sihuo0860371

Tanger Factory Outlet Centers Inc. (NYSE:SKT) is a REIT that invests in shopping centers. The trust is well-managed, its dividend is covered by funds from operations, and the REIT increased its FFO projection for 2022.

Tanger Factory’s value has recently become quite appealing, and investors are receiving a discount on the trust’s funds from operations multiple.

Because the trust has a very low FFO payout ratio, it is well positioned to increase its dividend in the future, even if the U.S. economy experiences a recession.

A Quality Shopping Center Investor

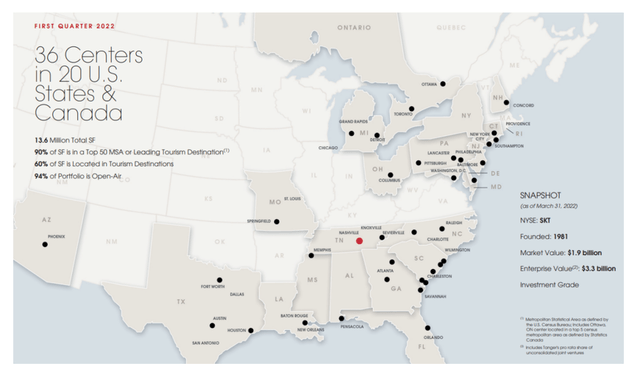

Tanger Factory’s property featured 36 shopping complexes in 20 states and Canada as of March 31, 2022, totaling 13.6 million square feet. The trust’s shopping center investments are concentrated on the East Coast and in the southern states of the United States, with open-air shopping centers accounting for the vast majority (94%).

Property Investments (Tanger Factory Outlet Centers)

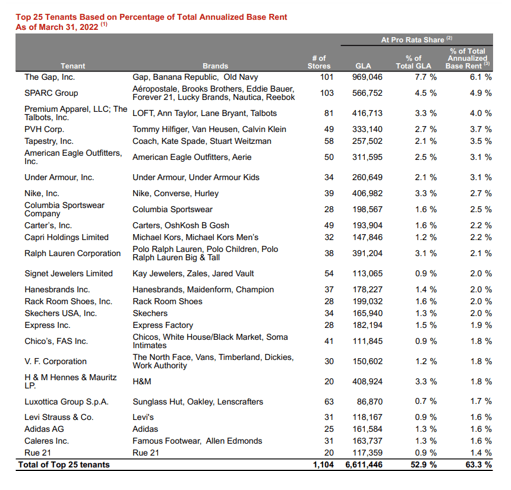

Tanger Factory is home to numerous well-known retail brands, including The Gap, Ralph Lauren, Under Armour, Nike, Adidas, and Levi Strauss.

The Gap is the trust’s largest tenant in terms of rental payments, accounting for 6.1% of total rental income. Tanger Factory’s top 25 tenants lease a total of 1,104 stores from the shopping complex trust, indicating a diverse tenant structure.

Top 25 Tenants (Tanger Factory Outlet Centers)

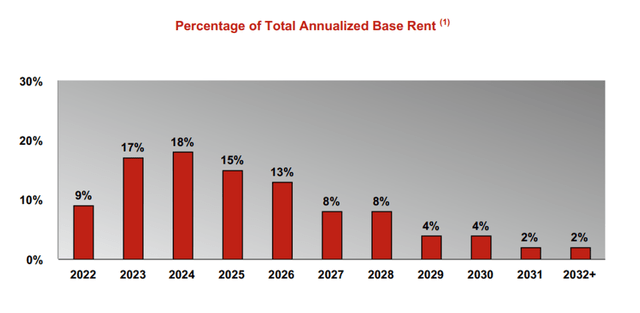

A total of 35% (17% in 2023 and 18% in 2024) of the trust’s basic rent will expire during the next two and a half years, requiring the trust to either extend leases with existing tenants (which is likely) or find new tenants to take over expiring leases.

Because the bulk of Tanger Factory’s tenants are huge, well-established retail and fashion enterprises, I believe the trust will be able to renew the majority of the leases that are about to expire. Having to extend more than a third of your lease base during a severe recession, on the other hand, could provide some difficulties for the trust.

Percentage Of Total Annualized Base Rent (Tanger Factory Outlet Centers)

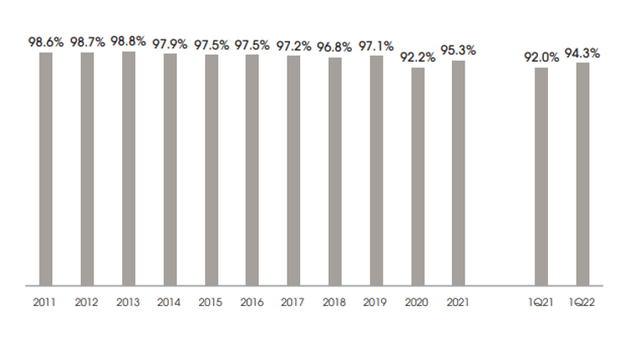

Tanger Factory’s portfolio is experiencing a comeback in occupancy following the epidemic. The portfolio’s occupancy rate fell by 4.9% in 2020 due to Covid-19 control limits and a significant drop in footfall at shopping centers. Having said that, Tanger Factory’s occupancy rate is much healthier today, having rebounded to 94.3% as of March 31, 2022.

Occupancy Rate (Tanger Factory Outlet Centers)

The Dividend Is Set To Rise

Tanger Factory cut their dividend during the pandemic, but increased it by nearly 10% in April to $0.20 per share quarterly. SKT has a total annual dividend payout of $0.80, resulting in a dividend yield of 5.5%.

Very Low Payout Ratio

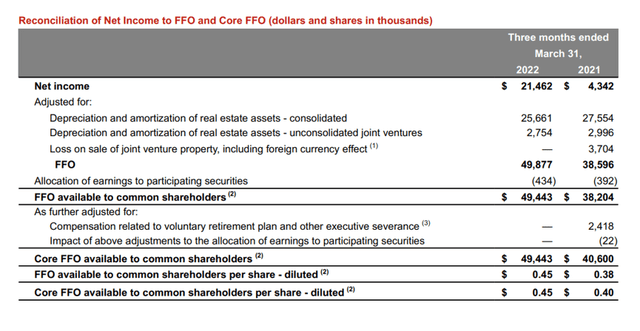

Tanger Factory’s dividend payout ratio was 55% in 2021, and the trust’s funds from operations can support a greater dividend. Tanger Factory’s portfolio generated $0.45 per share in funds from operations in 1Q-22, but the trust only paid out 41% of the FFO.

Tanger Factory’s dividend will likely continue to grow in the future due to its low payout ratio and two recent dividend hikes. Trusts with stable cash flow and modest payout ratios may even be able to generate enticing overall returns as recession fears mount.

Because Tanger Factory has such a competitive payout ratio, a fall in rental income would not necessitate a dividend modification. With a payout ratio that is less than half of its funds from operations, I believe Tanger Factory will be able to increase its payout even if the United States experiences more serious economic issues. The low payout ratio also contributes to the creation of a margin of safety that other trusts with greater payout ratios lack.

FFO (Tanger Factory Outlet Centers)

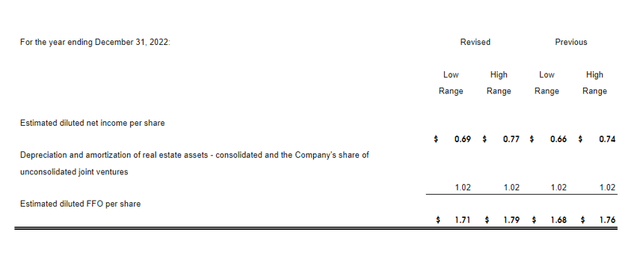

Raised Funds From Operations Guidance 2022

Because of Tanger Factory’s stock price decline in 2022, the shopping center trust’s funds from operations multiple has reached an acceptable level. SKT’s valuation has dropped by 21% in 2022, implying that the multiple has also dropped by a similar amount.

FFO Per Share (Tanger Factory Outlet Centers)

Kimco Realty Corporation (KIM) and Simon Property Group Inc. (SPG) are industry competitors. Kimco Realty anticipates funds from operations of $1.50-1.53 per share in 2022, implying a P/FFO ratio of 13.1x. Simon Property Group anticipates funds from operations in the $11.60-11.75 per share range, representing an 8.4x FFO-multiple. Tanger Factory is valued competitively in comparison to its contemporaries.

Why Tanger Factory’s Valuation Could Decline

Shopping center REITs have higher earnings and cash flow volatility than residential REITs, implying that they are also more vulnerable during a recession.

Tanger Factory may witness a rise in vacancies and lower portfolio income, with the magnitude of those decreases dependent on the severity of the economy’s overall slump. A significant downturn in the U.S. economy could result in Tanger Factory losing leases and making it more difficult for the trust to extend existing leases if retail companies decrease their operations.

My Conclusion

Tanger Factory’s stock currently provides a 5.5% yield. This yield is maintained by funds from operations and a relatively low payout ratio. During the past recession, shopping center trusts reduced their payouts, which supported the sector’s recovery.

However, Tanger Factory’s dividend is increasing again, and the trust’s occupancy rate is improving. The low P/FFO ratio, combined with the dividend’s safety, makes SKT an appealing yield play.

Be the first to comment