Justin Sullivan

Hey, do you remember that Ford Model T slogan? “You could have any color as long as it’s black.” Tesla’s (NASDAQ:TSLA) Model Ys and Model 3s may not be as popular as the Model T was in its day. Still, many Teslas are purchased in numerous colors, with extensive options, and are now iconic EVs with monopolistic tendencies. Another factor about Tesla is that most owners genuinely love their vehicles and could become lifetime users of Tesla products. Considering these and other factors, it’s no wonder the company’s sales have continued to surge despite the rough times. Tesla recently provided better-than-expected EPS results.

Furthermore, the company illustrates a tenacity for surpassing consensus estimates. Unlike most companies, its forward EPS and revenue revisions continue heading higher. Therefore, Tesla will likely continue reporting solid earnings and providing robust guidance as we advance.

In early 2017, I wrote my first article about Tesla, discussing whether it would become a trillion-dollar company within the next decade. However, Tesla’s market cap surged from around $50 billion to a trillion dollars much quicker than anticipated, but now Tesla must recover and sustain its trillion-dollar valuation status. Tesla’s next significant run-up could take the stock into the multi-trillion-dollar valuation spectrum. Thus, Tesla’s preferred long-term buy-in target is in the $180-200 range. However, if the bear market accelerates, the stock may drop to approximately $150, making it a strong buy. Despite this near-term downside potential, Tesla’s stock price should appreciate considerably in the coming years, making it a top investment for the next decade.

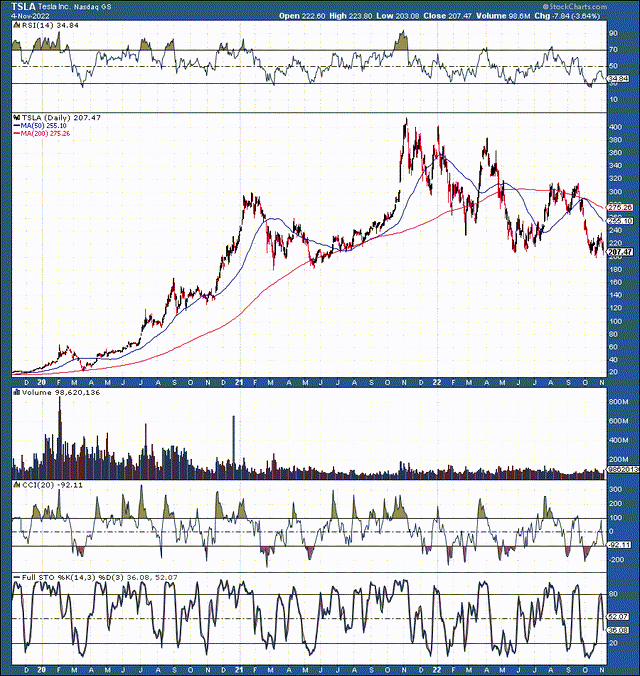

The Technical Image

TSLA (StockCharts.com)

If we go back to pre-split adjusted levels at $200 here, Tesla would be worth $3,000. While Tesla’s tenfold run-up since its deeply undervalued years in 2019 and earlier is significant, the stock has a long way to go to get the company to a sustainable trillion-plus dollar market cap.

Tesla is approaching a critical support level at $200-$180. While this level represents an excellent long-term entry point, Tesla’s stock could fall through this level, sliding toward the critical $150 support level. The stock is down by approximately 50% from its all-time high, and while the share price could dip lower because of a broader economic slowdown, Tesla’s price should bounce back and advance substantially higher in the coming years.

The Recent Report

Tesla’s stock dipped lower after the company posted “mixed” results in its recent earnings announcement. The company’s $1.05 in non-GAAP EPS beat by four cents, but Tesla’s revenues increased slightly less than was anticipated (56% YoY). The consensus bar was set high, yet the 56% YoY growth rate is spectacular. Elon Musk said that Tesla could be worth more than Apple (AAPL) and Saudi Aramco (ARMCO) combined, and I don’t see why not.

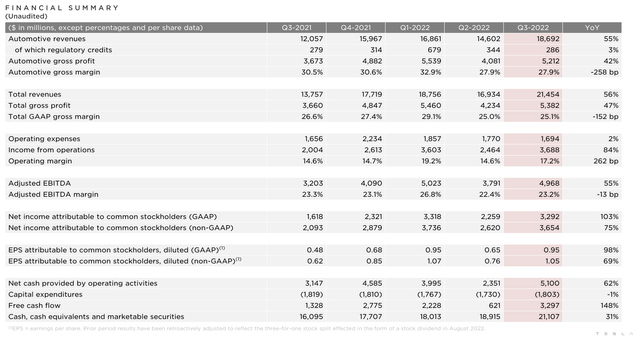

Let’s Look At The Results

Tesla financials (Tesla-cdn.thron.com)

Tesla achieved an impressive 55% YoY automotive sales growth despite only implementing $286 million in credits. Automotive gross profit surged by 42% YoY to $5.2 billion while maintaining a healthy automotive gross margin of 28%. Operating expenses increased by 2% YoY, leading to an 84% surge in operating income of nearly $3.7 billion. This dynamic enabled Tesla to deliver $0.95 in GAAP EPS, a 98% YoY increase.

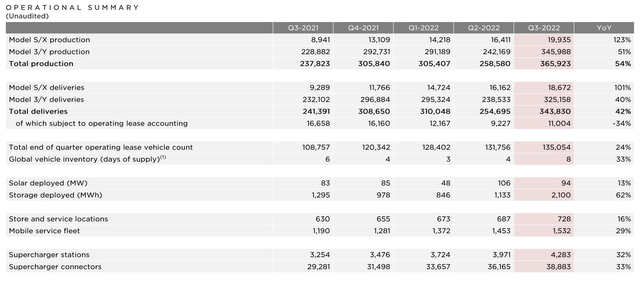

Operational Opportunities

Operations (Tesla-cdn.thron.com)

Tesla delivered solid 54% YoY production growth, including 123% YoY growth in its Models S/X unit. This phenomenon illustrates the continued robust demand for Tesla’s high-end premium vehicles. This dynamic should keep Tesla’s ASP elevated, leading to higher revenues.

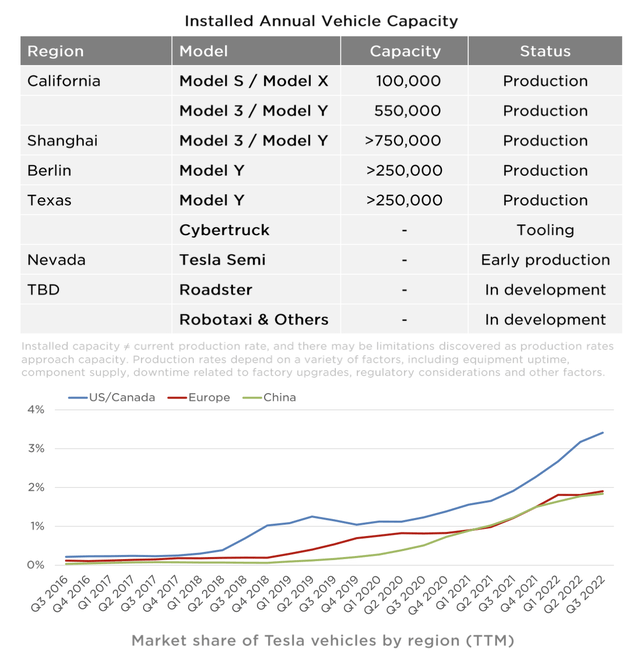

Vast Production Capacity

Production capacity (Tesla-cdn.thron.com)

Tesla can build nearly two million “Model S3XY” annually now. This segment alone could deliver about $100-$120 billion in sales for Tesla next year. In addition, Tesla is working on an eventual Cybertruck. The Tesla Semi is in early production.

We should be aware of the Tesla Semi’s potential. Tesla plans to have production up to 50,000 Tesla Semis annually in 2024. We can estimate the ASP from prior reports, which is around $175,000. I’m optimistic that the ASP could go substantially higher due to abundant options and may stabilize closer to $200,000 down the line. Therefore, we should see approximately $8-10 billion in annual revenue flow from the Tesla Semi segment in the coming years. In addition, we will see significant growth in the Tesla Semi segment, and we could witness revenue growth of 40%-50% for several years.

We also should see revenues increase as Tesla’s Cybertruck hits the market in 2024. However, a significant revenue increase from the truck will likely materialize in 2025 and onward. While it’s challenging to speculate, if Tesla sells about 50,000-100,000 Cybertrucks annually, it could lead to an additional $5-$10 billion boost in sales in the coming years. Therefore, the automotive segment can potentially deliver $125-$150 billion in revenue by 2025. Tesla’s non-automotive sales segments accounted for about 13% of revenues last quarter. Thus, approximately $15-$20 billion in revenue will contribute to a revenue target of $140-$170 billion by 2025.

Tesla’s non-GAAP net income margin came in at 17% last quarter. A 17% income margin equates to approximately $24-$29 billion annual net income for Tesla in the coming years. Tesla has about 3.5 billion outstanding shares. Thus, we should see an EPS of around $7-$9 in 2024/2025.

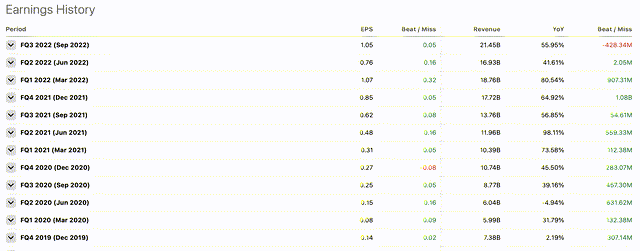

Tesla Rarely Misses

Tesla has delivered remarkably consistent revenues and earnings beats in recent years.

Earnings History

Earnings History (SeekingAlpha.com )

We also saw impressive sales and EPS growth recently. Revenues have surged from roughly $6 billion in Q1 2020 to approximately $21.5 billion last quarter. Earnings also increased dramatically in this period going from just eight cents in Q1 2020 to $1.07 in Q1 2022.

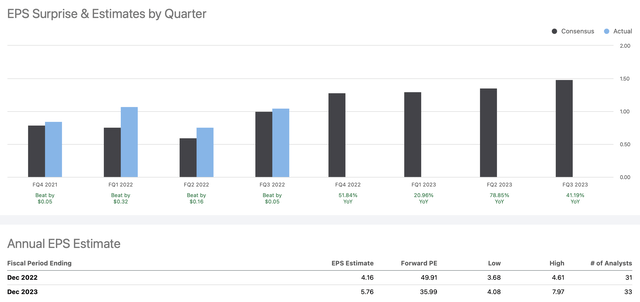

EPS Surprises and Estimates

EPS surprises (SeeingAlpha.com)

Last year, Tesla beat analysts’ estimates by a healthy margin. The consensus EPS estimate is $5.76 next year. However, Tesla could continue outperforming the consensus figures, and we could see around $6-6.50 in EPS next year. At about $200 a share, Tesla’s trading at approximately 33-30 in next year’s earnings estimates. However, if Tesla drops to $180-$150, the stock would only be around 20-17 times 2024/2025 EPS estimates.

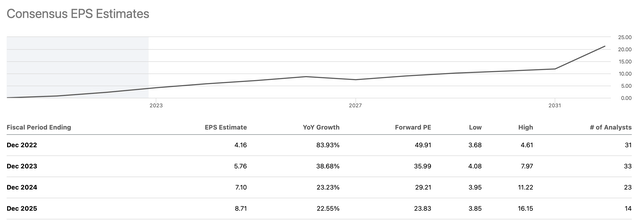

EPS Estimates

EPS estimates (SeekingAlpha.com )

My estimates are close to the consensus figures, and we should continue seeing robust 15%-20% annual EPS beyond 2025. Tesla’s revenue growth should persist, and with expanding market share and new product lines, the company’s revenues could skyrocket in future years.

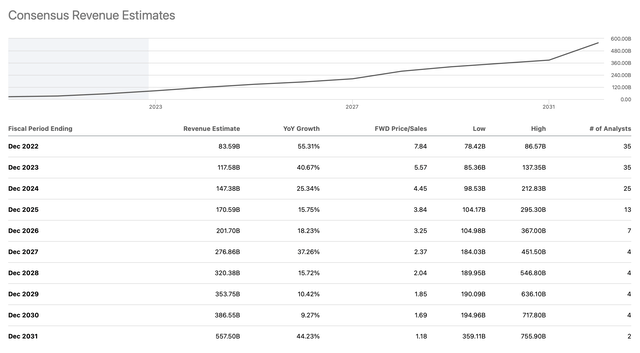

Revenue Estimates

Revenue estimates (SeekingAlpha.com)

Analysts’ estimates illustrate that we could consider an average annual revenue growth rate of 15%-30% through 2030. Thus, Tesla’s stock should command a relatively high multiple (20-30) as the company advances.

Here’s what Tesla’s financials could look like in future years:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $84 | $120 | $150 | $180 | $216 | $260 | $310 | $367 | $433 |

| Revenue growth | 56% | 42% | 25% | 20% | 20% | 20% | 20% | 18% | 18% |

| EPS | $4.30 | $6.25 | $8 | $10 | $12 | $15 | $18 | $22 | $25 |

| Forward P/E | 32 | 31 | 30 | 29 | 28 | 27 | 26 | 25 | 24 |

| Stock price | $200 | $250 | $300 | $350 | $420 | $486 | $572 | $625 | $700 |

Source: The Financial Prophet

Risks to Tesla

Risks exist for Tesla – The company may miss earnings and revenue estimates. Furthermore, a slowdown in demand, increased competition, supply issues, decreased growth, issues with regulators and foreign governments, and other variables are all risks we should consider before betting on Tesla to move higher. Serious concerns could cause Tesla’s valuation to lose altitude, and the company’s share price could even head in reverse if any serious issues should arise. Therefore, one should consider these and other risks before committing any capital to a Tesla investment.

Be the first to comment