JHVEPhoto

Introduction

Shares of e-commerce software company Shopify (NYSE:SHOP) have declined by almost 80% year-to-date as markets digest fading pandemic tailwinds and rising interest rates that typically don’t bode well for growth stocks. Nevertheless, the stock continues to attract the interest of growth investors who apparently think now is arguably the best time to buy the dip and chill at the beach when all the macro headwinds are said and done. For those who find Shopify to be the bargain of their lifetime, here’s why I think otherwise.

The bull thesis

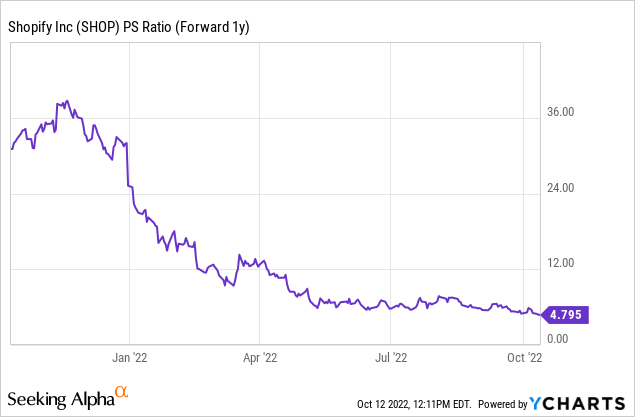

First and foremost, Shopify is extremely cheap (or undervalued as bulls like to say) at just 4.8x forward sales. The stock started 2022 with a forward P/S ratio of 28x and has suffered a dramatic de-rating until today.

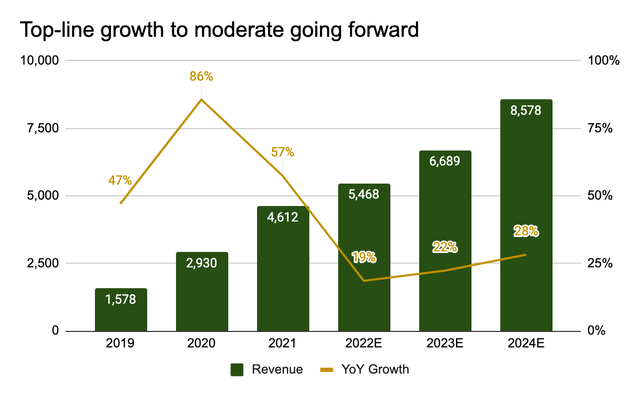

While Shopify is understandably dealing with slower top-line growth following an explosive 2021 where revenue grew 57% (and 86% in 2020), the company remains a very attractive story as the anti-Amazon (AMZN) solution that allows small merchants to build and run their own websites without having to rely on Amazon forever.

Sellers know that Amazon can be a potential threat to their businesses from time to time. This then creates the need to develop a direct-to-consumer channel as the business scales, and Shopify is the best e-commerce SaaS platform that gets the job done. Pandemic or not, e-commerce will continue growing and Shopify remains a long-term story. Once the Fed becomes happy with where inflation is, interest rates will start to come down, valuation will normalize to the upside and Shopify shareholders will be smiling to the bank.

Sources of past returns

Shopify’s past returns have mainly come from (1) revenue growth and (2) multiple expansion. The company went public in 2015 and revenue grew at a CAGR of 67% until 2019. During this period, Shopify went from a $200-million-dollar business to almost $1.6 billion, and markets rewarded the stock by pushing up the revenue multiples from 13x at IPO to a peak of 24x in 2019.

When the pandemic hit, sales exploded as Shopify’s revenue grew 86% YoY in 2020 and 57% in 2021, with the forward P/S reaching an all-time-high of 47x in February 2021. While these multiple expansions had much to do with Shopify’s parabolic top-line growth, it had more to do with investors jumping aggressively into growth names in an ultra-low interest rate environment when money was virtually free.

| Year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Revenue (mm) | 205 | 389 | 673 | 1,073 | 1,578 | 2,930 | 4,612 |

| YoY Growth | 95% | 90% | 73% | 59% | 47% | 86% | 57% |

| Peak NTM P/S | 12.7x | 7.9x | 14.2x | 15.1x | 24.4x | 47.6x | 47.3x |

| Stock’s return | -8% (May-Dec) | 66% | 136% | 37% | 187% | 185% | 22% |

Source: Author, with data from Seeking Alpha

Slowing revenue growth

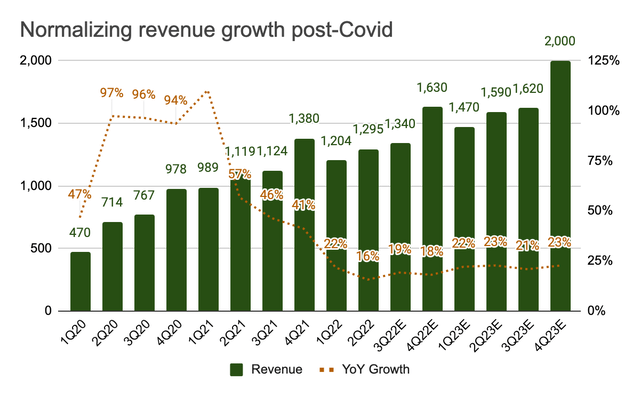

Unfortunately, Shopify’s days of 50%+ revenue growth are likely behind us. Following a record 2020 and 2021, revenue growth has materially slowed down with 1Q22 and 2Q22 growth of 22% and 16%. In Q2, both total GMV of $46.9 billion (+11%) and revenue of $1.3 billion (+16%) missed consensus estimates by 5% and 3%. While offline GMV grew 47%, online GMV grew just 8% as the e-commerce saw broad-based normalization. Although payment was a bright spot with a record 53% penetration amongst merchants, the underwhelming GMV and revenue growth made many investors nervous.

Consensus estimates, Albert Lin

With high inflation, slowing consumer spending, and a strong dollar, revenue growth is will probably be muted in 2022 even though Shopify guided higher GMV growth vs. the retail industry in 2H22. Given the economy is likely to enter a recession in 2023, Shopify could have another tough year with top-line growth. The Street is currently expecting a 3-point increase in revenue growth in 2023 and an additional 4-point increase in 2024. In my view, these figures still look optimistic.

Consensus estimates, Albert Lin

Lack of profitability

When a hyper-growth company has seen its best days of revenue growth, profitability becomes a key variable determining the stock’s performance. During the pandemic, Shopify generated positive operating income for 6 consecutive quarters from 2Q20 to 3Q21. Unfortunately, those earnings proved to be short-lived as sales growth started normalizing from 4Q21. In the past 3 quarters (4Q21-2Q22), Shopify had a total operating loss of $265 million, which already wiped out half of the $519 million in operating income generated over the 6 profitable quarters during the pandemic.

Markets also seem unconvinced of a return to profitability as Shopify invests heavily in fulfillment capabilities to compete against Amazon’s 3rd party services. This means a multi-billion investment cycle that will weigh heavily on operating margins. In July, Shopify completed its acquisitions of e-commerce fulfillment provider Deliverr for $2.1 billion ($1.7 billion cash + $0.4% billion stock). Deliverr has no impact on GMV, will be margin-dilutive, and is expected to add a few points of top-line growth in 2022.

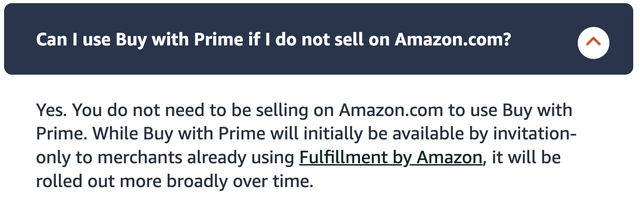

Speaking of competition, Amazon announced in April 2022 that Buy with Prime fulfillment will be extended to merchants that do not sell on Amazon. This move is in direct competition with SFN (Shopify Fulfillment Network). While merchants could still choose SFN over Amazon given Shopify’s neutrality, intensifying competition could still pressure Shopify’s take rate.

Amazon

Why Shopify could still dropify?

Shopify is dealing with slower revenue growth, a lack of profitability, a heavy-investment cycle with intensifying competition, and a worsening macroeconomic backdrop. The days of hyper-growth figures are likely behind us and the stock continues to face selling pressure with non-existent EPS in a raising interest rate environment.

Worse yet, should the economy enter a recession in 2023, there’s really not much for investors to be positive about the name. For a little history, Amazon’s forward P/S multiple contracted to less than 1x during the 2008 recession despite being a major beneficiary of the e-commerce super cycle back then. Now that online shopping is a much more mature segment of the economy, I see Shopify’s multiples easily being compressed to below 1x in case of an economic downturn. Assuming 2023E revenue of $6.7 billion holds, this comes down to target price of ~$5/share on 1x P/S.

That said, I would highlight the fact that shorting the stock could be risky as the current valuation of just 4.8x 2023 revenue could lead to a “how much can I lose” mentality amongst dip buyers. From a technical perspective, the stock is in a very oversold territory with heavy weekly volumes since December 2021. Should the macro data such as inflation offers a slight ray of hope to growth investors, those on the short end of the trade may have to cover quickly, potentially leading to a double-digit up move in one single day.

In the end, I see no reason to be bullish on Shopify’s stock and would remind investors that market’s valuation framework has shifted from GAAP (growth at all cost) to GARP (growth at a reasonable price). Shopify’s growth headwinds will likely persist, and the lack of earnings will make investors question whether they’ve paid a reasonable price for the company. As a result, I would recommend against bottom-picking the stock as the risks far outweigh the rewards.

Be the first to comment