Lemon_tm

Recently, a reader told me that REITs will go bankrupt.

He claims that the recent surge in interest rates, coupled with a recession, will be too much for a lot of REITs.

He believes that the rising costs coupled with declining revenue will cause the profitability of REITs to drop so much that they won’t be able to service their debt in many cases.

This could then force them to sell properties, which would only delay the inevitable as cash flow drops even further, asset prices decline, and the debt is just too much to handle.

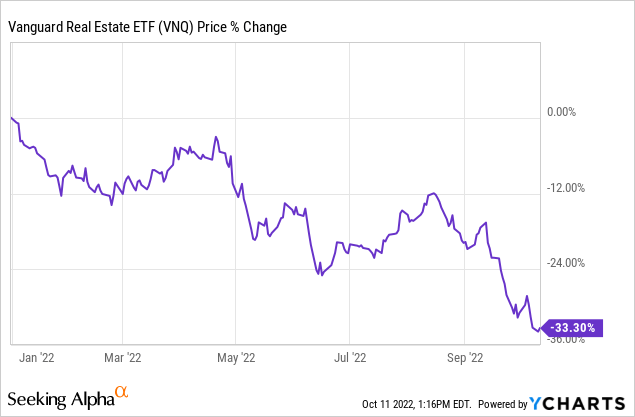

It is one of the most pessimistic views of the service that I have read, and clearly, the market is giving some credit to it. Otherwise, it wouldn’t be down so much:

This is just the average performance of the REIT sector.

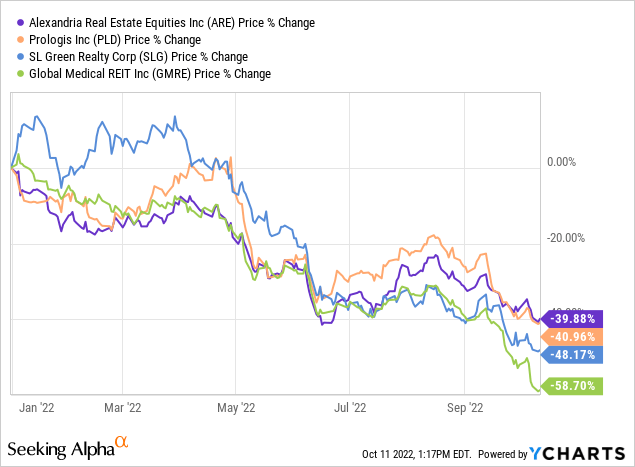

There are actually a lot of individual REITs that are down far more than this. Just to give you a few examples, Alexandria (ARE), Prologis (PLD), SL Green (SLG), and Global Medical REIT (GMRE) are all down between 40-60% in 2022:

I suspect that it is this crash in share prices that has caused some to conclude that REITs are headed into bankruptcy. Each day that passes, it feels like they are only headed lower and we are not even properly in a recession yet. Plus, the Fed is not done hiking interest rates, which leads many to believe that things will only get worse for REITs.

But how much truth is there to these claims? Are REITs really headed into an inevitable bankruptcy as a result of rising rates and a recession?

The answer is a clear no.

Investors are emotional right now and make these claims because they are fearful, but if they knew anything about REITs, they would understand that their claims are ridiculous.

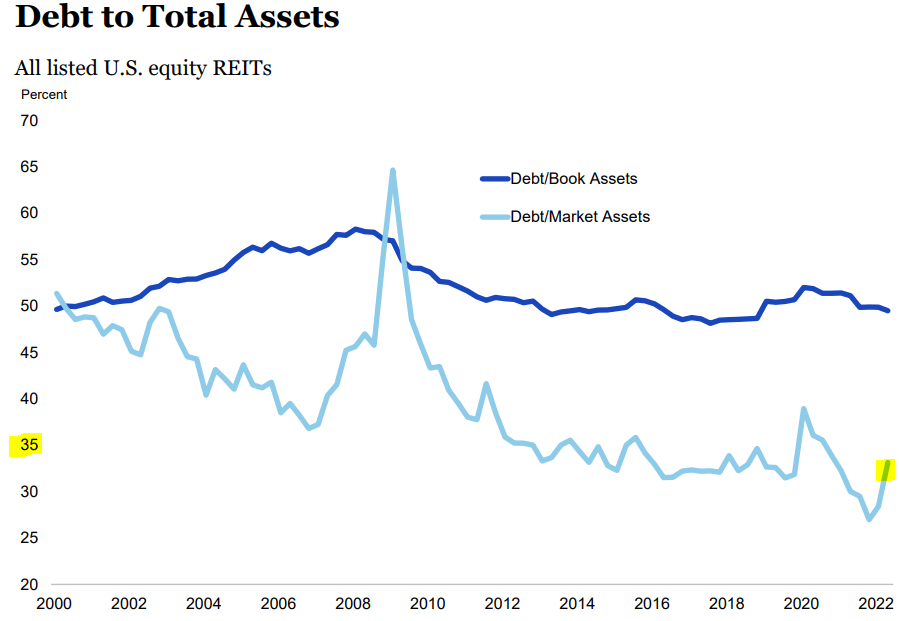

And the reason why is quite simple: REIT balance sheets are the strongest that they have ever been.

The average LTV is only 35%, which is very low. Just think about how much debt most home buyers use in comparison. It is not uncommon for home buyers to finance their property with an 80% or even 90% LTV and that’s despite buying a single, concentrated, illiquid asset, and they still consider it to be relatively safe.

REITs only use 35% and they own well-diversified portfolios of high-quality assets. This is near the lowest it has been in their history:

NAREIT

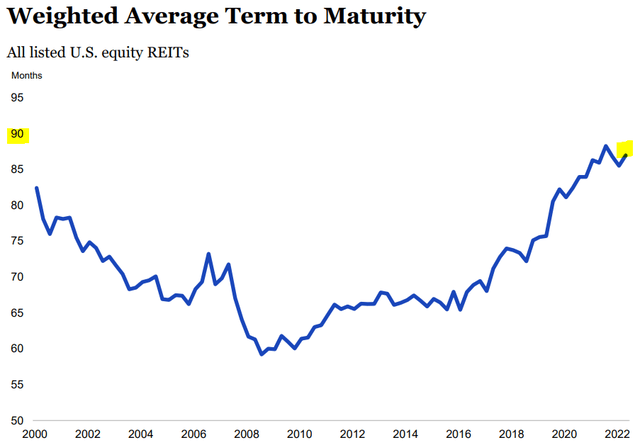

So the impact of rising interest rates won’t be significant on the profitability of REITs since they don’t use much debt, and this is particularly true when you consider how this debt is structured.

Most of it is fixed rate and enjoys long debt maturities. In fact, the debt maturities are today some of the longest ever. Lots of REITs don’t have any maturities to refinance from before:

So the impact is not even noticeable in many cases, and when there is an impact, it typically isn’t material.

Besides, interest rates are only rising because inflation is high, and inflation clearly benefits real estate investors. The rent growth of REITs has been some of the highest in years in 2021 and 2022, and this explains why REIT dividends have been growing so rapidly. Despite the market crash, most REITs have actually hiked their dividend this year. This is simply because the positive impact of inflation is greater than the negative impact of rising interest rates.

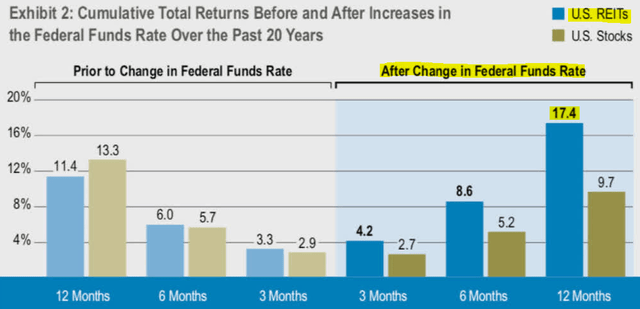

This explains why REITs have historically actually outperformed and generated high positive returns during times of rising rates, which is exactly the opposite of what positive investors appear to believe:

But let’s not stop here. Perhaps investors fear that a recession could be what really drives REITs out of business.

Once again, this makes little sense.

REITs are by nature some of the most recession-resistant businesses in the whole stock market. They own diversified portfolios of properties that generate steady rent checks, month after month, and these rent checks don’t change materially from one year to another in most cases.

Sure, some property sectors would suffer more than others. Malls, offices, and hotels would suffer from a cyclical downturn, but only about ~10% of REITs invest in these sectors.

Today, the vast majority of REITs invest in defensive property sectors such as:

-

Apartment communities

-

Manufactured housing communities

-

Industrial warehouses and distribution centers

-

Farmland

-

Data centers

-

Cell towers

-

Net lease properties

-

Grocery-anchored strip centers

-

Ground leases

-

Etc.

Independence Realty Trust

Most of these properties aren’t materially impacted by a recession. They earn steady rental revenue from long-term leases, and their tenants still need the real estate and don’t want to reconfigure their entire real estate footprint just because of a temporary downturn.

Besides, REITs mainly buy the highest quality, Class A assets in strong markets. Those assets are even less impacted than average since tenants would firstly vacate properties that are less desirable.

Moreover, REITs are large and their portfolios are well-diversified by property, tenant, and geography, which reduces the downside even further.

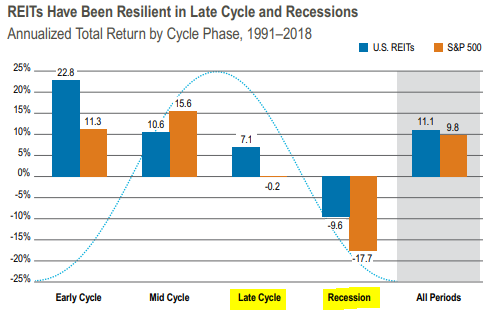

This explains why REITs have historically enjoyed nearly 2x better downside protection during most recessions. On average, they have only dropped by about 9% in past recessions:

Cohen & Steers

And it actually gets even better. Today, a lot of REITs are still stuck with rents that are well below market because they signed long-term leases with tenants before the inflation really took off. This means that as legacy leases expire, they will be able to push for large rent hikes, and it also means that they enjoy superior margin of safety in a recession because their rents are already below market.

Moreover, another consequence of high inflation is that construction prices have risen substantially, and it has made it more difficult and riskier for developers to build new real estate. A lot of new projects have been canceled or delayed, and it puts existing properties on an even stronger footing as it reduces the risk of oversupply.

So all in all, it is really hard to make sense of the claim that REITs will go bankrupt because of rising rates and a recession. The rising rates don’t have a major impact on REITs since they use little debt and they structure this debt in a way that mitigates the impact. Moreover, REITs are by nature more resilient to recessions since the need for their properties does not simply disappear and their rental income is typically protected by long-term leases.

REITs have gone through countless recessions, periods of rising interest rates, and many other crises and always made it to the other side. Many of the past crises were actually far worse than what we are experiencing today, and yet, there have been only a handful of REIT bankruptcies in our entire history.

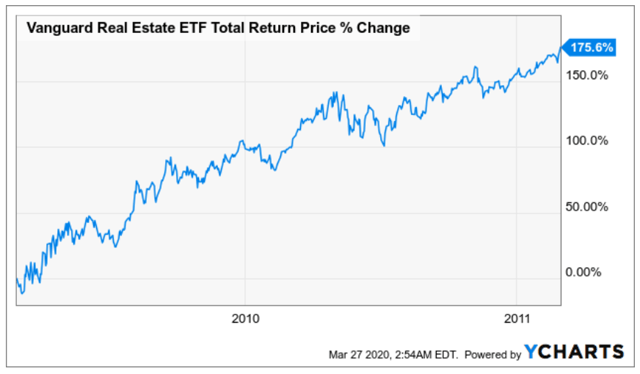

In 2008, REITs entered the great financial crisis with far more leverage than today even as the global banking system collapsed. Even then, only one overleveraged mall REIT (GGP) had to file for bankruptcy and REITs then rapidly recovered as share prices nearly tripled in the following two years:

YCHARTS

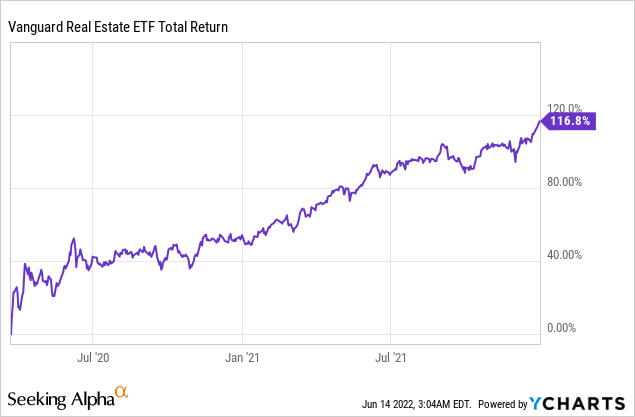

In 2020, REITs were in many cases forced to temporarily close down their properties due to the pandemic and for a while, tenants skipped rent payments. Even then, only a few overleveraged mall REITs (CBL and WPG) had to file for bankruptcy, and the rest recovered within a year:

YCHARTS

These two crises were far worse and they only took down a few mall REITs that were overleveraged.

There are two takeaways here:

Firstly, REITs are much more resilient than the market gives them credit for. Again, today, people are making claims about REITs headed into bankruptcy, but clearly, they haven’t studied their history or their current fundamentals.

Secondly, REIT share prices tend to drop too much due to market overreaction, but they also recover really quickly.

Share prices nearly tripled in the two years following the great financial crisis.

They also more than doubled in the year following the pandemic crash.

Today, REITs are down 33% on average and many individual REITs are down closer to 50%, despite experiencing rising cash flow and hiking their dividends in 2022.

We think that this is yet another historic buying opportunity for those investors who can ignore the near-term noise and focus on the bigger picture. Buying good real estate at a steep discount to fair value has never disappointed investors in the long run.

Be the first to comment