olm26250

Retirement planning is not overly complicated. But it does require strong will, some effort, discipline, and due diligence. First of all, one needs to recognize the importance of having a plan. It’s never too early to have some goals and an action plan. Retirement planning requires savings on a regular basis and investing those savings wisely and relatively safely. Another important factor is the length of time those savings would be able to grow and compound. That’s why we cannot overemphasize how important it is to start saving at an early age. It makes retirement planning so much easier. However, unfortunately, most of us don’t get this wisdom in our 20s or even in our 30s. But at the same time, we like to remind that it’s never too late, either. Even older folks who are well into their 50s could still achieve their goals, though the path will definitely be harder and will require more sacrifices. Please see our previous article from Oct. 2022 that illustrates an investment plan for folks in their 50s.

Typically, millennials are defined to be in the age group of 26 to 41 in the year 2022. For the purpose of this article, let’s assume our investor is in his early 30s and earns roughly $100,000 annually. We would explain why a person who has recently turned 30 would probably need roughly $3.6 million for a comfortable retirement. Let’s also assume he/she wishes to have the ability to retire in their 50s or, at most, by 62. We will also assume that, as of now, our investor has not saved anything except maybe some emergency cash. After all, when you are in your early 30s, retirement planning is the last thing on your mind, and it appears to be far away.

However, if you are an older millennial, say nearing 40, you may reduce your target accordingly. In our rough estimation, if all other factors are assumed to be the same, a 40-year-old should need roughly $2.8 million for a similar retirement.

When to retire?

Frankly, there is no right or wrong answer to this. It really depends and varies from person to person. It depends on many factors, and many of them are personal to each individual. It would likely include your savings, your basic expenses, spending habits, hobbies, retirement goals, and your own unique situation. Besides, many people would like to continue working beyond 60 or even 65 years of age, as they may like what they are doing or they just like the active routine that comes with a 9-5 job.

So, depending on your personal situation, like retirement assets, spending needs, and your priorities in life, retiring early could make sense. But then, these are all individual decisions based on your specific situation.

All that said, there may be other good reasons to at least plan for early retirement in your late 50s, even if you decide not to when the time comes. The emphasis here is on retirement planning and not on actually retiring. There can be many unforeseen situations that may force you or provide enough incentives to retire early.

So, how much is good enough to retire?

Just like everything else, one size does not fit all. Everyone’s needs are different. It depends on many factors, including your pre-retirement income, retirement location, spending habits, health situation, supplemental income like social security, pension, or part-time work income, but above all, your goals in retirement.

Until the early 2000s, $1 million was a good benchmark and was a sufficient amount to have a highly comfortable retirement. Obviously, due to inflation (even at a low 2%), $1 million is not the same as it used to be 20 years ago. Also, more recently, we are seeing very high inflation numbers that have not been seen in the last four decades. All that said, with some prudent strategic planning, currently, $1 million worth of savings (along with social security benefits) can still go a long way to fund a reasonably comfortable retirement for a couple. However, the younger folks in their 30s or even in their 40s need to save even more to account for reduced social security benefits or maybe no benefits at all.

Why saving early and saving enough are critical

This is mostly relevant to younger folks. We believe the most important factor that determines how wealthy you are going to be later in life has to do with how soon you are willing to start saving and paying yourself first. In other words, start saving for retirement. The easiest way to save is by means of setting up auto-deduct or auto-transfer. The amount that you never see in your regular account usually does not get spent.

However, another equally important factor is how you invest your savings. There are so many folks who save regularly but are too scared to invest or simply do not invest enough. They just can’t seem to tolerate the idea of their savings losing any significant value. But they need to understand the destructive power of inflation. Sitting on large amounts of savings in cash is equally risky as it loses a tiny amount of value every day and week of the year. The only cash saving you need to have is the emergency cash worth six to nine months of your living expenses.

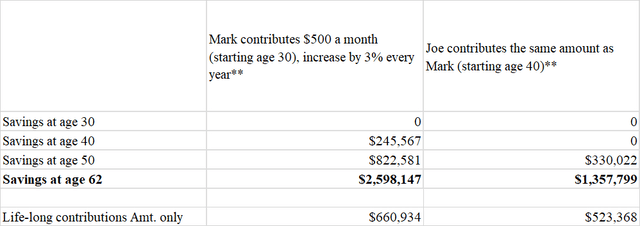

The table below shows how early savings can impact the quality of life in later years. This can be best illustrated with an example of two friends, Mark and Joe. Mark starts contributing $1,000 a month ($12,000 a year) at age 30 and increases it by 3% every year until 62. However, Joe waits for another ten years but starts saving the same amount as Mark at age 40. Assuming they both get an 8% annualized return, Mark would end up nearly double what Joe would accumulate. If Joe wants to match the total savings that Mark would have, he will have to contribute almost double the annual amount starting from age 40 to 62. The main reason for the difference in the time that Mark’s savings had to compound.

This is how their savings at age 62 stack up, assuming an 8% annualized return:

Table-1:

You are 30 and want to have an investment plan

Let’s assume that you have been working for a few years but did not give much thought to savings or investments. But the very fact that you are now thinking of having an investment plan for the future is in itself very positive and commendable. Not many folks think of saving and investing at this age. Since you are very young and more than likely have 30-35 years of working career ahead of you, you have a lot of options. The biggest advantage you have is the length of time that you have for your savings to grow and compound. However, there are a couple of disadvantages as well compared to someone who is already in their 50s.

- Due to inflation, the value of your savings will not be the same as measured in current dollars. In the past couple of decades, we had very low inflation, but that is changing now. The future is always uncertain, but we will assume that long-term average inflation will be 3% for the next 30 years. It is somewhat higher than in the past few decades, but it is better to err on the side of caution.

- The current retirees or folks who are already 55 (or older) usually consider Social security benefits as guaranteed. We think anyone who is 50 or older can expect these benefits to remain there either in the current form or somewhat in reduced form, for example, 75% of their current value. However, anyone who is in their 30s now cannot take them as guaranteed, and they should plan as if those benefits would not be there when they retire 30 years from now.

Let’s do some planning:

Let’s work out our retirement targets in the following manner:

- We will calculate the equivalent amount of $1 million in inflation-adjusted dollars. With 3% long-term inflation for 30 years, today’s $1 million will be equivalent to $2.4 million (roughly).

- Now, assuming the social security benefits won’t be around (at least in the current form), you will have to save for some kind of annuity that would provide benefits somewhat similar to the current social security. So, we should plan for enough capital that is enough to generate at least $2,000 per month in today’s dollars or $4,800 in inflation-adjusted dollars (in 30 years). Though we are not a fan of annuities as such, just for the sake of calculation, we will see how much capital one should accumulate for an annuity that would generate $4,800 a month. From our rough estimates (based on some annuity calculators), one would need an initial annuity capital of roughly $1.2 million to generate $4,800 with a 3% annual adjustment for 30 years.

- From the above two calculations, you would need roughly $3.6 million ($2.4m + $1.2m) to retire comfortably in 30 years. Obviously, these are rough calculations based on certain assumptions. So, it is better to exceed this target rather than fall short.

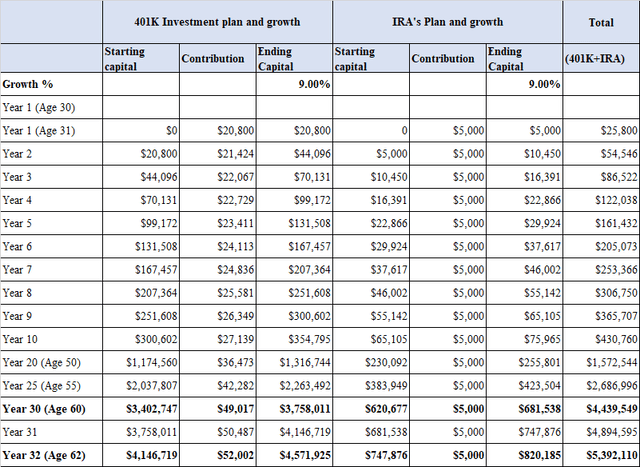

Now, with the above estimates, and assuming your current annual income of $100,000, the below table will show how much you should save on a monthly basis.

Assumptions made:

- Annual income $100,000

- Savings rate for 401(k): 16%, with employers’ contribution of 80% on the first 6%.

- Savings rate for IRA or ROTH IRA: $5,000 annually

- Average long-term growth rate of 9% (we will also calculate based on 7% growth)

Note: The question regarding whether you use traditional IRAs or ROTH IRAs is rather a complex one and can vary based on the individual situation; hence it is outside the scope of the current discussion.

Table-2:

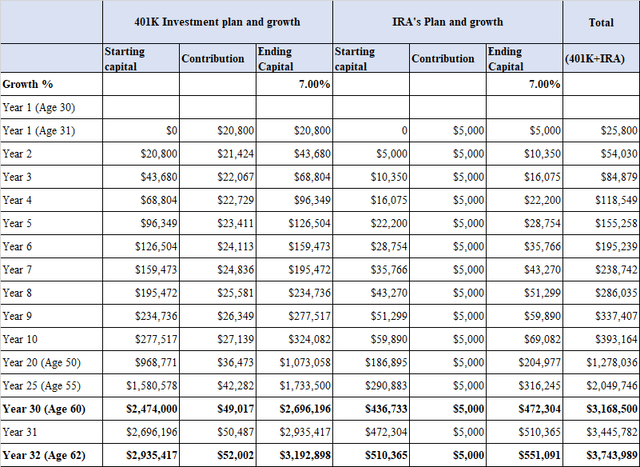

Now let’s assume the growth of the investment does not pan out to be 9% but only 7%.

Table-3:

As you can see from the above tables that even with 7% average growth with 3% average inflation, you will comfortably meet your target retirement goals. But saving consistently at a high rate and investing for your future is a must.

Retirement Planning Part-II: Investing Successfully

There are two most critical concepts to retirement planning:

- Save early and save enough

- Invest wisely and relatively safely.

As we talked about it earlier, the first very important part of retirement planning is to save early in life and save enough on a regular basis. It can be best achieved when it’s done on autopilot. Being on autopilot means your investment account always gets paid first before you get money into your checking account to spend on things that are essential and non-essential. So how much is enough? We think saving 10% of your income on a monthly basis is a good start. However, it should be increased from there on to at least 16% or as high as possible for you, depending upon your individual goals.

So, while saving is very important, you cannot get wealthy simply by sitting on cash or keeping it in a savings account. The second part of retirement planning is how well you invest the money that you are saving so diligently. This is equally important as the first part, if not more. Not only do you have to protect your cash from inflation, but you also need to compound it over time. Growth and compounding will do wonders for your investment capital over time, and it is necessary to meet the needs of a comfortable and possibly long retirement.

Though there are many ways to achieve the same goals, we recommend the following multi-basket strategy:

We are assuming that your 401(k) accounts do not permit buying individual securities but only allow certain mutual funds and ETFs (exchange-traded funds). They decide to divide their 401(k) capital into two buckets, roughly 50:50, and invest in two strategies.

Note: Most 401(k) accounts do not permit trading in individual stocks, but some 401(k) managers do. Some brokerage houses (managing 401(k) accounts) do allow a certain percentage of the account in individual stocks/securities.

401(k): Strategy-1

For half of the funds in their 401(k), you could decide on the following combination of funds (mutual funds or ETFs). Once this has been set up, the rest would really be on auto-pilot. Every paycheck, contributions will be invested in the proportions as selected. Since this portfolio is very balanced, we hope to get a minimum growth of about 8%-9% annualized for the next 12 years.

- 25% in the S&P 500 fund

- 25% in the Total Stock Market fund or the Equal-weighted S&P 500 fund

- 15% in high-growth Technology funds

- 15% in the Developed International fund

- 10% in Emerging Markets fund

- 10% in Bonds and Treasury funds.

401(k): Strategy-2

We recommend deploying the second half of 401(k) money in a risk-adjusted strategy to ensure that we get most of the gains of the market, but at the same time, it will hedge the risks in case of a bear market. This strategy is discussed in the next section. We can hope to get at least a 10% return from this strategy. Besides a decent return, this strategy will reduce the overall volatility to a great extent.

IRAs: Strategy-3

Since you will be saving at least $5,000 in your IRAs every year, this will also provide you with tax deductions at the assumed income level.

We recommend putting these funds into DGI (Dividend Growth Investing) stocks and implementing a DGI Portfolio, described in the next section. Please note that the DGI portfolio stocks/securities must be evaluated every three years to see if any changes need to be made. A company that appears to be excellent today in terms of its wider moat and long-term perspective may start underperforming in the future due to unforeseen reasons.

Summary of investments:

Table-4:

|

Type of funds |

Strategy |

Type of Strategy |

|

50% of 401(k) accounts |

Strategy -1 |

Mutual funds or ETFs from the available pool |

|

50% of 401(k) accounts |

Strategy-2 And/or Strategy-2B |

Rotation strategy suited for 401(k) using funds And/or Rotation strategy (if individual securities trading allowed) |

|

IRA funds |

Strategy-3 |

DGI portfolio |

Investment Portfolios

Strategy-1: 401(k) Funds allocation

This will depend on what funds are available to invest in your 401k account. The appropriate funds can be selected according to the allocation model provided in the previous section.

Strategy-2: Risk-hedged rotation strategy for low drawdowns (for 401(k) accounts)

Since this strategy is being implemented inside 401(k) accounts, it needs to be simple and easy to implement. Most 401(k) accounts offer a limited number of funds that one has to choose from. This strategy rotates on a monthly basis.

The strategy will be invested in one of the following four securities (or equivalent funds), which are:

- Vanguard 500 Index Fund Investor (VFINX)

- Vanguard Total International Stock Index Fund Inv (VGTSX)

- Vanguard Long-Term Treasury Fund (VUSTX)

- Vanguard Short-Term Treasury ETF (VGSH) or iShares 1-3 Year (Short-term) Treasury Bond ETF (SHY)

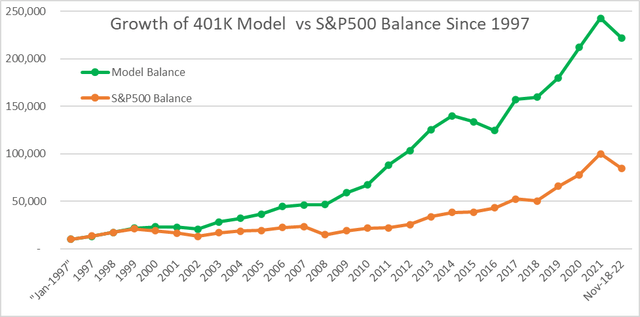

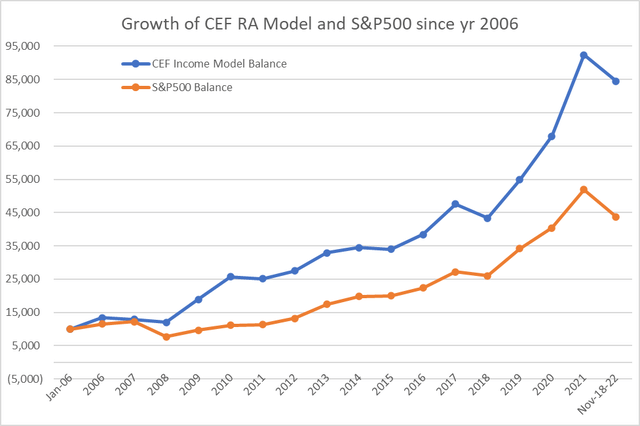

VUSTX and VGSH are two of the hedging assets and will be used only when the other main securities are not performing well. By deploying this strategy, since Jan. 1997, it has returned an annualized return of 13.03% compared to 8.57% from the S&P 500. In the year 2008, it was up slightly compared to -37% for the S&P 500. During the tech-bubble crash from 2000-2002, the RA (risk-adjusted) model was down only by 3.2% cumulatively, while the S&P 500 lost more than 43% during those three years. We would like to caution that backtesting results are no guarantee of similar results in the future because no two periods are going to be the same. However, the main advantage of using such a strategy would be to limit the downside and drawdowns during recessions and corrections.

Note: In our backtesting model, the short-term Treasury fund SHY was considered in place of VGSH. Also, prior to Jan. 2003, SHY was not considered in the model since it did not have a history prior to 2002.

Equivalent or similar ETFs that can be used for the above mutual funds:

Table-5:

At the end of every month, the strategy will check the performance (total return) of the four assets for the previous three months and select the best-performing asset. The portfolio will be invested in the top-performing asset for the next month. The process will be repeated every month. Below are the backtesting results since 1997 and performance comparison with the S&P 500. The model portfolio accumulated almost three times that of the S&P 500, mainly because of smaller drawdowns during the bear markets of 2001-2003 and 2008-2009.

Chart-1:

Author

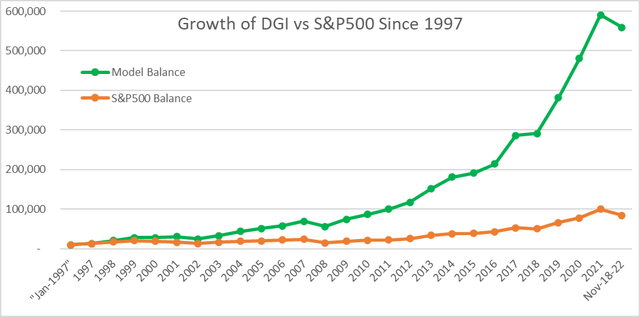

Strategy-2B: Risk-hedged rotation strategy (for IRA, 401(k) accounts)

Note: This strategy is for accounts where it is possible to trade individual stocks or funds. These days, many brokerages that manage 401(k) accounts also allow participants to invest in individual securities.

This Rotational model could be used either as an alternative to the first one or as an addition. Having two models provide some diversification as well. This model also can generate some income (of 5% or so) on a consistent basis with limited drawdowns and much lower risk than S&P 500. Though we recognize that young folks do not need income so that income can grow within the portfolio. The model uses five CEFs (closed-end funds) from various asset classes and uses a short-term Treasury fund as the hedging security. We compare the performance of each of the six securities (including distributions) during the previous three and seven months (average the two) and select the top 3 performing funds for investment. Any security that had a negative performance return is not selected and replaced with the hedging asset, i.e., SHY. This process is repeated on a monthly basis at the end of each month.

There will be times when the portfolio is partially or even fully invested in SHY (SHY generating little income), but most times (at least 2/3rd of the time), it will be invested in CEFs, generating nearly 8% income. If we average it out, it should be able to provide roughly 6% of income.

The five CEF securities are:

- EV Tax-Advantaged Dividend Income (EVT)

- Flaherty & Crumrine Preferred and Income Securities (FFC)

- Kayne Anderson Energy Infrastructure (KYN)

- Nuveen Muni High Inc Opp (NMZ)

- Cohen & Steers Qty Inc Realty (RQI)

- BlackRock Science & Technology (BST)

- iShares 1-3 Year (Short-term) Treasury Bond ETF (SHY)

Note: The last one, SHY, is the hedging security. BST is included for growth.

Chart-2:

Note: For backtesting purposes, BST has been considered from years 2016-2022, whereas (QQQ) was considered from 2006-2015.

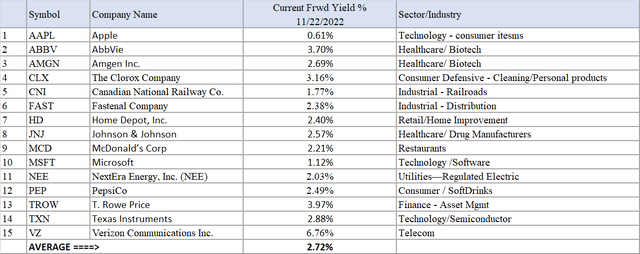

Strategy-3: DGI Portfolio for the IRAs

This is the DGI (dividend growth investing) portfolio that you can build for your IRAs. This portfolio should include about 15-20 blue-chip stocks, which in theory, you could hold for the next 10-20 years. Obviously, things will change over time, and occasionally you may have to make changes. We recommend reviewing the stocks at least on an annual basis.

For this part of the portfolio, most of the stocks selected are large-cap and have a history of paying and growing dividends. These stocks are believed to be relatively safe and tend to do reasonably well during recessions and corrections but still provide nice growth over time. The idea is that low volatility will provide an easier ride than the S&P500 and ultimately translate into long-term performance.

Stocks selected:

Apple (AAPL), AbbVie (ABBV), Amgen (AMGN), Clorox (CLX), Canadian National Railway (CNI), Fastenal (FAST), Home Depot (HD), Johnson & Johnson (JNJ), McDonald’s (MCD), Microsoft (MSFT), NextEra Energy (NEE), PepsiCo (PEP), T. Rowe Price (TROW), Texas Instruments (TXN), and Verizon (VZ).

Table-6:

Chart-3: Growth of DGI portfolio

Note: Please note that even if we were to remove Apple from this portfolio, the CAGR (cumulative annual growth) would still be 14.70% (instead of 16.62% with Apple), compared to 8.61% for the S&P 500.

Conclusion

Most folks understand and appreciate the importance of a high rate of savings and how it can lead to financial success. However, most of us don’t get this wisdom in our 20s or even in our 30s. That’s why it is important to emphasize to younger folks how important it is to start saving early in life. The time factor (time left for the investments to grow) is most important in determining how wealthy you are going to be in your retirement. A dollar saved early in life and invested to compound is worth much more than a dollar saved later in life. Growth is directly proportional to the time these investments have left to grow.

So, let’s not forget the other two components. Ultimately, three factors define how much money you are going to have in retirement, namely time in the market, the rate of savings, and the average rate of investment returns. The first two are directly controlled by you, whereas the third one does depend on decisions you make but also on extraneous factors like market and economic conditions.

We believe there are many ways to achieve your retirement goals. We believe it is not too difficult to achieve a 7% to 9% growth rate on a long-term basis. Nevertheless, we have provided a model portfolio with several buckets, including a DGI portfolio and two Rotational models. These models have a proven track record and should provide not only consistent growth but also lower volatility and much lower drawdowns. Obviously, past performance cannot guarantee similar returns in the future but still provide a track record of outperformance.

Be the first to comment