Scharfsinn86/iStock via Getty Images

Introduction

In this article, I would like to share the reasons why I believe that Volvo Group (OTCPK:VOLAF; OTCPK:VLVLY) is a much safer pick than Nikola (NASDAQ:NKLA) for investors who are looking for exposure to the electric truck manufacturing industry.

I recently covered the main truck manufacturers and whoever is interested in reading my research so far will find at the end of this article the links to the other one. However, I would like to briefly recap here what I said about Volvo Group and Nikola.

In my previous article, I showed how Volvo Group is the best player in the industry in terms of margins, the company displays very solid financials and it is already the European market leader for electric trucks.

On the other hand, I showed in another article how it was still very difficult to give a fair valuation for Nikola and that the safest metric we have right now, which is the price/sales ratio, was still very high compared to current results and future guidance.

Now, both companies reported their Q2 earnings and I would like to draw a comparison and explain why I chose Volvo as the better option to be invested in the truck electrification process which is expected to create a market worth around $15.6 billion by 2030.

Volvo Group

Ownership

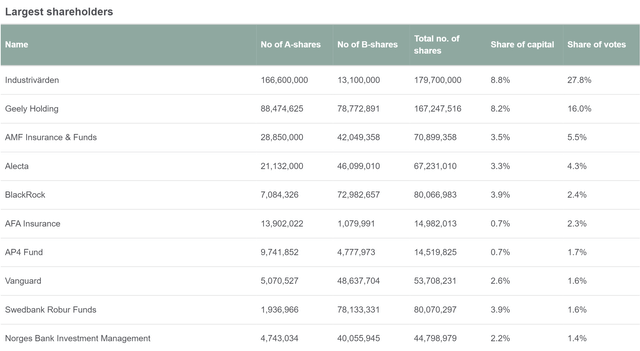

Now, before jumping into the most recent reports, I think it is important to understand Volvo Group’s ownership structure. Unlike the car manufacturer, Volvo Group is held by only one Chinese holding, Geely, which has 8.2% of shares which account for 16% of voting rights. However, the major owner is a Swedish holding which invests, Industrivarden, which aims at investing into the best Swedish companies. The other shareholders all belong to Scandinavia or North America. I think that in a world with geopolitical tensions like today’s, it is important to take a look both at the shareholders’ structure alongside with the markets a company operates in.

Volvo Group Investor Relations Webpage

Financials

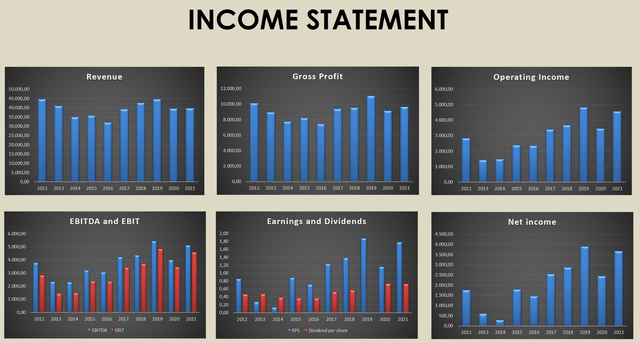

I put together some of the most important financial data to show how everything for Volvo Group is moving in the right direction. In fact, one of the first things I usually do before diving into the numbers is to look at the trends shown by the bar charts. There are ones that I want to see go up, others that I like to see go down. It helps me visualize the direction the company’s fundamentals are going towards.

In order to know the context, we have to keep in mind that in 2021 Volvo completed the sale of UD trucks to Isuzu Motors (OTCPK:ISUZY). This explains why in the last couple of years both revenue and gross profit decreased a bit compared to the historical upward trend of the previous years.

Here is the income statement. We see that the revenue shows some cyclicality, but that it trends slightly upwards if we factor in the UD trucks sale. Every other metric shows the exact chart I want to see as an investor: gross profit moving upwards, operating income trending upwards, EBITDA and EBIT are increasing and so is the net income. As a consequence, both the EPS and the dividends paid move up.

Author, with data from Seeking Alpha

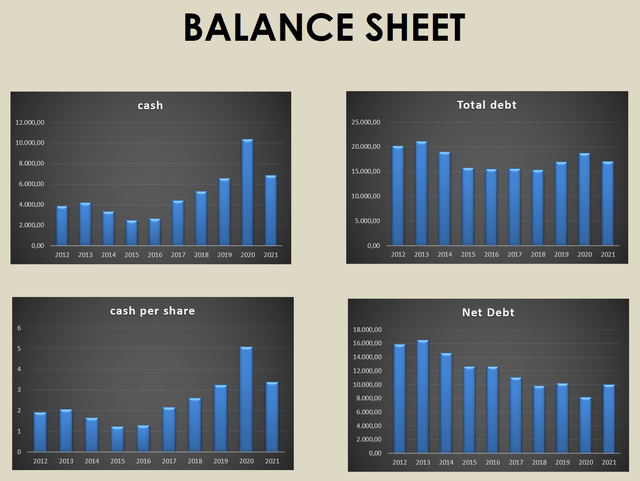

The balance sheet also shows an increasing cash position, while total debt is being reduced. Thus, cash per share is clearly going up while net debt is decreasing steadily. This is a strong balance sheet that is able to withstand major downturns while having the strength to finance even aggressive investments in case they were needed. During ordinary times, this balance sheet is the guarantee that the company will be able to return a part of the profits to the shareholders because it doesn’t have to focus on operations like deleveraging.

Author, with data from Seeking Alpha

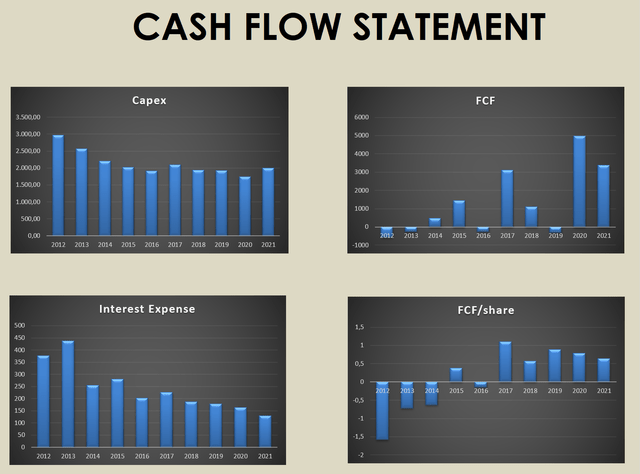

One last picture with some charts shows us how Volvo Group is performing in terms of cash flow. Capex is being managed well and it is under control, with reduced spending. This is particularly important because it is one of the data that shows how Volvo Group is able to put into action the electrification of its trucks without losing control of its costs. Interest expenses are going down, too, and they eat away a smaller and smaller chunk of the company’s earnings. Finally, Volvo Group has managed to turn free cash flow positive since 2014 with only some small declines in 2016 and 2019. However, if we look at the FCF/share, we see that in 2019 it was well above 0, reaching almost $1 per share.

Author, with data from Seeking Alpha

2Q Results

Before we look at the most recent numbers, we have to consider that Volvo Group reports its results with the Swedish krona (SEK). To make things easier for Seeking Alpha’s readers, who are usually accustomed to USD and EUR, I will convert Volvo’s results into USD, using the exchange rate of 1USD:10SEK, which is very close to the currency exchange rate of 1USD:10.17SEK.

Volvo Group released its 2Q 2022 earnings report declaring that revenues for the quarter increased by 31% to $11.89 billion (vs $9.06 in 2021). The adjusted operating income amounted to $1.37 billion (vs $973 million in 2021). This is an adjusted operating margin of 11.6% (vs. 10.7% in 2021). Earnings per share amounted to $0.51 (vs. $ 0.44 in 2021). Operating cash flow in industrial operations amounted to $720 million ( vs. $593 million in 2021).

If we look at the first half of the year, total revenues reached $22.43 billion (vs. $18.46 in 2021). The adjusted operating income amounted to $2.64 billion (vs $1.79 billion in 2021). This is an adjusted operating margin of 11.8% (vs. 11.7% in 2021). Earnings per share reached $0.86 (vs. $0.87 in 2021). Return on capital employed in industrial operations was 26.8% (vs. 23.4% in 2021).

During the past quarter, net order intake decreased by 8% to 53,388 trucks while deliveries increased by 33% to 60,833 trucks. However, as I pointed out in my previous article, the decrease in order intake is not caused by demand destruction, but by restrictive order-slotting for 2023. Volvo has, in fact, been one of the first companies to understand that we were heading into times of high inflationary pressure and long delivery times, a possible threat to margins. This is why, starting already in 2021, the company chose to pursue a strategy aimed at preserving margins, by lowering volumes and managing order intake cautiously, without filling order books as much as possible in advance. This has enabled the company to sell its vehicles at high prices, offsetting inflation and gaining further advantages compared to its peers.

The total net order intake for the quarter was as follows:

- Europe heavy and medium-duty trucks: 26,595 vehicles (-25%YoY)

- North America: 9,731 (+26% YoY)

- South America: 9,336 (+14% YoY)

- Asia: 4,883 (+50% YoY)

- Africa and Oceania: 2,843 (-13% YoY)

Overall, the total order intake decreased by 8% YoY. On the other hand, deliveries increased by 33% YoY.

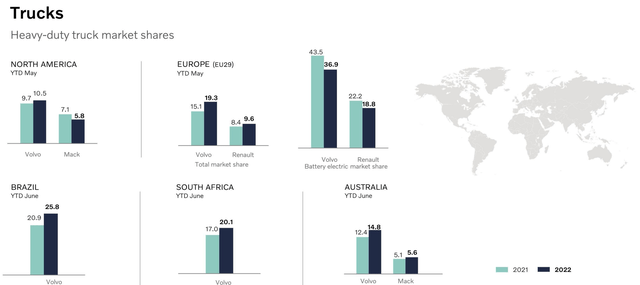

Let’s also take a look at Volvo Group’s market share, as shown in the slide below.

Volvo Group Q2 Results Presentation

Volvo Group increased its market share in Europe (19.3%), in North America (10.5%), in South America, with the outstanding results from Brazil (25.8% of market share compared to the previous year’s 20.9%). South Africa and Australia were, too, among the best performing countries in terms of market share gained.

So far so good, but what I have shown so far is just a brief picture to get an idea of Volvo Group and understand that it is a very solid company, with strong fundamentals, growing margins and good brand value as it is able to be present in many important countries with a significant market share.

Let’s get to the point of electrification.

In Europe, the electric heavy-duty market share of Volvo is currently 36.9%. The company has already begun delivering its trucks in 2021 and this year operations are speeding up.

Volvo has a range of electric trucks, with the Class 8 VNR Electric being its most important one. The truck has a 275 mile range, a 565kWh battery capacity and an 80% charge accomplished in 90 minutes.

Let’s take a look at how Volvo is developing this business.

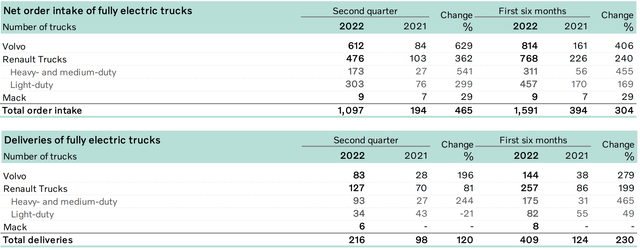

As we can see, Volvo’s deliveries for the quarter were 216 vehicles, up 120% YoY. In the first six months, we see that the company delivered 409 electric trucks, with a 230% increase. Order intake is doing even better. For the quarter, orders are up 465% YoY being for the first time in the thousands. For the first six months, the total order intake is 1,591 vehicles, up 304% YoY.

This proves that Volvo is already carrying out the electric transition. While the company develops this new business, it can fund its needs with the already profitable business of IC trucks.

Volvo trades at a fwd price/sales ratio of 0.84, which I don’t think resembles the reliability of the company’s sales. Secondly, its PE is 11.44, 40% lower compared to the sector average. The fwd EV/EBITDA ratio is 7.44, 32% cheaper than the sector average. With a free cash flow yield of 6.27% and a dividend yield that averaged in the past 4 years around 6%, the company offers some very interesting multiples if we consider it on the verge of riding the tide of a disruptive business in electrified trucks.

Nikola

Nikola is a new company and, as such, it doesn’t have the history to put together some charts like the ones shown for Volvo to get an idea of the direction of its fundamentals. As we will see and as we could expect from a newly found company, results are usually negative and the company runs at a loss. In my previous article, I tried to show how Nikola’s price to sales multiple was still very high for a company that, at the moment of writing, still hadn’t delivered a single truck.

Now, Nikola reported in its Q2 results release that it produced its first electric trucks, the Nikola Tre, in the past quarter and managed to deliver 48 of them, just 2 away from the original low-end guidance of 50 deliveries for the quarter. For the first time, the company reported revenues coming from the sale of electric trucks. The amount is $18.1 million, beating its high-end guidance. The company expects to deliver 300-500 Tre BEV trucks by the end of 2022.

As expected, the company reported a gross loss of $29.26 million for the quarter, with the net loss totaling $173 million and a net loss per diluted share of $0.41. For the first six months the total net loss is $326 million.

The first problem with Nikola is that, currently, it has a cash burn rate around $55 million per month. During the earnings call, Kim Brady, Nikola’s CFO, gave us some details about the balance sheet and its cash position:

On the balance sheet, we ended the second quarter with $529.2 million in cash and equivalents, including restricted cash up from $385.1 million at the end of Q1. The $144.1 million increase came from, one, the $200 million private placement of convertible notes we placed in June with Antara Capital, and two, $50 million proceeds from the issuance of a promissory note collateralized by Nikola on equipment and restricted cash.

In addition to the $529.2 million in cash and equivalents, we still have $312.5 million available liquidity through our two equity lines with Tumim Capital. At the end of June, we have total liquidity of approximately $841.8 million, up from $794 million at the end of Q1. As of the end of June, we have sufficient capital to fund our business for the next 12 months of operations.

Given our target of keeping 12 months of liquidity on hand at the end of each quarter, we will continue to seek the right opportunities to replenish our liquidity on an ongoing basis while trying to minimize dilution to our shareholders.

Nikola is safe for the next 12 months, but this is not enough time to make the company turn profitable and support its business. The company did give a guidance of achieving positive gross margin at the end of 2023 for the Tre BEV, while it will need to wait until the end of 2024 to see positive EBITDA.

The company will need further funding. Among the ways to raise more capital, the company has finally managed to get shareholder approval to issue more share, up to 800 million from the currently 600 million authorized. Given the depressed share price, this dilution may be very costly for Nikola, with the further disadvantage of causing further downward pressure on the stock.

Now, the Nikola Tre BEV truck does seem a little better performing than Volvo’s. It has a range of up to 350 miles and a 753kWh battery. However, the recharge time to reach 80% of battery charge takes longer than Volvo as it is currently 120 minutes.

Nikola just agreed to acquire Romeo Power in order to bring battery pack engineering and production in-house. However, Nikola will have to pay around $144 million and will provide Romeo with $35 million in interim funding to facilitate continued operations through closing. This will be a further burden on this year’s results, while, over the long-run, the company expects from this operation up to $350 million in annual savings by 2026.

The more I look at Nikola, the more I see a lot of uncertainty about the future developments of this business. I do think the company will find it market share, as demand for BEV trucks will be so great that all the manufacturing efforts of the established players in the industry will not keep up with it, leaving space for newcomers. However, I don’t think the company enjoys the first move advantage as Tesla (TSLA) did among automakers. Secondly, it is not clear when the company will be able to turn profitable. Thirdly, Nikola has to back its operations up through debt and stock issuance. These things effect negatively the fundamentals and, as a consequence, they will put downward pressure on the stock.

Furthermore, Nikola still trades at a fwd price/sales ratio of 29, which makes it expensive, even though, if we look at normal stock price chart, it seems like the company is cheap because it is near its lows. However, among the reasons they brought the stock down, I think there is also the attempt of investors to bring the stock to a price where its multiples make sense.

Conclusion

It is clear that freight and transport will be key components of the economy for years to come. Given the fact that among truck manufacturers there hasn’t been a player that started operating much in advance compared to the others, we are in front of an industry that will see a huge turnaround that will give big opportunities to many. On one side, I see a solid company that has within itself the technological and financial strength to slowly scale out of IC trucks while directing its profits towards the electrification process. On the other, I see a perhaps promising company that may have an interesting product, but is lacking both the financials and the scale to disrupt the industry and wipe out the other competitors. This is why I chose to buy Volvo Group, as I think it is a much more reliable investment to benefit from a major change we will all witness in the next decade.

Be the first to comment