Marc Dufresne/iStock via Getty Images

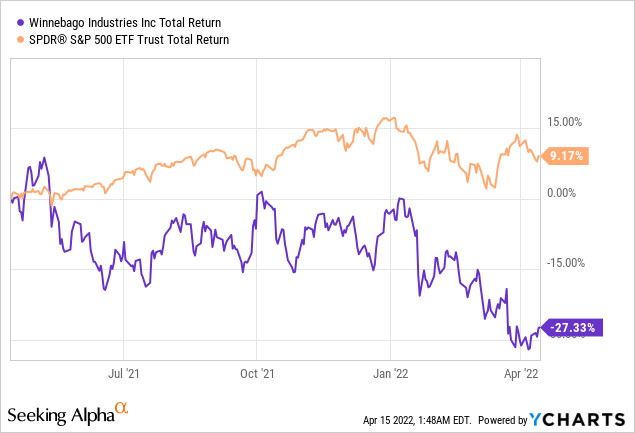

Winnebago Industries, Inc. (NYSE:WGO) is a leading North American manufacturer of recreation vehicles (RV) and marine products to support outdoor recreational activities. The stock has been underperforming the overall market recently. However, I think there is a lot to like about WGO. The business qualities cannot be ignored. Here I will share some of my thoughts.

Great momentum on growth

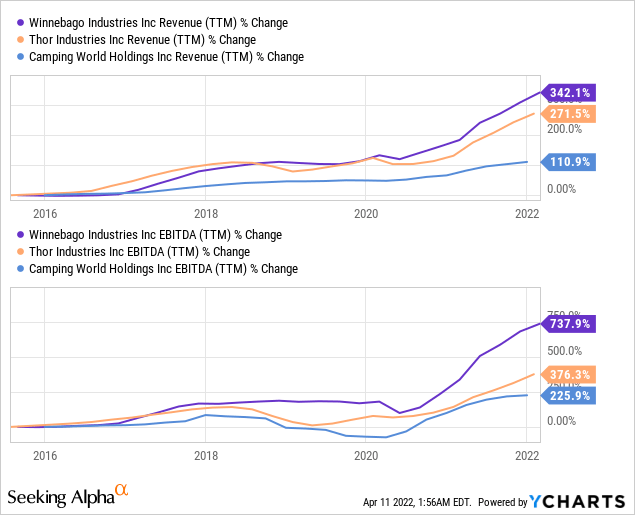

WGO has gone through rapid growth for the last decade. Through organic growth and acquisitions, WGO can grow its revenue at a surprising 20% CAGR over the last ten years. This is not an easy job for a company making physically built products like RVs and boats. Google’s (GOOG) (GOOGL) CAGR over the last ten years is only 18%. From the chart below, WGO has outperformed its peers in terms of revenues and EBITDA. Current 12-month trailing sales are 4.3B compares to 0.97B for FY2015. EBITDA grew even more from 60M in 2015 to the current 12-month trailing EBITA of 545M.

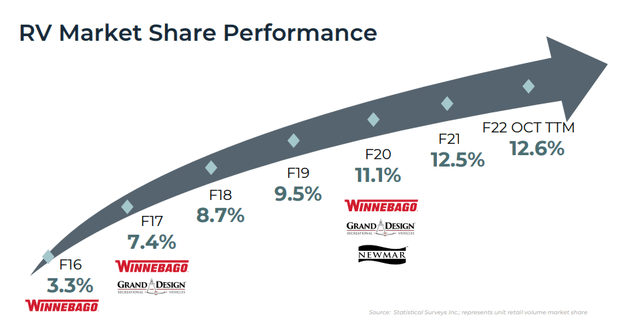

While some of the revenue growth may come from seasonal or macro tailwinds, WGO is actually winning the industry competition. As the chart below, it has grown its 3-month trailing RV share from 2.9% in 2015 to the current 12.6%.

F22 RV market share (2022 Q2 presentation)

Focus on quality, innovation, and service

WGO’s success comes from long-term investment in its RV expertise and brand legacy, as it is best known in the industry for its quality, innovation, and service. All WGO RV brands have been awarded RVDA’s quality circle award in 2021(a huge comeback since 2015). According to 2021 10-K, WGO products often commanded a price premium due to their quality reputation. The US only manufactured 600K RVs last year. Comparing to consumer vehicle production (Ford, GM, Toyota), RV manufacturing involves lots of human labor and doesn’t have the scale for automation and standardization. The total production unit number is small, while the total components included in one RV are very high. So all RVs will have issues here and there, quality control is not easy. For WGO, all vehicles have to go through shake and stress testing before selling. The company runs the world’s largest RV factory and makes its own metal, plastic, and wood parts. Many furniture, seats, and mattresses are made in-house, which offers better quality control. The specially designed steel SuperStructure (photo below) uses interlocking joints (instead of screwing and gluing) to connect the floor, sidewalls, and roof and mount appliances and cabinets.

WGO superstructure (Lichtsinn RV blog)

Margin improvements and brand awareness

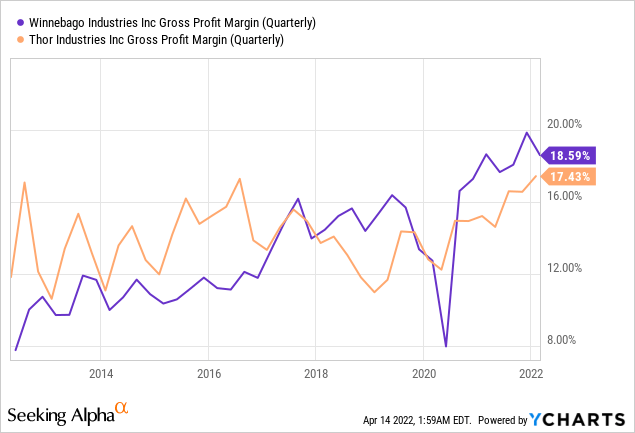

During FY 2016, WGO invested in its manufacturing and supply chain competencies to transform the company into a larger, balanced, and more profitable business. Five years later, the company is in much better shape by acquiring Grand Design, Chris Craft, Newmar, and Barletta, which bring synergetic benefits on bigger scales. The gross margins have improved to 18.59% and surpassed RV giant Thor Industries (THO).

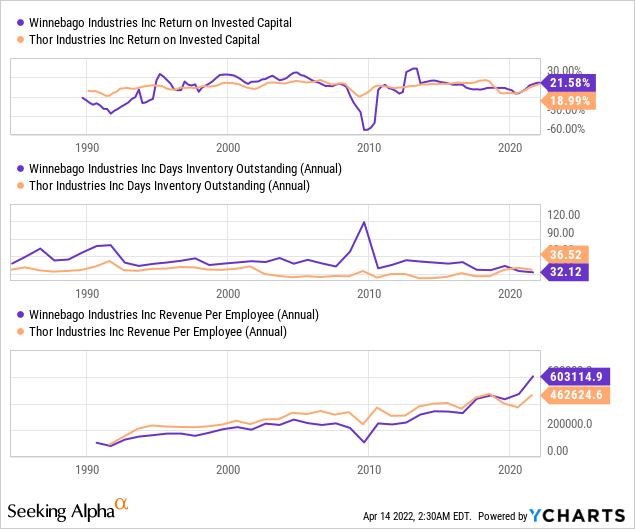

WGO’s improvement in profitability and efficiency is also evident from the trend in ROICs, days inventory outstanding, and revenue per employee (chart below).

Regarding brand awareness, WGO previously had branding issues with younger customers during its 2016 assessment. Now millennials are buying WGO RVs as WGO sees record sales from Millennials, with around 10% of buyers now 30 years 0ld or younger. The average age of its customers has also been dropping significantly.

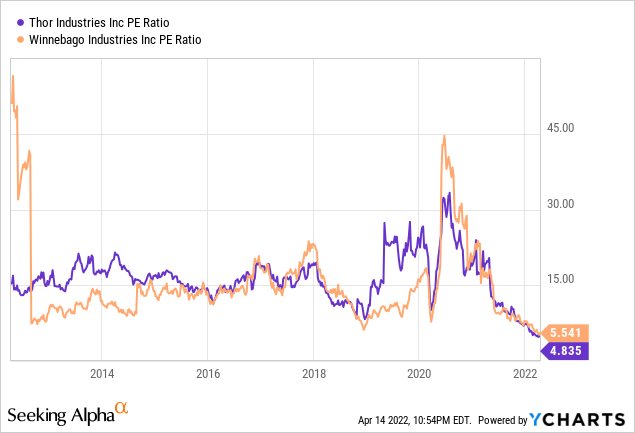

Sustainability and recession Immunity

RVs are not seen as life essentials. RV sales go up when the overall economy goes well and people have extra money. RV sales go down under recessionary conditions and slow or negative economic growth rates. The RV business is always subject to volatility. The current sales and earnings levels may not be sustained in the future. This explained why WGO and THO had low PE valuations of around 15X in recent years, even under the favorable market sentiment and monetary policy.

From 2022 forward, an inflationary environment should have a negative impact on WGO’s performance. However, the CEO Michael Happe is confident about the company’s pricing power:

So, we will continue to monitor that. We believe that we do have pricing power in the marketplace. We will seek first to offset inflationary pressures with cost savings initiatives or cost avoidance initiatives, and we will continue to price to the extent that we need to with the goal to maintain margin, not just the dollar per unit, but the margin per unit. That has been our stance historically and it will continue to be.

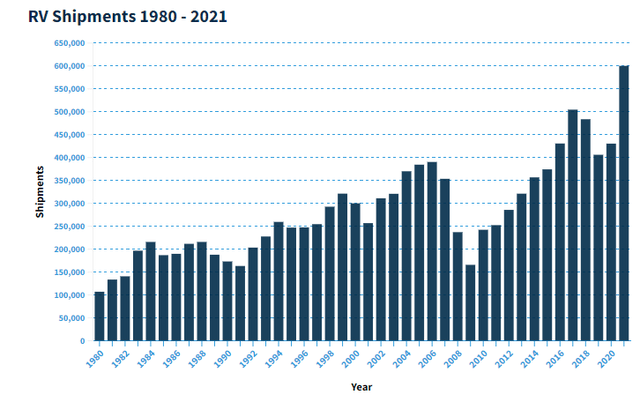

He believes that the current WGO is in a very different position than 2008 or 2018 as WGO is more disciplined, informed about the market, and has a more resilient product mix. WGO should sustain a double-digit plus adjusted EBITDA yield in the future, no matter under what conditions. The good news is market downturns usually last 6 to 24 months, and industry shipment always returns to a new record high, as shown in the chart below. In the long-term timeframe, the RV industry will still grow. Three big players, WGO, Thor, and Forest River, should gain more shares with stronger positions after the ups and downs through time.

RV shipment (www.rvia.org/historical-rv-data)

Valuation and risks

With 4.3B revenue, 0.34B net income, 0.09B free cash flow, and 1.2B Equity, WGO’s current market cap of 1.78B is already very cheap by all traditional valuation measures (PE, PS, PB, Cashflow yield). 0.15B buyback plan remaining also provides safety for the stock price. We think the pandemic brought unusual tailwinds to WGO, and the current earnings may not be sustainable. To be conservative, we use the average of current TTM and 2019 earnings of 0.225B as the start point. If we set the future growth rate to follow the overall GDP rate 3% and a discount rate of 7%, WGO should be able to collect 10-year discounted earnings of 1.83. Considering the current 1.78B market cap and conservative assumptions, this is a very good return.

If you have a long-term horizon, I think the macro risk is actually low. Yes, hyperinflation and recession may come. But megatrends from aging demographics and outdoor living should offer tailwinds to WGO. Moreover, the housing shortages will continue for the foreseeable future, which may also benefit RV demands to accommodate outdoor activities. One major concern to me comes from future competition and investment risks. Once built, RVs are subject to significant depreciation (27% after three years). If the company fails to manage inventory levels or builds capacities too fast, shareholder returns will be undermined.

Conclusion

Overall, WGO offers great value to investors. Although there are short-term headwinds, the long-term risks are very limited. Human beings have innate need to explore the nature and physical world. United States visitations to state and national parks keep growing. There is no question that future demand for outdoor living will continue, and WGO will play a big role in that.

Be the first to comment