It has been a rough start to the new era of Reiwa for Japan. What was supposed to be a golden opportunity to revive its struggling economy turned into dust after the coronavirus pandemic led to the postponement of the 2020 Olympics. Though the Japanese stock market took the news in stride, as the Nikkei 225 has mounted an impressive 20%+ rebound alongside the rest of the world in light of the “corona-curve” showing signs of flattening across major developed nations. The iShares MSCI Japan ETF (EWJ) likewise jumped over 20% off the lows:

Source: WingCapital Investments

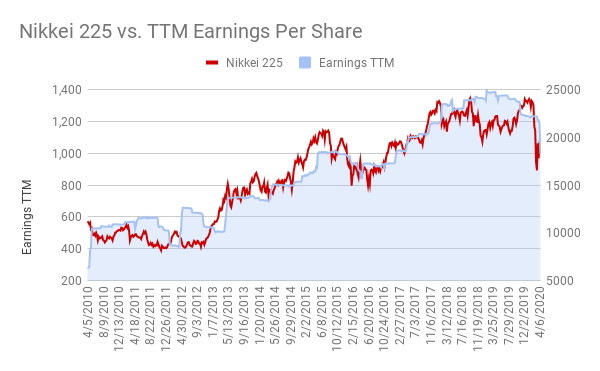

From a longer-term perspective, EWJ and the Nikkei 225 had plummeted to the lowest level since 2016 before the relief rally, but remains 20% off multi-year highs. Indeed, the Japanese stock market had failed to break out prior to the coronavirus crisis due to corporate earnings already rolling over last year:

Source: WingCapital Investments, Nikkei.co.jp

Source: WingCapital Investments, Nikkei.co.jp

Japan Inc. Suffers Earnings Beatdown

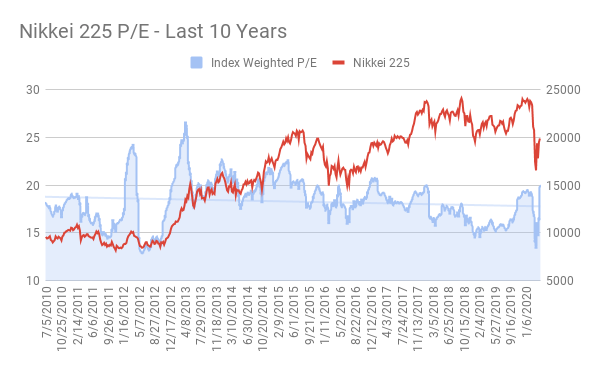

The global pandemic has further led to corporate earnings snowballing with a year-over-year 28% decline thus far, which is more or less consistent with the flagship index’s roughly -20% from year-to-date highs. In terms of valuation, after taking into account of recent negative earnings growth, the Nikkei 225’s index-weighted P/E is now trading above its 10-year trendline, suggesting it is not cheap from a historical perspective.

Source: WingCapital Investments, Nikkei.co.jp

Source: WingCapital Investments, Nikkei.co.jp

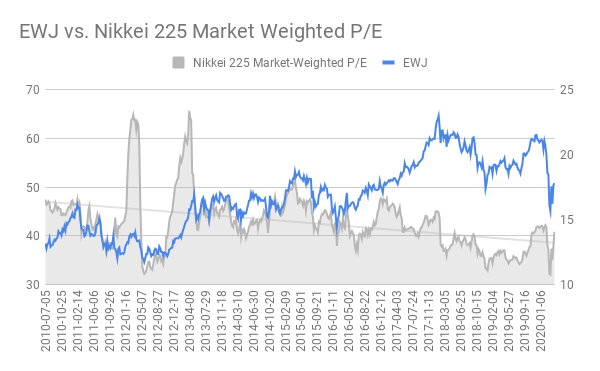

Meanwhile, the market cap-weighted P/E of Nikkei 225, which is more suitable for evaluating the market cap-weighted MSCI Japan ETF (EWJ), likewise has been in a secular downtrend and currently sits right above the trendline:

Source: WingCapital Investments, Nikkei.co.jp

Source: WingCapital Investments, Nikkei.co.jp

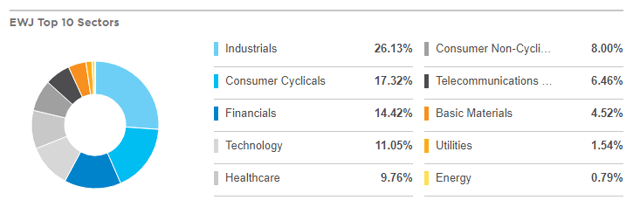

EWJ’s heavy allocation to cyclical sectors (~60% in industrials, consumer cyclicals and financials) is most certainly bearing the brunt of the economic fallout due to COVID-19.

Escalating Domestic Outbreak Piles Pressure On Fragile Japanese Economy

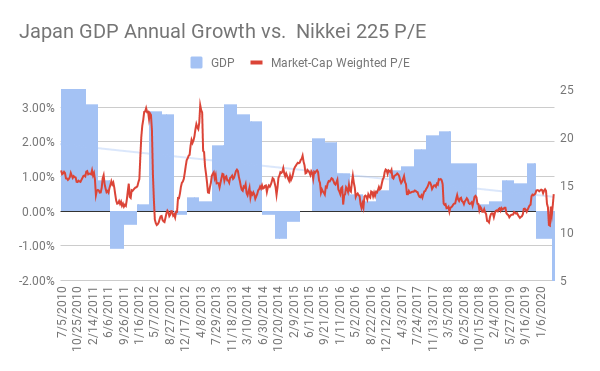

For an economy already reeling from a consumption tax increase and global economic slowdown, the coronavirus pandemic certainly could not have struck at the worse time. Indeed, Japan was already headed for a recession with a -1.8% GDP growth as of end of 2019. Diminishing economic growth since Abenomics were enacted has justified the persistent downtrend in Japanese stock market valuation:

Source: Nikkei.co.jp

Source: Nikkei.co.jp

To add insult to injury, tourism plunged by as much as 90% ever since the virus went global, after which the outbreak started gathering pace domestically. The Abe administration reacted by declaring a state of emergency while offering a 100,000 yen cash handout to every resident. Though the effectiveness of the stimulus package is already being questioned. To wit from Financial Post:

Recipients of the payouts include the rich and the people whose incomes are not suffering, so savings will also rise,” said Ryutaro Kono, chief economist at BNP Paribas Securities. “Even considering more people will suffer an economic pain this time than during the 2009 financial crisis, the proportion of the payouts that will be spent is estimated at about 40%. As such, it would push up GDP only by 0.3 percentage points.”

On the surface, the number of COVID-19 cases in Japan pales in comparison to the other G-7 nations with new cases rising at a pace of less than 1,000 per day. In truth, the extreme inadequacy of COVID-19 tests in Japan may have created a false sense of reality on the extent of the outbreak. Indeed, the measly 900 tests per million is comparable to that of a developing country and actually worse than that of South Africa and Ecuador.

G7 COVID-19 Statistics Comparison

| Country | Total Cases | Daily New Cases | Tot Cases/1M pop | Deaths/1M pop | Total Tests | Tests/1M pop |

| USA | 764,636 | 25844 | 2,310 | 123 | 3,861,549 | 11,666 |

| Italy | 178,972 | 3047 | 2,960 | 391 | 1,356,541 | 22,436 |

| France | 152,894 | 1101 | 2,342 | 302 | 463,662 | 7,103 |

| Germany | 145,742 | 2018 | 1,739 | 55 | 1,728,357 | 20,629 |

| UK | 120,067 | 5850 | 1,769 | 237 | 482,063 | 7,101 |

| Canada | 35,056 | 1673 | 929 | 42 | 536,062 | 14,203 |

| Japan | 10,797 | 501 | 85 | 2 | 112,816 | 892 |

As of 4/19/2020. Source: Worldometer

While the government is progressing towards expanding its testing capacity, time is of the essence with the annual Golden Week holiday on the horizon, after which the state of emergency is scheduled to end on May 6th. Should the outbreak remain out of control, further turmoil will be in store for the Japanese economy and stock market.

Technicals Point To Protracted Bear Market In Nikkei 225 And EWJ

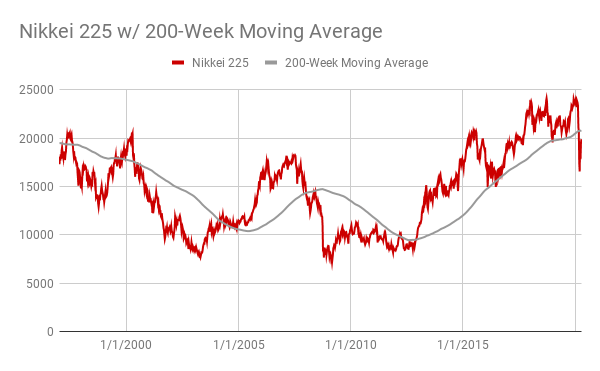

Over the past 30 years, we observe that the 200-week moving average has been the line in the sand which defined the secular bull and bear markets in the Nikkei 225. For instance, the Nikkei 225 had stayed above the 200WMA during the course of the bull market since 2012 until the recent collapse. During the 2 bear markets before that, the flagship index would continue declining to lower lows after initially piercing through the 200WMA:

Source: WingCapital Investments

Source: WingCapital Investments

As such, we would expect the sell-off to resume in Japanese stocks with the Nikkei 225 soon meeting stiff resistance at the 200WMA that was decisively broken through. Meanwhile, with the currency impact almost negligible due to USD/JPY virtually unchanged since the crisis started, the same outlook applies for EWJ which has been highly correlated with the Nikkei 225.

In summary, we expect another leg lower in the Japanese stock market and the corresponding MSCI Japan ETF on worsening economic and corporate earnings outlook. Technicals likewise suggest the bear market is still in progress, and the relief rally in the Nikkei 225 will most likely stall at the 200-week moving average.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We may have options, futures or other derivative positions in the above tickers mentioned.

Be the first to comment