PhonlamaiPhoto

ChipMOS (NASDAQ:IMOS) has much to offer. Its dividend declared on May 27, 2022, whose payment yields 16% at today’s share price of $18.21. The leading provider of outsourced semiconductor assembly, test, and bumping services is not immune to the slowdown. In the last two months, the company reported revenue declines.

After returning negative 48% in 2022, ChipMOS is a compelling technology firm to consider from here.

Compelling Dividend Yield

In the shipping sector, Zim Shipping (ZIM) rewarded investors with regular and special dividends. The market did not care. ZIM stock closed near its low at below $24 after the firm distributed its cash flow. ChipMOS suffers from the same dynamic. It pays a generous dividend, more than that offered by Intel (INTC) and its 5.8% yield. Broadcom (AVGO) pays a dividend that yields 3.81%. The firm, however, is smaller in market capitalization. It is also based in northern Taiwan.

Escalating tensions between the U.S. and China scared investors from buying Taiwan-based firms. Taiwan Semiconductor (TSM), a supplier to AMD (AMD), Intel, and Nvidia (NVDA), is down by 47.3% this year.

ChipMOS has a small size to maneuver through multiple headwinds. Investors should overlook China’s threat of invading Taiwan for a moment. The semiconductor supply disruption and soft demand are the pressing issues.

Revenue Decline

ChipMOS did not post growth since May 2022 when revenue grew by 2.5% sequentially. In June, revenue started falling. By July, revenue declines intensified. It fell by 19.4% to $65.1 million. That month, the company said a change in macro demand hurt ChipMOS’s DDIC (Display driver IC) businesses. It offset this weakness with the continued strength in its memory products business.

In August, revenue fell by 28.5% Y/Y and by 12% month-over-month. The company cited weak near-term demand and inventory adjustments. Those factors hurt the broader semiconductor industry.

Mixed Second Quarter 2022 Report

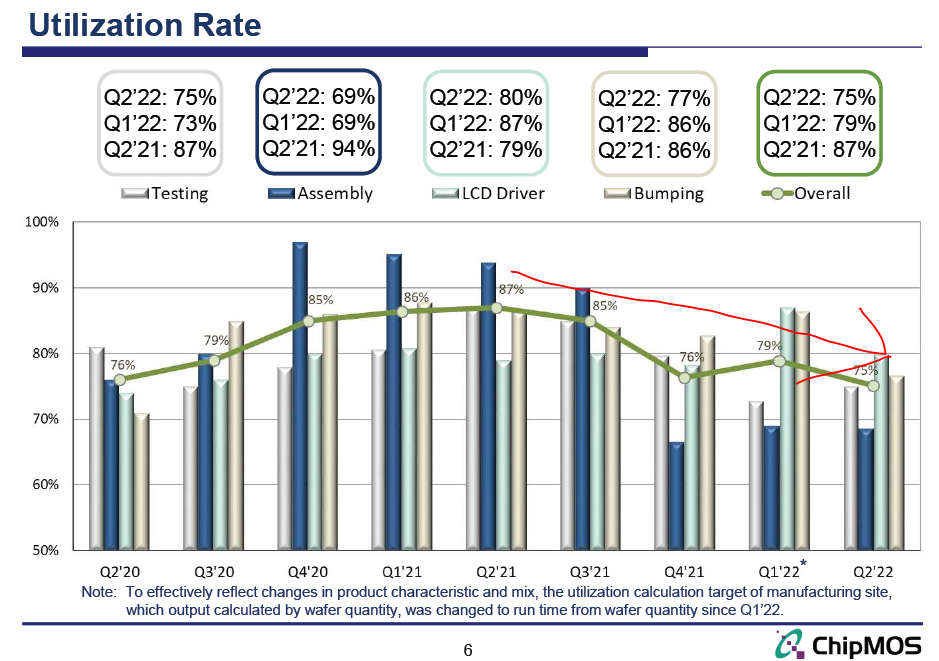

The company already reported weak demand in the DDIC segment in the second quarter. Still, its high-end DDIC test capacity increased. Overall utilization decreased to 75%. The company showed a downtrend in its utilization rate since peaking in Q2/2021:

ChipMOS Presentation

After falling sharply from Q3/2021 to Q4/2021, the Assembly unit is showing signs of improving utilization. It will need testing and wafer bumping activities to offset the ongoing weakness in memory.

Memory products accounted for 40.5% of ChipMOS’s total revenue. Both DRAM and flash sales are declining on a year-over-year comparison. The firm’s integrated circuit-related product revenue benefited from a price increase in March. Furthermore, it increased its high-end test capacity in the second quarter. This offsets the weakness in smartphones and TV panels.

Opportunity

OLED is a small opportunity for ChipMOS. Although it is around 5% of Q2 DDIC revenue, its growth rate should continue. OLED benefited from strong demand in the automotive sector. Manufacturers use this product for car display panels. The electronics and industrial markets also require OLED.

ChipMOS and the semiconductor industry are overcoming the impact of the Covid lockdown in China. While China’s policy of zero-covid tolerance is inconsistent, the country will eventually ease restrictions. ChipMOS is among the firms that will benefit as output increases, lowering inflationary pressures.

In Q2, ChipMOS worked with its long-term business customers to push out testing. It is moving its high-end test capacity to 2023. By lowering its capital expenses, the company reduces the risks of overspending. It may watch for demand for electronics to improve first. Customers may optimize their product mix by making use of ChipMOS’s take or pay contracts.

Third Quarter Revenue and FY 2022 Revenue Outlook

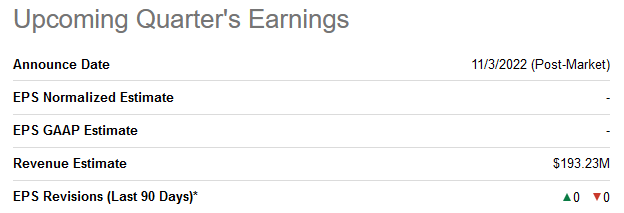

In the third quarter, ChipMOS posted revenue of $165.3 million. This is below the estimated $193.23 million in revenue as shown below.

Seeking Alpha

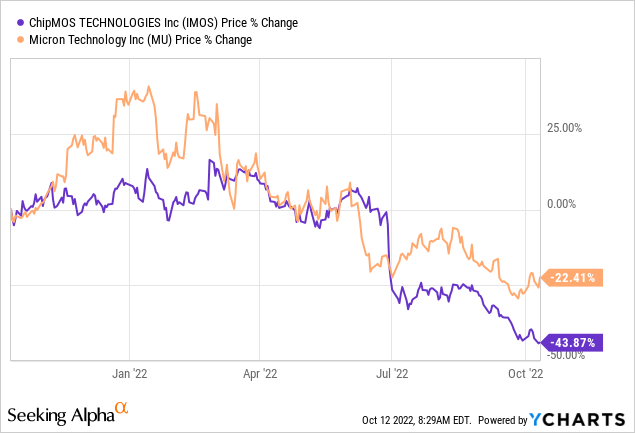

The decline is consistent with Micron’s (MU) cut in spending plans. Micron is a memory and storage chip supplier that is the bell weather for the semiconductor industry. Although it will spend $100 billion on a manufacturing facility in New York, it plans to cut wafer fab spending by up to 50%.

In the stock chart above, ChipMOS stock tended follow Micron’s stock closely. For example, when MU stock sold off in the summer, IMOS stock soon followed.

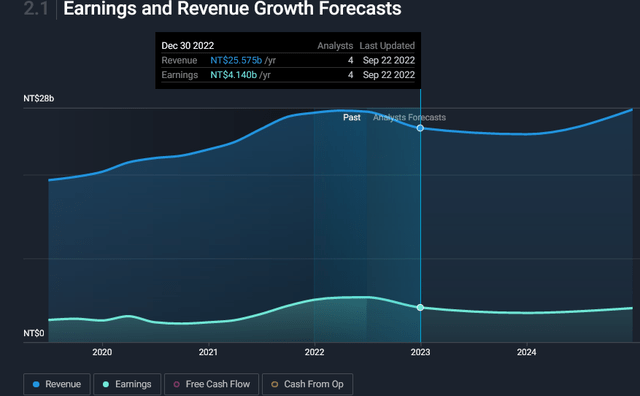

Analysts are forecasting flat revenue for the year. They expect revenue of NT$25.575 billion for the year.

Risks

China’s on and off Covid shutdowns have an impact on inventory levels. China’s unpredictable policy will add uncertainty to IMOS stock. However, at a price-to-earnings ratio of 4.0 times, the stock more than prices in those risks.

Rating and Related Investments

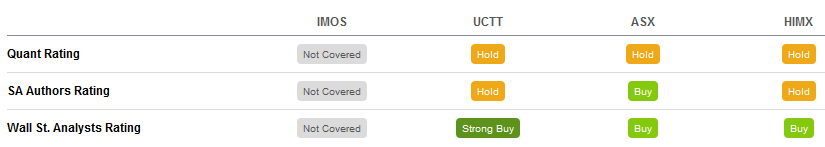

Seeking Alpha’s Quant system does not offer scores for IMOS stock. Still, semiconductor stocks I researched or watched previously have similar “hold” ratings.

SA Premium

In the ratings above, ASE Technology (ASX) has a hold rating. ASE is a semiconductor assembling and test manufacturer services firm. Like ChipMOS, the headquarters is in Taiwan and has 65,695 employees.

ASE stock trades at a P/E of 4.3 times, which is also the same as that of IMOS stock.

Ultra Clean Technology develops ultra-high purity cleaning and analytical services for the chip industry. The firm is headquartered in California. UCTT stock trades at a forward P/E of 5.94 times.

Himax Technologies (HIMX) is not a semiconductor testing firm. However, its P/E is also around 4 times. HIMX stock pays a dividend of $1.25 that yields 23.6%.

Your Takeaway

Geopolitical risks between the U.S. and China dominate the headlines. This has an impact on the semiconductor sector. Investors will require a deep understanding of the tension. Fortunately, ChipMOS is not a widely followed stock with only 3,620 followers on Seeking Alpha. Some of the biggest upsides come from stocks that few consider. ChipMOS is one of them.

Be the first to comment