chonticha wat

By Jim Wiederhold

During the Diwali festival in India, retail gold demand tends to pick up, offering a floor to global gold prices or the potential impetus to push prices seasonally higher. Several years of lower-than-expected gold demand suggest that there is room for an uptick in demand in Q4 2022 for India’s second-largest import by value. India plays a crucial role in the gold market, with global annual imports of gold moving back and forth between India and China as the biggest net importer.

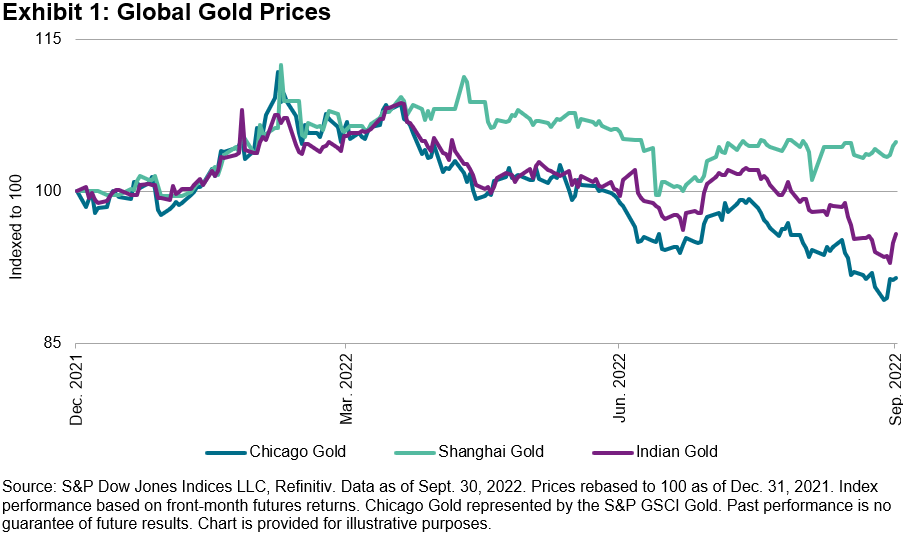

Gold prices have moved lower over the course of 2022, as many central banks across the globe have embarked on rate hiking regimes in order to get control of inflation. Gold in India hit another new low, as the U.S. dollar continued to make new highs on the back of the U.S. Fed announcing one of the most aggressive rate hiking campaigns in decades. The Reserve Bank of India (RBI) also increased interest rates, but not as aggressively in comparison, given that inflation has risen but is not as high as in the U.S. Expectations are for the RBI to hike less in coming meetings, while the U.S. Fed could continue to increase rates at large clips, which could lead to further weakness in the short-term gold price, given it is historically negative correlation to the U.S. dollar.

There are potential tailwinds in the short term for gold outside of the demand from the Diwali festival. Gold has been known as an inflation hedge due to its use as a store of value. Recently, it has not held up to that claim; inflation has soared higher, while gold prices have lagged other commodities. If we look back historically to other high inflation periods in the 1970s and mid-2000s, gold tended to lag other commodities prices higher and usually did so in the second half of these high inflation time periods. Will this time echo those prior periods? It’s hard to say with other potential new stores of value present that were not available in past high inflation environments, like cryptocurrencies.

This article was first published in The Economic Times on Oct. 8, 2022

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment