Drs Producoes/E+ via Getty Images

Brazilian FinTech darling StoneCo (NASDAQ:STNE) has dropped nearly 30% since it published its Q2-results on August 18th. Investors are left wondering why, as the company doubled its revenue and was profitable once more, albeit on an adjusted basis. Let’s take a look.

The numbers

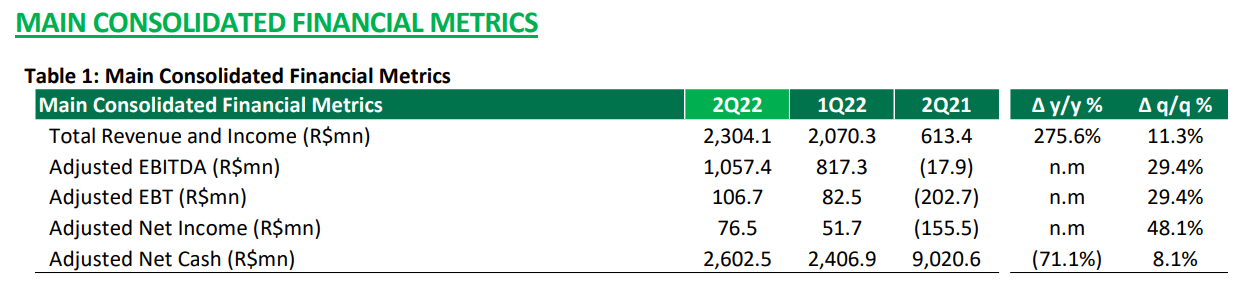

StoneCo Q2

Revenue is up 275% year-over-year. However, this is because StoneCo had to book negative revenue adjustments last year because of all the defaults in its credit-division. Adjusted for this booking, revenue increased by more than 128%, and more than 11% over the prior quarter. Moreover, the company posted another quarter of positive adjusted net income, which even increased by as much as 48% over Q1.

Both divisions, Financial Services & Software, were responsible for this growth.

Financial Services

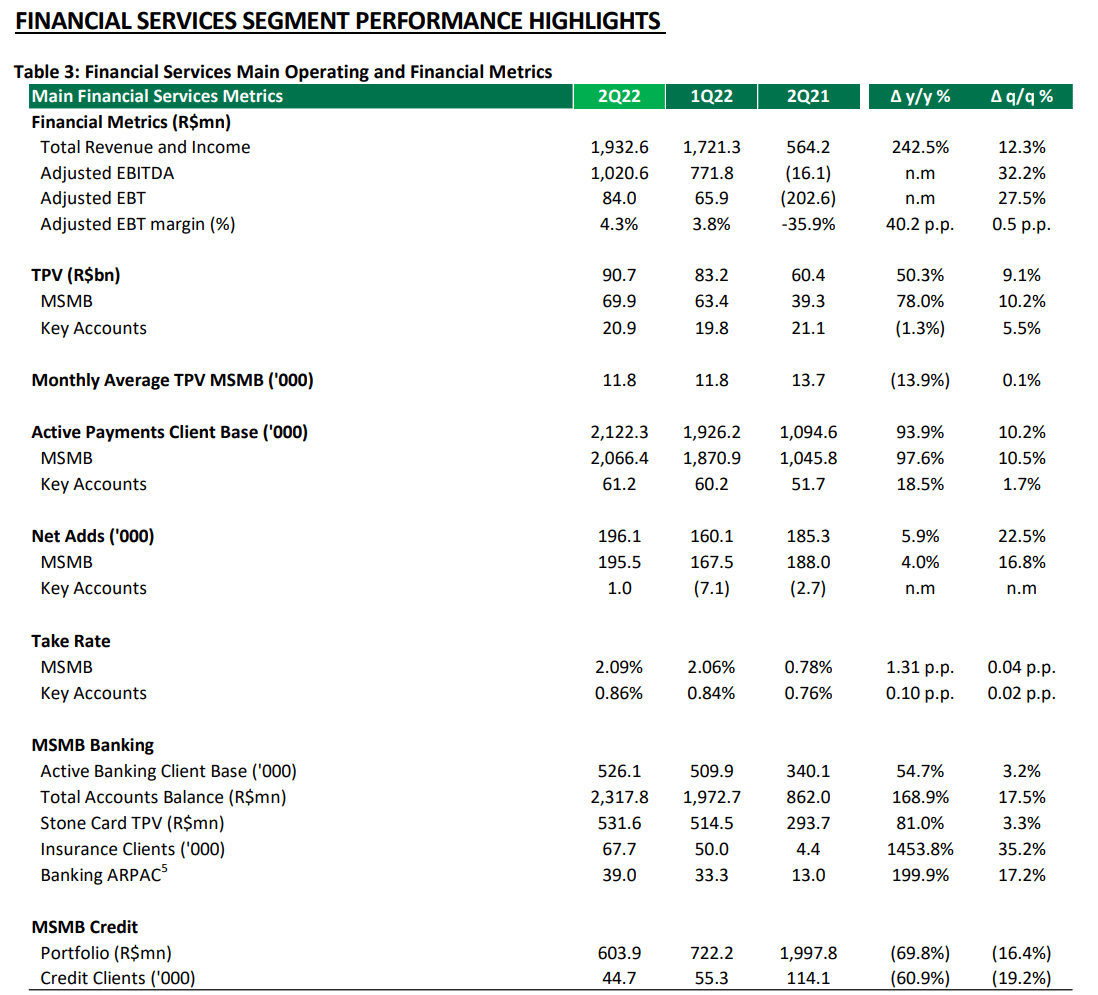

StoneCo Q2 earnings report

Here, (adjusted) revenue increased by 101%. The main drivers were (i) the increase in take-rate from (adjusted) 1.79% to 2.09% and (ii) the increase in client base with a net add of 195.500 MSM businesses.

Payments per customer are on the decline, though. While the number of customers increased by 97.6%, the total payment volume only increased by 78%. Worse, TPV in the key account segment is down year-over-year, although it increased 5% over Q1.

StoneCo is also upping its banking efforts. Deposits increased by 17% over the past quarter to more than 2.3B reais, while the average revenue per banking/insurance customer increased strongly once again, by 17% as well over the prior quarter.

Software

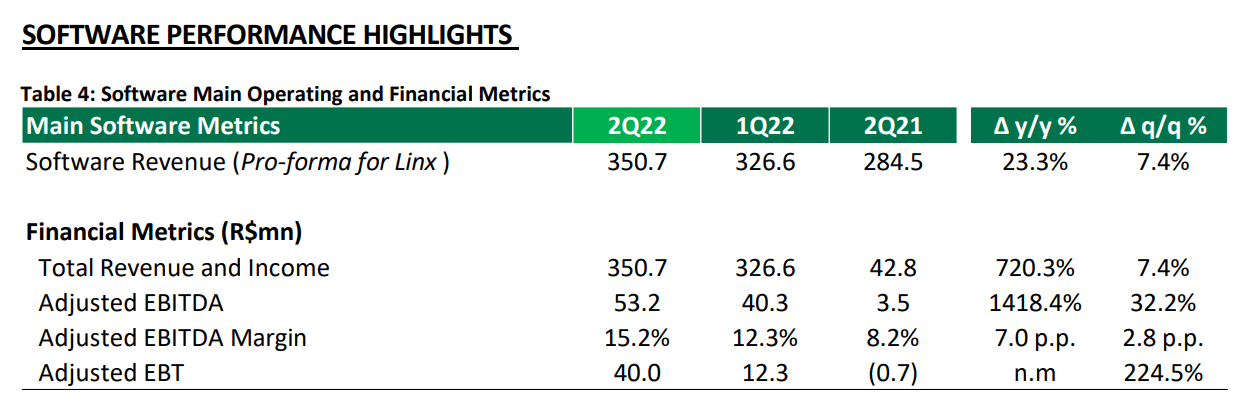

StoneCo Q2 earnings report

Revenue in the software division has increased YoY by 23%. While the ERP-division grew 28%, the Digital-software division shrunk by 6% because the number of e-commerce transactions has dropped.

Still, I would have liked to see stronger growth. Linx grew 27% upon acquisition, and StoneCo has since made other minor acquisitions. Growth of 28% thus means that the growth of Linx has slowed. Due to the cross-selling possibilities, I would’ve expected otherwise (even though Linx is cannibalizing some of StoneCo’s former ERP customers).

On the other hand, profitability is great. EBITDA-margin is already a quite hefty 15%, while probably increasing further in the coming quarters.

If the numbers are so great… why did the stock drop?

If the numbers are so great, why is the stock down almost 30%? I see three reasons.

- For starters, the giant net loss the firm posted: While the ‘adjusted’ net profit is 76M Brazilian reals, the non-adjusted net “profit” is (489)M reais. Or a loss of 1.56 reais per share. Q2 last year was a profit of 1.72 Brazilian reals. It is quite possible that this steep loss has made at least some investors sell.

- The outlook: there is almost no expected growth for Q3, as management expects revenue of 2.4B reals, compared to 2.3B reals in Q2. As a supposed growth stock, that’s not so great.

- The slow(er) roll out of the credit division. In the conference call, management indicated that it only now started testing its working capital products: “we started testing in a very small scale, the product and the system improvements that we have made. We’re really in test mode right now to test systems, collateral, the user experience, some features and enhancements that we’ve done in the product. And the idea is to continue these tests to run a full cycle before we actually decide to scale.” This is rather disappointing, as I had expected the restart of the credit business to be further ahead than only some first tests.

With this information in mind… is StoneCo a buy?

I believe so. Let’s discuss the three headwinds discussed above, and why I believe these headwinds to be only temporary.

1. First, the statutory profit. To be frank, I could not care less about the paper profit of StoneCo. Due to the large volatility in Banco Inter’s stock, the statutory profit of StoneCo has been “manipulated” by StoneCo’s 5% holding in Banco Inter for 5 quarters in a row now:

Tikr

For once, I believe it is much more sensible to look at the adjusted profit instead of the statutory profit. This is very much positive, and net income margin should increase further in the second half of the year.

2. The no-growth outlook is not much of a concern to me, to be honest. In the conference call, analysts tried to decode whether this outlook was just conservatism, or that growth has indeed seemingly halted. It clearly is the former:

“… of course, we want to make sure that we’ll reach the guidance that we give. And of course, the guidance is above 2.4%. But I think that this is the best number we have right now that we are very confident that we will reach.”

Let it be clear that the 2.4B reals guidance is the absolute minimum the management expects to rake in next quarter.

Since the trouble last year and the damaged (risky) image of StoneCo, management has become very conservative in trying to comfort investors. For example, the guidance for Q2 was given at the end of May, or 2 months into the quarter already. Yet, the actual results came in far higher than guided. I believe that management has repeated this trick, and that revenue will grow in Q3 just as well.

Also, management indicated that it will discontinue working with some sub-acquiring business, as it seeks to increase profitability. While this might reduce revenue, stopping loss-making activities is hardly a bad thing.

3. The slow rollout of the credit division may not be that much of a problem, as StoneCo is focusing instead on its credit card activities:

“We’re on track to start a pilot very soon with our credit card products and continue this pilot throughout the second half of the year.”

The ever-increasing amount of customer deposits will thus be put to good use, be it through credit cards or working-capital financing.

My outlook

I expect StoneCo to surpass comfortably its own guidance of 2.4B reals revenue in Q3. At the same time, profitability should further increase. EBT-margin was 4.6% in Q2, and 4.0% in Q1. As price increases will further materialize in Q3, while some unprofitable activities will be terminated, I expect EBT-margin to further climb towards 5%. EBT should therefore come in at least 125M reals in Q3.

Longer term, credit cards will be introduced and scaled by the end of the year, while working capital financing should be up and running next year. At the same time, profit margins will be much higher than before and are likely to continue increasing due to cross-sell possibilities which require little additional cost relative to the extra sales they generate.

Analysts expect $0.54 USD adjusted net profit in 2023, meaning that the stock currently trades at 16 times earnings. As I believe that (i) expectations are a bit too soft, given the conservatism of the management, and (ii) 16 times earnings will be too low once the market realizes that StoneCo has fixed its issues, I believe there is quite good upside for StoneCo. However, this all depends on it, indeed, fixing its credit business. While the stock may yield above-average return, it also carries above-average risk. Still, a risk worth taking, in my opinion.

Be the first to comment