Taiyou Nomachi

Published on the Value Lab 10/18/22

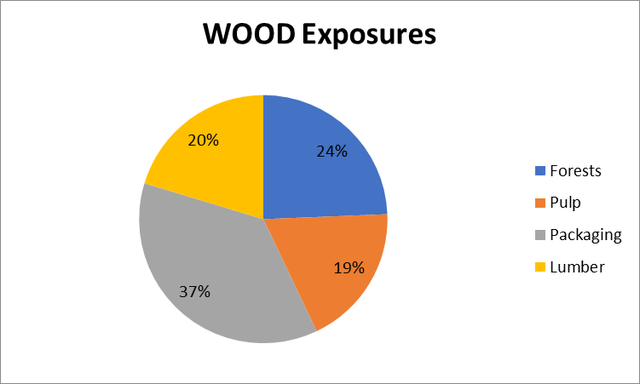

The iShares Global Timber & Forestry ETF (NASDAQ:WOOD) is really low multiple right now. While lots of its exposures mostly deserve it, not all do. There’s quite a lot of vertical integration in this portfolio to deal with the fact that Russia has cut supply of its birch trees to the west. We think it’s good value, but going to be a pretty volatile ride.

WOOD Breakdown

What does WOOD contain? Lots of stocks that do one or more of the following things:

- Produces corrugated packaging, other types of packaging and paper. This goes into a lot of consumer staples and products, but also offices which is not the most vibrant application, as well as construction (for construction paper) and hygiene.

- Some packaging producers are also producers of pulp, which means they take fiber from timber, both hardwoods and softwoods depending on the products’ needs, and create pulp which is then used for producing packaging. Pulp can also be produced from recycled paper and packaging.

- Some packaging producers and/or pulp producers also have their own forests and own the timber commodity, which can be used both for the paper and packaging industry as described above, or can be processed at sawmills and used directly in construction as lumber or used to make OSB and other lower density wood products.

- Sawmill owners also exist here who produce OSB, plywood and lumber for construction and DIY markets.

The trouble is that many companies are vertically integrated, so how all these activities are divided up within them isn’t always super clear. There’s 29 holdings here, and because we’ve covered these ideas in the past here’s our breakdown by activity based on the largest companies and the first couple of pages of holdings (note that this is a coarse breakdown).

Estimated Activity Breakdown (iShares.com)

Remarks

The big development is that Russia who supplies 10% of the world’s timber, is not retaliating against Western markets by cutting its supply of iconic Russian birch. We called it. Who suffers here?

Birch is used for a lot of soft products, so packaging doesn’t directly suffer too much, but some of the companies we put in packaging will suffer directly because they need that special pulp for hygiene products. Pulp producers will see higher birch fiber input costs for pulp production, but they typically pass these on and take the moment to expand margins. Also, companies that are not strategically positioned may have to reduce volumes and go on downtime, which means the capacity becomes more valuable. On balance, pulp producers shouldn’t get hurt, while some that have access to Russian supply because they don’t operate in the Western bloc will benefit a lot. This consequently means that even packaging companies that don’t directly produce products that need the short fiber from birch will suffer as their inputs will rise since capacity will be lower broadly and pulp producers will be raising prices. Indeed, wood pulp prices are broadly rocketing way ahead of even the worst of the goods boom in the protracted 2020-2021 lockdown. Forest owners will benefit if they have timber that can become fiber that will substitute the lost supply in birch.

In general, the industry has also been suffering due to higher logistic costs, which would include lumber as well which we haven’t yet mentioned. Lumber has some more idiosyncratic macroeconomic risks, specifically that it is levered to DIY and also newbuild construction. The building phase that involves lots of lumber has passed for the current cycle, and the rate situation and declines in real estate limits a revival there. Nonetheless, secular supply side support and very low multiples make lumber still an attractive part of the portfolio.

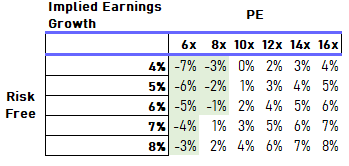

The multiple on this ETF is 6x. That’s very low and implies a 18% earnings yield.

EFT Value Chart [VTS]

According to our value matrix for ETFs, that implies a precipitous long-term decline that would reflect total secular obsolescence of the related markets. At the 5% assumed terminal interest rate (it could end up being higher), the -6% declines rival almost the short term fluctuations of the lumber companies, whose economics are the most volatile, even though the -6% refers to a terminal growth rate. There is value here, but the multiple is low because the expected volatility is substantial. A lot of this portfolio, meaning lumber and pulp, and to a lesser extent forestry which has honestly been pretty steady at all points in this latest cycle starting from the pandemic, are total commodities and feature a decent amount of operating leverage due to the industrial economics. Nonetheless, while under margin pressure for the time being, the packaging activity is more resilient, and some of the commodities in this portfolio are exposed well geopolitically. Overall, we like WOOD.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment