staticnak1983/E+ via Getty Images

A Quick Take On OneConnect Financial Technology

OneConnect Financial Technology Co., Ltd. (NYSE:OCFT) reported its Q2 2022 financial results on August 17, 2022, growing total revenue sequentially and year-over-year.

The company provides banking and insurance companies in Asia with cloud-based financial technology software system tools.

OCFT is an all-too-common story of a China-based company that is growing revenue and gross profit impressively, but producing significant losses and operating under substantial regulatory uncertainties both within China and in the U.S.

Until these uncertainties have been removed and the firm has made a meaningful turn toward operating breakeven, I’m on Hold for OneConnect.

OneConnect Financial Overview

Shenzhen, China-based OneConnect Financial, a Ping An spin-off founded in 2015, has developed a SaaS financial technology platform for banking service and insurance providers.

OneConnect’s Chairman and CEO is Shen Chong Feng, who was appointed to the position in October 2021 and was previously at Kingdee Software [China] Co.

The firm has thousands of institutional users as of September 30, 2019, to whom it offers over 50 products.

OneConnect Financial’s Market & Competition

According to a 2019 market research report by ReportLinker, the global financial services application market was valued at $79 billion in 2018 and is projected to reach $ 128 billion by 2024, growing at a CAGR of 8.8% between 2019 and 2024

The main factor driving forecast market growth is the growing need for quantifying large quantities of data.

Major competitors that provide or are developing financial software include:

-

Fidelity National Information Services

-

Accenture

-

Tata Consultancy Services

-

Fiserv

-

Infosys

-

IBM

OneConnect Financial’s Recent Financial Performance

-

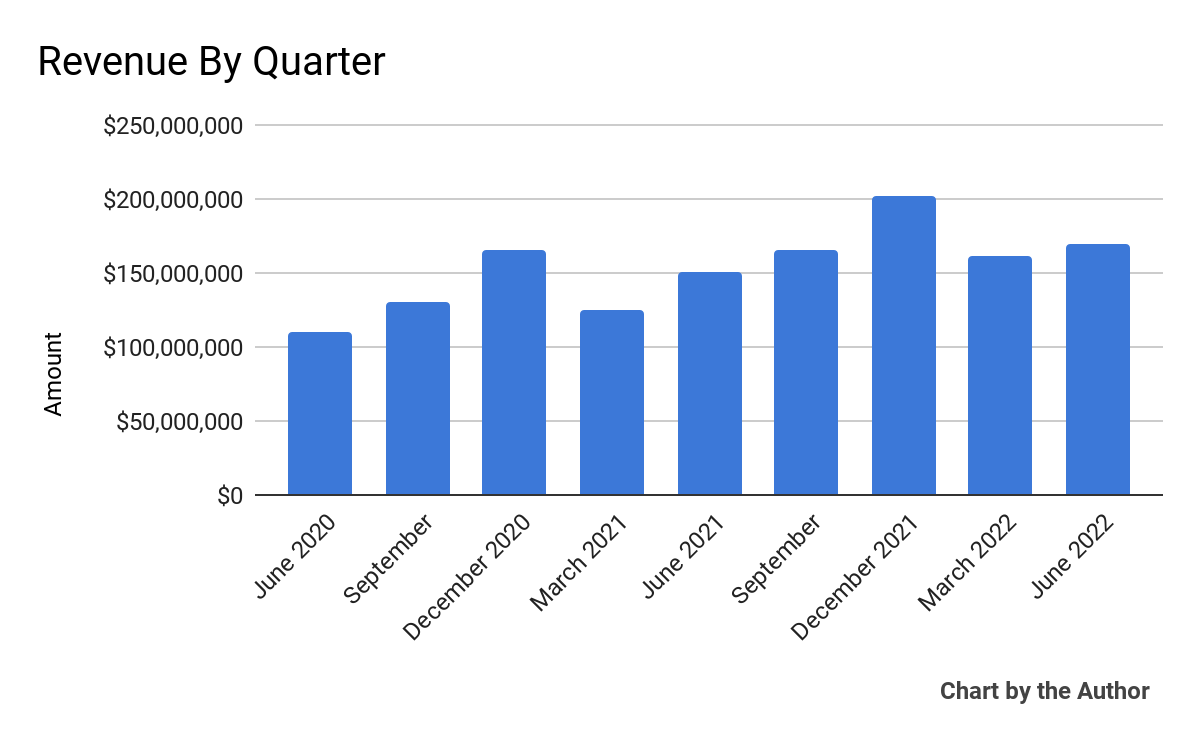

Total revenue by quarter has trended higher on a seasonal basis:

9 Quarter Total Revenue (Seeking Alpha)

-

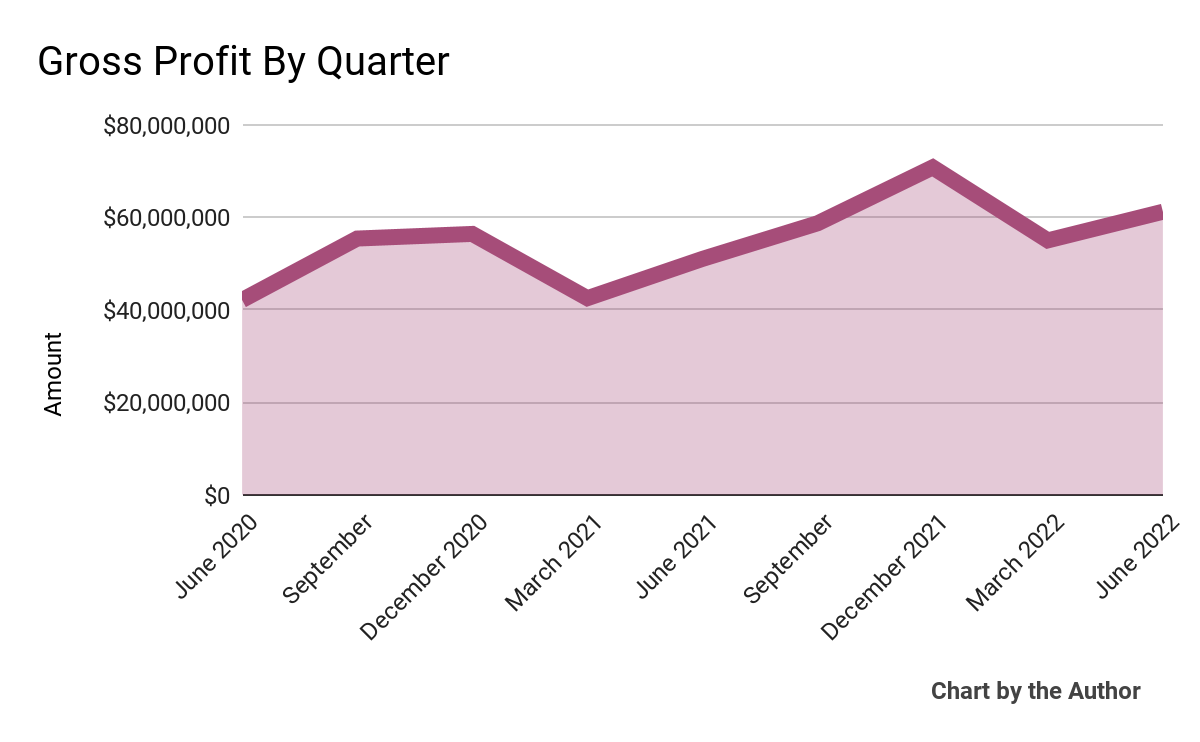

Gross profit by quarter has followed a similar trajectory as total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

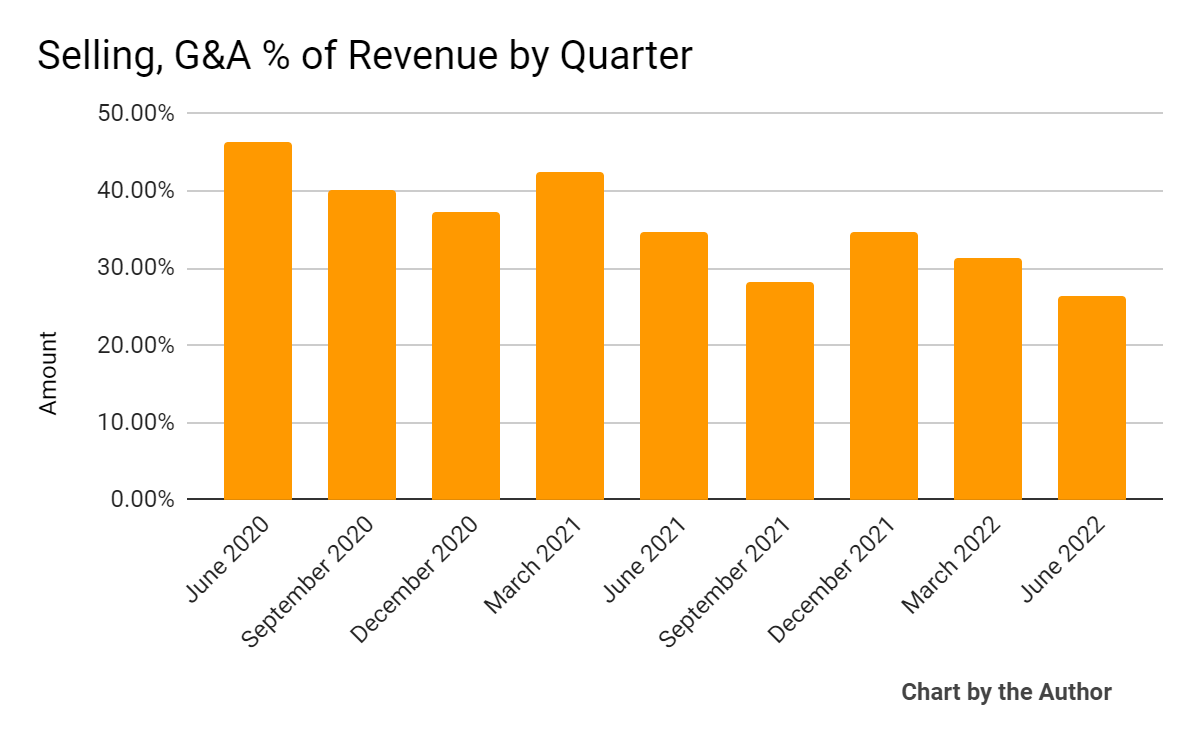

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower over time:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

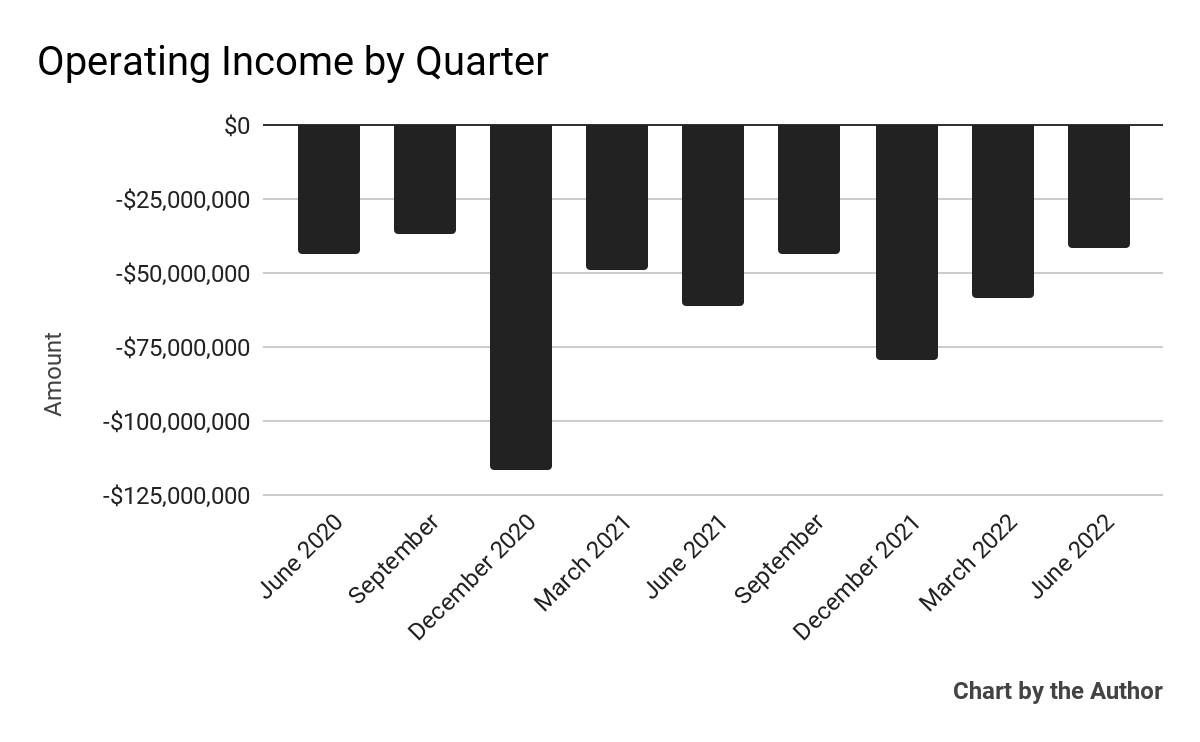

Operating losses by quarter have remained significant, as the chart shows here:

9 Quarter Operating Income (Seeking Alpha)

-

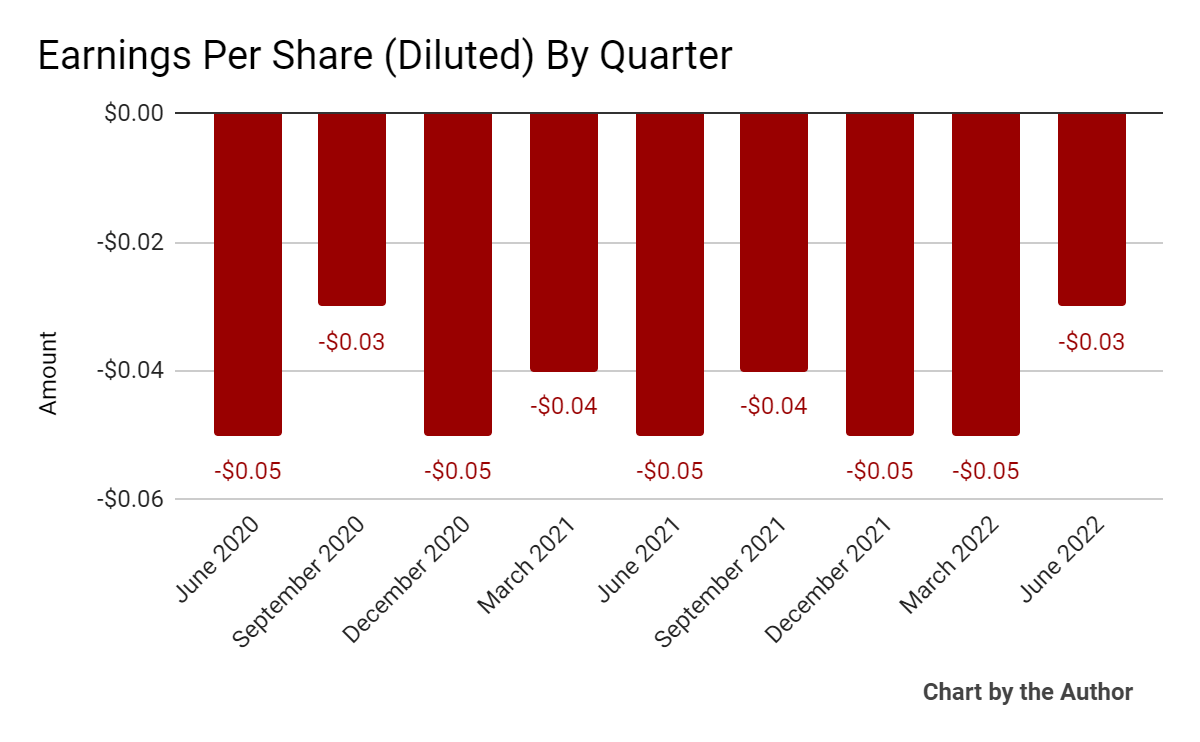

Earnings per share (Diluted) have also remained negative:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is IFRS)

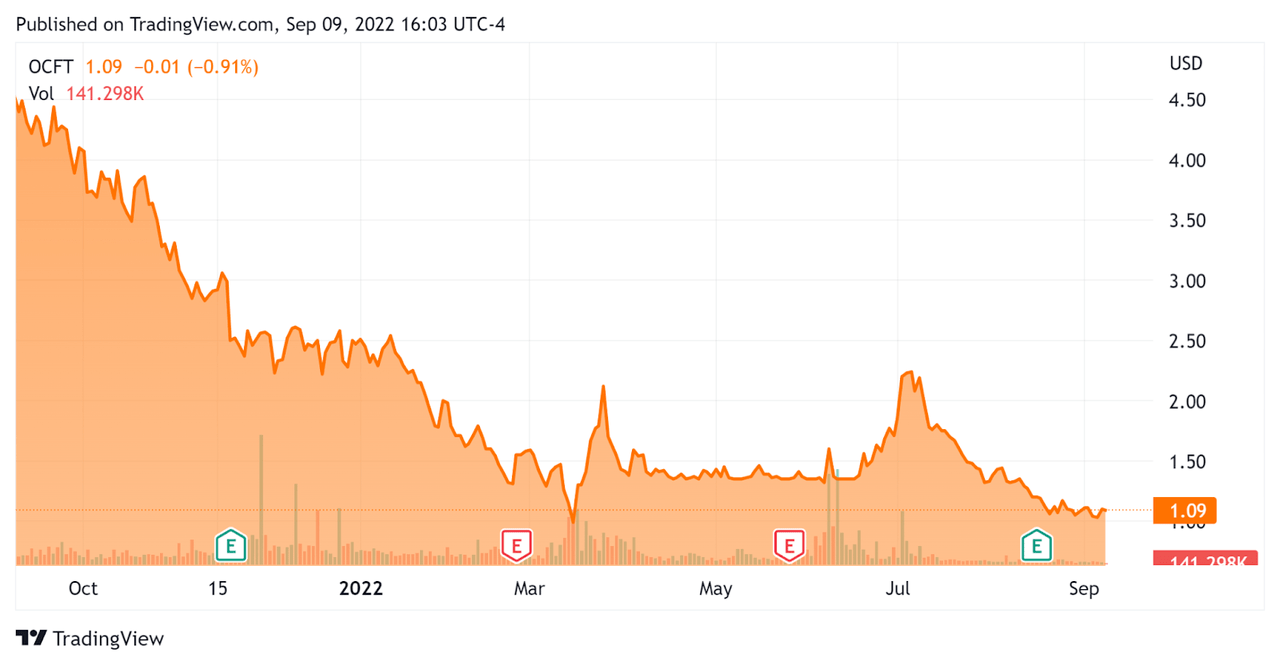

In the past 12 months, OCFT’s stock price has dropped 76% vs. the U.S. S&P 500 index’ fall of around 9.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For OneConnect Financial

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Revenue Growth Rate |

20.1% |

|

Net Income Margin |

-26.5% |

|

IFRS EBITDA % |

-30.8% |

|

Market Capitalization |

$403,940,000 |

|

Enterprise Value |

-$52,890,000 |

|

Operating Cash Flow |

$4,650,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.17 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

OCFT’s most recent IFRS Rule of 40 calculation was negative (10.7%) as of Q2 2022, so the firm needs substantial improvement in this regard, per the table below:

|

Rule of 40 – IFRS |

Calculation |

|

Recent Rev. Growth % |

20.1% |

|

GAAP EBITDA % |

-30.8% |

|

Total |

-10.7% |

(Source – Seeking Alpha)

Commentary On OneConnect Financial

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the recent completion of its listing on the Stock Exchange of Hong Kong as an addition to its NYSE listing.

However, management noted the ongoing risks to the Chinese economy from the “on and off COVID outbreaks, but we believe these are […] temporary influences.”

Interestingly, the firm incorporates alternative data for credit modeling, which management says is the only firm to do so in the markets in which it operates.

OCFT also signed a cooperation deal with PISMO, a system provider in Brazil, in order to export its “core systems to small and medium size banks in Southeast Asia and the Middle East.”

As to its financial results, total revenue rose 12.9% year-over-year in dollar terms, with third party revenue increasing by 9.6% and the customer base growing from 113 to 134.

Notably, its loss ratio dropped substantially to 18.6%.

Management did not disclose the company’s retention rates, which provide investor visibility into its product/market fit and sales & marketing efficiency.

For the quarter, Selling, G&A expenses as a percentage of total revenue dropped, as did operating losses and negative earnings as COVID outbreaks reduced marketing spend.

For the balance sheet, the firm finished the quarter with $498.6 million in cash, equivalents, short term investments and trading asset securities and no debt.

For the trailing twelve months, the company used free cash of only $2.2 million.

Looking ahead, management intends to continue its investments in R&D to remain competitive but said it will shut down projects that don’t meet defined growth expectations.

Regarding valuation, the market is valuing OCFT at a Price/Sales multiple of around 0.63x.

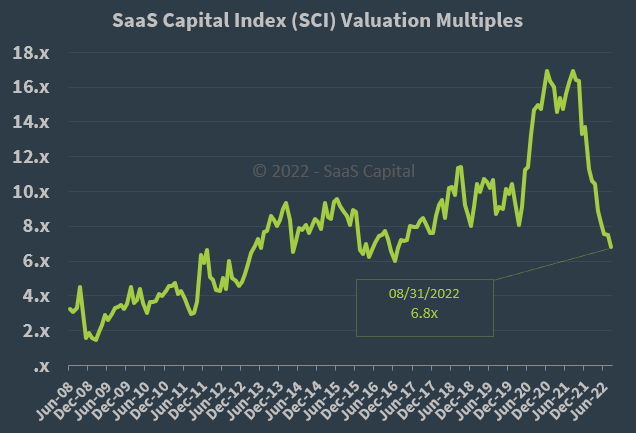

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at August 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, OCFT is currently valued by the market at a large discount to the broader SaaS Capital Index, at least as of August 31, 2022.

The primary risk to the company’s outlook is an increasingly deep Chinese economic slowdown or potential recession, which may slow sales cycles and reduce its revenue growth trajectory.

Additional risks include the potential for sudden regulatory changes from Chinese regulators as well as possible delisting from the U.S. due to auditor review uncertainties. The firm has been included on the SEC’s list of identified companies covered by potential delisting action.

OCFT is an all-too-common story of a China-based company that is growing revenue and gross profit, but producing significant losses and operating under regulatory uncertainties both within China and in the U.S.

Until these uncertainties have been removed and the firm has made a meaningful turn toward operating breakeven, I’m on Hold for OneConnect.

Be the first to comment