Kevin Brine/iStock Editorial via Getty Images

From time to time, Political Calculations will follow a single stock. To qualify as a stock we follow, we look for one major characteristic: the stock must be on the verge of a major potential change involving its dividend, when the question of whether the company will change its dividend is still up in the air.

In 2018, that stock belonged to General Electric (GE), which followed through on our prediction that it would cut its dividend by a large amount. In 2020, we identified Iron Mountain (IRM) as a promising investment based on the hypothesis it would not cut its dividend despite its depressed stock price.

Last Thursday, September 15, 2022, FedEx (NYSE:FDX) came roaring onto our radar screen when, after the market had closed, the firm tossed out the earnings guidance it presented to investors just three months earlier, because of the deterioration of the U.S. and global economy’s outlook over the summer.

The company’s stock price was hammered in the next day’s trading, falling over 21% from the previous day’s close, its “biggest plunge ever“. But although the firm withdrew its previous earnings guidance and announced plans to shutter retail stores, park its cargo transport aircraft, freeze its hiring and cut back labor hours of its staff, it left one big cash-preserving option unaddressed. FedEx’s leaders haven’t announced what they might do about the company’s quarterly dividend.

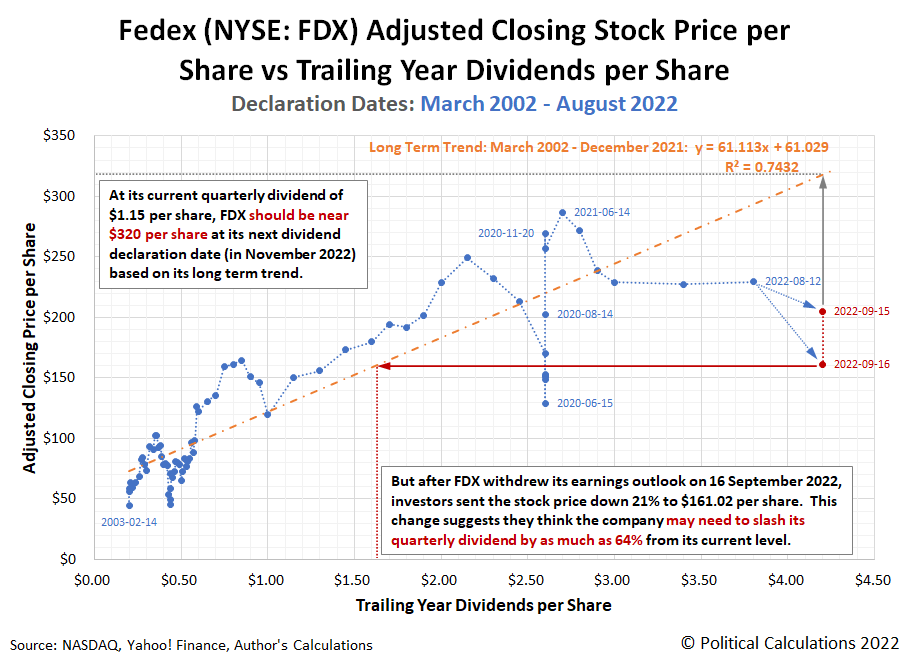

The following chart illustrates how we see FedEx’s options potentially playing out:

Author

Superficially, FedEx’s current situation is similar to what we found for Iron Mountain back in 2020. The company’s current stock price is well-depressed, where a handsome reward awaits if its outlook improves and no dividend cut is needed, or a major dividend cut needs to be on the table because its outlook remains grim.

The chart shows FDX lived through a very similar experience back in June 2020 as faces the company today. Then, the company’s executives were presented with similar options. If the company’s prospects improved, leaving the dividend alone would see its stock price soar back to the level the long-term relationship between it and the company’s trailing-year dividends per share would place it. If they didn’t, a dividend cut of 61% would make sense given the level of its stock price.

Ultimately, the prospects for the global economy and FedEx rapidly improved in the following months, and investors who might have bought into the company at that time were well-rewarded. But what would happen today?

If the “outlook gets better” scenario holds, given where its stock closed on Friday, September 16, 2022, our simple analysis suggest FDX could double in value. But if the “things stay grim” scenario is the right one, FedEx’s board of directors could cut the dividend by as much as 64%.

We have one more bit of information to consider that may tell us which way FedEx’s board will go. In June 2022, they boosted FedEx’s quarterly dividend from $0.75 to $1.15 per share, a 53.3% increase. When they implemented that dividend, it was based on the company’s earnings outlook from that time. The one they just trashed. Since they’ve thrown out that forecast, we think FDX’s dividend is now also on the cutting board, with at least a 50% reduction up for consideration. That’s despite the company’s history in avoiding cuts to its dividends for its shareholding owners.

The only question is now is how long it will be before the board acts. In ordinary circumstances, the company could wait to announce a cut when it will next declare dividends in early November. In an economy with deteriorating prospects, it would be to their advantage to act much sooner than that.

References

NASDAQ. FDX Dividend History. [Online Database]. Accessed September 17, 2022.

Yahoo Finance. FedEx Corporation Historical Data. [Online Database]. Accessed September 17, 2022.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment