Justin Sullivan/Getty Images News

Introduction

As a dividend growth investor, I am constantly looking for additional dividend growth opportunities that will increase my income. On some occasions, I add to my existing positions; on others, I start new positions to increase my diversification and exposure to different segments. The volatile market may be an opportunity for investors seeking cheaper income-producing assets.

One of the segments that declined the most was the consumer discretionary sector. Shares in the industry tend to be more cyclical, and investors are afraid of a recession, so they sell the stocks. Long-term investors can then benefit from that short-term weakness. I will analyze Williams-Sonoma, Inc. (NYSE:WSM), a prominent consumer discretionary name, in this article.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alpha’s company overview, Williams-Sonoma operates as an omnichannel specialty retailer of various products for the home. It offers cooking, dining, and entertaining products, such as cookware, tools, electrics, cutlery, tabletop and bar, outdoor furniture, and a library of cookbooks under the Williams Sonoma Home brand, as well as home furnishings and decorative accessories under the Williams Sonoma lifestyle brand.

Fundamentals

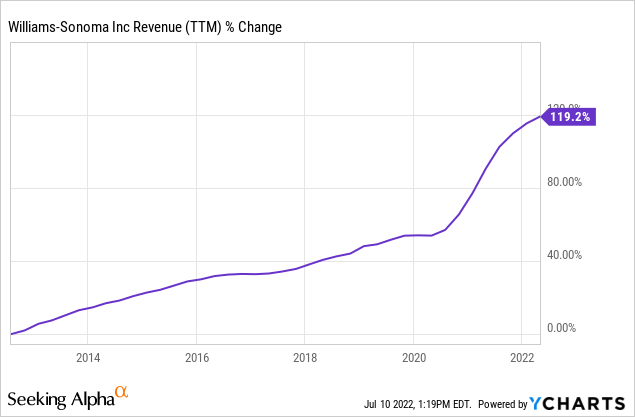

Sales of Williams-Sonoma have more than doubled over the last decade. The most noticeable increase in sales was during the pandemic, when consumers had spare time and couldn’t spend money as the economy was on lockdown. The growth is mainly organic, as the company opens stores and increases same-store sales. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Williams-Sonoma to keep growing sales at an annual rate of ~3% in the medium term.

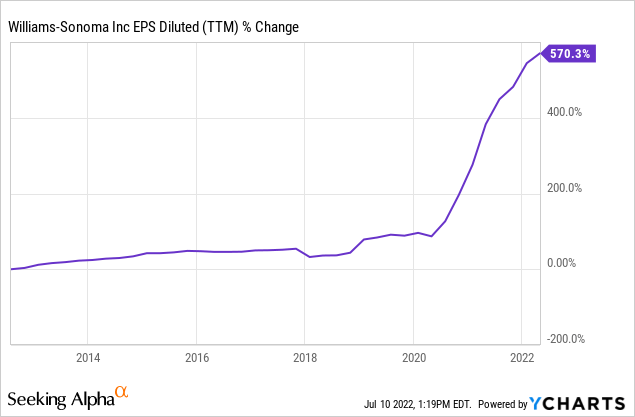

The EPS (earnings per share) has increased faster than the sales. EPS has increased by 570% in a decade, with a significant increase during the pandemic. EPS increase is the combination of sales increase, buybacks, and an 80% increase in the operating margins. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Williams-Sonoma to keep growing EPS at an annual rate of ~4% in the medium term.

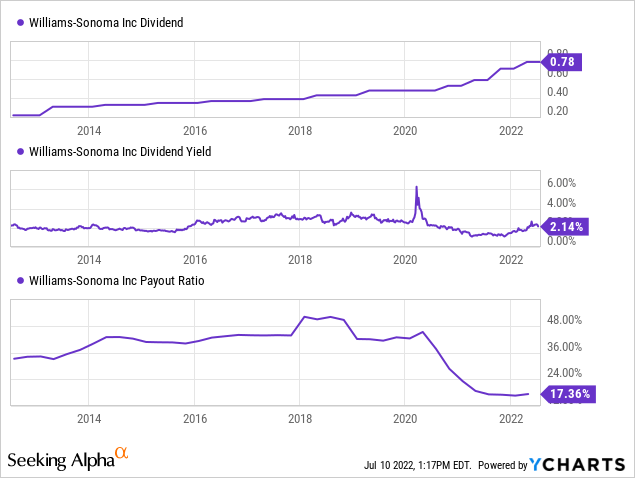

The company’s most prominent way to return capital to shareholders is through dividends. The company has been increasing its payout annually for 12 years. The dividend yield is relatively safe, with the payout ratio below 20%; which means the company should be able to maintain it even if there is a recession. The entry yield is 2.1% due to that low payout ratio.

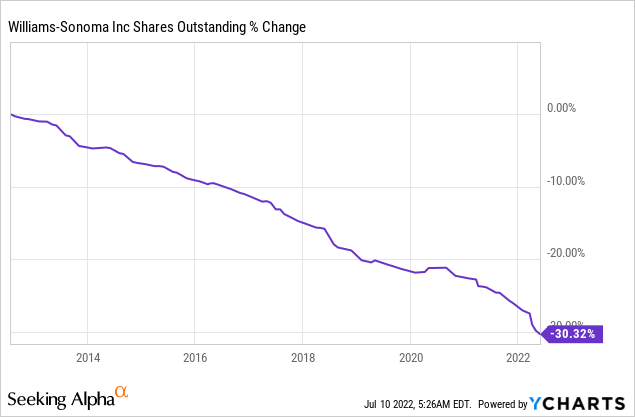

In addition to dividends, the company also returns capital to shareholders via shares repurchases plans. These buyback plans contribute to the bottom line of growing companies. Over the last decade, the company has repurchased more than 30% of its outstanding shares. Additional buybacks at the current valuation will have a meaningful effect on the EPS.

Valuation

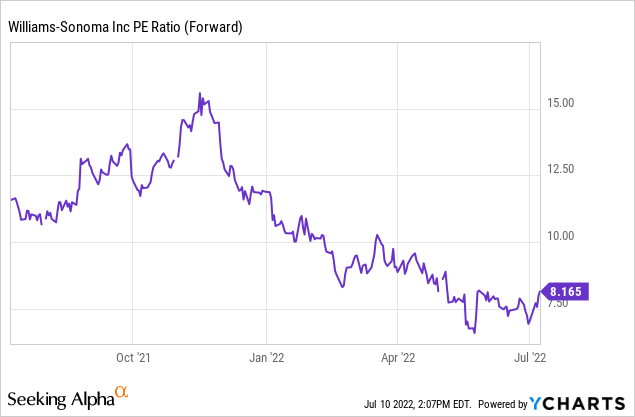

The company’s P/E (price to earnings) ratio, considering the forecasted earnings for 2022, is 8. It is the lowest point we have seen over the last twelve months. Even if it grows slowly, paying eight times the earnings of a growing company seems attractive to me. It is usually hard to find quality stocks trading for a single digits P/E ratio.

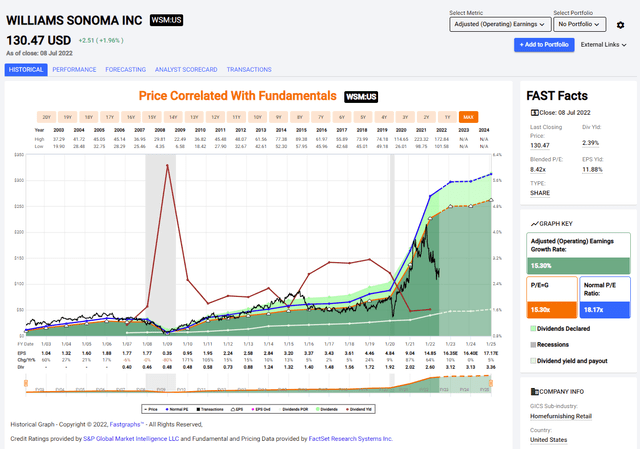

The graph below from FAST Graphs™ emphasizes how attractively valued the company is. You can see that during the last two decades, the shares of Williams-Sonoma traded almost in line with the average P/E of 18. However, several months ago, the share price plunged and is continuing to do so. While the company doesn’t grow as fast as it did in the last twenty years, it is still not justifying such a deep discount, in my opinion.

To conclude, Williams-Sonoma is a solid consumer discretionary company. Unlike other companies, it is not as cyclical, allowing it to increase sales and EPS continuously. This leads to higher dividends and buybacks as the company prioritizes returning capital to shareholders. This package comes at what I believe to be an attractive valuation.

Opportunities

The debt levels are very low at the moment. The net debt to EBITDA is below 1, giving the company plenty of flexibility for its balance sheet. The low debt level has two advantages. It means that as the interest rates climb, the company’s interest payments won’t grow too much. It also means that as share prices of other companies decline due to the volatility, Williams-Sonoma will be able to grow by acquisition.

Moreover, there is an increase in the price of houses in the United States. Therefore, we see construction companies trying to close the gaps and build more houses to capitalize on the price increase. These new houses will need home furnishing, and that’s where Williams-Sonoma will capitalize on that trend. The growing need for homes will support the company in the medium term.

The company is also expanding globally and in terms of sales channels. Williams-Sonoma is already present in Canada, Europe, the Middle East, and more. This broad reach makes it less dependent on the American market, making the sales less volatile. In addition, its investment in the digital world is crucial as it becomes more efficient as digital sales are cheaper in terms of labor cost and the need for stores.

Risks

Inflation affects retailers harsher than it affects other businesses. Retail is a business with high labor costs, and retailers usually have low margins as they connect producers and end clients. The price increases of the goods sold and the higher wages will pressure the company’s margins. Williams-Sonoma has a high 18% operating margin, so it may be able to absorb some of the blow, but it will still affect profitability.

Another risk is the looming recession. The economy may enter a recession when the GDP in Q2 is announced. Negative growth means lower spending and less consumer confidence. Consumers who are not confident spend less on discretionary expenditures, such as kitchenware. Therefore, the company’s EPS may decrease in the short term if there is a long and harsh recession.

Interest rates do not affect Williams-Sonoma significantly, but they do affect its clients. Clients acquire home furnishing and kitchenware using debt, and as debt becomes more expensive their ability to finance significant purchases will decline. Therefore, even if the interest rate won’t affect the company’s balance sheet, it will negatively impact its clients’ purchasing ability.

Conclusions

Williams-Sonoma is a leading retailer of home furnishing and kitchenware. The company manages to grow its revenues and EPS steadily. The EPS growth is fueling aggressive buybacks and steady dividend increases over the last twelve years. The company has several growth opportunities as the demand for housing grows and expands globally.

While there are risks to the investment thesis, mainly around the possible recession and the higher rates, the current valuation is very attractive. I believe that the company is a decent investment opportunity despite the negative sentiment over the last several years. Therefore, investors should consider slowly buying into a position.

Be the first to comment