Joe Raedle

Some would say that the 2000 to 2010 timeframe was a lost decade for stocks. However, I would say that the 2010 to 2019 time period was a lost decade for value investors, with many cyclical stocks masquerading as growth at any price during this timeframe.

This brings me to Stanley Black & Decker (NYSE:SWK), which is one such stock that has crashed back down to earth this year. In this article, I highlight why now may be a great time for value investor to pick up this beaten down dividend gem.

Why SWK?

Stanley Black & Decker is a diversified industrial company with businesses in tools & storage, commercial electronic security, and engineered fastening. It has been in business for over 170 years and is a well-recognized brand with a loyal following. The company has a diversified product lineup and operates in over 60 countries.

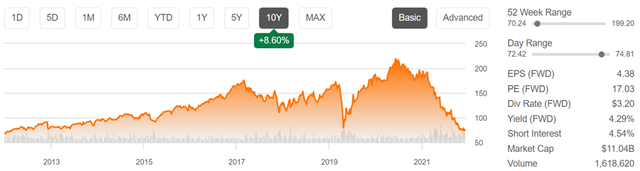

SWK stock has seen plenty of negativity over the year, with the price being down by 60% since the start of the year. As shown below, SWK is now trading at levels not seen since 2012, resulting in a “lost decade” for the stock, with an underwhelming 8.6% share price increase over the past 10 years.

Of course, no stock gets this cheap without having its share of headwinds. While SWK’s total revenue was up by 9% YoY to $4.1 billion in the third quarter, this was largely driven by recent acquisitions in outdoor power equipment, strong industrial growth, and higher prices.

However, the DIY market continues to be weak, driven by lower consumer demand on a YoY basis for at home projects (compared to robust sales during the pandemic) and lower housing demand due to higher interest rates. This was reflected by overall tools & outdoor organic revenues falling by 5% YoY.

Moreover, SWK’s margins have been challenging, as adjusted gross margin during Q3 was down by 760 basis points, as higher prices were more than offset by commodity inflation, higher supply chain costs, and lower volume. These factors led management to downgrade its adjusted EPS guidance to a range of $4.15 to $4.65 from the previous range of $5.00 to $6.00.

While SWK’s near term is under pressure, it does give management an impetus to make long-term changes to its operating model to drive efficiencies. This is reflected by the company being on track to generate cost savings of $175 million at the midpoint for the current year, $1 billion by the end of 2023 and grow to $2 billion by 2025. This is not insignificant for a company with an equity market cap of just $11.0 billion. Moreover, management noted progress around investments and innovation across its strong brands during the recent conference call:

In the next three years, we expect to redeploy $300 million to $500 million to advance innovation across our iconic brands, accelerate electrification in our Outdoor and Engineered Fastening businesses, rapidly accelerate our end-user market activation and create the supply chain of the future.

These investments will position the Company for strong, sustainable, long-term growth, profitability, consistent free cash flow generation and shareholder return. We have a strong track record as the industry leader in breakthrough, world’s first innovations in our businesses. From FLEXVOLT to ATOMIC and XTREME to POWERSTACK, we will build upon this strength to deliver an even higher quality of core and breakthrough innovations with shorter development cycles and new technologies.

Electrification is a key growth driver across our Tools & Outdoor and Engineered Fastening businesses. We plan to make incremental investments to accelerate our efforts, capitalize on share gain opportunities and fortify our market leadership position as the technology continues to shift and adoption accelerates.

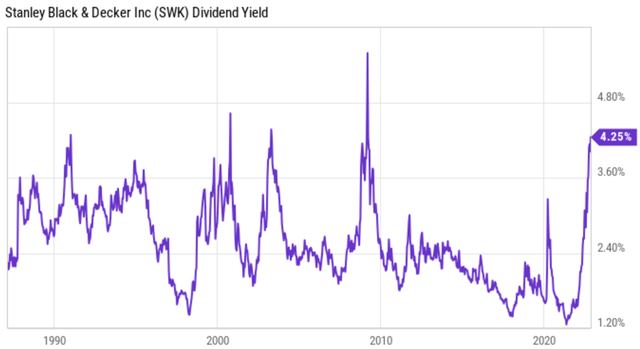

Meanwhile, SWK maintains a strong A rated balance sheet, and currently yields a respectable 4.3%. As shown below, this is the highest yield over the past 20+ years, and is one of the highest throughout the stock’s history. The payout remains comfortably covered by management’s recent earnings guidance, and notably, SWK is a Dividend King with 53 years of consecutive annual raises through a multitude of recessions.

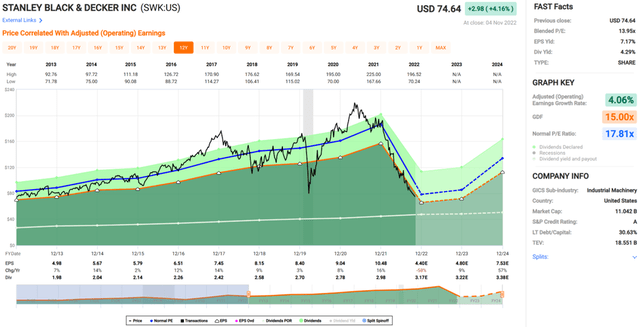

While SWK doesn’t appear to be cheap from a PE standpoint (forward PE of 17.0 based on the midpoint of guidance). This is due primarily to depressed earnings in the near term. Analysts project for EPS to begin turning around next year, with 21 – 42% annual EPS growth over the next 2 years. Even with the current depressed EPS, SWK is still cheaper than its normal PE of 17.8 over the past decade, as shown below.

Investor Takeaway

While Stanley Black & Decker’s near term is fraught with challenges, the company is making the right steps to drive sustainable and increasing cost savings and is investing in innovations. Analysts expect earnings to dramatically improve over the next couple of years. This gives value investors a great opportunity to add to this Dividend King while it remains cheap with a historically high yield.

Be the first to comment