CloudVisual

W&T Offshore (NYSE:WTI) stock price increased by about 60% in the past month due to the increased oil and gas production in the Federal Gulf of Mexico and hiked oil and natural gas prices. As the war in Ukraine continues, the energy crisis in Europe intensifies, and U.S. oil and natural gas exports increases. I expect WTI’s 3Q 2022 financial results to be strong. Also, in the fourth quarter of the year 2022 and the first half of the year 2023, WTI will benefit from the market conditions and make huge profits. The stock is a buy.

Quarterly results

In its 2Q 2022 financial results, WTI announced total revenues of $274 million, compared with 2Q 2021 total revenues of $133 million, driven by increased oil and natural gas revenues. The company’s oil revenues increased by 81% YoY and 29% QoQ to $159 million in 2Q 2022. Also, WTI’s natural gas revenues increased by 188% YoY and 80% QoQ to $92 million in 2Q 2022. The company’s total costs and expenses increased from $99 million in 2Q 2021 to $111 million in 2Q 2022, driven by increased leased operating expenses. The company reported a net income of $123 million in the second quarter of 2022, compared with 2Q 2021 and 1Q 2022 net loss of $52 million and $2 million, respectively. WTI’s 2Q 2021 and 1Q 2022 net loss per diluted share of $0.36 and $0.02, respectively, turned into a net income per diluted share of $0.86 in the second quarter of 2022.

The company’s total oil and natural gas sales volumes increased from 3721 MBoe in 2Q 2021 and 3398 MBoe in 1Q 2022 to 3859 MBoe in 2Q 2022. WTI’s oil sales volume increased from 1352 MBbls in 2Q 2021 and 1304 MBbls in 1Q 2022 to 1476 MBbls in 2Q 2022. Its natural gas sales volume decreased from 12189 MMcf in 2Q 2021 to 10471 MMcf in 1Q 2022 and then increased to 11995 MMcf in 2Q 2022. “We are very pleased with our mid-year reserve report that showed strong reserve growth. Positive performance and pricing revisions, combined with the acquisitions made in the first half of the year allowed us to replace about two and a half times our production,” the CEO commented.

The company’s oil average realized sales price (before the impact of derivative settlements) increased from $65.11 in 2Q 2021 and $94.10 in 1Q 2022 to $107.90 in 2Q 2022. Also, its natural gas average realized sales price (before the impact of derivative settlements) increased from $2.66 in 2Q 2021 and $4.91 in 1Q 2022 to $7.70 in 2Q 2022. “The Company is well positioned with a solid balance sheet and stable production that will allow us to generate meaningful cash flow for years to come,” the CEO stated.

The market outlook

According to International Energy Agency (IEA), World oil demand is projected to increase by 2.1 million barrels per day in 2023. World oil production rose to 101.3 mb/d in August 2022 and is expected to increase to 101.8 mb/d in 2023. European Union and United Kingdom’s oil import from Russia decreased by 880 kb/d since the start of the year to 1.7 mb/d. On the other hand, their oil import from the United States increased by 400 kb/d to 1.6 mb/d. The EU embargo on Russian crude oil imports that comes into effect in December 2022 means that European countries will need to increase their oil reallocations from other countries.

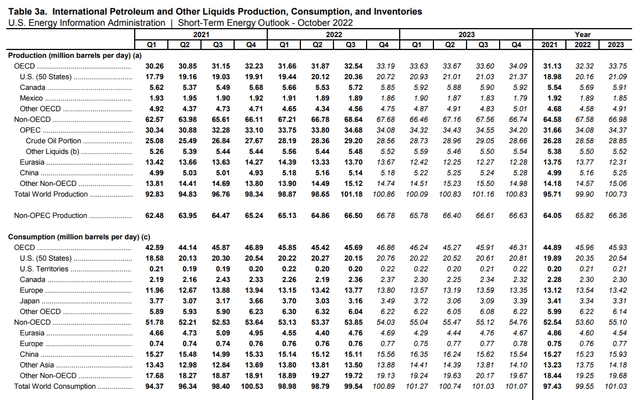

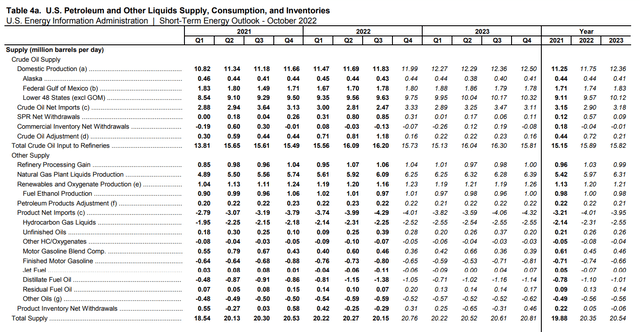

Furthermore, Energy Information Administration (EIA) expects that world petroleum and other liquids production and consumption to increase in 2023 (see Figure 1). Total world petroleum and other liquids production and consumption in all of the quarters of 2023 are expected to exceed 100 million barrels per day. U.S. oil production was 20.12 mb/d in 2Q 2022 and 20.36 mb/d in 3Q 2023. It is expected to increase to 20.72 mb/d in 4Q 2022, 20.93 mb/d in 1Q 2023, and to more than 21 mb/d in 2Q-4Q 2023. U.S. petroleum and other liquids consumption is expected to increase from 20.35 mb/d in 2022 to 20.54 mb/d in 2023.

Figure 1 – International petroleum and other liquids production and consumption

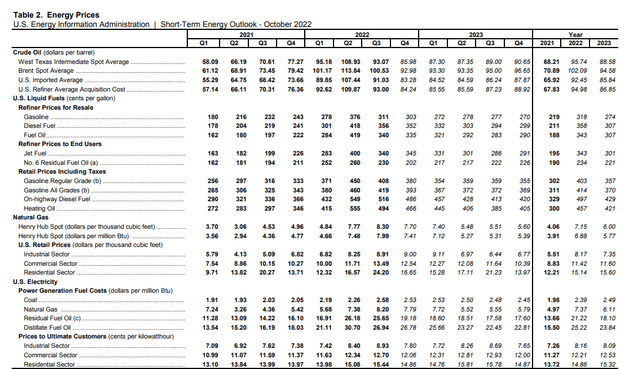

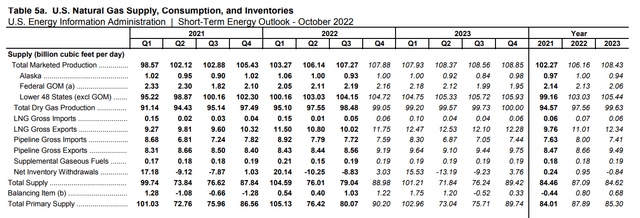

Furthermore, due to higher household energy consumption as a result of colder temperatures, OPEC+ production cut, the continuing war in Ukraine, and continuing sanctions on Iranian oil and gas, crude oil and natural gas prices will remain high for the rest of 2022. EIA expects Brent crude oil spot price averages $93 per barrel in 4Q 2022 and $95 per barrel in 2023. Also, EIA forecasts Henry Hub’s natural gas spot price to average $7.40 per MMBtu in 4Q 2022 and then fall below $6.00 per MMBtu in 2023 as U.S. natural gas production rises. Figure 2 shows that crude oil prices in the United States in 3Q 2022 were lower than in 2Q 2022 and are expected to decrease further in 4Q 2022. On the other hand, natural gas prices in the United States in 3Q 2022 were higher than in 2Q 2022. U.S. natural gas prices in 4Q 2022 are expected to be close to their levels in 2Q 2022.

Figure 2 – Energy pieces in the United States

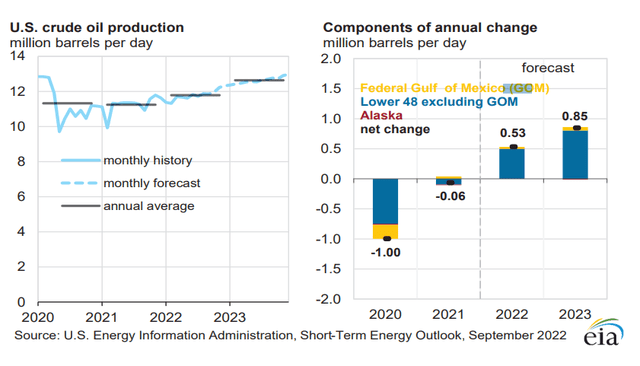

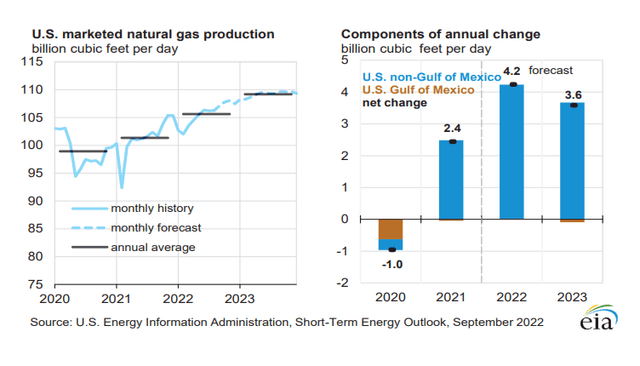

“As of June 30, 2022, WTI had working interests in 47 fields in federal and state waters and has under lease approximately 637,000 gross acres, including approximately 462,000 gross acres on the Gulf of Mexico Shelf and approximately 175,000 gross acres in the Gulf of Mexico deepwater,” the company announced. According to Figure 3, U.S. crude oil production in the Gulf of Mexico is expected to increase in 2023. However, Figure 4 shows that U.S. natural gas production in the Gulf of Mexico in 2023 is expected to be lower than in 2022.

Figure 3 – U.S. crude oil production and its components

Figure 4 – U.S. natural gas production and its components

Performance outlook

According to Figure 5, the U.S. crude oil supply in the Federal Gulf of Mexico in 3Q 2022 was higher than in 2Q 2022. It is expected to increase further in 4Q 2022 and 1Q-3Q 2023. Furthermore, according to Figure 6, the U.S natural gas supply in the Federal Gulf of Mexico in 3Q 2022 was higher than in 2Q 2022. Also, the 4Q 2022 and 1Q 2023 U.S natural gas supply in the Federal Gulf of Mexico is expected to be higher than in 2Q 2022. Thus, based on the hiked oil and natural gas prices and the increasing oil and natural gas supply in the Federal Gulf of Mexico, I expect WTI’s total revenues in 3Q 2022 and 4Q 2022 to be strong. I estimate that the company’s 3Q 2022 natural gas revenues be higher than in 2Q 2022. Also, I expect its 4Q 2022 natural gas revenues to be as strong as 2Q 2022. Moreover, I expect WTI’s oil revenues in 3Q 2022 to be as strong as in 2Q 2022. However, its 4Q 2022 oil revenues will be lower than in 2Q 2022. With current levels of oil and natural gas prices and current levels of production, WTI will make a huge profit in the second half of 2022 and the first half of 2023.

Figure 5 – U.S. petroleum and other liquids supply

Figure 6 – U.S. natural gas supply

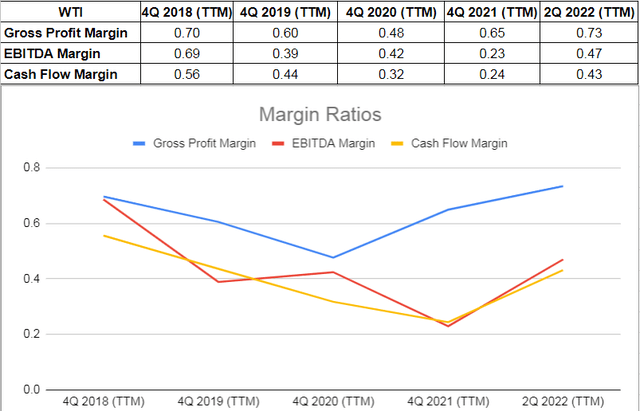

I looked at W&T Offshore’s profitability ratios to realize how the company can turn a profit and use its assets to bring profit for its investors. I examined the profitability ratios by margin ratios to provide insights into the financial health of the company. I calculated the ratios in comparison to previous years to be more helpful. Generally, margin ratios evaluate the company’s ability to turn revenues into profits. It is clear that this company has had higher gross profit, EBITDA, and cash flow margins in TTM compared with the end of 2021. In detail, WTI’s profit margin increased by 12% to 0.73 in TTM compared with its level of 0.65 in 2021. Also, after a severe decline to 0.23 in 2021 from its level of 0.42 in 2020, its EBITDA margin improved back to 0.47 on 30 June 2022 (TTM). Examining the EBITDA margin has the advantage of excluding fluctuating costs and providing a clear view of the company’s performance. Finally, the company’s cash flow margin has about doubled and sat at 0.43 on 30 June 2022 from its previous level of 0.24 at the end of 2021. The cash flow margin indicates the relation between operating cash flow and the company’s total revenue. In summary, W&T Offshore’s profitability metrics across the board of margin ratios indicate that the company is in a solid condition and the management is able to balance its financial statements. Thus, not only can they minimize expenses, but also take advantage of upcoming growth opportunities (see Figure 7).

Figure 7 – WTI’s margin ratios

Summary

In terms of market condition, oil and natural gas prices will remain high as a result of the Russian oil sanctions and the natural gas crisis in Europe. Also, oil production in the Gulf of Mexico is expected to increase in the following quarters. Also, natural gas production in the Gulf of Mexico in 3Q 2022 increased and will remain higher than in 2Q 2022 for the next two quarters. In terms of the company’s performance, 2H 2022 financial results will make the company able to improve its financial health and reduce its net debt. I am bullish on the stock.

Be the first to comment