metal reaching the $1600 level.

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Zain Vawda

Key intraday levels that are worth watching:

Support Areas

•1675

•1650

•1615

Resistance Areas

•1700

•1730

•1750

| Change in | Longs | Shorts | OI |

| Daily | 3% | 13% | 5% |

| Weekly | -11% | 20% | -5% |

Resources For Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicators for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Be the first to comment