imaginima

The Williams Companies, Inc. (NYSE:WMB) is one of the largest natural gas-focused midstream companies in the United States. This is a very good place to be as natural gas has incredibly strong forward growth potential, which sets up the company for powerful prospects. This is a very real advantage that the company has over some of its peers that do not have such strong growth prospects. Unfortunately, The Williams Companies only has a 4.78% yield at the current price, which is much less than other firms in the same industry. However, the company does have some of the same qualities that midstream investors typically appreciate, such as incredibly stable cash flows that are independent of the conditions in the broader economic environment. As some readers may recall, I have discussed The Williams Companies before (notably here) but several months have passed since then and the company has had several news announcements along with an earnings release so it may be time to revisit our thesis. Overall though, the company still remains a great way to earn a high yield from the growing demand for natural gas, including liquefied natural gas.

About The Williams Companies

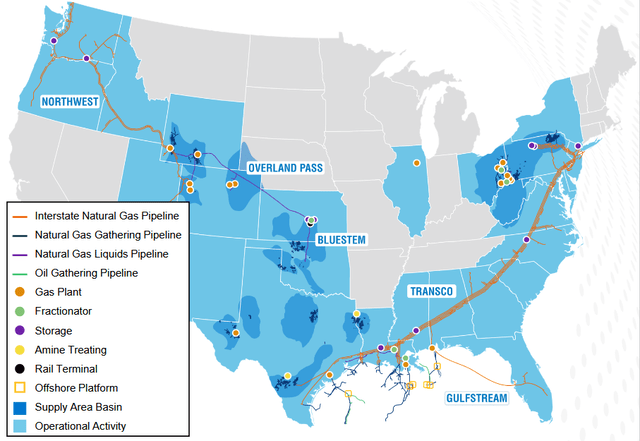

As mentioned in the introduction, The Williams is one of the largest natural gas-focused midstream companies in the United States, boasting infrastructure stretching across the country:

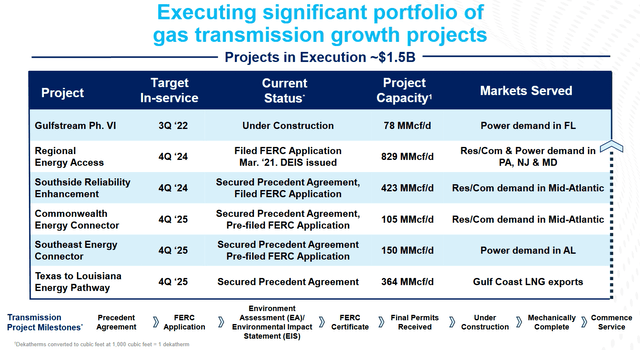

In total, the company has 24.4 billion feet per day of natural gas gathering capacity, 23.7 million dekatherms per day of natural gas transmission capacity, and 7.4 billion cubic feet per day of natural gas processing capacity. Although the company has infrastructure all over the nation, by far its most important asset is the Transco pipeline system that stretches across much of the East Coast, going from Texas to New York City. This system by itself carries approximately 15% of all natural gas consumed in the United States. The system is also likely to be the focal point of the company’s growth going forward. As we can see here, the company currently has $1.5 billion worth of growth projects that are scheduled to come online over the next few years, all of which are intended to serve some region that is along the Transco system:

In a previous article, I stated that one of the dominant trends in the energy industry right now is electric utilities retiring their old coal-fired power plants in favor of natural gas-fired ones. This is because natural gas burns much cleaner than coal and is actually reliable enough to support the needs of a modern economy, which separates it from renewables. A number of these new gas plants are being constructed along the East Coast and The Williams Companies is in a prime position to satisfy the need that these plants will have for natural gas due to the presence and scale of the Transco system. The company is indeed moving to take advantage of these opportunities. The company has six projects in development that are intended to provide approximately three billion cubic feet of natural gas per day to these powerplants. These projects will admittedly have a very limited near-term impact on the company. This is because none of them is scheduled to come online before 2027. Thus, the company will not see any cash flow growth from them for a number of years. A long-term investor may not mind this as much, however.

The nice thing about these projects is that we know that this cash flow growth will actually occur. This is because The Williams Companies has already secured contracts from its customers for the use of this new capacity. The reason that we as investors should appreciate this is that the company is spending $2 billion to build out these new projects. The fact that the company already has the customer contracts in place ensures that this money will not be spent on things that nobody wants to use. In addition to this, The Williams Companies knows in advance exactly how profitable these projects will be so it knows that it will earn a sufficient return on its investment. The company has not divulged exactly how profitable they will each be, but on average a project that the company undertakes pays for itself in about six years so that is probably a fair estimate here. This is certainly reasonable for fairly low-risk projects like these, although historically Kinder Morgan (KMI) manages to achieve better rates of return on its projects.

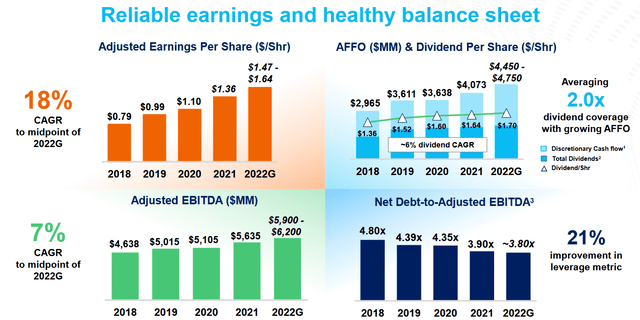

In the introduction, I stated that The Williams Companies enjoys remarkably stable cash flows regardless of the conditions in the broader economy. This is mostly because of its business model that revolves around entering into long-term contracts with its customers under which the fee paid by the customer is independent of energy prices. As these contracts are typically five to ten years in length, they should outlast any economic problems such as what we saw in 2020. In fact, The Williams Companies has consistently increased its cash flows over the 2018 to 2022 period, including in 2020:

The company managed to continue this historic growth streak in the second quarter of 2022 as its adjusted EBITDA (a proxy for pre-tax cash flow) was up 14% compared to the prior-year quarter. This was mostly due to the company’s customers increasing their natural gas production and sending more resources through the firm’s infrastructure than back in 2021. As one of the methods under which The Williams Companies receives compensation from its contracts is by charging based on volumes handled, these higher volumes resulted in higher cash flows. In fact, the company’s performance was so strong during the quarter that it prompted management to increase its cash flow guidance for 2022. This is something that any investor should appreciate. Fortunately, the forward fundamentals point to growing natural gas demand, and by extension, volumes for The Williams Companies over the coming decade or two.

Fundamentals Of Natural Gas

As just stated, the fundamentals for natural gas are quite strong and point to growing production going forward. This should prove beneficial for The Williams Companies since the company’s core business depends mostly on resource volumes.

As already mentioned, one source of natural gas demand growth comes from the utility sector, specifically electric utilities. This comes from concerns about climate change related to carbon emissions. As coal is the most heavily polluting fuel in use today, utility companies have been looking to replace their coal-fired power plants with alternatives. Renewables are a common choice but renewables are not reliable enough to handle the needs of a modern grid on their own. After all, wind power does not work if the air is still and solar power does not work if the sun is not shining. Thus, something else is needed to supplement renewable power to ensure that the grid remains powered and performs properly. Natural gas plants are the logical choice for this because it burns very cleanly and is as reliable as coal. There are currently 58 coal plants along the East Coast that produce approximately sixty gigawatts of power. If all of this capacity were to be replaced with natural gas, it would increase consumption by 9.5 billion cubic feet per day. This is substantially more than the two billion cubic feet per day that The Williams Companies currently has in development so it is quite possible that the company may have some growth potential beyond what it is already working on. This should obviously be very attractive for long-term investors if it plays out.

Dividend Analysis

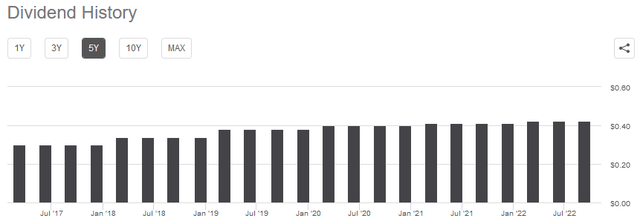

One of the biggest reasons why investors purchase shares of The Williams Companies is because of the dividend that it pays out. Indeed, as of the time of writing, the company yields 4.78%, which is substantially better than the 1.42% yield of the S&P 500 index (SPY). Perhaps more importantly, the company has a long history of increasing its payout to investors every year:

The reason why this dividend is nice to see is because of today’s inflationary environment. As everyone reading this is likely aware, the August 2022 consumer price index was 8.52% higher year-over-year. This means that if the company was paying out only a static dividend then an investor would not be able to acquire the same goods and services with the dividend that they could last year. The fact that the company increases the amount that it pays out helps to offset this effect, although admittedly inflation is right now higher than the company’s dividend growth. It is still much better than a steady dividend, though.

As is always the case, it is important that we determine the company’s ability to actually pay this dividend. After all, we do not want to be the owners of the company if it suddenly has to reverse course and cut the dividend since that would both reduce our income and almost certainly cause the stock price to decline. The usual way that we do this is by looking at a metric known as the available funds from operations. This is a non-GAAP metric that theoretically tells us the amount of cash that was generated by the company’s ordinary operations that is available to be paid out to the stockholders. In the second quarter of 2022, that figure was $1.130 billion, which represents a 23% increase year-over-year. This was also enough to cover the company’s dividend 2.19 times over. Analysts generally consider anything over 1.20x to be reasonable and sustainable. However, I tend to be more conservative and like to see this figure over 1.30x in order to add a margin of safety to the investment. As we can clearly see, The Williams Companies easily surpasses both of these requirements. Thus, it appears that the current dividend is sustainable and the company likely will be able to hike it again in another quarter or two, as it usually does.

Conclusion

In conclusion, The Williams Companies continues to look like a very solid investment for anyone that is looking to earn an attractive yield while the natural gas story continues to play out. The company has a number of opportunities to transport gas to various utilities along the East Coast and even get involved in supplying the substance to the rapidly emerging liquefied natural gas market. This provides it with a strong growth pipeline over the next decade and should allow it to provide investors with a safe and growing income stream to meet their needs.

Be the first to comment