hapabapa

It’s official: with a hawkish Fed intent on raising rates, investors aren’t taking any chances with tech stocks. The slightest bad news produces huge losses; and the market is gravitating around the strongest, most stable names.

Workday (NASDAQ:WDAY), unsurprisingly, falls into this “stable” category. The undisputed leader in HCM software and a giant in its own right in its second category, financial management software, has just released strong second-quarter results that bucked the trend of disappointing earnings releases elsewhere in the sector. While many other software companies cited slowing deal cycles and FX headwinds as drivers for cutting their outlooks, Workday held firm to its targets. The company’s confidence drove the stock up ~3% post-earnings (especially impressive as on that same day, the broader market fell roughly 3% on Fed Chair Jerome Powell’s hawkish statements at Jackson Hole).

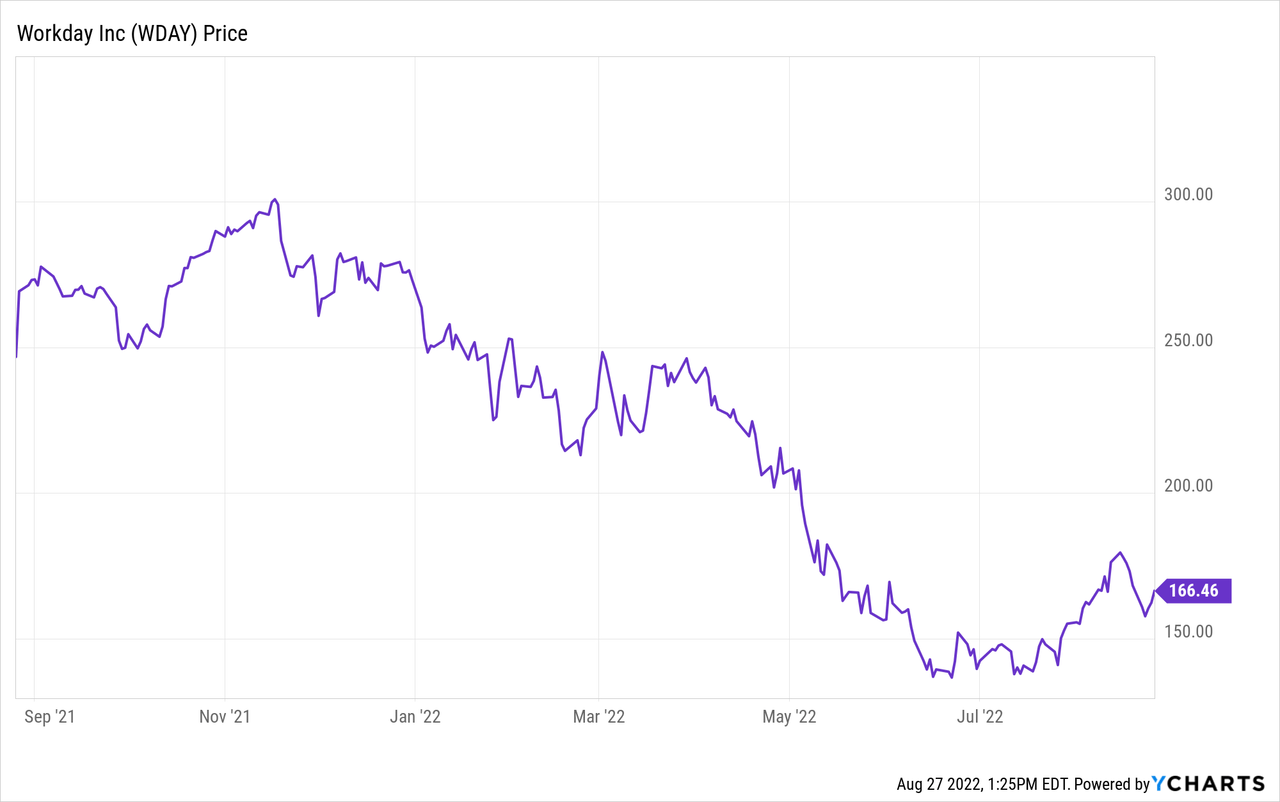

The stock remains down nearly 40% year to date, but in my view, Workday is well on track to recovering these losses and continuing to outperform tech peers over a 12-month horizon:

I remain solidly bullish on Workday. This is a company that has claimed dominance in two massive areas of enterprise software totaling more than $100 billion in market opportunity. Workday’s brand prominence is undisputed in the IT community, and its years of solid operational excellence speak to the quality of its execution. It’s worth noting as well that “backend” software systems like Workday, which integrate deeply into core corporate functions like payroll, accounting, and financial reporting, are extremely costly to rip out once installed – making Workday a perfect example of a software company that is a true “land and expand” play.

For investors who are newer to Workday, here’s a refresher on what I consider to be the key bullish drivers for this stock:

- Category leadership in two very large markets in enterprise software. For investors who don’t have the history, Workday was born out of ex-Oracle employees who eventually turned Workday into a premier cloud software solution for HR. The company has now extended that dominance into financial/ERP software, and together between these two markets Workday now sits on a massive $105+ billion market opportunity.

- Cloud-based, recurring revenue software. Workday has always been one of the “original” large-cap software companies, alongside Salesforce.com. Its revenue base is almost purely driving from subscriptions, giving Workday a powerful recurring revenue stream from which to grow.

- Ample resources and cash. Workday has more than $6 billion of cash on its balance sheet, giving it plenty of financial firepower to pursue both organic and inorganic growth.

- Growth/profitability balance. Workday is a “Rule of 40” software stock, which is a goal many fellow enterprise software companies strive to achieve and fail to do. With 20%+ revenue growth on top of 20%+ pro forma operating margins, Workday has achieved a level of growth/profitability balance that should give investors some comfort in a choppy stock market.

Surprisingly, in spite of these strengths that have set Workday apart from many other SaaS names, Workday remains quite modestly valued. At current share prices near $166, Workday trades at a market cap of $42.22 billion. After we net off the $6.29 billion of cash and $4.12 billion of debt on Workday’s most recent balance sheet, the company’s resulting enterprise value is $40.06 billion.

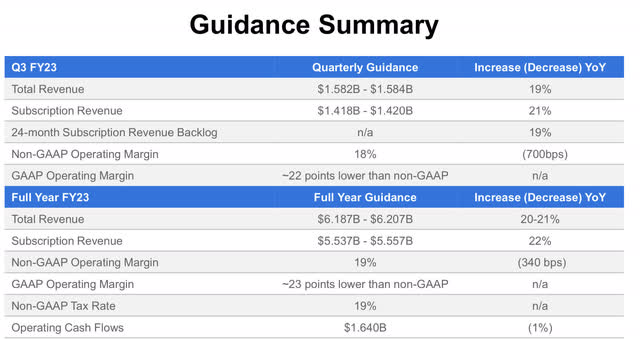

For the current fiscal year FY23 (which for Workday is the year ending in January 2023), Workday has maintained its full-year revenue guidance at $6.19-$6.21 billion, representing 20-21% y/y growth. This is quite an impressive growth rate for a company at a $6+ billion annual revenue scale, not to mention in a macro environment full of headwinds (ranging from a slowdown in corporate spending to FX headwinds).

Workday outlook (Workday Q2 earnings deck)

Looking ahead to FY24, Wall Street expects Workday to continue growing at a 20% y/y pace to $7.40 billion in revenue (data from Yahoo Finance). The company has also maintained its long-term target of hitting $10 billion in revenue by FY26 (implying at least 16-17% y/y growth throughout FY25 and FY26) and 25% pro forma operating margins at that time.

On a near-term basis, Workday’s valuation multiples sit at:

- 6.5x EV/FY23 revenue

- 5.4x EV/FY24 revenue

Note that historically, Workday’s multiples have tended to sit at a 7-8x forward revenue range (and during the pandemic, this multiple stretched to the low teens). Though higher rates do necessitate that valuation multiples compress, I think it’s still a great time to invest in Workday for the long haul.

Q2 download

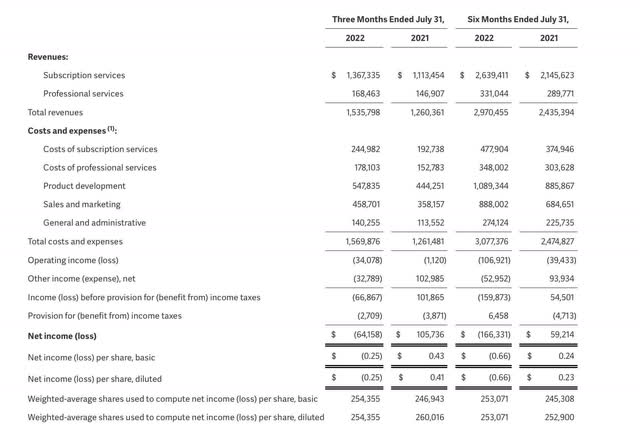

Let’s now go through Workday’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Workday Q2 results (Workday Q2 earnings deck)

Workday’s revenue in Q2 grew at a 21% y/y pace to $1.54 billion, beating Wall Street’s expectations of $1.52 billion (+20% y/y). Revenue growth also didn’t decelerate versus 21% y/y growth in Q1; though Workday is implying that revenue will decelerate to 19% y/y growth in Q3 (though Workday does have a history of guiding slightly conservatively and exceeding its mark).

Q2 came with a slew of strong customer wins. As shown in the chart below, the company signed on a number of notable names, including fellow SaaS giant Salesforce (CRM) and financial services company Raymond James.

Workday Q2 logo wins (Workday Q2 earnings deck)

Workday also achieved FedRAMP certification at the “moderate” security level, which marked the company’s entry into the federal government sales space. As seasoned software investors are aware, federal government contracts often represent among the most lucrative deals in the software sector.

Recall that in Q1, Workday noted that several deals had seen elongating cycles – and many investors worried at the time that this would mean lost revenue. Workday noted that two of the large deals that delayed in Q1 ended up closing successfully in Q2.

The company continues to expect an “uncertain” environment through the rest of the year, but hopefully the dynamics will be similar to the deals that pushed out of Q1 and into Q2 – with little permanent loss of revenue. Per co-CEO Chano Fernandez’s prepared remarks on the Q2 earnings call:

Our strong Q2 results were driven by momentum across several of our key growth initiatives, including customer base, international, medium enterprise and the office of the CFO, a testament to our strategy and the significant long-term opportunity that we have ahead.

In addition, as Aneel mentioned, we closed the two largest deals that slipped out of Q1. And while the near-term market environment remains uncertain and we are not immune to it, we continue to see organizations of all sizes prioritizing their investments with Workday to continue their digital backbone transformation and drive increased agility and flexibility […]

As we move through the second half of the year, we expect the environment to remain uncertain, and we see signs that in certain deal cycles, particularly some of our more strategic opportunities, there is increased scrutiny and potentially longer sales cycles. As buyers do extra work before making investment decisions during these uncertain times.

The good news is that when companies go through their due diligence, we typically come out on top, given the compelling return on investment and reduce total cost of ownership that our solutions provide. Our track record of successful deployments of scale and our reference base of thousands of customers who can speak to the meaningful business value that Workday delivers.“

Pro forma operating margins did slip in the quarter, consistent with many other companies facing wage inflation pressures. Pro forma operating margins of 19.6% were 360bps weaker than 23.2% in the year-ago Q2, and management expects margins to slip to 18% in Q3. We note though that at least as of Q2, Workday retains its “Rule of 40” status with 21% y/y revenue growth and 20% operating margins.

Key takeaways

Strong category leadership, consistent execution, rich gross and pro forma operating margins, and a path to hitting $10 billion in revenue and 25% margins by FY26 – there are a lot of reasons to like Workday, especially in the current volatile environment. Keep riding the recent upside momentum here.

Be the first to comment