Philiphotographer/iStock Unreleased via Getty Images

It’s not the first time that we covered the German chemical giant (OTCQX:BASFY, OTCQX:BFFAF), but today, we are providing new company estimates looking at the direct/indirect consequences of BASF’s Russian exposure.

Starting with their Russian exposure

If we do the simple job and search “Russia” in their latest Integrated Corporate 2021 Report, we note that it’s only mentioned seven times. BASF co-owns Wintershall Dea and has a 67% stake in it, the remaining stake is held by LetterOne. The main Wintershall Dea business is the natural gas supply to major industrial customers. Two other lines of revenue are held by the company: pipeline and E&P. Wintershall Dea transports gas together with Gazprom and other European companies. Concerning the E&P division, the company owns state-of-the-art exploration technology to find and to locate gas and oil. Since the Russia invasion, Wintershall Dea wrote off financing for Nord Stream 2, no additional CAPEX will be implemented in the region but the critical infrastructure to supply gas will continue to operate.

Wintershall Dea’s CEO Mario Mehren said “that the Russian President’s war of aggression against Ukraine has shaken the foundations of the company’s work in Russia to the core. The brutal attack is causing unimaginable suffering and marks a turning point”.

Aside from Wintershall Dea operations, BASF generated top-line sales in Russia amounting to approximately 1% of its group total sales.

Wintershall Dea IPO (BASF FY 2021 Result)

Furthermore, regarding direct exposure, BASF’s intention was an IPO and our internal team believes that it’s going to be very challenging. Wintershall Dea’s 50% production is located in Russia. Going into the numbers, we valued the 67% equity stake as €4 per share in BASF’s total sum-of-the-parts valuation (a significant discount compared to precedent transactions).

What’s important to note is not only the direct exposure but the indirect consequences on energy prices.

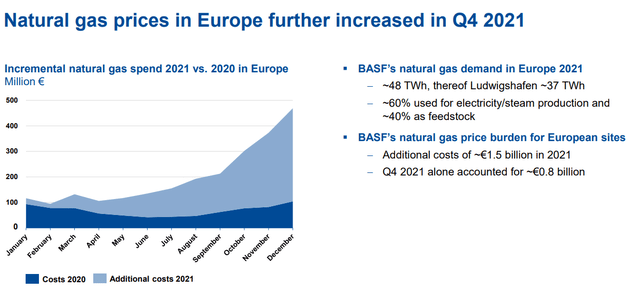

Our internal team has reduced BASF’s operating profit margin in 2022 by almost 3%, this was due to energy pressure. In the near future, we estimate that chemicals will remain robust and very supportive thanks to BASF’s ability to increase end prices (remember that the company was able to pass through a 69% increase in Q4). Our major concern lies in the downstream margin progression. Looking at the long term on energy price, we believe that the German giant will offset gas price volatility with an increase in renewable energy production (that was already quite relevant in 2021 accounting for 16%).

Natural gas prices in Europe (BASF FY 2021 Result)

Conclusion

Implementing all the numbers in our internal model and taking into consideration Russia’s direct/indirect exposure, we have reduced our price target but we still see significant upside potential. Our target price is derived from peers’ multiples and we arrived at €70 per share versus €51 per share at the time of writing. Few times in history, BASF has been yielding 6.5%. What’s very important to note is the fact that Wintershall Dea divestment was not necessary to support growth CAPEX initiative. The dividend raise and China CAPEX are already priced into our numbers.

Be the first to comment