Timothy Hiatt/Getty Images Entertainment

Editor’s note: Seeking Alpha is proud to welcome The Pineapple Investor as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Investment Thesis

Williams-Sonoma (NYSE:WSM) is one of the largest retailers in the home furnishings industry today. With a solid commitment to a digital-first but not a digital-only strategy, this San Francisco company has outperformed the S&P 500 by 3.5x over the past five years. Despite this outperformance, the WSM stock trades at just 8.17 x earnings, making WSM a fantastic opportunity for investors to compound their capital.

A Description of the Business

You may already be familiar with Williams Sonoma products, as they have built a reputation for selling some of the finest cookware in the industry. However, you may be surprised to find out that Williams Sonoma is just one of many brands, which include Pottery Barn, West Elm, and Pottery Barn Kids & Teens, owned by the parent company. The namesake brand Williams Sonoma is not even the company’s largest. That title belongs to Pottery Barn, which accounted for $3.1 billion of the total $8.2 billion in revenue for 2021. With 21,000 employees across the country, WSM operates an expansive and diversified network of stores including 175 Williams Sonoma stores for premium cookware, 188 Pottery Barn stores for contemporary furniture and home décor, and 121 West Elm stores for more modern furniture and home décor. In total, WSM has 544 stores globally; with such a diverse portfolio of brands, I believe it will not be a stretch to say that no matter what the latest trend is in home furnishings, WSM is in an excellent position to succeed0.

As evident in the 2022 Investor Presentation, WSM has a large and growing e-commerce business, with 66% of revenues coming from online sales. In 2021, e-commerce revenues totaled $5.4 billion, making WSM a top 25 e-commerce retailer across all industries, not just home furnishings. Even more impressive is that e-commerce sales have doubled in the past five years as WSM recorded online sales of $2.6 billion in 2016. This shift to e-commerce is attributed to leadership’s pursuit of a digital-first strategy which has driven industry-leading innovations. These innovations include Design Crew Room Planner, allowing users to use augmented reality to view furniture and décor from all of Williams-Sonoma’s brands inside the user’s home. Customers can also use online Design Chats to collaborate with real-life design experts to help pick out the right home furnishings for their home without ever going into a store. This digital-first strategy has resulted in more than 900 million online shopping visits annually. However, WSM is not abandoning their stores anytime soon as they believe their stores are a competitive advantage that fuels e-commerce growth. Their research indicates that Omnichannel customers spend four times as much and three times as frequently as single-channel customers. In addition, less than 5% of their total business comes from omnichannel sales, which could be a meaningful growth driver moving forward.

Track Record of Growth and Profitability

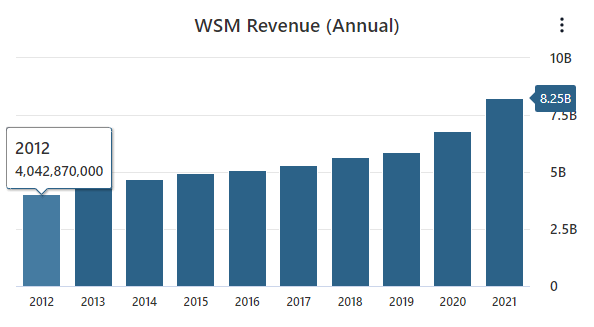

When looking at potential companies to invest in, I do like to see a track record of performance as it shows that management can produce results over the long term, and WSM’s performance over the past ten years has been impressive. In fact, besides big tech, I struggle to find another company with a track record like WSM. WSM has doubled annual revenues over the past ten years, from $4 billion in 2012 to $8.2 billion in 2021.

WSM data by Stock Analysis

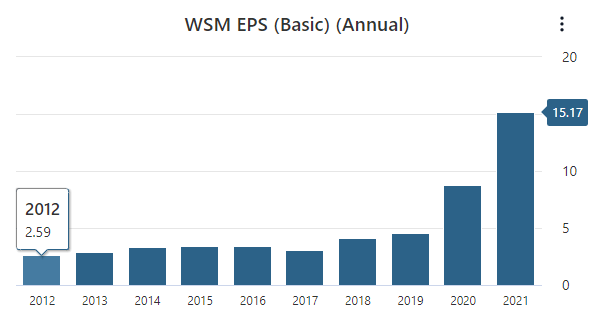

The bottom line has grown much faster, from $2.59 per share in 2012 to $15.17 per share in 2021.

WSM data by Stock Analysis

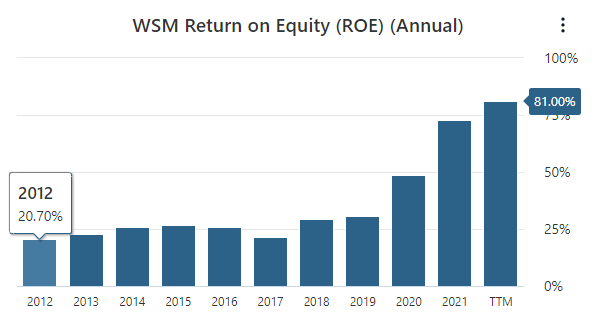

What is even more impressive is that over the past ten years, WSM has averaged a 32.55% return on equity with not a single year under 20%.

WSM data by Stock Analysis

Leadership has also proven to be shareholder friendly, growing the dividend by 295% over the past ten years and consistently buying back shares. Since 2012 WSM has repurchased over 25 million shares.

Growth Opportunities Moving Forward

With revenue of $8.2 billion in 2021, management has committed to a goal of $10 billion in revenues by 2024 while maintaining current operating margin levels. One way WSM can hit this target is by taking market share from smaller competitors that do not have an e-commerce presence. As mentioned by CEO Laura Alber on the second quarter earnings call, “Our positioning in the industry is a competitive strength. Our industry is large and fragmented with more than half of sales from small brick-and-mortar retailers that do not have sophisticated e-commerce capabilities.” One reason the home furnishings industry has lagged other sectors in transitioning to e-commerce is that the products WSM sells are typically products consumers want to touch and feel before purchasing. It makes sense that people want to sit on a couch before buying it to ensure it does not give them back pain. However, since the pandemic, online home furnishing sales have soared, and WSM’s investments in e-commerce have paid off nicely. Before the pandemic, in 2019, WSM saw 56% of total sales come from e-commerce, but last year, in 2021, the percentage of sales coming online was 66%. This transition to e-commerce was why WSM grew by 22% in 2021 while the rest of the industry grew by just 7%. Suppose the home furnishings industry continues to shift towards e-commerce. In that case, WSM, which continues to invest in a digital-first strategy, will continue to win market share and grow the business.

Another significant tailwind for WSM is that millennials are rapidly moving into homeownership. When they do, they need couches, tables, and cookware to fill up their new homes. Millennials moving into home ownership benefits WSM in a couple of ways. First, millennials prefer to shop online as the largest group of online shoppers are millennials with ages from 18 to 34, which plays well into WSM’s digital-first strategy. The second reason is millennials like to work from home. With many millennials spending more of their personal and professional lives at home, home furnishings are more crucial than ever, which bodes well for WSM in the long run.

Risk Factors

We are currently in a rising rate environment which will negatively affect the housing market. Higher interest rates mean consumers must borrow more money to pay for a house, which leads to many people deciding not to buy a new place altogether, which hurts companies like WSM. On the other hand, people who choose not to purchase a new home will often opt to renovate their old home instead, which is a good thing for WSM since, after a renovation, consumers will need new home goods to design their space. Overall, the home furnishings industry is cyclical and will be negatively affected by rising interest rates, inflation, unemployment, and other economic factors.

Another risk factor is the return to the office. With the COVID-19 pandemic ending, employers across the country are calling their employees back to the office, which means people will spend less time at home, and the need for new home furnishings will become less of a priority. However, I believe that some form of hybrid work is here to stay for most people and whether you work five days a week or only once, you will still need a home office with home furnishings.

WSM – Valuation

To place a value on WSM, we will run comparative and discounted cash flow analyses. We will start with the comparative analysis and see that WSM is currently trading at 8.17 x earnings of $16.44 per share, which is heavily discounted to the 5-year average PE ratio of 14.74. If we take the 5-year average PE ratio of 14.74 x the current EPS of $16.44 per share, we get a share price of $242.32, representing an 80% increase from the current share price. Looking at the bullish PE ratio the market has paid for WSM over the past five years, we see a PE of 17.12 in 2019. That bullish valuation at current earnings would amount to a share price of $281.45, or a 109% increase from the current share price. On the flip side, if we look at the most bearish valuation the market has paid for WSM, we are currently close to those levels. Finally, if we take the sector median PE of 10.03 and multiply it by the current EPS of $16.44 per share, we get a valuation of $164.89, representing an upside of 22% from the current share price.

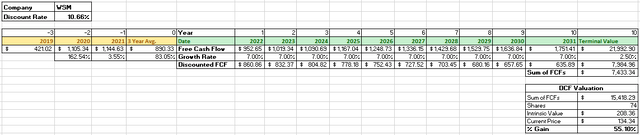

Now for the discounted cash flow analysis. We’ll start by taking the average of the WSM’s free cash flows from the past three years, which is $952 million; this is a reasonable starting point for the DCF analysis since, in 2020, WSM grew its free cash flow by 162%. I think the growth rate is unsustainable, and WSM could see a decline in free cash in the near term, so to be safe, we’ll assume a significant decrease in free cash flow in year 1 of the analysis. We’ll then use a growth rate of 7% for the next ten years. I believe this is a reasonable growth rate because, using the Rule of 72, a 7% growth rate translates to WSM doubling its free cash flow in 10 years, likely if management continues to execute its strategy as they have recently. Then we’ll use a 2.5% growth rate to figure out the terminal value. Finally, the discount rate we will use is 10.66%, based on a calculation of the weighted average cost of capital. From there, we’ll find that the sum of the free cash flows is $15.4 billion, and when we divide that figure by the 74 million shares outstanding, we end up with an intrinsic value of $208.36 per share, which is a 55% gain from the current share price.

To wrap up the valuation, we will consider share price values from the average of the 5-year average PE ratio at current earnings, which was $242.32, the sector median PE ratio at current earnings, which was $164.89, and the discounted cash flow analysis, which was $208.36. The average of these three estimates gives us an average intrinsic value of $205.19 per share, which is an upside of 52% from the current share price.

Summary

WSM has demonstrated a remarkable track record of growth and profitability over the last decade. In addition, management has invested heavily in a digital-first but not digital-only strategy which has paid off nicely as the home furnishings industry increasingly shifts towards e-commerce. If this trend continues, WSM should continue to win market share from smaller regional players. As a result, I estimate that WSM’s intrinsic value is $205.19 per share, representing a great buying opportunity for investors to buy this excellent business.

Be the first to comment