blackCAT/E+ via Getty Images

Investment Thesis

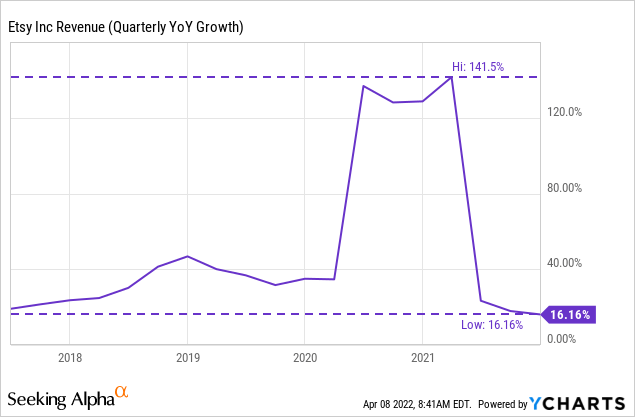

Bearers argue that Etsy, Inc. (NASDAQ:ETSY) was a ‘pandemic’ stock that benefited during the Covid-19 outbreak, but now the narrative has changed. That is partly true as the global macroeconomic factors that prompted a significant shift towards online purchases are not transitory and are here to stay.

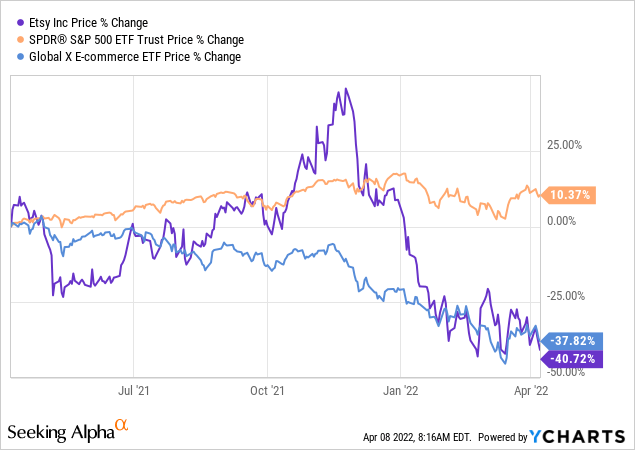

Eventually, the stock crashed from all-time high levels of nearly $308 down to roughly $121 per share, a 60% plunge. ETSY was oversold in the past month and traded sideways for a while but recently entered an upward trajectory, showing signs of recovery. I have recently opened a small position with ETSY in my model portfolio, and I plan to cost average on pullbacks. Therefore, I rate ETSY with a buy rating, but I wouldn’t overweight it yet, waiting for better entry points for larger additions.

Margins and Performance

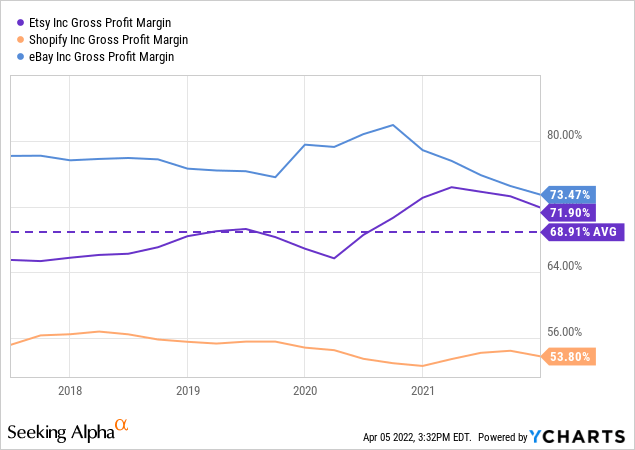

Etsy boasts remarkable gross profit margins (GP) reaching nearly 72% TTM that remained relatively stable despite the rapid rise in the company’s revenues which have almost tripled since the outbreak of Covid-19. In addition, the company’s operating margin (OM) for the last reported quarter stood at 20%, higher than the 93% of 1092 companies in the industry, proving its operational resilience. The slight decrease in OM from the all-time high level at 24.5% in 2020 was due to a YoY spike of 44% across all operating expenses categories, with the R&D expense reporting alone a 50% YoY increase.

These market-leading margins arise from the company’s asset-light business model, with no fulfillment centers and manufacturing facilities and, therefore, no heavy inventory management headaches. For instance, Amazon.com, Inc. (AMZN) achieves much tighter profit margins due to its large warehouse and logistics network. Therefore, comparing the margins of Etsy with eBay Inc. (EBAY) or Shopify Inc. (SHOP) makes more sense due to their similarities in the business model.

The increased Transaction Fee will boost GPs

The management made a major announcement during the company’s Q4-2021 earnings call. Etsy plans on increasing the base transaction fee charged to the sellers from the current 5% up to 6.5%, effective from April 11. The last increase by the company in transaction fees came in 2018 when the company raised the fee from 3.5% to the current 5% rate.

On announcing the hike in fees, the management elaborated that the hike is solely to benefit the seller and the marketplace. Etsy will be reinvesting the incremental revenue generated from the rate hike in marketing, improving customer experience on the platform, and customer retention, which will eventually benefit the seller.

However, the announcement of the rate increase has not gone down well with some Etsy sellers, and a petition launched online, signed by over 35 thousand people at the point of writing, advocates for Etsy sellers to go on a strike to record their protest against the company’s policies. As a result, from April 11 to April 18, the protesting sellers will put their shops on vacation mode, and the items in their stores will not be available for buyers to purchase.

Even if the company implements the proposed rate hike, Etsy’s seller fees will still be lower than that of eBay and Amazon, but indeed seller margins will shrink, which might provoke some sellers to move away from the platform. Though the number of protesting sellers is immaterial, accounting for roughly 0.6% of total active sellers. Certainly, Etsy needs to be prudent in handling this matter as the protest against company policies can be damaging to the public image and reputation of the company, posing a risk to growth in total active users.

Etsy’s analytics indicate a healthy Ecosystem

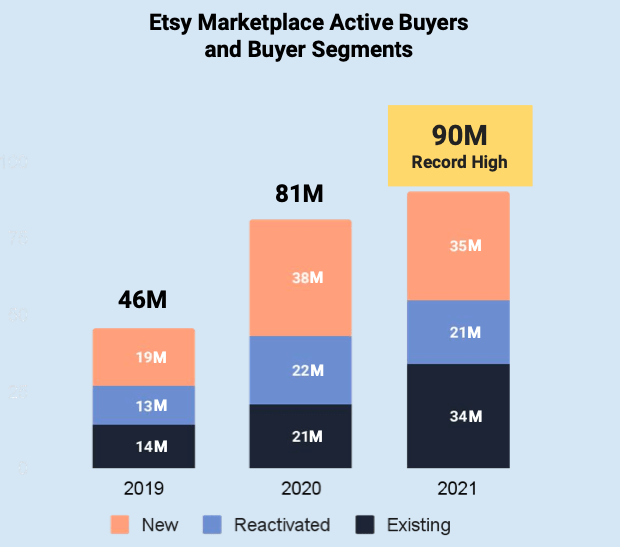

First, as defined by the company, an active buyer is a buyer who has made at least one purchase in the last 12 months. The number of active buyers in Q4-2021 stood at 90 million, up by 11% YoY from 81 million and up by 96% since 2019. Indeed, the number of new active buyers negligibly slowed down in 2021, but the active existing buyers have reported a notable increase of 62% in 2021, signaling strong customer loyalty.

Undoubtedly, the competitive strength of the e-commerce business is not only to attract new buyers but, most importantly, to retain existing ones since a high user churn rate is very costly for a company causing an endless user acquisition cycle. After all, the frequency of existing buyers drives higher gross merchandise sales (GMS) and retention rates over the long term. Therefore, the management’s relentless focus on reactivating and driving deeper engagement with existing buyers is value-enhancing for shareholders.

Etsy Financial Results Q4-2021 (seekingalpha.com)

Similarly, on the selling side, the number of active sellers in Etsy’s marketplace has reached 5.30 million, up by 29% YoY from 4.1 million. The number of active sellers on the marketplace has increased substantially after the pandemic, having more than doubled in 2021 from 2.5 million in 2019.

As a result, the company grows symmetrically, with a buyer-to-seller ratio hovering around 1:13. Even though this ratio varies between marketplaces and depends on each business’ lifecycle and the selling items’ nature, Etsy’s ecosystem remains healthy as long it maintains a ratio above 1:10. Lastly, Etsy maintains unique traits and demographics, with more than 79% of sellers being women, which strategically boosted the company’s reach through word of mouth in the women’s network.

The company reports market-leading GMS figures

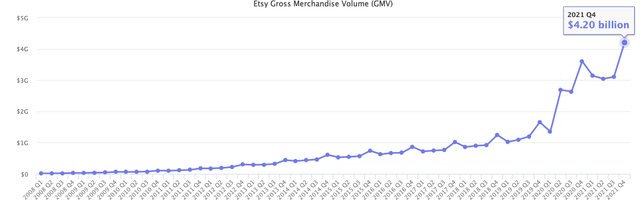

Moreover, GMS, a key growth metric of the company, has shown tremendous growth in the past couple of years. The GMS of the company during 2021 has reached $13.5 billion, up 31% YoY due to its record growth in 2020 as the pandemic shoppers flocked to the platform.

Remarkably, the quarterly GMS figure reached all-time high levels at $4.20 billion, up by 17% YoY from $3.61 billion. To that effect, the company currently maintains a healthy growth rate despite the high base effect of last year due to the unprecedented demand.

Buyers are spending more on the platform, and the GMS per active buyer reached an all-time high of $136 during the last quarter, up 16% YoY. This metric is valuable to track buyer retention, frequency, and repeat purchases, as the existing buyers contribute the most to higher GMS activity. Specifically, existing buyers boosted GMS by 34% YoY and accounted for 87% of the overall GMS.

GMS Growth (www.marketplacepulse.com)

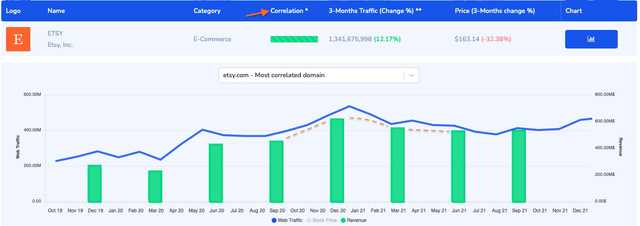

High Correlation between Revenue and Traffic

According to Jika.io, there is a high correlation between the traffic generated on the etsy.com domain and the company’s revenue for the past two years, signaling that traffic volume is a good indicator of the company’s revenue and earnings for each quarter. In addition, Etsy’s four marketplaces’ total active buyers have surpassed the 96.3 million mark on a consolidated level. Apparently, most revenue activity is generated on the website, and proving a high correlation provides valuable insight into the company’s future direction.

Taking traffic analytics for Q4-2020 as an example, it is evident that the increased traffic levels (orange dot-line) lead to increased reported revenue. Even though the regression analysis uses only two years of historical data, it is still a valuable tool for developing short-term revenue expectations.

Correlation Revenue & Traffic (www.jika.io)

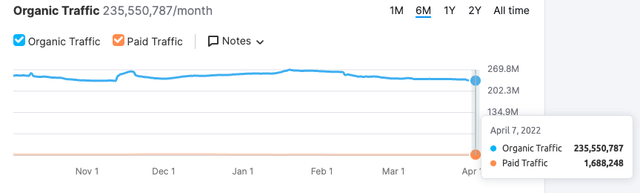

Traffic analytics points to normalization, but the overall trend remains favorable

Even though Etsy operates through four marketplaces, most traffic is generated through etsy.com, and tracking this domain only would provide a representative basis for what to expect. Unfavorably, digging deeper into the latest quarter’s analytics, it is evident that the domain’s traffic has slowed down by 7% in April, compared to December’s figures. However, the decline is not concerning for now as similar or even larger drops have been noted in the company’s closest peers.

Surprisingly, many might expect that the traffic peaked in 2020, but the latest data suggests that traffic jumped to record highs in January 2022, reaching almost 267 million in organic traffic. All in all, such QoQ fluctuations are expected, but zooming out the chart, the overall long-term trend remains positive, and Etsy’s marketplaces show no material signs of slowing down.

etsy.com traffic (www.semrush.com)

Marketplace Growth Powered by Acquisitions

By 2021, Etsy’s marketplace revenues reached $1.7 billion, accounting for 75% of the total revenues generated during the year. There is little doubt that Etsy has formulated a growth strategy for its marketplace, which relies heavily on acquisitions to expand the company’s footprint in other geographic locations.

More specifically, in 2021, Etsy acquired two companies. The first target was Elo7, also known as the ‘Etsy of Brazil,’ a marketplace specializing in custom made-to-order products and has roughly 55 thousand active sellers and about 1.8 million active buyers as per the latest quarter. In addition, the platform has a stellar buyer retention rate, and approximately 70% of Elo7’s GMS derives from repeat buyers, proving the resiliency of customer retention. Through this acquisition, Etsy hopes to establish a foothold in Latin America, an underpenetrated e-commerce region where Etsy currently does not have a meaningful customer base.

On the other hand, the second acquiree, Depop, is a clothing resale platform popular among the young ‘Generation Z’ consumer demographic. The subsidiary has roughly 3.7 million active buyers and about 2.0 million active sellers. With Depop, Etsy remains well-poised to capitalize on the growth prospects present in the second-hand market, which is likely to see a CAGR of 39% by 2024.

The company’s strategy of building a “house of brands” is fully reflected in its recent acquisitions of Reverb, Depop, and Elo7. Despite the normalization in growth rates lately, the recent acquisitions of Depop and Elo7 are expected to drive strong growth in revenue and GMS activity from 2022 onwards.

Conclusion

ETSY ticks most of the boxes of my investment checklist, and it’s a buy at current share price levels. However, due to the company-specific risks and uncertainties, I would prefer some more margin of safety to justify an overweight position. Finally, I will closely follow the company’s developments and operational progress in the following quarters with the potential of rerating in the near term.

Be the first to comment