ollaweila

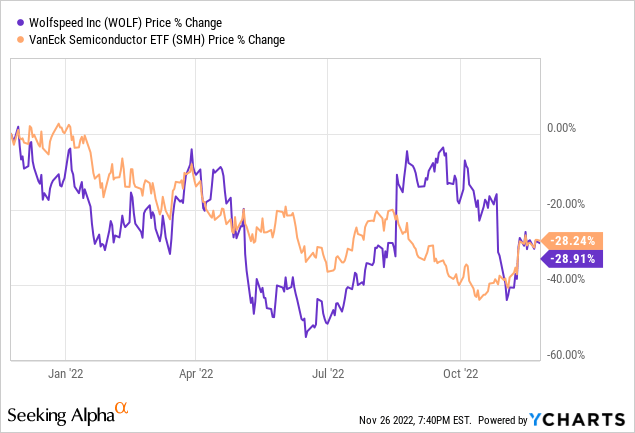

Silicon carbide (“SiC”) specialist Wolfspeed (NYSE:WOLF) appeared to be the current darling of the semiconductor industry and was on the way to significantly outperform the broad semiconductor sector – as represented by the VanEck Semiconductor ETF (SMH) – this year. But then WOLF’s Q1 report (and Q2 guidance …) was released and caused the stock to drop ~20% (see below). As I said in the bullets, WOLF stock is not for the faint-of-heart. However, in the mid- to longer-term, WOLF’s prospects for establishing its SiC technology in the very large and growing low-power/efficiency conscious EV market appears very bright. Today I’ll look at the company from a good news/bad news point of view and let you decide if the WOLF growth opportunity is currently worth an allocation of your investment dollars.

Investment Thesis

Silicon-carbide based semiconductors are quickly becoming the semiconductor technology-of-choice for low-power and efficiency conscious EV-makers. Wolfspeed – being one of the leading SiC providers – is growing like a weed. The company ran a $200 million business back in 2017, but last month reported $241.3 in quarterly million revenue for Q1 FY2023 alone (+54% yoy).

Wolfspeed

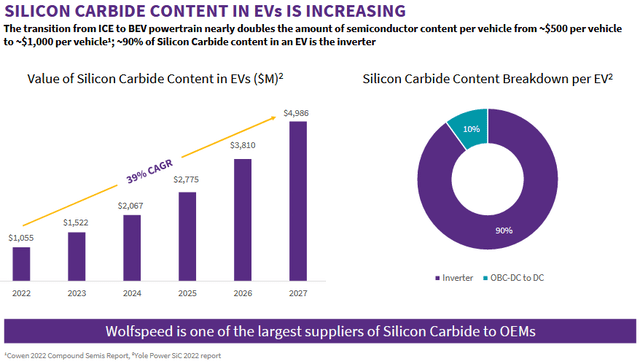

As can be seen in the graphic above, SiC content in EVs is expected to grow at a 39% CAGR over the next 5-years. 90% of that demand will be for inverters, and 10% will be for on-board chargers (“OBCs”). Investor’s Business Daily says SiC is chip makers’ “Next Gold Rush“. WOLF, being one of the largest suppliers of SiC, is in a great position to win its share (and perhaps a dominant share) of the SiC EV market.

The Good News

In addition to the macro-outlook related to the EV/SiC global market opportunity mentioned above, good news was also plentiful on the Q1 FY23 conference call and WOLF President & CEO Greg Lowe was happy to share some insights & highlights with investors and analysts:

Our device opportunity pipeline has increased to more than $40 billion, more than double the $18 billion that we talked about at our last Investor Day. And our sales team … posted another record quarter in Q1 with $3.5 billion of design-ins. Our last four consecutive quarters of design-ins … totaled approximately $9.3 billion, which is 3.5x higher than the prior period. We continue to see strong demand for our power devices with Q1 revenue up more than 120% year-on-year.

Lowe also said he expects WOLF to generate over $1 billion in revenue in FY23 – 5x the company’s revenue in 2017. Further, WOLF expects ~$2.8 billion in revenue for FY26 – although why a CEO feels compelled to go on the record with three-year-out revenue guidance is kind of interesting to me – mostly because it skips the years in between.

Lowe also reported that WOLF’s “Durham wafer fabs will likely remain fully utilized for the foreseeable future as customer demand remains strong.“

The Bad News

While the “design-ins” news was impressive, WOLF CFO Neill Reynolds reminded investors later on the Q1 call that “design-ins” are not the same as “design-wins”:

Underpinning the revenue growth is our design-in portfolio, which, along with the additional $3.5 billion this quarter, now sits at $14.5 billion cumulatively. Approximately 43% of our design-ins have converted into design wins, representing more than 1,600 projects.

Still, converting 43% of design-ins to design-wins is quite impressive. If WOLF can keep that level of performance going forward, investors could assume – all things being equal (but realizing they seldom are …) – that the $14.5 billion design-ins portfolio could convert into an estimated $6 billion+ of future revenue. Not bad.

As for the news about the Durham fabs running at full-capacity, the bad news there is that WOLF was unable to make a planned transition from 100-millimeter wafers to 150-millimeter wafers “due to the overwhelming demand for our products which has kept our factories full, leaving us essentially no factory downtime to make the transition.”

Perhaps even worse, due to strong demand for RF products, WOLF doesn’t anticipate it will be able to transition to larger wafers for “at least several years”, and reports that will be an ~300 basis point drag on overall gross margin. That was one reason Lowe gave for the loss of $0.04/share in Q1 versus a loss of only $0.02/share in the previous quarter- despite the fact that revenue grew 6% sequentially.

It is obvious that WOLF is undergoing growing pains. The solution is investing heavily to expand production in the company’s new Mohawk Valley fab. The upstate NY fab was opened in April and uses 200 mm wafers. It is the largest SiC fab in the world. In addition, Wolfspeed announced plans in September to build a factory in North Carolina to produce 200-mm silicon carbide wafers.

In Q1, note that free-cash-flow during Q1 was -$79 million: -$13 million of operating cash flow and $66 million of capital expenditures – including start-up costs primarily related to Mohawk Valley of ~$38 million. WOLF expects another $34 million of start-up and under-utilization costs next quarter. WOLF is still on track to deliver devices from Mohawk Valley in the second half of FY23. And on track to lose money at least until that new production capacity comes fully online.

Guidance

Q2 guidance was a bit puzzling: WOLF said it expects revenue in the range of $215-$235 million in Q2. Note that the midpoint of that guidance ($225 million) is actually $16.3 million lower than Q1. The explanation for revenue being down on a sequential basis was due to some processing challenges with longer boules and “lead time on spare parts of older fab equipment inside the factory.” Still, a sequential revenue decline appears rather odd given the rather dramatic growth projections mentioned earlier on the call.

Indeed, CFO Reynolds expanded on the issue:

This fiscal year, demand for our products continues to outstrip supply and our revenue will be gated by the speed at which we can increase output. That being said, we still expect top line year-over-year growth north of 30%.

So maybe “Wolfspeed” is actually slower than many expected. That said, annual revenue growth of 30% is nothing to sneeze at.

Financing

WOLF management has said it is focused on solving its growing pains (i.e. its go-forward cap-ex requirements …) using the “lower or non-diluted elements of that plan”. We learned what that meant about 10-days ago when BorgWarner (BWA) announced its intention to grow its EV revenue to $4.5 billion, and said it would invest $500 million in WOLF to “ensure that BorgWarner will have a reliable supply of high-quality silicon carbide devices, which are significant to the company’s inverter growth plans.” The $500 million investment agreement was part of WOLF’s planned $1.3 billion issuance of 1.875% convertible bonds due 2029 and also entitles BWA to purchase up to $650 million of devices annually. That bond issuance was up-sized one day later to $1.525 billion.

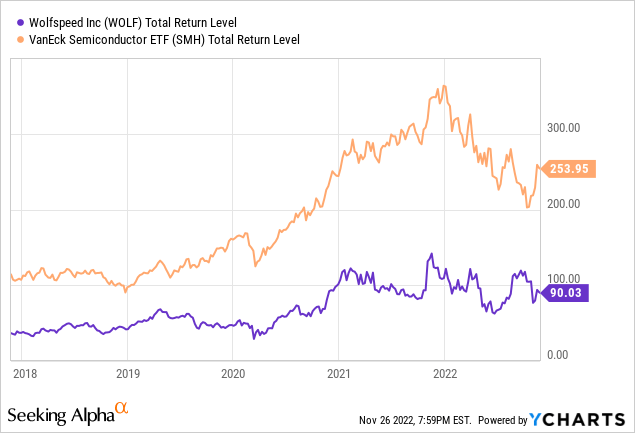

The initial conversion rate for those Notes is 8.4118 shares of Wolfspeed’s common stock per $1,000 principal amount. That is equivalent to an initial conversion price of ~$118.88/share of WOLF common stock (which closed Friday at $90.03, implying a ~32% premium). Meantime, WOLF expects to reap $238.7 million of net proceeds from the transaction, which it will be able to use for funding critically needed growth projects.

Valuation

WOLF currently has no P/E because it has lost money over the TTM and it is expected to lose $0.29/share in forward earnings. Yet the company currently sports a $11.1 billion market-cap while at Q1-end it had $1.2 billion in cash and cash equivalents and $1.3 billion in total debt. Seeking Alpha reports a 6.8% short position.

A 10x price-to-sales multiple on $1.1 billion in FY23 revenue doesn’t appear to indicate all that much upside to the shares from here over the next 12-months. However, WOLF reminds me of the new lithium miners, which are being valued based on their future prospects for strong cash-flow. And I do believe that WOLF has an excellent future ahead of it.

An upside-risk: the U.S. CHIPS Act and the EU Chips Act are strong government funding to re-shore critical semiconductor technology. Either or both could prove to be a significant tailwind for WOLF going forward.

Summary & Conclusion

I like WOLF and think it could become the dominant SiC supplier over the coming years. However, it will take time and taking time will potentially let other, and bigger, SiC competitors – like STMicro (STM), Infineon (OTCQX:IFNNF), and ON Semiconductor (ON), for example – have time to “tool-up”. Strong competition could reduce future margin growth.

That being the case, I don’t want to climb too far out on a limb to buy shares of WOLF. However, if market volatility gives me an $80 entry point, I’d be a buyer based on the large TAM in EVs, the large inventory of design-ins, and the company’s ability to attract capital at rather attractive rates and terms.

I’ll end with a 5-year total returns chart of WOLF versus the SMH Semiconductor ETF:

Be the first to comment