Corporate prosperity comes from tracking, analyzing, and understanding data. We Are/DigitalVision via Getty Images

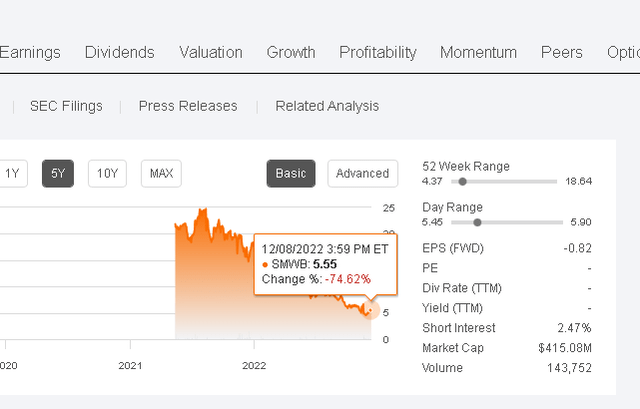

Similarweb Ltd. (NYSE:SMWB) is an Israeli company involved in the fast-growing $41.39 billion global data analytics industry. Similarweb touts a TTM revenue CAGR of 46.62%. It is growing faster than the estimated 30.91% CAGR of the data analytics industry. I agree with the hold rating that Seeking Alpha Quant has for SMWB. My neutral outlook for this analytics stock is despite its -74.62% decline from an IPO closing price of $21.87. The rising quarterly revenue performance of Similarweb did not prevent the big beatdown against its stock.

The big 25% plunge last month is just the market expressing its increased pessimism. There’s no near-term event that can justify the strong buy recommendation of Wall Street analysts for SMWB. My fearless forecast is that SMWB will not fulfill that average $11.91 price target of Wall Street analysts within the next 90 days.

The less-than-expected Q4 guidance and job cuts are not going to attract bulls anytime soon. Since it is projected to have a negative EPS for 2023, I cannot make my own 12-month price target for SMWB. If it can make a fiscal 2024 EPS of $0.50, I can give SMWB a 20x forward P/E multiple. My 24-month price target for SMWB would be $10.

Let Others Make It More Affordable

I cannot recommend SMWB as a bottom-fishing buy. The chart above clearly illustrates that the SMWB IPO traders/bulls took profit in July and August of 2021. The initial IPO euphoria pushed this stock above $25 in August 2021. I opine some of those early profiteers also made some money running down SMWB to below $6.

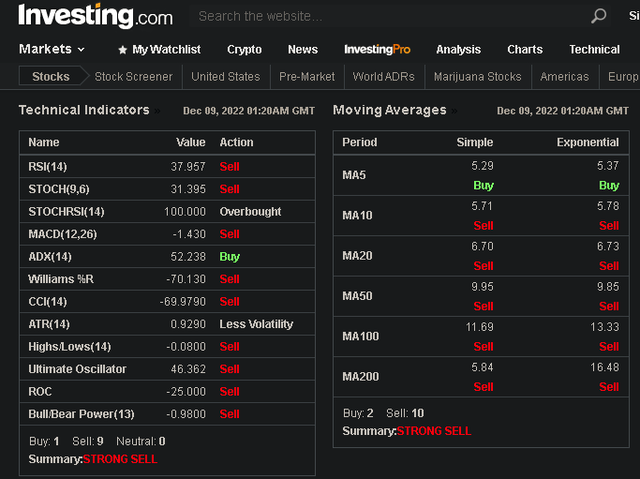

Similarweb’s stock is only a hold. Do not average down now. Let others beat it down further. A quick check on the momentum chart revealed SMWB recently bounced back higher. Unfortunately, I use technical indicators to gauge the stronger emotion of the market. Based on the weekly indicators tracking, the general market mood is that SMWB is a strong sell.

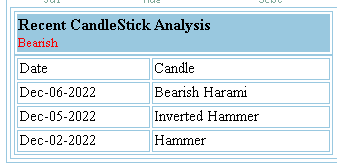

The pessimism of the chart above is congruent with the bearish Fibonacci retracement trend chart of SMWB. If you like candlestick patterns, the emerging trade signal for Similarweb is Bearish Harami.

StockTA.com

We can blame this sell-down on Similarweb’s atrocious eight weeks of consecutive net losses. This company was founded in 2007. Fifteen years of operations should have taught management that some shareholders still aspire to profitability. It is pointless for a company to post an annual sales growth of 40% if it continues to lose money.

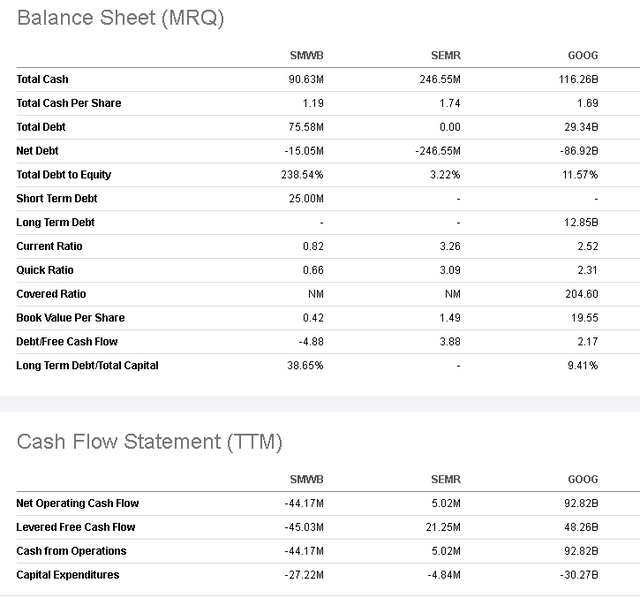

The May 2021 IPO raised $180 million for Similarweb. Going forward, another eight consecutive quarters of net losses could bankrupt Similarweb. This company’s total cash position is now only $90.63 million. Similarweb’s total debt is only $78.58 million but it has -$45.03 million leveraged free cash flow.

The precarious cash flow status of Similarweb is a jagged little pill I cannot swallow. SWMB is hampered by a TTM net income margin of -50.80%. Investors lost their faith in Similarweb because almost half of its quarterly revenue is a net loss. The chart above is an easy explanation why SMWB has a Piotroski F-score of 2, and an Altman Z- score of 0.25.

Upside Potential

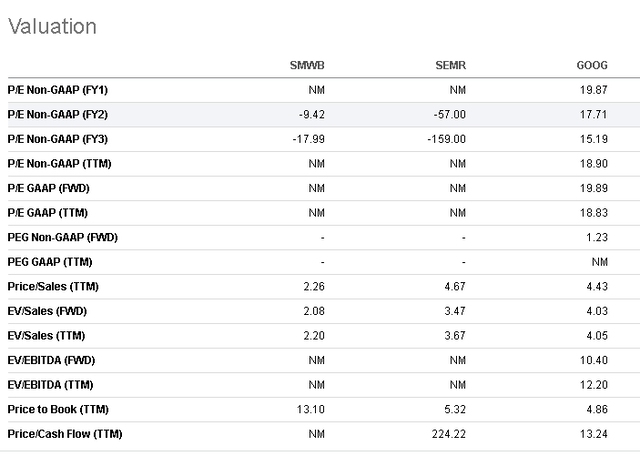

I am neutral on Similarweb. On the other hand, the big 74% dip since May 2021 has made its stock affordable. Compared to its data analytics peers Google (GOOG) and Semrush Holdings (SEMR), SMWB’s TTM Price/Sales ratio of 2.26 is much lower. Semrush is a money losing company, but investors still give it a P/S ratio of 4.43x.

The relative undervaluation of Similarweb against its fellow loss-making firm Semrush is not going to be permanent. The general investing population might eventually give fair treatment to SMWB.

The other upside probable event is that Similarweb’s battered valuation ratios might attract a takeover bid. Management might be amenable to a takeover bid if the offer is $1.6 billion. This $1.6 billion guesstimate is based on its IPO day valuation last year.

Microsoft (MSFT) might buy Similarweb and integrate it into its subscription-only Microsoft 365 or Power Platform. Microsoft offers its free Clarity analytics to web developers and administrators. Microsoft could buy Similarweb and sell this company’s comprehensive intelligence and analytics solutions for $99.99/month.

Similarweb currently sells its Competitive Intelligence service for at least $167/month. Similarweb now also offers Stock Intelligence for investors/traders/speculators.

My Verdict

Similarweb is a growth stock that has more downside potential. Wait for it to become more affordable. The bearish technical indicators defy the strong buy endorsement Wall Street analysts.

Heed the hold rating of Seeking Alpha Quant. Letting other people beat down SMWB is a prudent tactic.

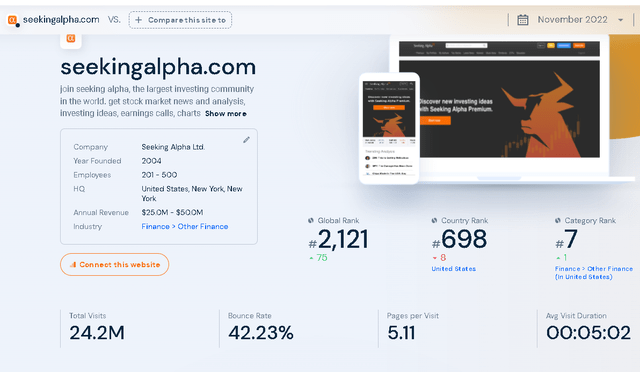

Holding on to your SMWB shares is valid. This company is truly relevant to companies who want to know about their customers’ web/app browsing & shopping habits. Similarweb helps me track freemium Seeking Alpha’s rising web traffic. Seeking Alpha management should give us promotional jackets, caps, or beer bottle openers. This crowd-sourced website is now the no. 698 most visited site in the United States.

It is a quixotic effort for a 15-year-old company to aim for 40% revenue CAGR and risk running out of cash. A TTM net income margin of -50% is unacceptable. I don’t mind a slower sales growth of 20 to 30%. A net income margin of 3 to 10% is desirable.

Similarweb has a long-term tailwind from the 30.91% CAGR of the $41.39 billion global data analytics industry. The growth momentum is obvious. Management only needs to learn how to make Similarweb a profitable business.

Be the first to comment