Paul Morigi

Rental properties are some of the favorite investments of individual investors.

The idea is simple: you buy a property with the bank’s money and then let the tenant pay off your mortgage, all while the property keeps gaining value. You may even earn extra cash flow along the way and enjoy tax benefits if you structure things well.

It seems like a brilliant strategy.

But if it is so brilliant, do you ever wonder why legendary investors like Warren Buffett don’t invest in rentals?

He sure could: he has the capital, the skills, the connections and access to talent. And yet, he decides not to invest in rentals.

Why is that?

Fortunately, over the years, he has given us some clues in his Berkshire Hathaway (BRK.B / BRK.A) shareholder letters and televised interviews.

In what follows, we highlight the 3 main reasons why Warren Buffett doesn’t buy rentals, and we then present a better alternative for most investors.

Discover

Reason #1: Rentals require a lot of work

Rentals are typically perceived to be passive investments. People imagine that you simply buy a property, rent it out, and let the passive income pile up while you play golf.

But the reality is very different, and Buffett understands this. In an interview in 2012, he explains that if there was an efficient way to invest in rentals, he probably would, but the management makes it impossible. In a previous article, I shared the following list of tasks, which is not comprehensive:

- Studying different markets and sub-markets.

- Getting to know what’s fair value and what’s not.

- Looking for the right property and meeting with brokers.

- Negotiating, negotiating, and then negotiating a bit more.

- Getting financing and closing on the property.

- Deciding what to repair, interviewing contractors, and getting bids.

- Monitoring the repair works and complaining about things not being done properly. Getting another round of repairs…

- Marketing the property to find a good tenant.

- Interviewing tenants…

- Setting up a company and a bank account for the property.

- Getting the right insurance.

- Collecting rental income and paying all property expenses.

- Doing some more repairs…

- Etc.

And, cumulatively, that’s a lot of work! In a sense, a rental is more similar to a part-time job than a passive investment. Individual investors will typically work on their rental property and fail to account for the value of their time.

Buffett-type people are very aware of the fact that your time and work have value and once you account for it, the returns of rentals are rather disappointing in most cases.

Reason #2: Understanding your circle of competence

Buffett is very good at understanding his circle of competence and sticking to it. He made his fortune by investing in consumer goods, retail and insurance businesses. He understands those businesses really well and has a competitive advantage over other investors.

But he also understands that this doesn’t apply to real estate. While he certainly has some skills and probably knows more about real estate than most of us, he is still put at a disadvantage when compared to REITs (VNQ) and other private equity players like Blackstone (BX) and Brookfield (BAM).

Here is what Charlie Munger, Buffett’s right-hand man, noted at a previous annual meeting:

“We don’t have any competitive advantage over experienced real estate investors… We have no special competence in the field and that means that we spend almost no time thinking about it. And then such real estate that we have actually owned, I’d say we have a poor record at it.”

REITs and private equity players are specialists, and they have access to superior resources. Buffett understands that he simply cannot compete with them.

Reason #3: Difficult to find opportunities

Buffett is a value investor. He looks for mispriced opportunities to earn exceptional returns.

But unfortunately, there aren’t many such opportunities in the real estate sector. In a previous interview, he explains that:

“Under most conditions, it is difficult. It is a very competitive world. Real estate is more accurately priced most of the time.”

This makes sense when you think about it.

Real estate is not a commodity, but it is closer to being one than a regular business. You have four walls and a roof, and you then earn rental income by renting it out. It is fairly simple to understand. The cash flow is consistent and predictable, and the fair value can be easily determined, at least relative to a business.

As a result, there are fewer mispricings and opportunities for value investors like Warren Buffett. Most real estate investors buy properties at around market value and then earn returns by holding them for the long run.

A Better Alternative: REIT Investing

Buffett may not invest in rental properties, but he occasionally invests in real estate investment trusts (“REITs”), which are publicly listed real estate investment firms.

Just to give you a few examples, he has previously invested in Tanger Outlets (SKT), General Growth Properties, Vornado (VNO), ((now Brookfield (BAM)), Seritage Growth Properties (SRG), and STORE Capital (STOR), which was recently bought out by Blue Owl Capital (OWL). To be clear, REITs still aren’t a major part of Berkshire, which is understandable given its size, but he appears to have historically invested a lot more in them than rentals.

Why is he favoring REITs over rentals?

It is simply that REITs turn the weaknesses of rentals into strengths:

- Weakness #1: rentals require a lot of work, but REITs are completely passive. They are managed by professionals and they are highly cost-efficient thanks to their large scale.

- Weakness #2: rental investing requires skills and resources that you may not have. REITs can hire the best talent and pay them generous salaries, while still being cost-efficient given their scale. If you cannot compete with them, you may as well join them.

- Weakness #3: rentals are rarely mispriced, but REITs often offer great opportunities. Unlike rentals that are fairly stable, REITs are highly volatile because they are publicly traded. As a result, REITs will often be mispriced, like stocks, since most investors focus too much on short-term results. Today, REITs are particularly heavily discounted, trading at 20, 30, 40 or even 50% discounts relative to the value of the real estate they own. Buffett is a value investor, and he prefers to buy good real estate that’s professionally managed at a discount to fair value.

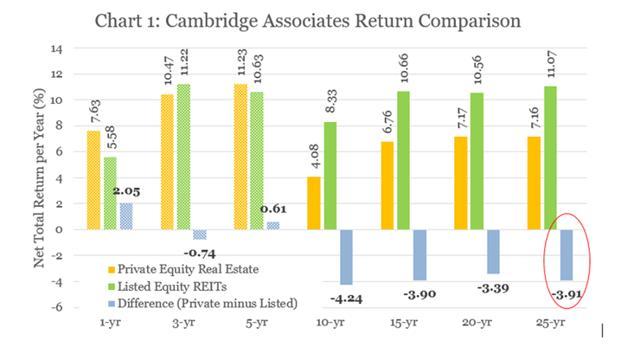

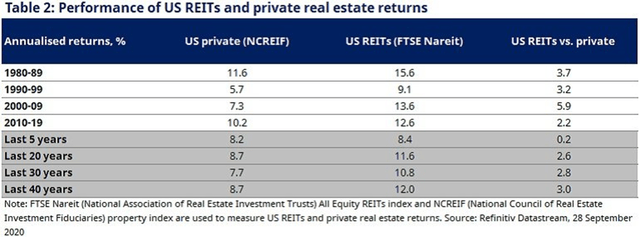

Beyond these advantages, there are several studies that conclude that REITs are more rewarding than rental properties in the long run. This makes sense because REITs enjoy huge economies of scale, have access to the best talent, better relationships, lower cost of capital, and many other advantages:

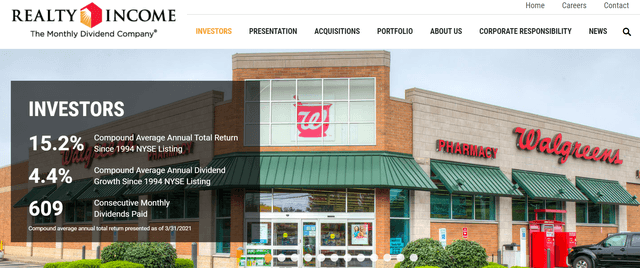

REITs also allow you to invest in real estate strategies that you couldn’t follow on your own. To give you an example, Realty Income (O) buys triple net lease properties that it leases to Fortune 500 companies like McDonald’s (MCD), Walgreens (WBA) and Walmart (WMT) on a long-term basis. It is a simple strategy that has resulted in 15%+ average annual total returns since its inception, and it has hiked its dividend every single year for nearly 30 years in a row.

If you had bought Realty Income after a major crash when it was discounted, your average annual returns would have been closer to 20% per year on average.

Could you achieve that by investing in rental properties?

It is unlikely because you lack scale and skills, and rental properties are rarely mispriced. This appears to be why Buffett favors REITs over rentals in most cases, and it is also why I prefer to invest in REITs.

Today, especially, it makes little sense to invest in rentals because REITs are heavily discounted after the recent market selloff and offer much better value than rental properties.

Just to give you a quick example: Whitestone REIT (WSR) owns a portfolio of service-oriented, grocery-anchored shopping centers in rapidly growing sunbelt markets like Phoenix and Austin. Its rents are today growing rapidly, but the company is currently priced at a near 50% discount relative to its NAV.

Whitestone REIT

Essentially, what this means is that you get to buy real estate at 50 cents on the dollar and get the additional benefits of liquidity, professional management, diversification, and scale for free on top of that.

The only reason why it is so heavily discounted is that the REIT market is today mispriced and temporarily detached from the private real estate market. It wouldn’t surprise me if Berkshire bought some more REITs in the coming quarters.

Bottom Line

Buffett rarely invests in real estate because it isn’t his specialty, but when he does, he tends to favor REITs over rentals.

I used to work in private equity real estate, but when I came to the realization that REITs were superior investments in most cases, I decided to become a REIT analyst and that’s how I end up here on Seeking Alpha.

Today, the majority of my real estate capital is invested in publicly listed REITs.

Be the first to comment