naphtalina/iStock via Getty Images

If you are looking for an IT company that is highly profitable and pays dividends at an above 3% yield, you can stop by Open Text’s (NASDAQ:OTEX) stock. Its only shortcoming is its much lower revenue growth rate when compared to the Information Technology or IT sector, but, wasn’t the Micro Focus (NYSE:MFGP) acquisition supposed to address the problem?

Well, investors thought otherwise when the deal was announced on August 25, punishing Open Text’s stock with a 20% downside as encircled in red below, all resulting in underperformance with respect to the Vanguard Information Technology ETF (VGT) by more than 16%.

Comparing the price performances of OTEX and VGT (www.seekingalpha.com)

The price tag of $6 billion for a company that has seen negative growth since 2018 seems to have spooked the market, and thus, my aim with this thesis is to bring more clarity as to the reasons for the deal and whether it makes sense.

For this purpose, I take advantage of details published in the company’s first-quarter fiscal 2023 earnings call published on November 4.

Making Sense of the Acquisition

First, to make sure that we are on the same wavelength, Open Text is an ECM (Enterprise Content Management) company that supports enterprises in managing their data in order to derive some form of competitive advantage. This sounds like marketing talk, but it certainly pays in the current dynamic business environment to leverage existing corporate data as well as integrate it with external sources using AI (artificial intelligence) tools to get actionable insights, so important these days to gain market share.

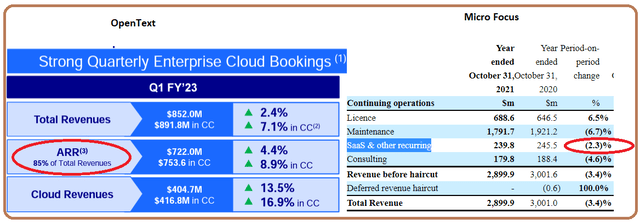

Thus, as pictured below, despite facing some currency headwinds, the Canadian company grew revenues in its first quarter of the fiscal year 2023 (Q1) which ended in September 2022. More important for a company that is evolving its product pipeline to the cloud, related revenues increased by 13.5%, more than total sales themselves which went up by 2.4%. Another important metric is ARR or annual recurring revenues which increased by 4.4% and constituted 85% of total sales at the end of Q1. This contrast sharply with Micro Focus whose SaaS and recurring revenues declined by 2.3% in the year that ended October 31, 2021, as shown below encircled in red.

Recurring Revenues for Open Text and Micro Focus (www.seekingalpha.com)

Then, one of the aims of this acquisition could be to boost Micro Focus’ recurring revenues by converting its large License and Maintenance revenue bases (above table) to the ARR charging model, synonymous with a more stable income stream amid a highly dynamic and competitive business environment.

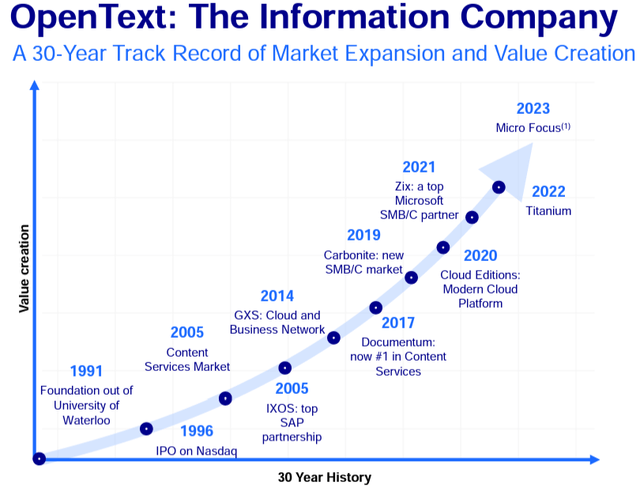

For this purpose, with a history of executing successful acquisitions like Documentum for ECM, and Carbonite for cybersecurity Open Text is certainly qualified to “return Micro Focus to organic growth”, to be driven by the cloud SaaS (software as a service) and renewals businesses.

Going Deeper into the Acquisition

Going deeper, Open Text has built a large pipeline of products through 80 acquisitions in the last 30 years with Micro Focus expected to be integrated in the first quarter of 2023.

Open Text Acquisitions (static.seekingalpha.com)

Now, the British company which I covered in 2020 has been on a long road to recovery, but one plagued by weak financial results amid tighter competition as investors have increasingly put into question the viability of its restructuring plans. As a result, its share price is now 25% of what it was in 2019 and one of the factors which weighed significantly on investors’ sentiment is the merger with HPE’s (HPE) software business segment where the intended synergies were not delivered.

However, it has not all been bad when looking at the breadth of the technology portfolio, namely with the 2017 Cobol-IT acquisition in order to develop expertise to migrate COBOL applications to the public cloud while expanding its reach in the Asia-Pacific markets. Thus, in addition to software development, which is its core activity, Micro Focus now has a wide portfolio encompassing the cloud and on-premises information systems, RPA (Robotic Process Automation), data observability/analytics, and cybersecurity. These represent industry verticals that Open Text could use to land on new turfs and expand.

Along the same lines, driven by factors like shortage of IT skills and increased regulatory scrutiny impacting sectors like Healthcare and Financials, cloud adoption is on the rise as more content has to be digitalized, which is precisely Open Text’s core business.

Some more Precisions on the Merged Entity

Thus, the merger provides Open Text with new opportunities and a more geographically diverse customer base, estimated at a $170 billion addressable market through 2030. As for the bottom line, about $400 million of cost optimizations are expected. Also, the management gave the assurance as to the continuation of the dividend program with the payout ratio at 20%.

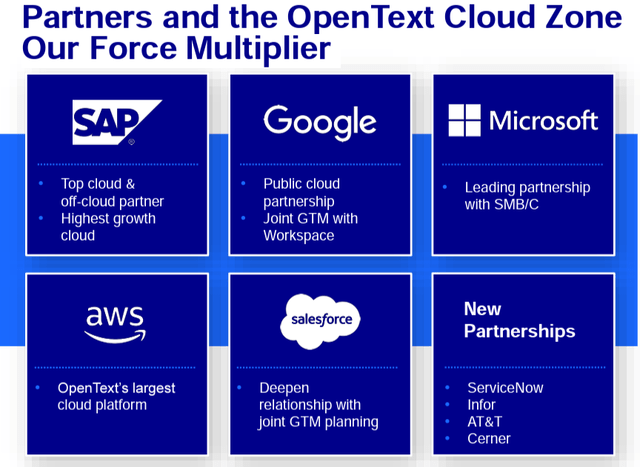

Pursuing further, factors that could accelerate growth are increased orders for software and cloud-based professional services. Also, with a combined market cap of around $9.17 billion, the combined entity will be one of the largest software and cloud players in the world, which means that it can squeeze more value out of its partnerships with the hyperscalers (public cloud providers) like Microsoft (NASDAQ:MSFT) as well as Enterprise Resource Planning companies such as SAP SE (SAP) as pictured below.

Company Presentation (static.seekingalpha.com)

At this stage, it is important to note that while Micro Focus is mainly known for software development, testing, and QA (Quality Assurance), Open Text is more an ECM company that manages information in corporate data centers or in the cloud. Thus, ECM and Software Development can be considered as two separate business activities forming part of the wider Application Sector industry, all grouped under the IT sector.

Consequently, the merger cannot be considered to be some horizontal integration between two companies involved in the same activity, or at the same level in the software value chain. This is precisely the reason why there are limited cost synergies, or only $400 million of savings, which, by the way, includes $300 million which had already been planned by Micro Focus. Therefore, effectively, it’s only $100 million in cost savings.

On the other hand, as an end-to-end provider ranging from content management, and software development to testing, and supported by a rich ecosystem of partners, the merged entity can more than double its annual revenues of $6.23 billion (2.74 + 3.49) to $12.5 billion if it can just tap into 10% of that $170 billion TAM. That may take time, but, with the acquisition closing in the first quarter of 2023, adding Micro Focus’ $2.74 billion to Open Text’s $3.49 billion, means 44% of revenue growth for fiscal 2023 (ending in June next year) over 2022.

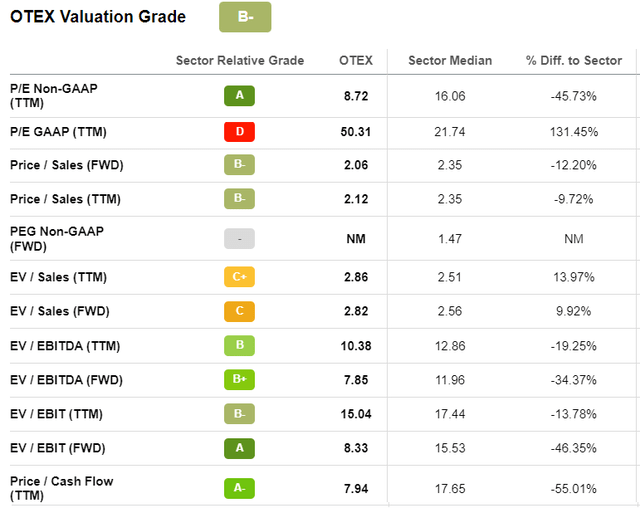

Valuing Open Text

Therefore, with such revenue prospects and its current undervaluation by 12% with respect to the sector median when the forward price-to-sales of 2.06x is considered, Open Text deserves to be better valued. Adjusting accordingly, I obtain a target of $32.67 (29.17 x 1.12). As for Micro Focus, after its above 50% upside, after the deal was announced, it is more of a hold.

Valuation Metrics (www.seekingalpha.com)

Another metric that deserves to be mentioned is Open Text’s trailing Price-to-Cash Flow multiple of 7.94x which is below the median for the IT sector by 55%. Normally, it is cash flow that is the most critical metric to be watched out for when a company is transitioning to the recurrent revenue model.

Here, the fact that the ECM company generates a relatively high level of cash shows a high degree of success and should also help in refunding the $4.6 billion in new debt incurred for acquisition purposes, in addition to the existing $4.48 billion. In this respect, the management is committed to bringing debt down to less than 3x Debt to EBITDA within 8 full quarters of closing the deal.

I am also bullish as Open Text should also be helped by the current economic uncertainty, where there are more prospects to convert customers to effecting monthly payments through a SaaS model rather than paying large amounts of money upfront. This transition has not been an easy one for the British company as evidenced by $239.8 million of recurring revenues being ten times less than its license maintenance total of $2.48 billion (above table), but with a track record of successfully transitioning 85% of its revenue base to becoming recurrent, Open Text is in a good position to execute.

Conclusion

Finally, with an expanded customer base, global presence, and comprehensive go-to-market relationships with large cloud and ERP providers, Open Text is a buy as it has what it takes to recoup the $6 billion spent on the acquisition.

Adding a note of caution, there was market exuberance based on the low inflation print on Thursday, but, bear in mind that the figures are still high. As a result, the Fed may reduce the pace at which it raises rates, but monetary conditions are likely to continue tightening, with investors more likely to weigh in on Open Text’s high debt load. Therefore, do expect volatility to continue as the value strategy prevails.

Be the first to comment