stockinasia

Investment Thesis

- I currently rate Walt Disney (NYSE:DIS) as a buy since the company has a broad economic moat and, at the same time, it has strong growth drivers that will contribute to the company’s success in the upcoming years.

- I expect that Walt Disney’s broad and diversified product portfolio, strong brand image and growing streaming service Disney+ will contribute to the company’s growth in the coming years.

- In my opinion, Walt Disney is an excellent buy and hold investment. The reason for that is that I consider Walt Disney to be an excellent choice in terms of risk and reward.

- Since I consider Walt Disney an excellent choice in terms of risk and reward, I would overweight the company in an investment portfolio built with a long investment-horizon.

- My opinion is also reflected in my personal investment portfolio, in which Walt Disney is one of my largest positions.

Walt Disney’s 3Q22 Results

Walt Disney presented strong 3Q22 results: The company’s revenue grew from $17,022M in 3Q21 to $21,504M in 3Q22, an increase of 26.33%. At the same time, the company’s diluted earnings per share from continuing operations increased from $0.50 in 3Q21 to $0.77 in 3Q22, implying an increase of 54%.

The company’s strong results in 3Q22 reflect Walt Disney’s robust and stable business model and its broad and diversified product portfolio.

Bob Chapek, Chief Executive Officer of Walt Disney, said the following about Walt Disney’s 3Q22 results:

“We had an excellent quarter, with our world-class creative and business teams powering outstanding performance at our domestic theme parks, big increases in live-sports viewership, and significant subscriber growth at our streaming services. With 14.4 million Disney+ subscribers added in the fiscal third quarter, we now have 221 million total subscriptions across our streaming offerings.”

The Valuation of Walt Disney

Discounted Cash Flow [DCF]-Model

In terms of valuation, I have used the DCF Model to determine the intrinsic value of Walt Disney. The method calculates a fair value of $189.03 for Walt Disney. The company’s current stock price of $96.64 gives Walt Disney an upside of 95.6%.

My calculations are based on these assumptions as presented below (in $ millions except per share items):

|

Walt Disney |

|

|

Company Ticker |

DIS |

|

Tax Rate |

17% |

|

Discount Rate [WACC] |

7.00% |

|

Perpetual Growth Rate |

3% |

|

EV/EBITDA Multiple |

18.9x |

|

Current Price/Share |

$96.64 |

|

Shares Outstanding |

1,823 |

|

Debt |

$51,602 |

|

Cash |

$12,959 |

Source: The Author

Based on the above, I have calculated these results:

Market Value vs. Intrinsic Value

|

Walt Disney |

|

|

Market Value |

$94.64 |

|

Upside |

95.6% |

|

Intrinsic Value |

$189.03 |

Source: The Author

Walt Disney’s Fundamentals

In terms of market capitalization, Walt Disney (with a market capitalization of $169.73B) is significantly larger than competitors such as Netflix (NASDAQ:NFLX) (market capitalization of $95.30B), and Warner Bros. Discovery (NASDAQ:WBD) ($28.16B). In addition, Walt Disney is also larger than these competitors in terms of revenue: while Walt Disney generates revenue of $81.11B, the revenue of Netflix is $31.03B, and that of Warner Bros. Discovery is $19.32B. Walt Disney’s higher market capitalization and revenue reflect Walt Disney’s enormous market power in the Movies and Entertainment Industry and again underlines its broad and diversified product portfolio.

Walt Disney’s EBITDA of $11.93B is almost 2x higher than the one of Netflix ($6.23B), and almost 4x higher than the one of Warner Bros. Discovery ($3.40B). Walt Disney’s significantly higher EBITDA compared to Netflix or Warner Bros. Discovery indicates that the risk of investing in Walt Disney is significantly lower.

When comparing the companies’ Total Debt to Equity Ratio, it can be highlighted that the figures of Walt Disney (Total Debt to Equity Ratio of 48.75%) are significantly lower than those of Netflix (88.64%), Warner Bros. Discovery (105.35%), and Comcast (NASDAQ:CMCSA) (106.06%), demonstrating once more that the risk of investing in Walt Disney is lower than the risk of investing in one of those competitors. Below you can find Walt Disney’s fundamental data compared to some competitors.

|

Walt Disney |

Netflix |

Warner Bros. Discovery |

Comcast |

||

|

General Information |

Ticker |

DIS |

NFLX |

WBD |

CMCSA |

|

Sector |

Communication Services |

Communication Services |

Communication Services |

Communication Services |

|

|

Industry |

Movies and Entertainment |

Movies and Entertainment |

Movies and Entertainment |

Cable and Satellite |

|

|

Market Cap |

169.73B |

95.30B |

28.16B |

132.62B |

|

|

Profitability |

EBIT Margin |

8.39% |

19.13% |

-1.38% |

18.25% |

|

ROE |

3.44% |

30.93% |

-7.98% |

14.34% |

|

|

Valuation |

P/E GAAP [FWD] |

45.59 |

22.81 |

NM |

9.59 |

|

Growth |

Revenue Growth 3 Year [CAGR] |

7.77% |

20.74% |

20.68% |

5.47% |

|

Revenue Growth 5 Year [CAGR] |

7.88% |

24.95% |

24.02% |

7.63% |

|

|

EBIT Growth 3 Year [CAGR] |

-18.81% |

47.19% |

NM |

3.44% |

|

|

EPS Growth Diluted [FWD] |

38.60% |

21.57% |

-67.73% |

13.73% |

|

|

Dividends |

Dividend Yield [FWD] |

– |

– |

– |

3.59% |

|

Dividend Growth 3 Yr [CAGR] |

– |

– |

– |

8.93% |

|

|

Dividend Growth 5 Yr [CAGR] |

– |

– |

– |

11.69% |

|

|

Consecutive Years of Dividend Growth |

0 Years |

– |

– |

5 Years |

|

|

Dividend Frequency |

– |

– |

– |

Quarterly |

|

|

Income Statement |

Revenue |

81.11B |

31.03B |

19.32B |

121.66B |

|

EBITDA |

11.93B |

6.23B |

3.40B |

36.28B |

|

|

Balance Sheet |

Total Debt to Equity Ratio |

48.75% |

88.64% |

105.35% |

106.06% |

Source: Seeking Alpha

The High-Quality Company [HQC] Scorecard

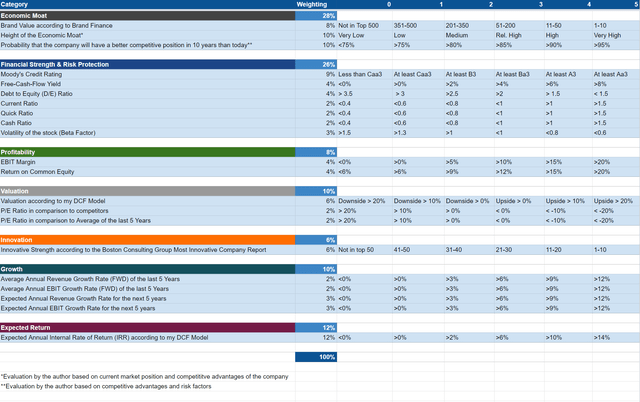

“The aim of the HQC Scorecard that I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

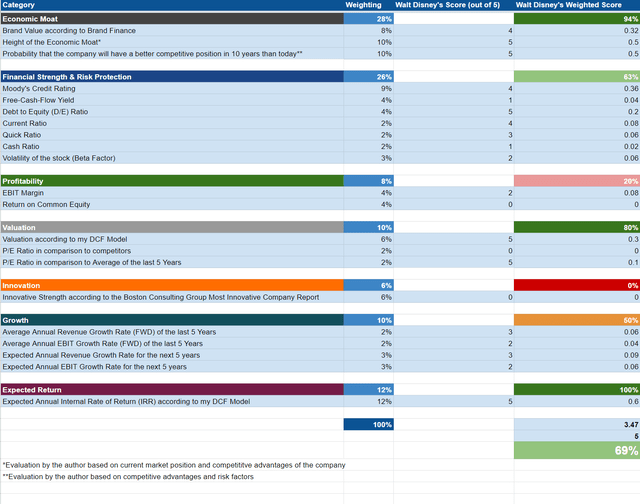

Walt Disney According to the HQC Scorecard

Walt Disney achieves an overall score of 69/100 points according to the HQC Scorecard. The results show that Walt Disney can be considered attractive in terms of risk and reward.

Walt Disney is rated as very attractive in the categories of Economic Moat (94/100 points), Valuation (80/100) and Expected Return (100/100).

In the category of Financial Strength (63/100), Walt Disney is rated as attractive and in the category of Growth (50/100) as moderately attractive. Regarding Profitability, Walt Disney is currently rated as unattractive (20/100).

Walt Disney’s attractive overall rating in terms of risk and reward underlines my investment thesis to overweight the Walt Disney stock in an investment portfolio built with a long-term investment horizon.

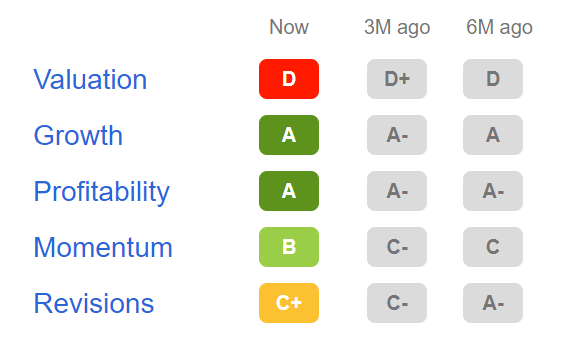

Walt Disney According to the Seeking Alpha Quant Factor Grades

The attractiveness of Walt Disney is underlined by the results of the Seeking Alpha Factor Grades. In terms of Valuation, Walt Disney is rated with a D rating. For Growth and Profitability, Walt Disney receives an A rating; for Momentum, a B and for Revisions, a C+. The Seeking Alpha Factor Grade results reinforce my belief to rate Walt Disney as a buy.

Source: Seeking Alpha

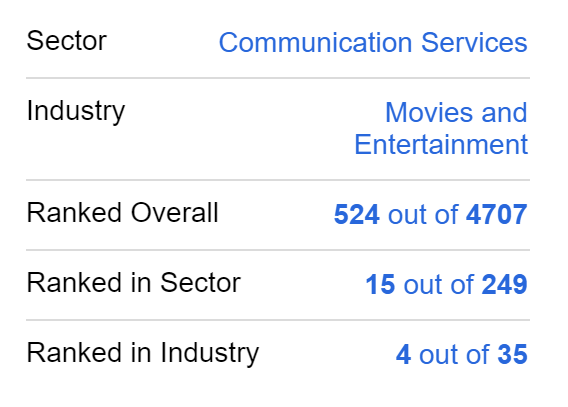

Walt Disney According to the Seeking Alpha Quant Ranking

Within the Movies and Entertainment Industry, Walt Disney is ranked 4th (out of 35), and within the Communication Services Sector, the company is ranked 15th (out of 249). In the overall ranking, Walt Disney is ranked 524th out of 4707. Walt Disney’s excellent results strengthen my belief to rate the company as a buy and to overweight it in an investment portfolio.

Source: Seeking Alpha

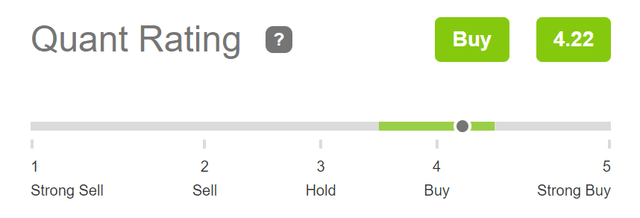

Walt Disney According to the Seeking Alpha Quant Rating

According to the Seeking Alpha Quant Rating, Walt Disney is currently a buy confirming my own buy rating on the company’s stock.

Walt Disney According to the Seeking Alpha Authors Rating and Wall Street Analysts Rating

According to the Seeking Alpha Authors, the Wall Street Analysts and the Seeking Alpha Quant Rating, Walt Disney is currently a buy, strengthening my belief to rate the company as a buy.

Source: Seeking Alpha

Walt Disney’s Growth Drivers

I see the following factors as Growth Drivers for Walt Disney in the upcoming years:

Walt Disney’s Broad and Diversified Product Portfolio

Unlike some of its competitors, such as Netflix or Warner Bros. Discovery, Walt Disney has a broader and more diversified product portfolio. This is underlined by the fact that Walt Disney’s revenue is significantly higher than that of one of its competitors, as I have shown before in this analysis.

The fact that Walt Disney generated in 3Q22 65.62% ($14,110M) of its total revenue by its business unit Disney Media and Entertainment Distribution and 34.38% ($7,394M) by its business unit Disney Parks, Experiences and Products demonstrates again that the company disposes of a broad and diversified product portfolio.

I expect that Walt Disney’s broad and well-diversified product portfolio will contribute to the company’s growth in the upcoming years.

Walt Disney’s Strong Brand Image

Walt Disney is ranked among the most valuable brands in the world. According to Brand Finance, Walt Disney is currently ranked 19th among the world’s most valuable brands. Walt Disney’s brand value is estimated to be $57,059M in 2022, which implies an increase of 11.35% compared to the previous year, 2021 (in which the company’s brand value was $51,244M).

I expect Walt Disney’s strong brand image to be an additional growth driver in the future. A strong brand image enables the company to pass on higher costs to its customers in times of high inflation.

Walt Disney’s Streaming Platform Disney+

The subscription based DTC video streaming service Disney+ has brands such as Disney, Pixar, Marvel, Star Wars and National Geographic in its portfolio. Walt Disney’s Programming consists of about 33,000 episodes and 1,850 movies from its television and film library.

Walt Disney currently has about 221M total subscriptions across its streaming offerings. In 3Q22, the company added 14.4M new subscribers.

According to data from Statista, Disney+ currently has 152.1M subscriptions, while Netflix’s total number of paid subscribers is estimated to be around 220.67M. However, Netflix reported in 1Q22 that it lost about 200,000 subscribers, although it had forecasted to add about 2.5M.

Several factors lead me to the conclusion that Disney+ will become a long-term success story for Walt Disney:

First, throughout its nearly 100-year history, Walt Disney has proven again and again its capability of adapting its strategy and content to changing environments. Second, Walt Disney has an immensely strong brand. Thirdly, I believe that the company will succeed in retaining customers very early because its target group includes young people and even children. Fourth, Walt Disney’s business results from 3Q22 prove that the company is on track in terms of growth. All these factors make me believe that Disney+ will be a success story.

All these growth drivers mentioned above contribute to the fact that I would overweight the Walt Disney stock in an investment portfolio.

Risks

One of the main risk factors I see when investing in Walt Disney is the company’s strong and intense competition within the Movies and Entertainment Industry. Walt Disney competes with companies that are financially strong and that have managed to establish strong brand images as well: Among Walt Disney’s competitors are Amazon (NASDAQ:AMZN) (with its Amazon Prime Video Service), Apple (NASDAQ:AAPL) (with Apple TV+), Alphabet (NASDAQ:GOOGL) (with its streaming service YouTube), Netflix, Warner Bros. Discovery and Comcast. The intense competition among all these streaming service providers could result in declining profit margins for Disney. However, due to Walt Disney’s strong growth drivers, I expect Wat Disney to be among the long-term winners among the companies out of the Movies and Entertainment Industry.

Additional risk factors I see for Walt Disney is the current difficult macroeconomic environment.

In economically difficult times, consumers could decide to spend less for streaming services such as Disney+. However, the company’s strong results in 3Q22 show the opposite: It was confirmed that Walt Disney is on track with its streaming service Disney+ when it comes to growth.

The consumer could also spend less on Walt Disney’s Parks. However, Walt Disney’s results from 3Q22 have shown that the number of visitors is increasing: the company’s revenue from Disney Parks, Experiences and Products increased from $4.3 billion in 3Q21 to $7.4 billion in 3Q22.

In my opinion, Walt Disney is attractive regarding risk and reward. My opinion is supported by the results of the HQC Scorecard, which rates Walt Disney with 69/100 points, which is an attractive rating in terms of risk and reward. Walt Disney’s attractive rating supports my theory to overweight the Walt Disney stock in an investment portfolio built with a long investment-horizon.

The Bottom Line

I currently rate Walt Disney as a buy: the company has strong growth drivers that will contribute to the company’s growth in the future. I particularly see Walt Disney’s broad and diversified product portfolio, its strong brand image as well as its streaming service Disney+ as the company’s main growth drivers in the years to come and I have shown in this analysis why I am convinced that Disney+ will be a success story for Walt Disney in the future.

In my opinion, Walt Disney is an excellent buy-and-hold investment. My buy rating is underlined by the company’s attractive rating in terms of risk and reward according to the HQC Scorecard (which rates Walt Disney with 69/100 points). The company’s excellent rating in terms of risk and reward strengthens my opinion to overweight the Walt Disney stock in an investment portfolio.

My recommendation to overweight the Walt Disney stock in an investment portfolio is reflected by the composition of my own investment portfolio, in which the company is one of my largest positions.

Be the first to comment