Scott Olson/Getty Images News

Investment Thesis

During the investor day 2022, Wingstop Inc. (NASDAQ:WING) divulged its future growth plans to increase AUV (Average Unit Volume) and expand its restaurant base over the coming years.

The growth in AUV will be driven by increasing brand awareness, investing in technology to enhance marketing capabilities, and bringing innovation to the menu. Previously, each restaurant used to contribute 4% of the gross sales net of discount to fund the national marketing. However, moving into fiscal 2022, the company increased the contribution rate to 5% of the gross sales net of discount. This extra sum of amount will be used for advertising purposes at the national level in order to increase brand awareness. The successful implementation of this strategy is likely to attract additional customers. Additionally, the company will also invest ~$40 million to ~50 million to enhance its marketing capability and develop personalized marketing content to target the right customers. Moreover, the market-test launch of chicken sandwiches could bring new customers who prefer sandwiches more than wings. The launch of the company’s virtual brand, Thighstop, should also benefit the company’s top line.

At today’s AUV of ~$1.6 million, the company is seeing a cash-on-cash return of more than 70% along with a less than 2-year payback period. In the U.K., the restaurants have done even better with AUV of ~$2 million, a 3-year comps stack of 22%, and a very healthy 4-wall margin at 22%. This sort of track record offers a compelling value proposition to the franchisee players to partner with the company and open new restaurants around the globe. The company intends to replicate this same operation model in other international markets such as China and South Korea. The company also announced a new development agreement for Indonesia which is expected to take the current restaurant count in Indonesia from 50 to 120. With 220 restaurants slated to be opened in fiscal 2022 and a strong pipeline of 1100 restaurants commitment, the company is progressing well to meaningfully increase its restaurant count. In the longer run, the increasing number of restaurants and management’s effort to grow AUV should benefit the company.

While other restaurants are struggling to deal with inflation, the spot market prices for wings, which contribute to 65% of the company’s food cost, have dropped down from a peak of $3.22 per pound late last year to $1.64 per pound. This will ease off some of the pressure on operating margin due to inflation. Moreover, usually, digital sales are less vulnerable to inflation than dining out. Hence, the company’s digital sales mix of more than 60% should benefit the company in the near term. Given the company’s healthy future outlook and near-term macro-tailwinds for margins, investors can consider buying the stock.

Increasing Average Unit Volume (AUV)

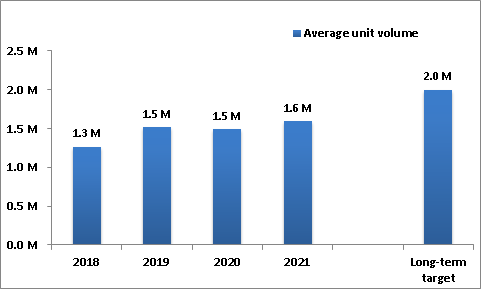

The company reported an AUV of ~$1.6 million in Q1 2022 versus ~$1.54 million in the corresponding quarter a year ago. Since 2018, AUV has grown at a CAGR of 5.33%. The company targets to achieve $2 million in AUV led by increasing brand awareness and leveraging technology to target the right customers while bringing innovation to the menu.

Wingstop Average Unit Volume (Company Data, GS Analytics Research)

Till last year, each restaurant contributed 4% of gross sales net of discount to fund national marketing and advertising campaign. However, the contribution rate increased to 5% of gross sales net of discount moving into fiscal 2022. This extra sum of amount will enable the company to deliver more efficient advertising while deploying an always-on media approach. I believe, that increasing brand awareness at the national level should attract new customers generating incremental sales.

A traditional restaurant brand leverages promotion to drive traffic. In contrast, the company will be investing in technology to enhance its marketing strategies. The company possesses a database of approximately 28 million guests. These insights along with proper technology allow the company to improve customer targeting, guest acquisition, and new customer retention while driving frequency with existing customers. The company will be making technology investments to the tune of ~$40 million to ~$50 million over the next 3 to 5 years in order to develop its marketing capabilities. A well-implemented marketing strategy should help increase restaurant footfalls and Wingstop’s website visits.

Besides leveraging the flavored sauce chicken wings, recently, the company launched a market test of a chicken sandwich. This chicken sandwich, which is available in 11 different flavors could attract guests who love sandwiches more than wings. Additionally, the company also launched a virtual brand, Thighstop, capitalizing on the whole bird strategy where the company sources other pieces as well alongside bone-in wings.

Macro-tailwinds

Nearly 65% of the company’s food cost is associated with the bone-in wing. The spot market prices for wings have dropped to $1.64 per pound from a peak of $3.22 per pound last year. Since the peak in 2021, overall food costs are 800 basis points lower. While the inflation is affecting other restaurant players, the price reduction in wings gives the company an advantage in terms of improving operating margins in the coming quarter.

To provide some context, the spot market for wings hit a record $3.22 per pound in 2021. And as we sit here today, the spot market is at $1.64 per pound. This significant deflation in wing prices as we exited the first quarter has bolstered restaurant level cash flows to the tune of delivering a payback of less than 2 years on an initial investment to build out a Wingstop.”

Michael J. Skipworth-President, CEO & Director, Q1 2022 Wingstop Inc Earnings Call

Moreover, the company is contemplating acquiring or building a small poultry complex over a longer-term horizon. As wings prices are volatile in nature, owning a poultry complex will give the company better control over the supply chain and prices.

While the macroeconomic environment is favourable for the company’s margins, sustained high inflation is expected to put pressure on revenues. However, here also, the company is better placed versus many of its peers. Usually, online orders are less affected by a rising inflationary environment compared to dine-outs. With 60% of the company’s restaurant sales coming through digital assets, its restaurants are less vulnerable to inflation than other competitors with a low digital sales mix.

Increasing Restaurant Count

The company’s brand partners have enjoyed 50% cash-on-cash returns over the years. At today’s food costs and AUV of ~$1.6 million, they are seeing a cash-on-cash return of more than 70% along with a less than 2-year payback period on their investments. On average, the new domestic restaurants generate ~$1.3 million in the first year. These numbers offer a compelling value proposition for the franchisee players to partner with the company to open new restaurants.

Moving to international markets, the international restaurants, especially the U.K. have performed better with AUV of ~$2 million, a 3-year comps stack of 30%, and a very healthy 4-wall margin at 22%. The company looks forward to replicating this same model in other international markets as well. Currently, the U.K. brand partners operate 20 restaurants with 15 openings slated for 2022. The company also announced a new development agreement for Indonesia. The new agreement is expected to take the market from its current restaurant count of 50 to 120. Additionally, with a little tweak to the menu, the company also plans to enter and expand into China and South Korea.

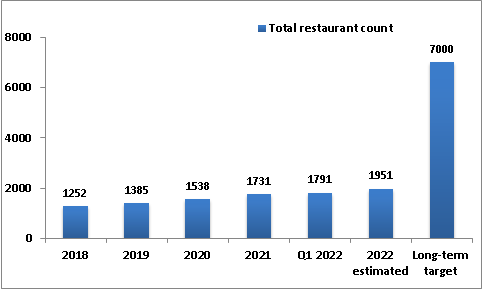

The company targets to open nearly 7000 total restaurants (including franchises and company-owned restaurants) –4000 in the domestic market and 3000 in the international market. With 220 restaurants slated to be opened in fiscal 2022 and a strong pipeline of 1100 restaurant commitments, the company is on the right track to achieving its targets.

Wingstop Total Restaurant Count (Company Data, GS Analytics Research)

Valuation and Conclusion

The stock price is trading at ~64.68 times the fiscal 2022 consensus EPS estimate versus its 5-year average adjusted P/E (FWD) of ~91.82x. While the company’s valuation is at a significant premium to the sector, this premium is well deserved given the company’s future outlook which targets to have around 7000 restaurants worldwide. Management’s effort to increase brand awareness while investing in technology to enhance marketing capability also bodes well for the company. Additionally, the softening of bone-in wing prices and healthy exposure to digital sales should benefit the operating margins in the near term. Given the company’s long-term growth prospects, macro-tailwind, and cheaper valuation in comparison to what the stock has been trading in the past, long-term investors can consider buying the stock.

Be the first to comment