Solskin

My followers know I advise investors to construct a well-diversified portfolio built for the long-term and to stay in the market throughout its ups-n-down. In the current macro-environment of high-inflation and rising interest rates, investors may be looking for investments that can weather-the-storm. Sector ETFs can be a great way to allocate capital to targeted sectors that have history of outperforming in times of high-inflation. The Health Care sector is one of the sectors that typically outperforms during inflationary times because most consumers will not delay critical treatment, most have insurance that will assist them, and health-care providers can typically pass through cost-inflation on to the consumer. That being the case, today I will take a close look at the Fidelity Health Care ETF (NYSEARCA:FHLC) to see if it should be considered as a long-term core sector holding for your portfolio.

Investment Thesis

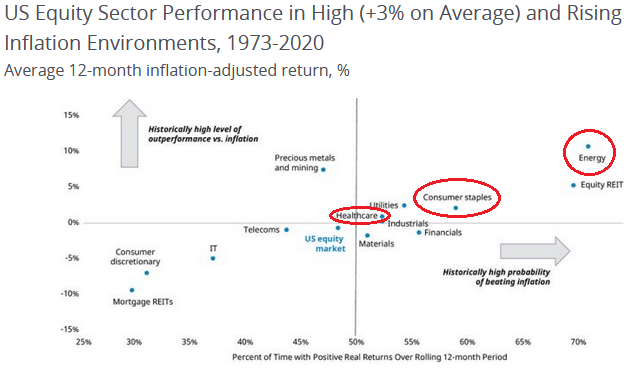

As you know, some sectors perform better in times of high-inflation than others. My best advice for investors during times of high-inflation is to own energy stocks, specifically: oil producers. My followers know that I have always thought that the price of oil is typically the dominate factor in determining the rate of inflation, and research supports that thesis:

The Hartford Funds

As can be seen in the graphic above, the Energy Sector is typically the best performer during times of high inflation – but there are others sectors that perform well too and that don’t carry near the cyclical risks associated with the commodity-based companies in the Energy Sector. Equity REITs typically perform well in times of inflation because, as Buffett pointed out during the Berkshire Hathaway (BRK.A) (BRK.B) 2015 shareholder meeting:

The best businesses during inflation are the businesses that you buy once and then you don’t have to keep making capital investments subsequently.

Buffett continued to say that you should avoid “any business with heavy capital investment.” The Consumer Staples SPDR ETF (XLP) does well during times of inflation/recession (it is a core sector holding in my personal portfolio), and the Health Care sector tends to outperform the market as well, although less so. However, Health Care can do very well in strong markets too, so it is certainly worthy of consideration as a core sector holding in a well-diversified portfolio.

So, let’s take a closer look at the Fidelity Health Care ETF to see how it has positioned investors for success going forward.

Top-10 Holdings

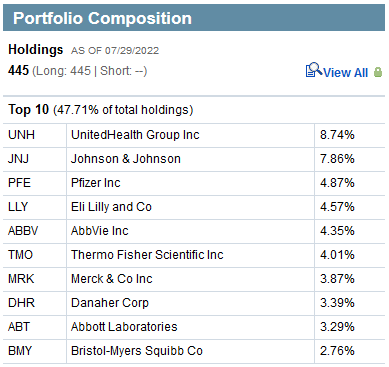

The top-10 holdings in the FHLC ETF are shown below and equate to what I consider to be a moderately well-diversified 48% of the entire 445 stock portfolio:

Fidelity

Source: Fidelity FHLC Webpage

The #1 holding in the FHLC ETF with a 3.7% weight is UnitedHealth Group (UNH). As you might know, UNH is the highest weighted component (~10.8%) of the DJIA due to its relatively high stock price ($536.60). The diversified healthcare company is up 30.6% over the past year and has significantly outperformed all of the major market averages. UNH has a strong long-term track record of generating revenue & earnings growth throughout the market cycles.

Diversified health-care conglomerate Johnson & Johnson (JNJ) is the #2 holding with a 7.9% weight. JNJ stock is relatively flat over the past year as revenue growth has slowed. Yet the company is very profitable and currently pays a $4.52/share annual dividend yielding 2.53%.

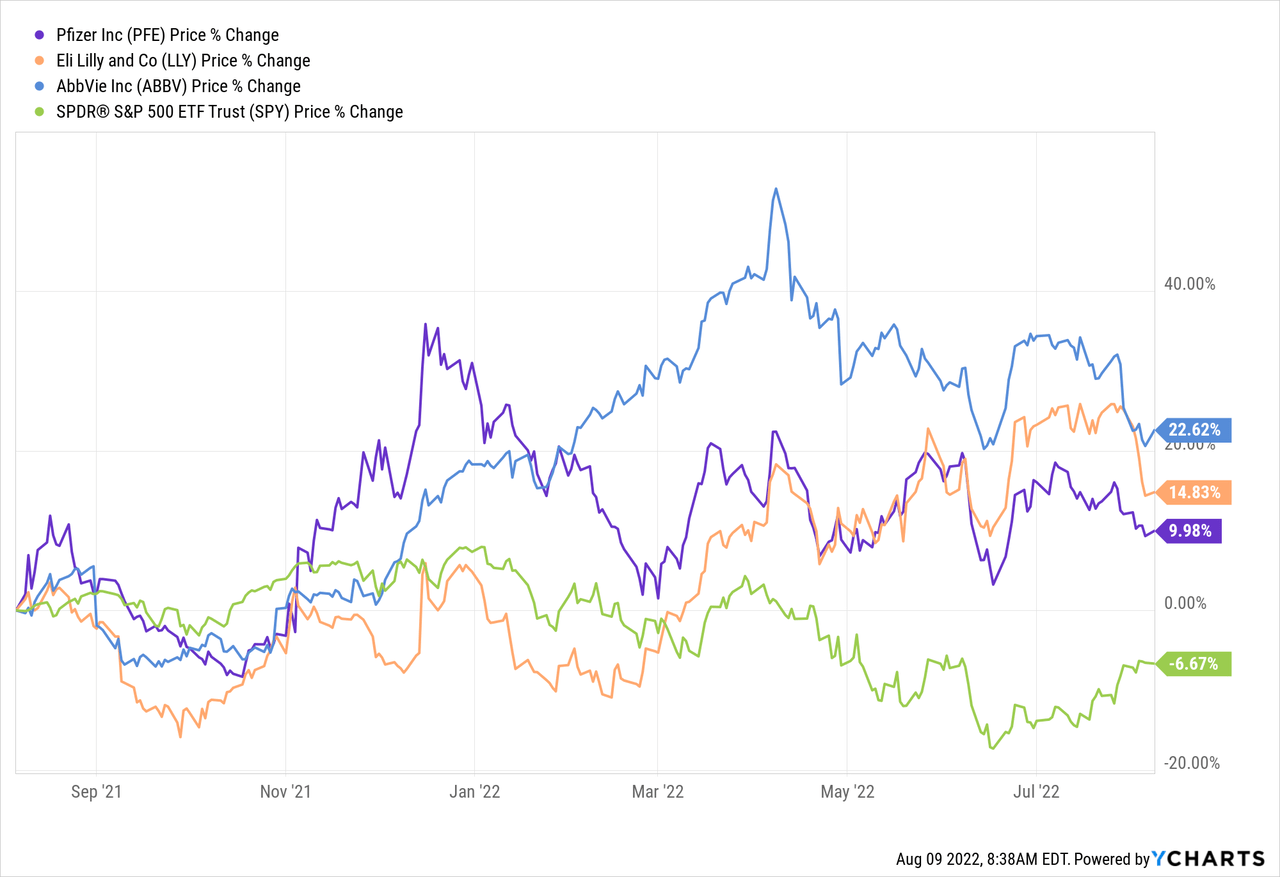

The #3-#5 holdings are pharmaceutical companies Pfizer (PFE), Eli Lily (LLY), and AbbVie (ABBV) with an aggregate weight of 13.8% and yields of 3.2%, 1.2%, and 3.9%, respectively. All three of these pharma companies have significantly outperformed the S&P500 – as represented by the (SPY) ETF – over the past year:

Eli Lily is a top insulin maker and will likely benefit due to the Republican Party’s refusal to support the Democrat’s proposal to cap insulin costs at $35/month in the Inflation Reduction Act.

Note the #7 and #10 holdings, Merck (MRK) and Bristol Myers Squibb (BMY) are also large pharmaceutical companies. Merck is up 17.5% over the past year and yields 3.1%. Bristol Myers is up 9.5% over the past year and yields 2.9%.

Diverse medical, commercial, and industrial device maker Danaher Corp (DHR) is the #8 holding with a 3.4% weight. Danaher has doubled revenue over the past 5-years while the stock gained 257%. It trades with a forward P/E = 27.4x and yields only 0.32% with a $1/share annual dividend.

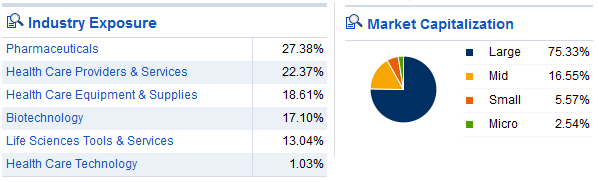

As you can see from the top-10 holding, the FHLC portfolio is heavily weighted in big pharma stocks. Indeed, they equate to 27.4% of the entire portfolio, which can generally be considered to be in the “Large-Cap Blend” category:

Fidelity

Source: Fidelity FHLC Webpage

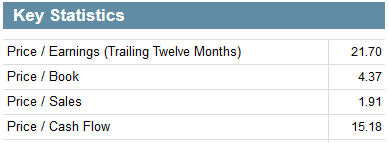

From a valuation perspective, the FHLC ETF trades at metrics which I consider to be relatively in-line with the S&P500:

Fidelity

Performance

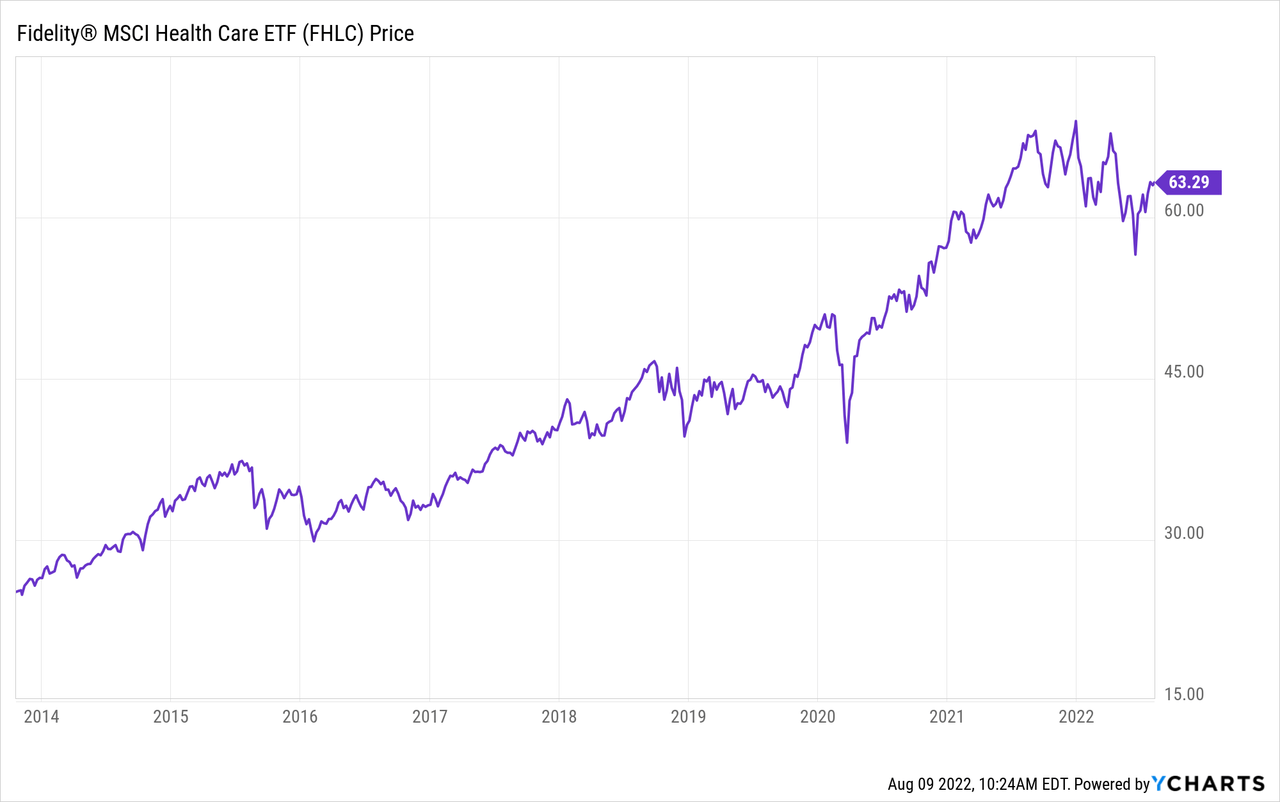

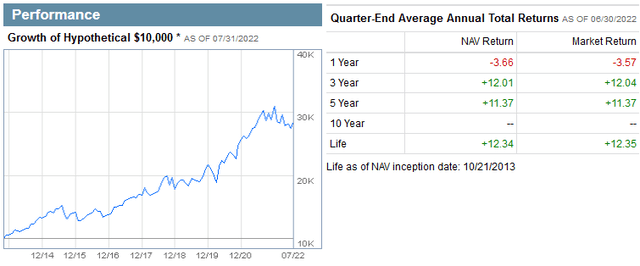

The FHLC ETF has a solid 12.35% average annual total return since its inception, which you will note is just short of 10 years ago:

Also note that the FHLC ETF fully participated in the bull-market but topped out and headed lower during the bear-market of 2022.

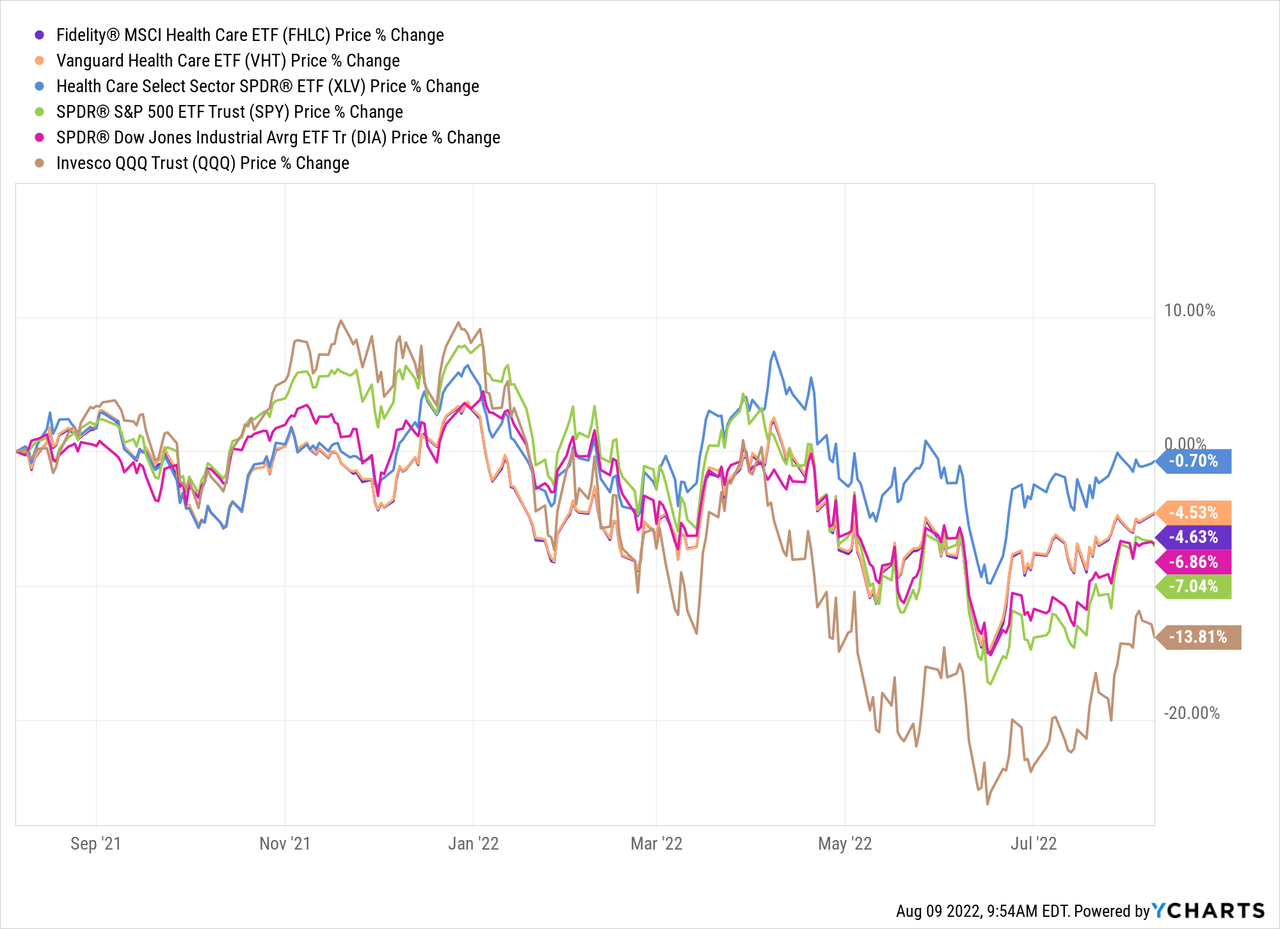

The graphic below compares the one-year performance of the FHLC ETF with that of peers the Vanguard Health Care ETF (VHT) and the Health Care SPDR ETF (XLV), as well as the broad market indexes as represented by the SPY, (DIA), and (QQQ) ETFs:

As can be seen in the graphic, all three Health Care Sector funds outperformed the broad market averages during the recent bear market, but the FHLC was the laggard of the three, and under-performed the XLV by almost 4%.

Risks

Health care companies are not immune from the adverse impacts of the macro-environment, which include covid-19 related supply-chains shocks and shut-downs, high inflation, a rising interest rate environment, and the impact of Putin’s horrific war-of-choice in Ukraine that has effectively broke the global energy & food supply chains. All of these could negatively impact US and global economic growth.

The recent Inflation Reduction Act (or the “IRA”) gives Medicare the power to negotiate prices with the pharmaceutical companies. This will likely reduce the prices those companies will charge for drugs – and therefore reduce profits. Considering that big pharma represents 27.4% of the FHLC ETF, this is obviously a headwind going forward. That said, it is quite likely if profits are crimped enough, big pharma will reduce R&D expenses and perhaps cut-down on TV advertising (I for one would applaud that!) in order to generate decent returns for investors.

So far, high inflation costs don’t seem to be percolating down through the health care sector. Indeed, as CNN reports, the Consumer Price Index rose 8.5% in the 12 months that ended in March while health care inflation has been sticky around its historical trend of around 2%.

Summary & Conclusions

The Fidelity Health Care ETF has a solid long-term performance track record, a 5-Star Morningstar rating, and is relatively cost-effective with a 0.08% expense fee. However, the fund is heavily weighted in big pharma and the winds-of-change are likely to negatively affect near-term sentiment on that sub-sector. So while I do believe the Health Care sector deserves an allocation of capital in a well-diversified portfolio, considering the sector’s relatively lackluster performance of late, and the headwinds facing big pharma, it’s hard for me to get overly bullish on FHLC at this time. That being the case, I rate FHLC a HOLD and suggest investors wait for, say, a 10% pull-back opportunity before starting a position or adding shares to an existing position.

I’ll end with a 1-year chart of FHLC and note that the fund frequently gives investors opportunities to buy on significant dips:

Be the first to comment