jetcityimage/iStock Editorial via Getty Images

Investment Thesis

Carvana Co. (NYSE:CVNA) is a leading online platform for buying and selling used cars. It has been a beneficiary of the robust growth in used car sales over the past few years. However, CVNA stock has also been buffeted since its momentum spike in late August. The company has recently faced several headwinds relating to logistics snarls, supply chain disruptions, significant price surges, and rapid interest rate hikes.

Consequently, the stock faced significant downward pressure as the market battled to value CVNA stock. Given its negative earnings and FCF profitability, valuing CVNA stock has posed a considerable challenge. Furthermore, the additional investments and buildout of its recent ADESA acquisition also added execution risks.

Given the challenging macro environment over unprofitable growth stocks, we believe Carvana stock could remain in the penalty box for a while. The macro and supply chain challenges could continue to be headwinds towards near-term re-rating. Furthermore, we believe there are plenty of profitable growth stocks to consider, given the recent tech bear market.

Therefore, we rate CVNA stock at Hold for now.

CVNA Stock Key Metrics

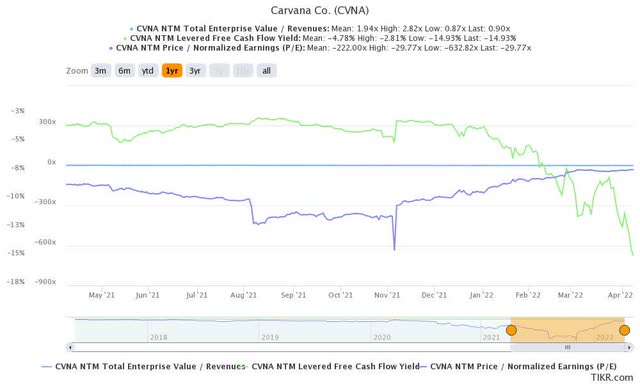

CVNA stock valuation metrics (TIKR)

CVNA stock has lost a massive 71.5% in value since its August highs. Despite that, we need to highlight that it doesn’t mean that CVNA stock is cheap now.

Investors need to be wary of growth stocks that seem to have low revenue multiples and think that they are cheap. For example, CVNA stock last traded at an NTM revenue multiple of 0.9x, markedly lower than its 3Y mean of 1.9x. However, it operates a first-party online sales model, and thus first-party retailers often have relatively lower revenue multiples, given their business model.

And, if we observe its FCF and normalized earnings multiples, it’s clear that Carvana is unprofitable. It last traded at an NTM FCF yield of -14.9% and an NTM normalized P/E of -29.8x.

Why Has Carvana Stock Dropped In 2022?

If we refer to Carvana’s recent 10-K risks disclosures, we can glean valuable insights on why it has continued to fall in 2022. The company highlighted that it has come under intense pressure from the challenging macro environment that has buffeted its business model. While it has affected the automotive industry, we think unprofitable businesses like Carvana’s would come under a more significant impact. Carvana highlighted (edited):

Our business is subject to risks related to the larger automotive ecosystem, including consumer demand, global supply chain challenges, and other macroeconomic issues.

Purchases of new and used vehicles are typically discretionary for consumers and have been, and may continue to be, affected by negative trends in the economy and other factors, including the COVID-19 pandemic, rising interest rates, rising vehicle prices, the cost of energy and gasoline.

In addition, our business may be negatively affected by challenges to the larger automotive ecosystem, including urbanization, global supply chain challenges, and other macroeconomic issues. (Carvana’s FY21 10-K)

Hence, the company has come under pressure from most of the listed macro and industry-specific conditions that have continued to batter the automotive industry.

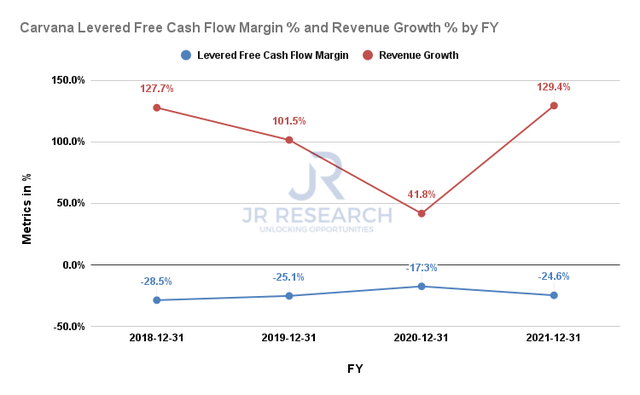

Carvana levered FCF margins & revenue growth % (S&P Capital IQ)

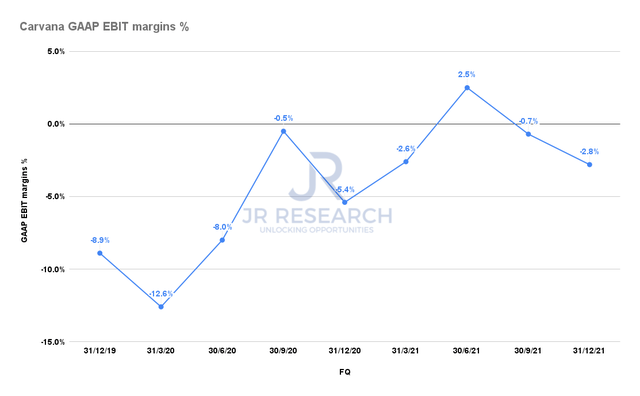

Carvana GAAP EBIT margins % (S&P Capital IQ)

Carvana has continued to post tremendous topline growth as it continued to penetrate a highly fragmented market. However, despite its massive growth, Carvana accentuated that it has merely penetrated 3.5% of its “oldest cohort.” Therefore, the company is confident that it’s still in the early innings of its market opportunity.

But, we can understand why the market has not given Carvana the due credit that it’s asking for. Despite its phenomenal topline growth, its FCF margins remained deeply in the red. Furthermore, it deteriorated in FY21, as its FCF margin fell from -17.3% to -24.6%. In addition, it has also been unable to generate consistent GAAP EBIT margins over time, as seen above. Therefore, it’s hardly surprising that the stock faced significant value compression. And, we think it’s well deserved. The market has gotten it right.

What Is Carvana Stock Outlook?

The company is optimistic about its latest ADESA acquisition. Management believes that the acquisition has given it tremendous leverage given its vertical integration. But, its purchase price was not cheap, priced at 22x EBITDA. The deal is also costly to finance, costing Carvana $3.3B (including $1B in CapEx investments across 56 sites).

But management is sanguine about the revenue and cost synergies relating to its acquisition. CEO Ernest Garcia accentuated (edited):

And so there is a large portion of the real estate that is owned by ADESA. That’s a very valuable asset that can be added to this. And on that land, we can build these inspection centers.

And if you think about what the 2M incremental capacity means to incremental EBITDA, it’s on the order of $5B annually. And then if you just look at our logistics benefits, we’re $750 better off in unit economics through lower inbound costs, lower outbound transport costs and lower customer acquisition costs because of higher conversion due to faster delivery.

So that’s a big number. So I say our job now is to execute because the path is clear. We can see the demand. We know the unit economics. We now have the facilities to build on top of, and now we have to go do that. – Carvana

But, we remain cautious about the company’s aggressive expansion plan. We concur that it has afforded the company meaningful synergistic opportunities. But, the challenge of vertically integrating the business is a massive one, given the company’s lack of profitability. Therefore, we think the market could continue to evaluate Carvana based on its current model, which has come under significant pressure. Unless the macro environment improves further, we believe the stock could continue to trade sideways in the near term.

Is CVNA Stock A Buy, Sell, Or Hold?

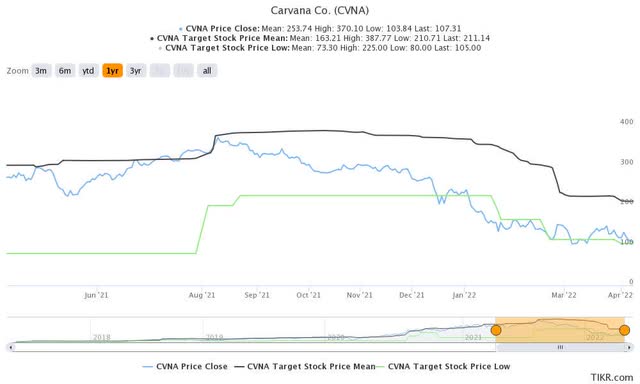

CVNA stock consensus price targets Vs. stock performance (TIKR)

The street has gotten their price targets on CVNA stock terribly wrong over the past year. The analysts had bought into the company’s “long-term growth story” without paying sufficient attention to its profitability.

Nonetheless, we believe that the market has digested its growth premium significantly. Therefore, going short on the stock now also doesn’t seem wise either.

Still, given the above structural headwinds, we believe the stock would continue to consolidate. As such, we rate CVNA stock at Hold.

Be the first to comment