Ridofranz/iStock via Getty Images

Recapping The Previous Article

In our article titled “Wise: A Hidden Gem,” we wrote about how Wise plc (OTCPK:WPLCF) addresses lingering cross-border payments problems by offering foreign exchange transparency and lower fees than traditional banks. In addition, the market potential is enormous, with total cross-border transactions having reached trillions of pounds. Therefore, we believe that Wise can capitalize on such an opportunity given its competitive advantage in prices.

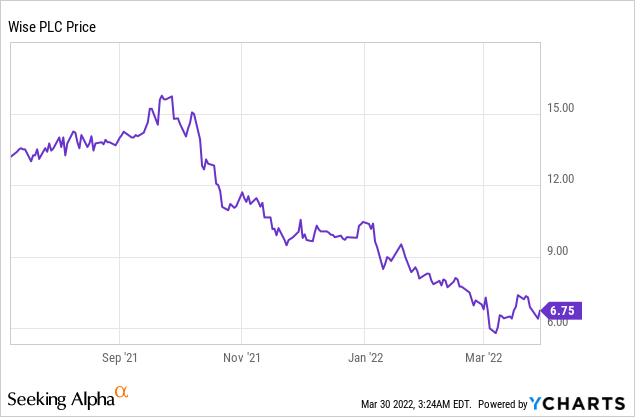

Nevertheless, since our last article, the share price has been down more than 40% to US$6.75 per share from US$11.3 per share. Therefore, does Wise offer an attractive entry point at the current levels? First, we will update Wise’s financial and trading results.

1H22 Results Update

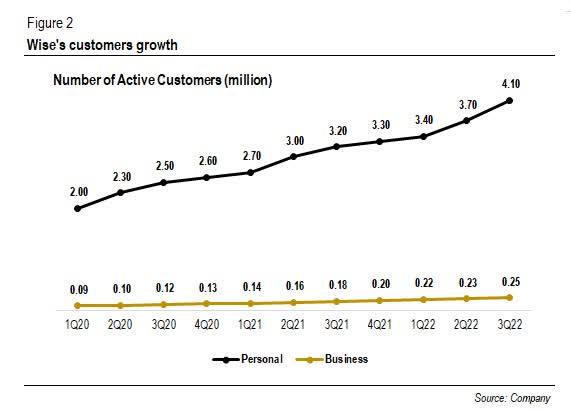

Please note that Wise reports its full financial results semi-annually while disclosing quarterly operational metrics and revenue. Wise’s active customers for the second quarter of the fiscal year 2022 reached 3.9 million, driven by increasing personal customers (+23% Y/Y) and business customers (+44% Y/Y).

In addition, rising volume per user brought revenue to £133 million (+25% Y/Y) for the quarter, although the overall take rate declined by six bps. By the earnings release, the management estimated the full-year revenue growth to be in the mid-to-high 20s.

Wise’s number of active customers (Company)

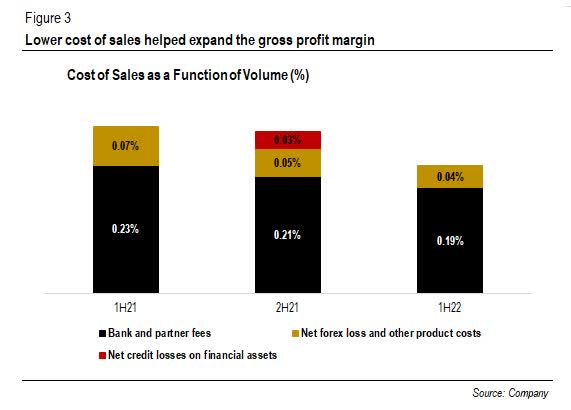

Additionally, it expanded its gross profit margin to 68% from 62% a year before, thanks to lower bank and partner fees.

Cost of Sales as a Function of Volume (Company)

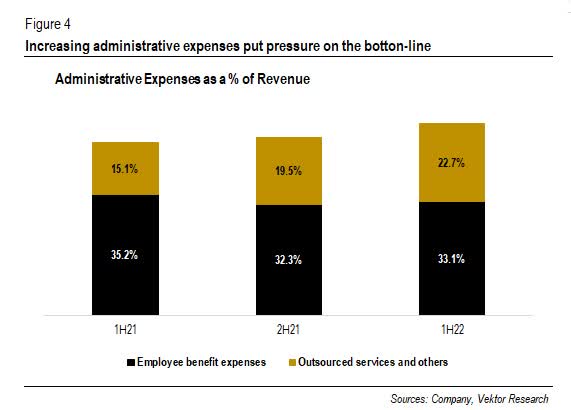

Nevertheless, at the bottom line, Wise’s 1H22 earnings declined to £12.7 million (-13% Y/Y) despite raking in £64 million more revenue than a year before. Administrative expenses are the main culprits: soaring outsourced services and others pressurized the bottom line. In addition, the management attributed rising expenses to higher travel expenses, marketing, and costs of being a public company.

Administrative Expenses as a % of Revenue (Company, Vektor Research)

What The Future Holds For Wise

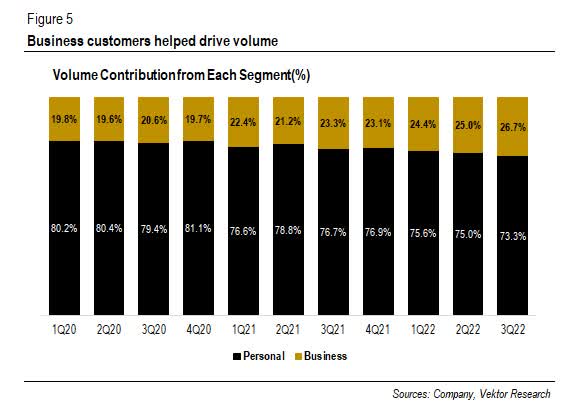

Yet, the outlook remains strong, especially for the business segment, in our view. While volume per personal customer stabilized at around £3.7k (+6% Y/Y), the volume per business customer rose to £21.6k in the 3Q22 (+13% Y/Y). Figure 5 shows that the volume contribution from business customers expanded in the last few quarters.

Volume Contribution from Each Segment (Company, Vektor Research)

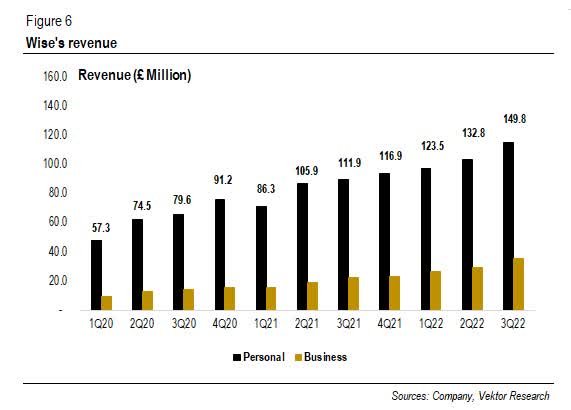

As a result, Wise’s revenue almost reached £150 million in 3Q22 (+34% Y/Y), supported by strong customer growth and volume per customer. Furthermore, expanding its global presence has always been Wise’s strategy. For example, Wise launched Wise Account and Card in Malaysia and introduced Wise Card in Canada and Brazil. Moreover, business customers can now transfer money to China in eight currencies. As a result, the management raised its revenue growth estimate from mid-to-high 20s to around 30%.

Wise’s revenue (Company, Vektor Research)

Looking forward, we believe that Wise’s growth story remains compelling. During the 2Q22 results announcement, the management said that the company would remain invested in “price, speed, and convenience, while sustaining a very healthy bottom-line margin, rather than growing that margin.”

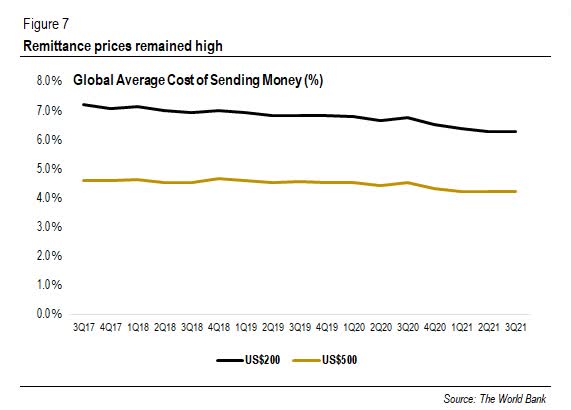

For example, Wise seeks to reduce prices in the second half of the fiscal year, thus expecting a slight drop in the gross profit margin to 65%-67% from 68%. Meanwhile, according to the data from the World Bank, the global average remittance cost has declined from last year, but the drop remained insignificant.

Global Average Cost of Sending Money (The World Bank)

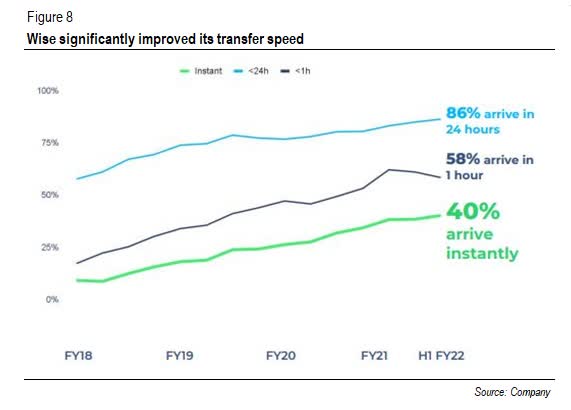

Wise is likely to reduce prices to stay competitive in the future if it is possible. Matthew Briers mentioned that most of £20.6 billion of volume has come from the banks when asked about the competition. In addition, he went on to say that banks were “not really innovating.” In contrast, Wise has significantly improved its transfer speed.

Wise’s transfer speed (as a % of transactions) (Company)

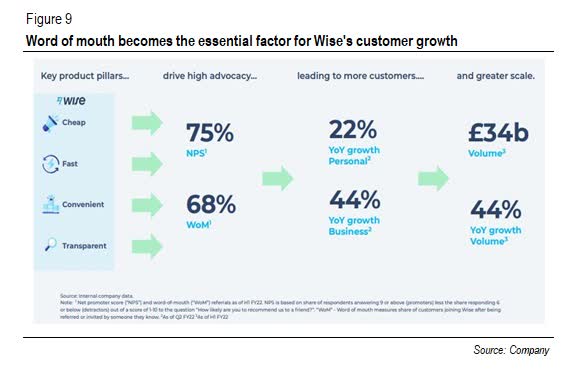

Additionally, word of mouth supports Wise’s organic growth: Wise claimed that 68% of its new customers joined Wise through referral or invitation. As a result, the company does not “have to spend a significant sum of money on marketing.”

Worth of Mouth that Drove Organic Revenue (Company)

With global remittance costs being high, we believe that Wise’s competitive advantage in prices will entice more customers to join Wise. Therefore, the management’s expectation of maintaining over 20% revenue growth in the medium term seems reasonable.

Valuation

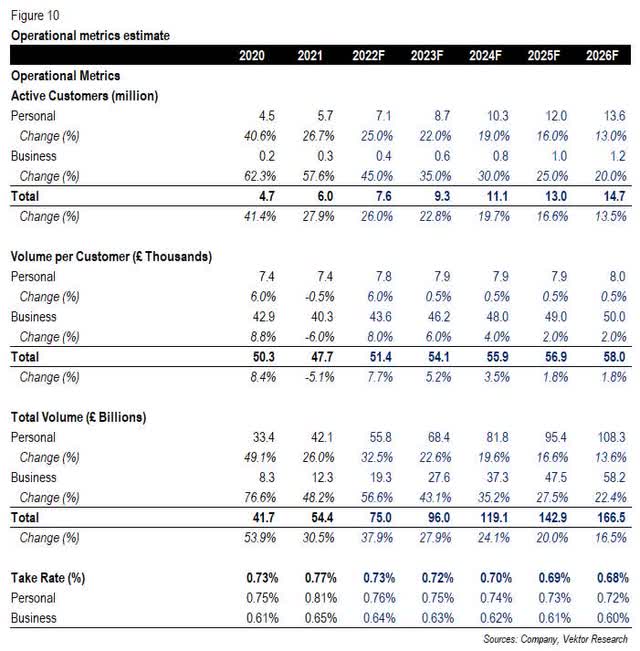

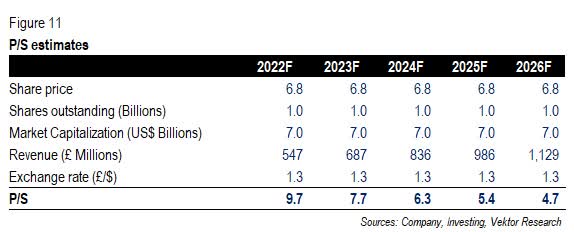

However, with the recent share price drop, is Wise a buy? Our back-of-the-napkin calculation shows Wise’s trailing-twelve-month P/S stands at 10x, higher than PayPal (NASDAQ:PYPL) at 5.4x and Western Union (NYSE:WU) at 1.5x. However, we believe that we should also incorporate future growth when valuing a growth stock. Below is our estimate of Wise’s operational metrics, and the assumptions are listed below:

- We assume a 5-year revenue CAGR of 22% from 2021 to 2026, in line with the company’s medium-term guidance of over 20%.

- We estimate total volume per business customer growth to outpace total volume per personal customer, which has stabilized based on previous results.

- Although the management expects the take rate to remain stable, we think it will slightly decline for the company to stay competitive.

- We assume the number of shares outstanding to be stable over time for simplicity.

Operational Metrics Estimates (Company, Vektor Research)

With its revenue estimated to double to £1.1 billion in a five-year time, Wise’s market cap (based on the current price) is almost five times its 2026F revenue, which makes much more sense, in our view. Indeed, maintaining a consistent 22% of revenue growth in the next five years is not easy and is prone to falling short of expectations. Yet, we are confident that Wise can capitalize on the significant opportunity with its competitive prices.

Wise’s P/S estimates (Vektor Research)

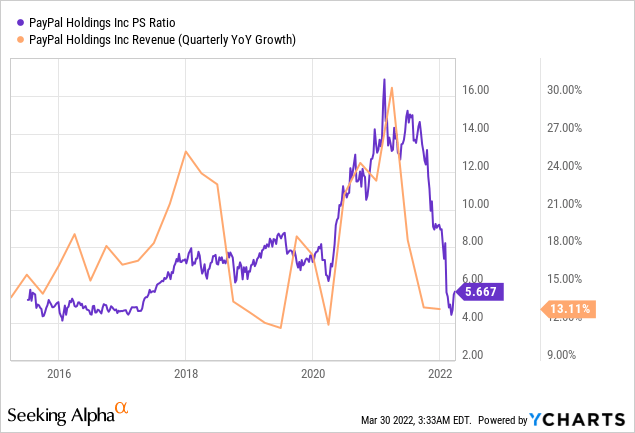

Let us see how PayPal’s share price has performed over time only for comparison purposes. Like Wise, more than a decade since its inception, PayPal generated over 20% of TPV growth. But it was not until 2017 that the market started to pay more after its revenue doubled from US$6.7 billion in 2013 to US$13 billion (18% CAGR). As a result, before the recent sell-offs, PayPal hit US$310 per share, more than seven times as great as the price five years earlier.

Final Thoughts

In our view, Wise is well-positioned to capitalize on an enormous opportunity with its competitive prices over its competitors. In addition, we notice that the global remittance cost in the last two quarters has declined but remained insignificant. Therefore, we believe that management’s confidence in maintaining over 20% of revenue growth in the medium term seems reasonable. Nevertheless, risks always remain in possible competition from banks and other remittance players. A 22% annual revenue growth will drive Wise’s revenue to exceed the one billion marks in five years (2021-2026).

After a recent drop in the previous months, the current valuation at 10x of its sales is seemingly expensive. But if we incorporate future growth, the valuation makes much more sense. Indeed, volatility has always been part of the game, and investing in growth stocks requires patience and a long-term investment horizon.

But is it worth it? It depends on each investor’s investment philosophy and risk tolerance. But for those with higher risk tolerance, Wise’s current share price might be an attractive entry point after dropping almost 50% in less than a year. In our view, a P/S slightly below 5x seems reasonable considering potential growth opportunities Wise could capitalize on in the future. The choice is yours to make.

If you have any thoughts, please do not hesitate to comment below.

Be the first to comment