Darren415

This article was first released to Systematic Income subscribers and free trials on Aug. 31.

Most income investors have caught on to the fact that short-term rates have risen sharply this year and will, almost certainly, continue to rise over the near term. Fed Chair Powell’s speech at Jackson Hole made it clear that inflation remains the chief priority and that other considerations such as a possible recession is, very much, of secondary importance.

This is why many investors have allocated to bank loan funds whose payments are linked to short-term rates and whose payouts have increased since the start of the year and will continue to do so. For instance, prior to the most recent bout of volatility in June, retail loan inflows were over $28bn (they are $12bn as of August). Total assets managed by loan mutual funds have also grown sharply to $124bn versus $69bn in 2020.

In this article we highlight that bank loans are not the only game in town when it comes to floating-rate assets. Loans also have important downsides as well which investors need to take into account. Our key takeaway is that just as investors diversify across a number of sectors and issuers, they should also diversify across their floating-rate exposure.

A Round-Up Of Floating Rate Sectors

As we highlighted already, very likely the first port of call for floating-rate exposure for most income investors are publicly traded corporate loans. The most compelling options here from a yield standpoint are arguably CEFs which boast a current yield twice that of their mutual fund and ETF counterparts. The average current yield in the loan CEF sector is 8.25%.

The last two times that the Fed hiked the policy rate, the sector saw significant distribution growth. A number of loan CEFs have already started to hike in response to and anticipation of income growth.

Within the sector we continue to hold the Apollo Tactical Income Fund (AIF), trading at a 9% current yield and a 11.3% discount. The fund has put up sector-beating returns over the last 5 years in total NAV terms, trades at a wider than average sector discount and has already hiked its dividend by about 8% since the start of the year.

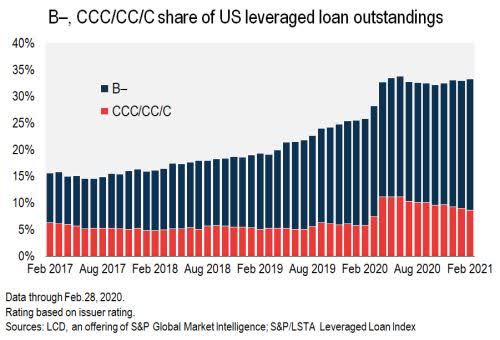

Many income investors stop here with floating-rate exposure. However, loans also have a number of downsides as well. The average leverage profile of the loan sector has increased over time. This is why the quality of the sector has worsened over the last few years with a significant uptick in the percentage of the sector carrying the lowest credit ratings.

S&P

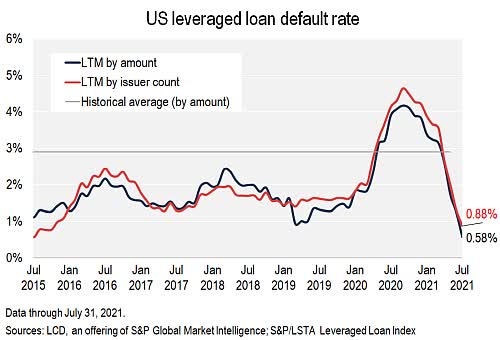

Second, loan borrowers will face significantly higher borrowing rates as short-term rates rise. This is simply the other side of the coin of higher distributions. PIMCO estimate that for a single-B bank loan issuer, a 3% rise in the Fed funds rate (the market consensus appears to be a 3.5-4% ultimate rise in the policy rate) will increase interest costs by 60-70%. Given interest coverage of these borrowers is already low – at around 2x – it will push many into a negative free cashflow position. Clearly, some borrowers are better positioned than others and some hedge their interest rate exposure but this increase in borrowing costs will leave a mark.

The point here is not that investors should avoid bank loans but that they should understand that the upside of higher distributions also comes with greater pressure on the borrowers who are forced to pay these higher distributions. All else equal, this results in a drop in quality of the underlying loan portfolio given the additional financial pressure exerted on the borrowers by higher rates.

This is why it makes sense to also seek out floating-rate exposure that has one or more of the following features: 1) it has a higher quality profile than bank loans and 2) puts less pressure on borrowers from rising short-term rates. Another reason to allocate to other floating-rate sectors is from a pure diversification perspective as well.

Arguably, the closest floating-rate sector to bank loans (i.e., publicly traded loans) is the middle-market loan space (i.e., privately negotiated loans). This sector is typically accessed via Business Development Companies by retail investors.

BDCs, arguably, have many of the same issues as bank loans. Many of their holdings operate at elevated levels of leverage (i.e. they would carry relatively low credit ratings if they were rated). The rise in interest rates will also put pressure on their free cashflow. Arguably, because middle-market companies are smaller they have less capacity to hedge out their rate exposure and would see a larger drop in interest coverage than the larger bank loan borrowers.

However, BDCs also have a number of advantages over bank loans. They can much more easily assist their borrowers (as they would typically have a much larger, if not the only, stake in the borrower’s total debt). They can also more easily renegotiate the loan, manage covenant breaches, or convert it to PIK for a period of time. They could also potentially convert the debt to equity. None of these things are slam dunks but the additional flexibility that BDCs have over bank loan managers can help their borrowers work through a difficult period, resulting in better performance. BDCs have historically delivered much stronger performance over loan CEFs over time and this is one of the reasons why that’s happened.

In the BDC sector we currently have Buy ratings on the Blackstone Secured Lending Fund (BXSL) and the Golub Capital BDC (GBDC), among others which trade at 9% and 8.8% dividend yields respectively.

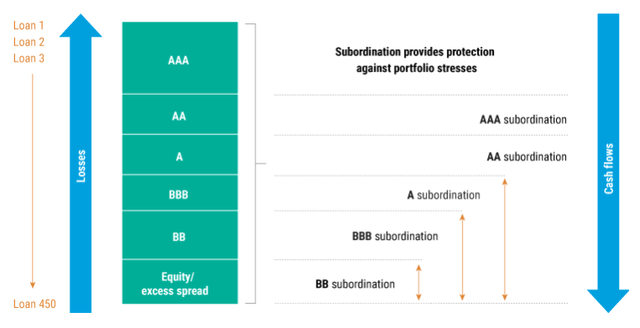

Staying with loans, another more esoteric sector worth a look are CLOs, particularly CLO Debt. The main advantage of CLO Debt over straight-up loans is two-fold. First, CLOs tend to maintain higher-quality portfolios than the broader loan market because of the limit on the “CCC bucket” i.e. the proportion of loans that can be rated CCC in the loan portfolio. And second, CLO Debt have “subordination” or a range of losses which don’t eat into the principal of a CLO Debt security as shown in the chart below.

Specifically, CLO Debt tends to have subordination of at least 10% (CLO tranches rated above BB tend to have a higher level of subordination). This means that we would need to see an unusually high and persistent level of defaults in the sector for the subordination to be wiped out – in excess of what we have seen historically.

S&P

The key risk for CLO Debt is that the tranches are fairly thin (the BB-rated tranche can be just 3.5-5% wide) so, unlike a standard loan portfolio, it can be fully wiped out when portfolio losses are around 15%. The key point here is that in a truly dire outcome CLO Debt will underperform a standard loan portfolio but in a typical recession it should suffer a lower level of losses. So if we see an uptick in defaults due to a drop in interest coverage but not a massive default wave then CLO Debt can protect investors from an “average” level of defaults in terms of principal loss.

Our usual go-to fund for CLO Debt is the CEF Eagle Point Income Company (EIC), however, the fund has been trading at an exorbitant valuation and we don’t find it attractive at all. This is why we prefer the Janus Henderson B-BBB CLO ETF (JBBB) which trades at a 5.1% SEC yield which will continue to rise further as short-term rates move up.

Another sector we like is the non-agency residential mortgage sector. This sector tends to be primarily floating-rate for both legacy as well as the new CRT assets.

These assets have three key benefits for investors over loans. First, they provide a different risk exposure than corporate credit – which often dominates income portfolios. Secondly, RMBS assets are available with different levels of credit quality spanning both investment-grade and sub-investment-grade securities whereas there are few investment-grade bank loans. And three, the rise in short-term rates does not put pressure on the issuers of these securities (i.e. government sponsored entities like Fannie Mae) as these would either be hedged out or not a material driver of performance.

In this sector we continue to like the Western Asset Mortgage Opportunity Fund (DMO) which is trading at a 9.9% yield and a 9.2% discount. We discussed this fund in more detail here. The fund has been relatively resilient this year – outperforming the broader credit CEF space.

We also like higher-quality floating-rate preferreds. These include both bank preferreds such as the PNC Series P (PNC.PP) with a 3-month Libor + 4.0675% coupon which trades right around its $25 liquidation preference. With 3-month Libor at 3%, the investment-grade rated stock has a 7% yield. The Valley National Bancorp Series B (VLYPO) also has a 7% yield and is BB-rated (VLY debt is investment-grade rated).

Takeaways

Most income investors are well aware that short-term rates have been on a strong uptrend this year and will likely continue to rise as the Fed channels its inner Paul Volcker and tries to rein in inflation. This makes floating-rate assets attractive as they will generate higher levels of income in response to rising short-term rates. For this reason many investors have flocked to bank loans to capture this dynamic. However, while we find bank loans reasonable holdings in the current environment, in our view, it makes a lot of sense to diversify floating-rate exposure across other floating-rate sectors. These sectors not only match the income profile of bank loans but offer portfolio diversification and more attractive features over bank loans.

Be the first to comment