Gary Yeowell

Overview

Over the last few quarters, Tripadvisor, Inc. (NASDAQ:TRIP) stock has been impacted by a number of factors, including:

- A slow recovery from the COVID-19 pandemic: This had a significant impact on the travel and tourism industry. Some revenue segments for Tripadvisor are still below 2019 levels.

- Economists expect an economic recession in 2023: Many market experts, including former Boston Fed President Eric Rosengren, are calling for at least a mild recession in 2023. The travel industry would without question, face challenges financially as people travel less to save money.

- Higher costs are impacting profitability: Selling and marketing costs were up 58% in Q3 2022 vs. last year. Additionally, Tripadvisor increased its headcount to manage the increase in travel post-pandemic.

- Management reduced Q4 2022 revenue guidance: The company expects a moderate decline in revenue relative to Q3 2022 and Q4 2019.

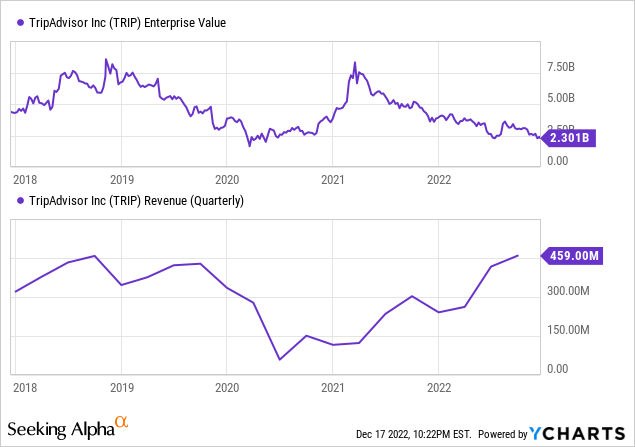

All of these factors precipitate a sharp decline in the company’s share price, and it’s hard to argue the logic. There haven’t really been any positive catalysts to justify buying Tripadvisor. However, as investors, it’s important to always be forward-looking, especially when market reactions become overblown. Tripadvisor’s enterprise value is now trading at levels not seen since March 2020, which is surprising since it reported record revenues and gross bookings during Q3 2022.

Management has been focused on investments in mobile and generating higher quality products, which has been a key driver for higher take rates, record new customers, and improved repeat rates this past quarter. In a normalized environment, the company will continue to operate on a leaner cost structure and I believe fewer R&D expenses to help improve profitability.

Under these assumptions, my long-term price target (into 2024) for Tripadvisor is $23 per share based on the following:

- Revenue: $2 billion

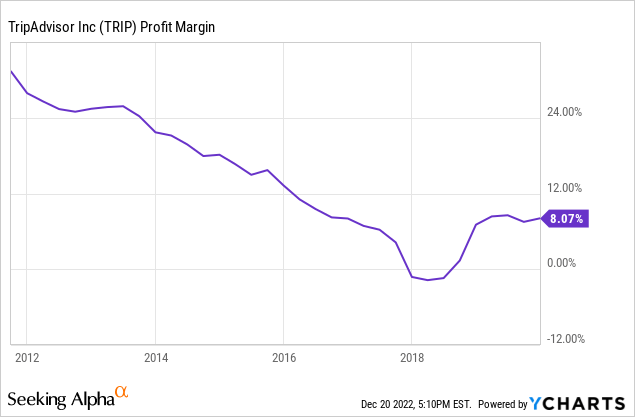

- Profit margin: 10%, based on 8% margins from 2018-2019 +2% for R&D expense reductions and leaner cost structure.

- Shares outstanding: 139.3 million

- P/E multiple: 16x, based on S&P 500 historical averages.

While the near-term outlook is quite negative, there are a few reasons why I like Tripadvisor over the next year:

1. Wall Street Has Already Priced In The Negative Outlook

It’s easy to write off Tripadvisor right now given the negative catalysts surrounding the company and the poor macroeconomic outlook in 2023. But that is too simple, markets already know that. Despite the record-setting quarter, shares have tumbled to lows not seen since early 2020. A lot of this is because the 2023 macroeconomic outlook is so negative. Markets are typically forward-looking, which is why we are already seeing outlooks cut for the travel industry by major research firms ahead of next year. This isn’t the first time travel stocks have received valuations based on future expectations.

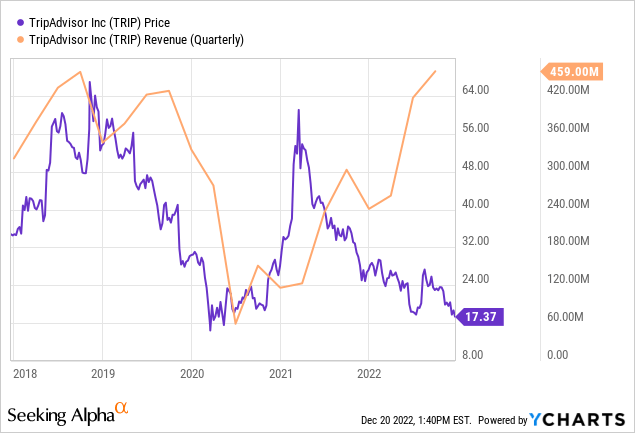

A good example of this forward-looking mindset can be seen in the chart below. Take a look specifically around late 2020, when Tripadvisor’s share price began to rally significantly, from under $20 per share to over $50 per share in a matter of months.

Notice how during that time frame, revenues barely changed as it hovered around $120 million per quarter from Q3 2020 to Q1 2021. Markets were expecting revenues to rebound in the coming quarters as the economy reopened and wanted to reflect that in the current share price.

I suspect we are seeing the opposite happen now in real-time. Revenues are at record highs, and its share price is almost at a 5-year low. If we do expect a mild recession to occur in 2023, when should Wall Street expect it to end? if it’s say, only 6-9 months, investors may re-evaluate Tripadvisor’s longer-term prospects sooner rather than later. And based on historical trends, investors would expect this to be reflected in the share price during the recession (likely towards the end of it). I think it’s key to get ahead of it before Wall Street does.

2. Debt Is Not A Concern

Another headwind I suspect is driving Tripadvisor’s share price lower is its debt. During the pandemic, Tripadvisor did have to raise a considerable amount of cash, in the form of fixed and convertible debt. There are two outstanding notes, due in 2025 and 2026. The 2025 debt was for $500 million fixed at 7% and the 2026 debt was for $345 million at 0.25%, convertible to equity at a conversion price of $73.81, which is well below where it trades now.

At the end of Q3 2022, Tripadvisor held over $1 billion in cash & equivalents on its balance sheet. Interest expense for the previously mentioned debt is very low relative to its cash position. The 2026 convertible debt interest expense is negligible at 0.25%, while the 2025 debt is around $9 million a quarter. When including this debt as part of the company’s enterprise value, Tripadvisor is still trading around 5-year lows, which is surprising in my opinion.

Enterprise Value Keeps Falling, Revenue Keeps Climbing

Notice that despite Tripadvisor’s quarterly revenue rebounding to 2019 levels, its enterprise value is still trailing by quite a substantial margin (~$5 billion in 2019 vs. $2.3 billion now). While many will point to the projected economic slowdown in 2023, I don’t see how much lower shares can go. It would be surprising to see valuations dip below the pandemic lows of March 2020.

3. Revenue Segments Are Growing Steadily

During Q3 2022, Tripadvisor saw notable improvements across its smaller business segments compared to 2021:

| Segment | Q3 2022 | Q3 2021 | Change |

| Tripadvisor Core | $284 million | $212 million | 34% |

| Viator | $174 million | $73 million | 138% |

| TheFork | $35 million | $30 million | 17% |

While Tripadvisor Core revenue for the quarter is only at 88% of 2019 levels, Viator is at 179% and TheFork is at 103%. Within Tripadvisor Core revenue, a notable standout was the “Experiences and Dining” revenue stream (represents 16% of Tripadvisor Core revenue) which was at 125% of 2019 levels. This was driven by improved offerings for travelers, as noted by CEO Matt Goldberg on the latest earnings call:

“We continue to build relationships with travelers looking for more than hotels. In our hotel B2B and media offerings, which have largely mirrored trends in hotel marketing and shifts in the advertising market, we recovered at 79% and 80% of 2019 levels, respectively.”

Management does not appear to be content with its current revenue figures. They are looking to grow further, which is a great sign as an investor. Rather than just looking to cut costs, Tripadvisor will continue investing in ways to grow revenue through better customer experiences and new offerings.

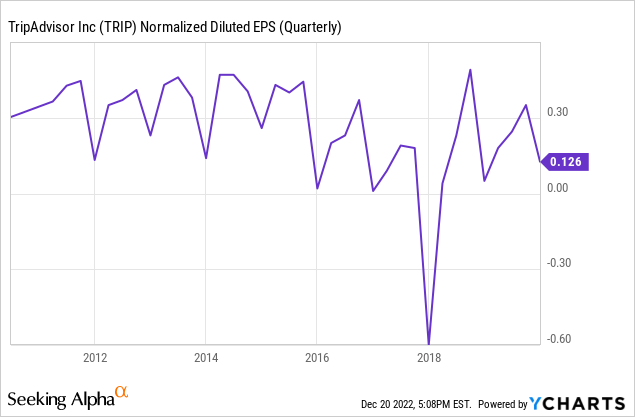

4. Earnings Can (And Likely Will) Change Fast

Tripadvisor’s historical earnings per share have been very volatile. When attempting to forecast Tripadvisor’s future EPS, I decided to look at pre-pandemic earnings, which represent a more normalized outlook in my opinion. As you can see below, the company has historically generated anywhere from $0-0.50 in EPS per quarter, depending on the profit margin:

While the overall trend for profit margin has been declining, it was beginning to stabilize around 8% prior to the pandemic. I have not found any comments from Tripadvisor’s management saying these margins will not be achievable again, so I believe it’s fair to assume the company can eventually get back to those levels.

Risks & Conclusion

Overall, the future performance of Tripadvisor’s stock will depend on a number of factors, including the continued recovery of the travel and tourism industry, the company’s ability to adapt to changing consumer behavior and preferences, and its ability to compete with other players in the online travel space. It is important for investors to carefully consider these factors and understand that travel stocks historically speaking, carry a lot of volatility. It’s a cyclical industry that is highly dependent on how the overall economy is doing. Investors should not expect Tripadvisor’s revenue to grow year-over-year as we head into 2023. Management has made that clear, for now.

I am looking much further ahead into 2024, as we hopefully will begin to see economic growth and travel demand pick up again. If Tripadvisor can return back to its pre-pandemic margins during that time, it means a ton of upside for the share price. Tripadvisor, Inc.’s current enterprise value of $2.3 billion is well below where it has historically traded, and I suspect that will change as margins improve and revenues stabilize.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment