piranka/E+ via Getty Images

Dear readers/followers,

So, first things first. I’m not talking about the French Company Dassault Aviation Societe (OTCPK:DUAVF). This is another business – Dassault Systémes SE (OTCPK:DASTY), and they’re very different. One is in aerospace and defense, the other is in 3D-design.

Now that that’s out of the way, let me show you why I’ve been following Dassault Systémes for a few years, but never invested – until now.

Dassault Systémes SE – What the company is and does

Dassault Systemes is a software shop that focuses on the design, simulation, and manufacturing of products. It’s around 41 years old at this point, employs 20,000 people in 140 countries, and has solid fundamentals. As the name and the tie suggest, it did grow out of the aerospace industry – namely the need for sophisticated drafting tools to streamline development as complexity of aviation design increased exponentially.

Dassault Systémes was actually spun out of Dassault, in order to develop, market, and work with the company’s 3D surface design software. The new company signed a deal with IBM (IBM) which was then allowed to sell the company’s CATIA CAD software. This was the beginning.

Dassault was market-leading in the 1990s. The company’s software was used to develop seven out of ten new airplanes, and almost 50% of all cars developed around the world. Companies that used Dassault’s software included Honda (HMC) Mercedes (OTCPK:MBGAF), BMW (OTCPK:BMWYY), and Boeing (BA). The change meant that all of these companies, rather than constructing physical prototypes, were able to model their ideas and new works using the company’s CAD software.

Examples of products that were designed this way are the Boeing 777, The Falcon 2000 Business yet, and the Rafale Jet Fighter – all of these were designed using CATIA.

This company is neither small nor insignificant, and if you’re “in the business”, the people that you speak to know Dassault, and they know CATIA.

Dassault IPO’ed in 1997 – fairly late – and quickly acquired some companies such as SolidWorks and Deneb Robotics which went to additional software suite developments. These M&A’s allowed entry into the Microsoft (MSFT) market, and we enter the 2000s.

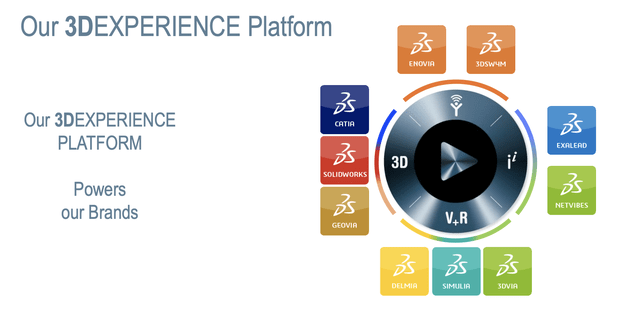

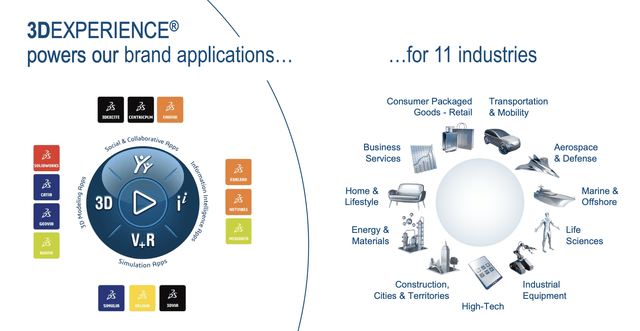

Demand increased exponentially, as you very well know. Digital tools became the new standard to drive innovation and efficiency. Dassault continued to M&A and expand its products. CATIA and its product suites became the 3DEXPERIENCE platform to connect its various software applications and enable global interoperability and cross-functional collaboration.

Many M&A’s were tacked on in order to increase the functionality of this platform, such as:

- Simpoe S.A.S. (2013)

- Realtime Technology (2014)

- Accelrys (2014)

- Quintiq (2014)

- CST (2016)

- Outscale (majority stake, 2016)

- Centric (majority stake, 2018)

- IQMS (2018)

- Medidata Solutions (2019)

- NuoDB (2020)

As the world went into ESG and sustainable strategies, the company kept up and added life cycle assessment solutions into its products.

Today, Dassault Systémes covers the entire value chain and can work with tens of thousands of processes going into virtual design, product development, manufacturing, engineering, operations, and logistics. The company has often been named one of the world’s most innovative companies, the best employers, and the company with the most growth potential.

The common view that many NA investors have that many European companies are “dead weight” does not apply to Dassault Systémes.

And that is why I’ve had the company on my list for such a long time.

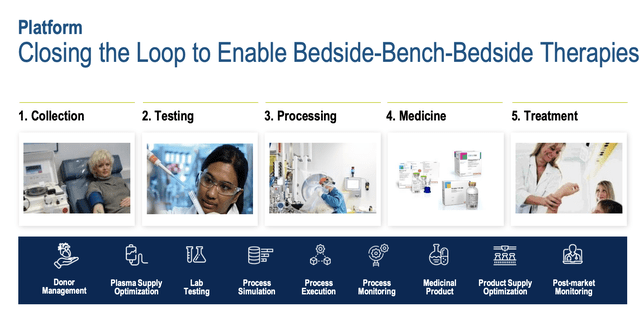

Dassault is also involved with areas that you would not expect from this sort of company. It was a major player in COVID-19, for instance, due to the capabilities of its platform and systems.

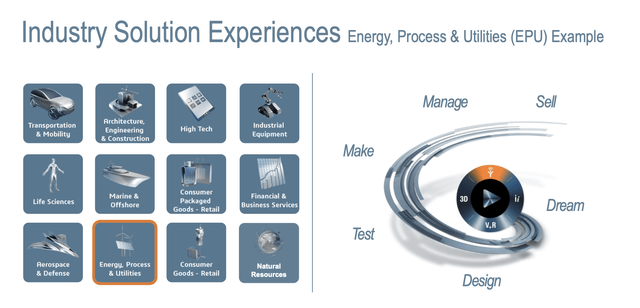

Healthcare has in fact been one of the major drivers of the company – but the appeal of the 3DEXPERIENCE goes across multiple sectors and fields.

And I believe the combination of innovation and product-development centric growth potential for the company translates into a situation where Dassault has the very realistic future of being one of the major beneficiaries of multiple, sector-independent trends. Its current largest revenue areas are Life Sciences/Healthcare, Manufacturing Industries, and Infrastructure/Cities.

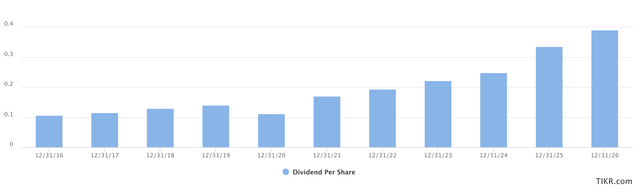

Dassault Systemes is rated “A” by S&P Global, implying its credit quality and safety. It does not, as I said, have much of a yield to speak of. The dividend for 2021, payable this year, was a total of 17 eurocents, coming to a yield of no higher than 0.5% for today’s share price – and the fact is, that yield compared to a 3-year average, is pretty high.

Now, the dividend is expected to grow – pretty far even – for the next couple of years.

Dassault Systemes Dividend (TIKR.com/S&P Global)

The 2026E dividend at this time implies a yield of more than twice the current yield level – over 1% – if these levels come in. But given the interest rates and where things are going, dividend levels are not why you should be investing in Dassault Systemes.

Let me show you some trends.

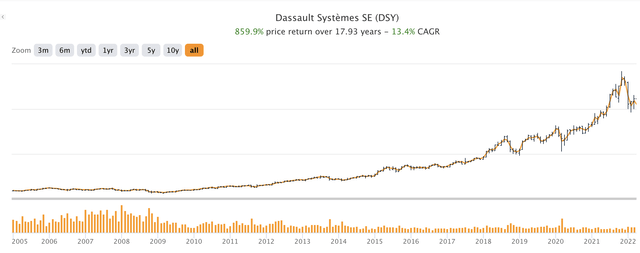

Dassault is a market-leading operator, that over the past 20 years and even with the crash of 35% this year, would have generated market-beating levels of returns over time. 860% in 17 years to be exact.

Dassault Systemes Stock Price (TIKR.com/S&P Global)

The reason I’ve been uninterested is exactly the sort of bounce we saw in 2020/2021, and the reason I’ve become interested is the ongoing decline in the company’s share price. So far, the company has lost more than 35% of its share price this year, and I do not think things are over just yet.

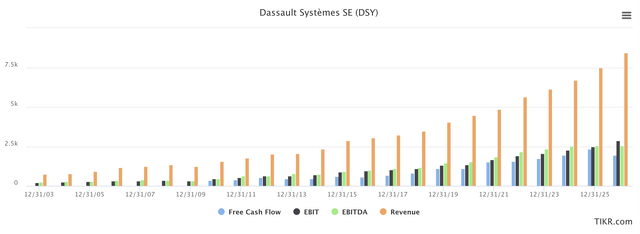

However, the company’s trends are stellar. The company has been able to average 7-14% revenue growth over the past 20 years – even during past cycles. The company also manages 30%+ EBITDA, EBIT, and operating margins, with net income margins over 22-23%, and seeing EPS drop is very rare for this business.

Dassault shows every single indication of being an extremely well-managed and well-handled sort of business, with none of the underlying volatility sometimes associated with businesses like this, or out of France.

The company is a storied and solid generator of FCF and is expected to continue to be this. In fact, every single relevant metric I look at is showing positive trends.

Dassault Systemes Results (TIKR.com)

This is the sort of company I believe we all want to own at the right price, and recent results have only confirmed the upside and stability for the company. 3Q22 is the latest quarter we have, and we saw revenue growth of 10% recurring, with earnings and profitability up more than top-line growth at EPS growth of 17% YoY. The company has reaffirmed 2022 growth targets and even bumped them, now expecting full-year growth of no less than 18-19%, and the company believes itself to be on track for 2024E revenues of €1.2, fully aligning with the growth expectations for the company.

The company’s transition to a subscription-based model is going according to expectations. The clients are displaying a preference for these licensing models.

Risks and downsides to the company?

Not many, I would argue – but they do exist.

China is a main market for Dassault, and with things looking the way they are, the company has been experiencing significant softness in this area, which really impacted licensing growth – not enough to hinder the company from beating positive EPS estimates, but still something to consider.

The company is also still in the comparative early stages of building its hosting infrastructure in relation to its €2B 2025E target – and it hasn’t yet decided on its own proprietary infrastructure, and the use of Amazon’s (AMZN) AWS. This is something we’ll want to follow over the next few quarters. From a CapEx perspective, I don’t see the need that Dassault actually invests until they have the revenue contracted. Also, Dassault is already using much of its own infrastructure and is in the position of being able to wait on offers from the market and to see what capacities are on the table in 1-2 years.

The company is, in layman’s terms, strategically end-loading its CapEx to make sure that revenue is on the table before they have to commit.

I wouldn’t see any other fundamental issues here in the company – so let’s move onto valuation.

Dassault Systémes Valuation

Dassault hasn’t been in an appealing “BUY” position for a long time, as I’ve seen it. I knew this would change this year as the tech started to decline, and the company has done what I hoped it would do.

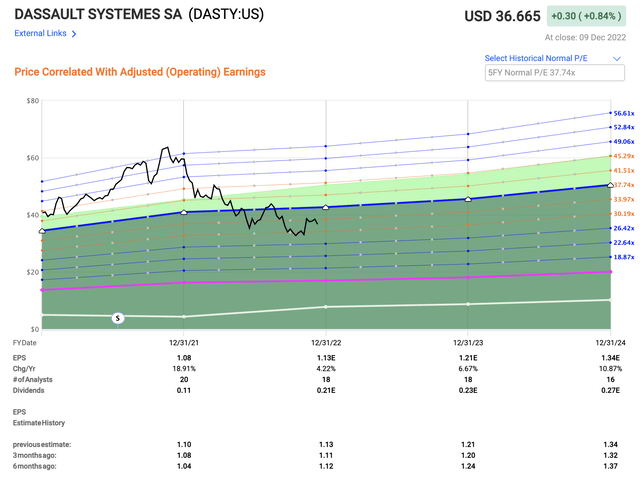

Relevant metrics have been declining very considerably. From a nearly 40x EBIT and 33x EBITDA multiple, as well as an almost 50x P/E, which I wouldn’t pay for any business, we’re now down to below 30x in all of those NTM multiples, with EBIT down below 23x.

Analysts have of course been continually exuberant for the company, calling Dassault a “BUY” even as it was flying higher than Icarus. However, targets are coming down – from a €50/share normalized PT with ranges that went up to nearly €70/share, we’re now down to a normalized S&P Global share price target of €39, with a low of €28/share (Source: S&P Global). The amusing thing is, less of the analysts actually have the company as a “BUY” than they did when the relative P/E target was close to 50x.

This goes to show you how trend-driven and ultimately unreliable some of these analysts can be considered to be.

Over 30x P/E for any company is a valuation I’m very, very rarely prepared to pay. Certainly not for Dassault. But here we are looking at P/E multiple ranges of 26-29x P/E, depending on where you forecast the business.

At the current time, 8 out of 22 analysts have the company at a “BUY” or equivalent, implying an upside of 12.3% conservatively.

The relevant ADR still trades at a normalized 32.5x, but this is down from a normalized 60x P/E back a year or so ago. The simple fact is, we’re “down” at this point.

Dassault Valuation (F.A.S.T graphs)

“When” to buy an investment like this is always the big question. That the company is attractive, there is no question of to me. The company’s DASTY ADR trades at a normalized P/E of 30.5x, and we’re not there just yet. We were there a few months back – and that’s when I loaded up on a few shares of the company when the native share price briefly broke below €33/share. We’re back up a bit again.

I argue that the ADR clouds the normalized P/E and multiples somewhat, but is in fact more or less accurate. The native normalized 20-year /E is close to 29x, and the current valuation for Dassault is 29.2x P/E for the native. As such, the implication here is that the company is barely fair-value in terms of P/E.

However, I believe this fails to take into consideration that future growth is going to outperform historical growth. Given the current growth estimates for the company, and the proof of outperformance we’ve seen in the past year or so, I’m applying a higher 4-7% EBITDA growth rate to the company, expecting it to grow faster than the overall market. When including such expectations, the result becomes that the company may warrant a higher multiple and that an average of 29-30x P/E is actually justified.

While we could wait for Dassault to go lower, and it might, I also believe that the company is currently at a level where it could be considered a “BUY” for the first time in over 2 years.

Because of that, I’m starting my coverage here, and applying a 29.5x normalized P/E to Dassault, which comes to €35.5/share, and gives the company a small degree of undervaluation.

Here is my stance for Dassault.

Thesis

- Dassault is a class-leading superb company in the realm of product modeling, life/health, and infrastructure technologies, or if we want to cover it all, “Application software”. It has superb management, and a solid, market-beating history. I want to own the company at a good price.

- I would argue that you should not pay above 30x normalized native P/E for the company. Given the company’s current price, this is actually possible here.

- I give Dassault Systémes a “BUY” with a PT of €35.5 here – a low target compared to analysts, but a conservative one.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

It would be a stretch to call Dassault “cheap” here, but it does have a realistic upside, therefore fulfilling 4 of my 5 investment criteria.

Be the first to comment