happywhale/iStock via Getty Images

By Alex Rosen

Summary

SPDR S&P Aerospace & Defense ETF (NYSEARCA:XAR) tracks a collection of U.S. aerospace and defense companies. The fund has shown steady growth since inception, up 15% while spreading its holdings among large, mid and small cap companies in a 40/40/20 ratio.

The fund holds predominantly electronic tech sector companies (86%) and exclusively invests in the United States.

In a time where global demands for arms is at a premium, and the aerospace industry is taking off, we rate XAR a hold until after the apocalypse.

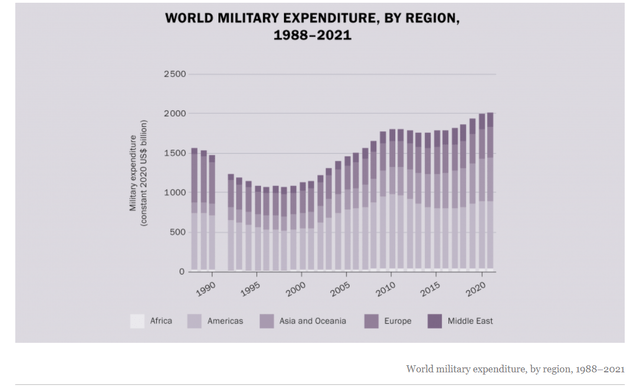

Global defense spending continues to grow (Stockholm International Peace research Institute)

Strategy

XAR does nothing fancy. It holds large, mid and small cap U.S. based aerospace and defense companies. Overall, the fund has 34 unique assets, with the top ten comprising 42% of the total fund. It’s straight forward, with a low expense ratio (.35%).

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Industry

-

Sub-Segment: Aerospace and Defense

-

Correlation (vs. S&P 500): High

-

Expected Volatility (vs. S&P 500): Low

Holding Analysis

XAR’s limited portfolio reflects the narrow focus of the fund. The concentration in U.S. companies is understandable considering the U.S. is the largest manufacturer, exporter and consumers of weapons and aerospace. The individual holdings reads like a who’s who of defense and aerospace companies. At the top, Axon (AXON) formally Taser, heads up the list representing 5.5% of the fund. Curtiss-Wright (CW) maker of airplane parts and nuclear submarine parts holds 4.36%, followed by Lockheed Martin (LMT), Boeing (BA) and Raytheon (RTX).

Strengths

War huh, what is it good for? War is good for the defense industry, that’s what. Since the start of the war in Ukraine, almost $100 billion in military hardware has been sent to support the effort. Everything from light arms to surface to air missiles have been sent to help the Ukrainians fight off the Russian invasion. On the other side, Russia has been buying drones from Iran among other things, and they are running out of munitions.

At the same time, the race back to the moon and beyond is on. Never has there been a better time to be in the private space exploration/satellite launching business.

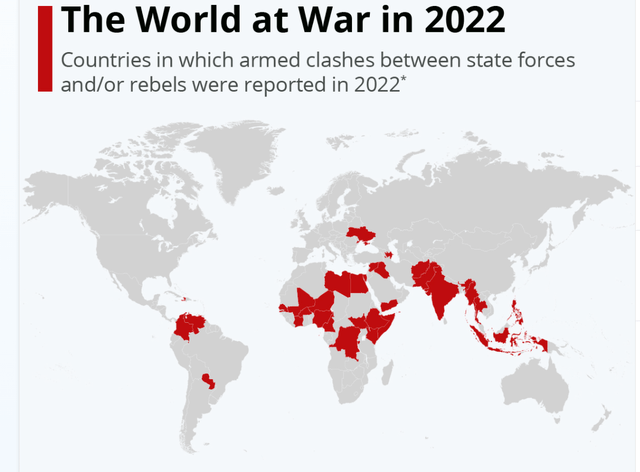

The truth is, XAR is well positioned to capitalize on global instability, and the longer the conflicts persist, the better they do. Despite how it may seem, the war in the Ukraine is far from the only current conflict. Yemen is in the midst of a proxy war between Iran and Saudi Arabia; Syria is still in the grips of civil war; Ethiopia is fighting rebels; in Eastern DRC, M23 and the Congolese Army are fighting, and these are just a few of the many ongoing conflicts. Also, don’t forget the constant threat of a full-scale invasion of Taiwan, and the U.S.’s own ever expanding military industrial complex.

Plenty of Demand for Munitions (Statista.com)

Weaknesses

Aerospace and defense industries are not for the faint of heart. They require deep pockets and advanced technical capacity. R&D is critical for success and despite what seems like a never-ending demand, profit margins are nothing compared to companies in the extraction business. Global defense spending is at an all-time high, and even with that, XAR is showing only small returns.

There will always be a need for defense spending, but exotic new weaponry and advanced systems are expensive, and for most of the world, a luxury item.

Opportunities

The real growth area here is in aerospace. The aviation industry has recovered since the pandemic and is predicted to continue to grow. People are tired of staying home, and the airline industry is responding. Growth in the sector will continue as long as the demand persists.

Threats

The whole world drops its weapons and we all hold hands and sing Kumbaya? Not likely. A more realistic threat is another global pandemic that shuts down the aerospace industry. An escalation of global conflicts that leads to its inevitable conclusion.

The reality is that XAR is swimming in a sector that is fairly recession-proof. The demand for bigger and better weapons will always be there, and the threats to the industry are really only on the balance sheets and not in the battlefields.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

XAR is a very sound ETF from a technical perspective. Whether or not you like the industry is irrelevant. The fund has a very clear objective, and it achieves it. The holdings are balanced as advertised, and the expense ratio is low.

The single country focus makes it even easier to understand from an investment standpoint.

ETF Investment Opinion

Whatever our personal opinions are about the sector, it’s hard to deny its persistent demand. This is not an infant industry or an experiment. This is real life guns and planes. Those are things that always sell, and even if for a moment the aerospace industry sees a slowdown in demand, it can always count on a return to glory.

For these reasons, we rate XAR a Hold.

Be the first to comment