Igor Borisenko

By Lee Clements, Head of Applied Sustainable Investment Research, Global Investment Research

Rising bond yields this year have seen many market analysts reach for a famous fixed income quote. James Carville, a White House political advisor, on being told that his government would have to rein in spending, wished that he could be reincarnated as the bond market – “because you can intimidate everybody.”

But fixed income markets are facing one risk that they cannot face down. Not so long ago, many investors saw sustainability or climate issues risks as down the road, but numerous data points show that the future is already here. A material portion of both issuers and investors are now sustainability-focused, it is now firmly part of the list of risks to be considered, alongside rates, inflation, credit etc. and ESG performance can impact investment performance in some markets. If that is not enough, regulators and stakeholders are forcing it to be a key issue for all investors.

Here are a few examples of the arrival of ESG fixed income risks:

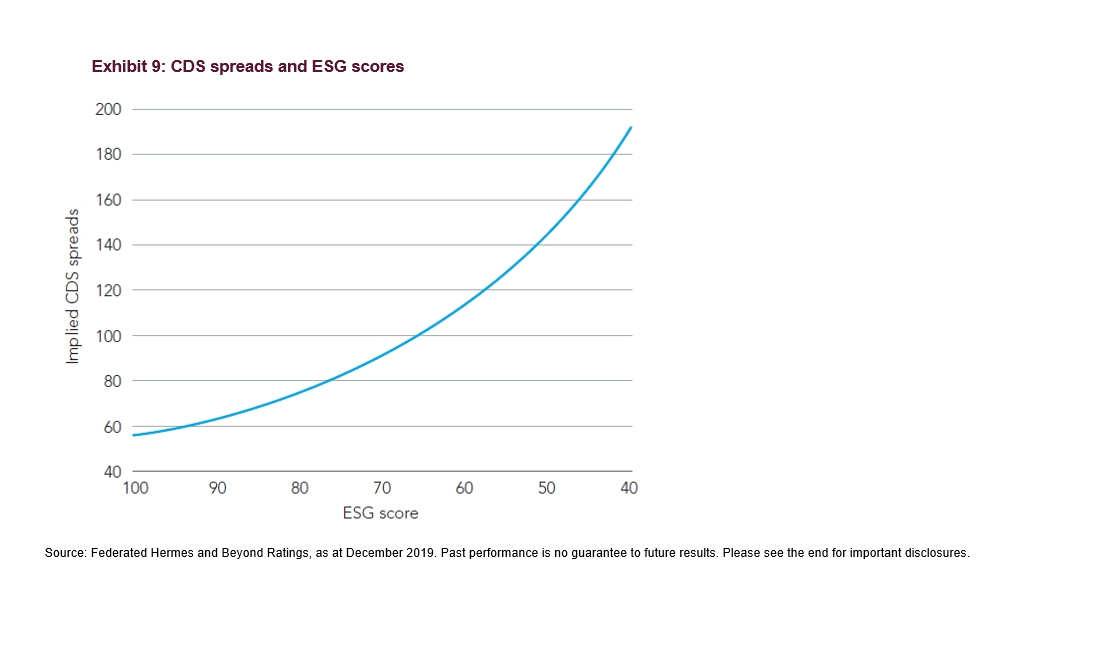

- Studies show a direct inverse correlation between sovereign bond performance (evidenced by CDS spreads) and ESG scores [1]. The better a security’s ESG score, the lower its risk of default

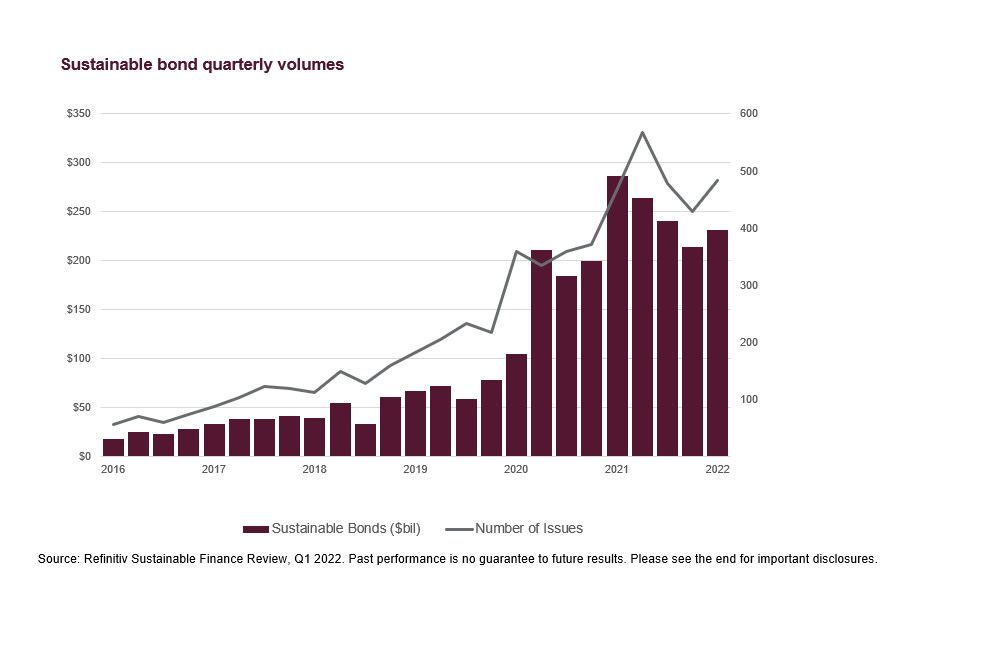

- Issuance of sustainable finance bonds, such as green or sustainability-linked bonds, are growing rapidly and are now 9-10% of global debt capital markets proceeds [2]

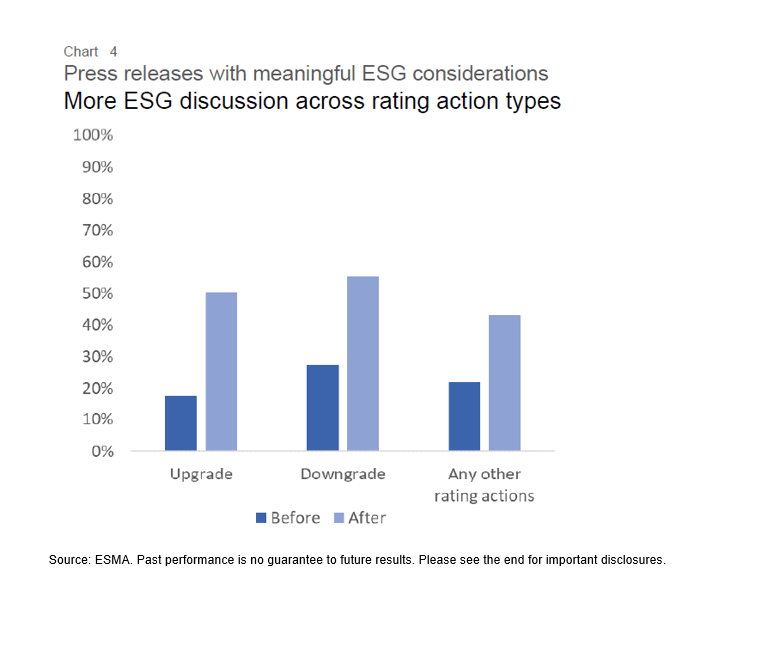

- Sustainability issues are having a growing influence on credit ratings. A recent NLP study by ESMA found meaningful ESG considerations in ~50% of the press releases relating to credit rating actions [3]

- Rising geo-political risk related to the war in Ukraine war has led investors to reconsider governance in issuers (both sovereign and corporate) relating to authoritarian regimes, human rights, etc. [4]

- The European Central Bank has recently stated that it will apply climate risk measures to its €386bn holding of corporate bonds [5][6]

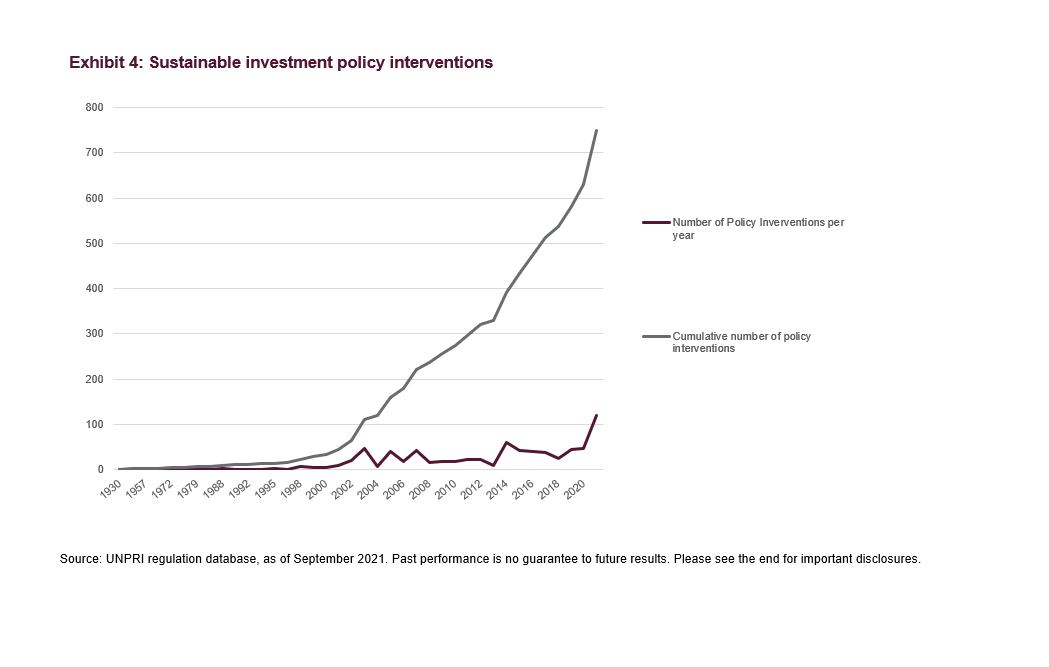

Fixed income markets are not only unable to face down or ignore SI issues, but they are also assimilating sustainability risks into their frameworks more than ever. These risks are firmly on the agenda of regulators worldwide, with the number of sustainable investment policy interventions growing rapidly [7].

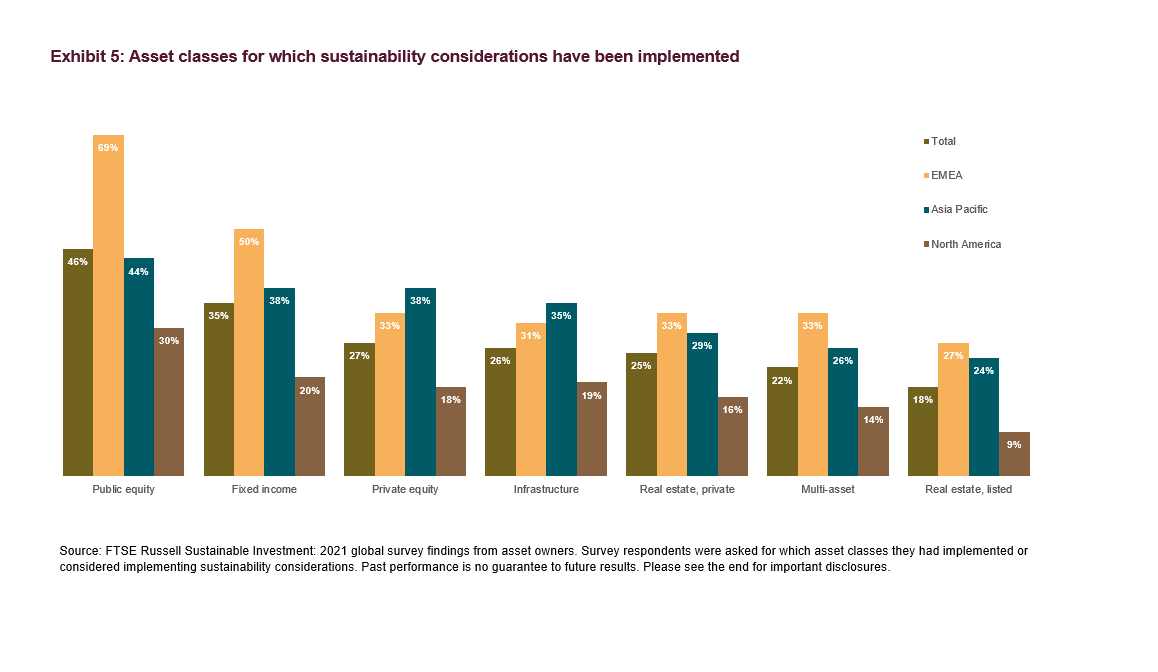

- Stakeholders are demanding holistic sustainable solutions across their portfolios and fixed income is playing catch up. Only 35% of asset owners are implementing sustainability considerations in their fixed income portfolios, compared with 46% in their equity portfolios (and it is much lower outside of the corporate bond sub-asset class)

While research shows the impact climate change could have for future default potential, even at the sovereign level [8], we’ve now arguably reached a critical mass of focus on sustainability where its impact has become self-sustaining and as fixed income investors manage their rates or credit risk, they now need to consider how it will impact their sustainability/climate risk and vice versa.

With all the activity and pressure behind sustainability in fixed income, then why aren’t we seeing more products, outside of sustainable finance bonds, and why do sustainable equities keep taking the limelight? The short, simple answer, which is a rare thing to find in the world of sustainability, is that building sustainable fixed income products is a difficult thing to do [9]!

Fixed income is, by its nature, a complex asset class. The first challenge is defining the issuer, with many corporates having complex structures of subsidiaries, which can have different jurisdictions and sectors, any of which can issue bonds. Mapping of these entities, which can be more than 1,000 for entities such as large banks, is critical to align with sustainability data for tilting, exclusions [10][11] or assessing climate risk. This becomes even more challenging when you throw in private companies, state-owned entities and other asset classes such as sovereign bonds [12][13] or securitized bonds [14]. These also require additional sustainability data, e.g., sovereign ESG and climate data, as well as an understanding of combining asset classes.

Fixed income is also relied upon by many investors as the bedrock of their portfolios and as such much attention must be placed on the investment characteristics of sustainable fixed income products. The risk/return characteristics of bonds is very different to equities and as such the impact of sustainability overlays can have different impacts. With the ever-changing universe of bonds (as they are issued and mature), specific characteristics of individual bonds (including rapidly evolving sustainable finance bond categories, such as sustainability-linked bonds) and evolving impact of sustainability data in changing portfolio allocation and it is critical in the creation of sustainable fixed income products that distinct attention is placed changing risk/return characteristics and portfolio concentrations and/or apply additional overlays to mitigate the risks (‘smart sustainability’ strategies). This is particularly true today as high inflation and rising inflation impact all bond portfolios, including sustainable ones [15].

The required building blocks to build sustainable fixed income indices are:

- A comprehensive family of conventional fixed income indexes;

- A mapping between bonds, issuers and datasets;

- Broad sustainability datasets (for example, climate risk-related, ESG, UN Sustainable Development Goals) across asset classes;

- A sophisticated range of index implementation techniques;

- Smart overlays to tailor custom solutions and adjust sustainability or financial characteristics;

- Analytics to measure the sustainability characteristics of the indexes;

- Rigorous quality control process across the data sources

An example of an innovative application of sustainability in fixed income can be seen in the FTSE EuroBIG ex Sovereigns SDG index.[16] [GP1]

In recent months there have been plenty of examples of bond markets intimidating central banks, economists, and investors. But it seems that sustainable risk is integral to fixed income markets, and that process can only deepen.

[1] Pricing ESG risk in sovereign credit: an emerging divergence | Federated Hermes Limited (hermes-investment.com); Pricing ESG risk in sovereign credit | Federated Hermes Limited (hermes-investment.com)

[2] Sustainable finance weathers wider market storm | Refinitiv Perspectives

[3] Text mining ESG disclosures in rating agency press releases, ESMA, Feb 2022

[4] How Russia’s war blindsided the world of ESG investing | Reuters

[6] ECB set for greener ‘tilt’ in €386bn corporate bond portfolio | Financial Times (ft.com)

[7] UNPRI regulation database

[8] Anticipating the climate change risks for sovereign bonds (part 2) | FTSE Russell

[9] Sustainable investment – not just an equity game | FTSE Russell

[10] Decarbonising fixed income investment | FTSE Russell

[11] Enabling global debt investors to align investment choices with values | FTSE Russell

[12] How to build a climate-adjusted government bond index | FTSE Russell

[13] Applying ESG Factor to Government Bond Indices | FTSE Russell

[14] ESG taxonomy for securitized products | FTSE Russell

[15] [SIFI Rates Blog]

[16] Investing sustainably with a custom credit index | FTSE Russell

© 2022 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) FTSE Fixed Income Europe Limited (“FTSE FI Europe”), (5) FTSE Fixed Income LLC (“FTSE FI”), (6) The Yield Book Inc (“YB”) and (7) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “The Yield Book®”, “Beyond Ratings®” and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products, including but not limited to indexes, data and analytics, or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (A) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (B) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing in this document should be taken as constituting financial or investment advice. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any representation regarding the advisability of investing in any asset or whether such investment creates any legal or compliance risks for the investor. A decision to invest in any such asset should not be made in reliance on any information herein. Indexes cannot be invested in directly. Inclusion of an asset in an index is not a recommendation to buy, sell or hold that asset nor confirmation that any particular investor may lawfully buy, sell or hold the asset or an index containing the asset. The general information contained in this publication should not be acted upon without obtaining specific legal, tax, and investment advice from a licensed professional.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back-tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This document may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB, BR and/or their respective licensors.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment