gremlin/iStock via Getty Images

The Influence of Disruptive Brands

When you think of a disruptive brand, or a disruptive technology, it usually refers to something that can replace the status quo, while, at the same time, being able to leapfrog over the competition by virtue of a distinct advantage or characteristic.

We generally think of such disruption as potentially changing the existing landscape of an industry, or a particular product, which typically has maintained a prominent position for many years.

Big Beverage & Their Stranglehold on an Industry

When it comes to the beverage industry, the dominant players, for the last 30 to 40 years, have been companies like a Coca-Cola (KO), PepsiCo, Inc (PEP) and Keurig Dr. Pepper (KDP).

For many years, these three big beverage companies derived the bulk of their revenues from traditional beverages, commonly referred to as soda or soft drinks. These drinks were, for the most part, carbonated and contained sugars such as high-fructose corn syrup.

As consumers become more sophisticated in their beverage choices and continue to gravitate towards the trend for healthy, functional beverages, we see traditional sugar-laden sodas and soft drinks continuing to lose ground.

That lost ground, in sales and revenues for “Big Beverage”, will have to be made up with new and unique products, that offer the type of functional benefits that today’s consumers want.

Micro-Cap Companies Can Often Lead Innovation

Companies like Celsius Holdings, Inc. (NASDAQ:CELH) and Glucose Health, Inc. (OTCPK:GLUC) are carving out new niche markets in the functional beverage space, by offering what we deem to be “disruptive brands” with clinical studies behind them.

If you have not looked at Glucose Health, Inc., we suggest that you perform some serious due diligence on the company, to see the explosive growth potential that exists for their diabetic-friendly drinks.

For a good starting point to gather preliminary information about GLUC, you may want to start here.

We would note that the primary challenge for Glucose Health, Inc., in the past, has been the high number of stock-outs on Amazon, and other retailers, due to limited amounts of inventory being available for shipment.

As shareholders with an ownership position of greater than 10%, we have spoken with CEO, Murray Fleming about this issue extensively. The solution to the problem, if you can call having too much demand for a product a problem, is to do a large-scale capital raise, thus allowing the company to produce enough inventory to provide a comfortable cushion to meet high demand.

We believe that with a successful IPO underwriting and fresh capital to work with, GLUC shares can resume their upward climb, by getting back to the business of providing great tasting functional beverages which focus on one of the world’s largest global macro-trends; the epidemic surrounding Type-2 diabetes.

Glucose Health’s largest distribution partner, Amazon, has sold an amazing amount of the company’s GlucoDown® product over the years, and we believe that an infusion of new working capital will reignite GLUC’s animal spirits and put the mojo back into what we consider another attractive disruptive brand.

For GLUC to enjoy continued success, it will be necessary to have enough inventory for Amazon, and other distribution partners to sell, thus avoiding the dreaded stock-out syndrome that has plagued the company over the past two years.

If Glucose Health, Inc. CEO, Murray Fleming, can get it right, and we truly believe that he can, many investors will eventually look back on today’s price for GLUC shares and wonder why they didn’t pay more attention to it.

CELH Inventory Levels Increase By 10-12X

Celsius Holdings, Inc. CEO John Fieldly knows all about stock-outs and why they need to be avoided when a company has the advantage of a vibrant and well executed marketing campaign that is driving massive sales momentum.

As part of his strategic plan to avoid low inventory levels, resulting from growing demand for Celsius energy drinks, he made an executive decision to significantly ramp up inventory levels to where they were 10-12 times the normal inventory levels which the company normally had on hand.

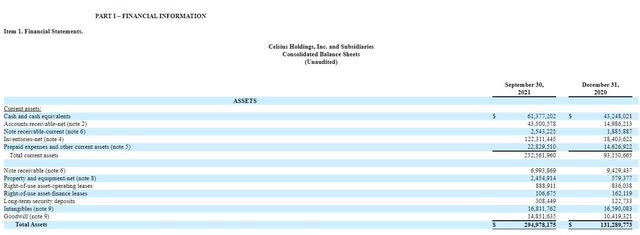

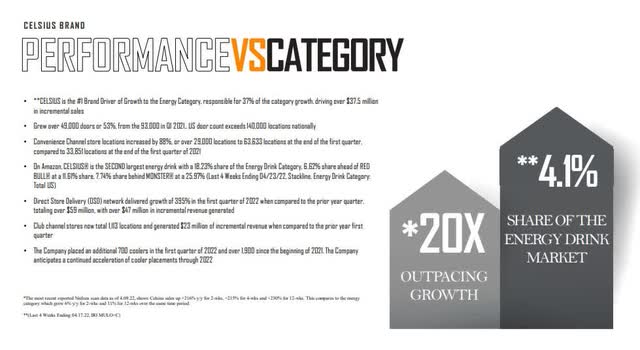

Here are two screenshots of the company’s 10-Q quarterly filing, for the period ending 9/30/21, showing the massive build-up in product inventories.

Screenshot of CELH 10-Q September 30, 2021 (Edgar Filings)

Screenshot of CELH 10-Q September 30, 2021 (Edgar Filings)

John Fieldly also addressed this inventory build-up on several conference calls with investors.

The Company accomplished this exponential growth despite their tremendous supply chain constraints that continue to impact the industry. In order to hit the majority of our orders during the quarter, we did have to sacrifice efficiencies on the margin side, which we believe are either one-time costs or short-term in nature, with specific identifiable processes we are implementing to improve our margin profile going forward. The largest one-time costs impacting margins during the quarter stemmed from the build out of our 6 orbit distribution warehouse centers, which we announced in the second quarter.

We expect to see tangible efficiencies in both miles on cases, freight costs, as well as reduced inventory stock-outs with our distribution partners going forward from this initiative. But we did have incremental costs in Q3 as we essentially moved from 2 main warehouse centers to 6, while also significantly expanding inventory runs with our co-packers. With this, we had excess freight costs as we built out an optimized inventory levels across our warehouses, which is reflected in our cost of goods.

Source: CELH Q3 2021 Investor Conference Call

We did increase inventories that were strategic. We spoke about that prior as well. And we feel we’re optimized. We’re going to continue to invest in the business, in inventory, personnel, and resources as we continue to scale, so we can drive that optimal leverage and reach our goals.

Source: CELH Q3 2021 Investor Conference Call

Conservative Guidance By Wall Street Analysts

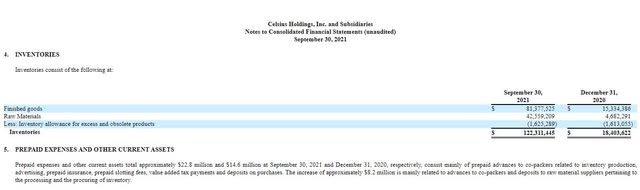

We believe that Wall Street analysts have been too conservative in their quarterly revenue and profit forecasts for CELH, as the company has consistently beat consensus numbers.

Historical Estimates by CELH Analysts (Yahoo Finance)

The most recent Q2 2022 financial results for CELH were again nothing short of spectacular.

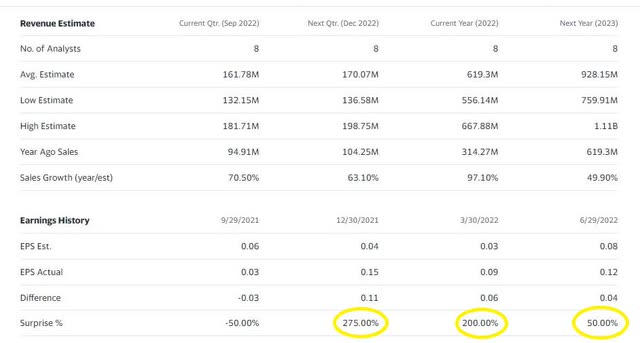

Consumer demand for Celsius on a dollar base accelerated through the second quarter of 2022 and through July of 2022 to record levels. Their most recent reported Nielsen scan data as of July 16, 2022, shows Celsius sales were up 143% year-over-year for 4 weeks, 194% for the 12 weeks and 185% for the second quarter. This compares to the — the overall energy category grew 8% for the 4 weeks, 8% for the 12 weeks, approximately 8% for the second quarter over the same period.

On Amazon, Celsius has continued to maintain the second-largest energy drink spot with a 22.6% approximately share in the energy category, ahead of Red Bull that has a share of approximately 10.6% and just behind Monster at a 24.7% approximately. And this is as of the latest 4 weeks ending July 30, 2022, Stackline Energy category data total U.S. Celsius year-over-year sales is up 185% compared to Amazon energy category, which is up 79%. Celsius is outpacing the category growth on the platform by approximately 2.5% on a year-over-year basis, and that is the 4 weeks ending July 30, 2022, Stackline total energy total U.S.

The company placed an additional 800 coolers in the second quarter of 2022 and over 2,700 since the beginning of this year. The company anticipates the continued acceleration of cooler placements throughout 2022. Our total U.S. store count now totals approximately 196,000 locations nationally, growing over 59,000 doors and locations or 54% growth from 109,000 doors or stores reported as of the end of the second quarter of 2021 with additional expansion planned throughout 2022 and acceleration anticipated with the new partnership with PepsiCo.

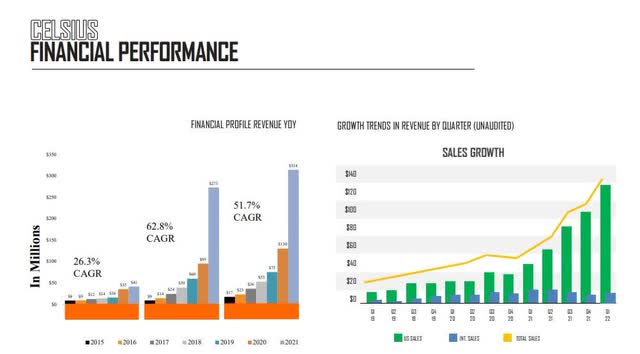

CELH Investor Presentation 5-16-2022 (Celsius Holdings, Inc.)

CELH Investor Presentation 5-16-2022 (Celsius Holdings, Inc.)

Note: Data does not include most recent Q3 2022 results

Celsius vs. Monster – David vs. Goliath

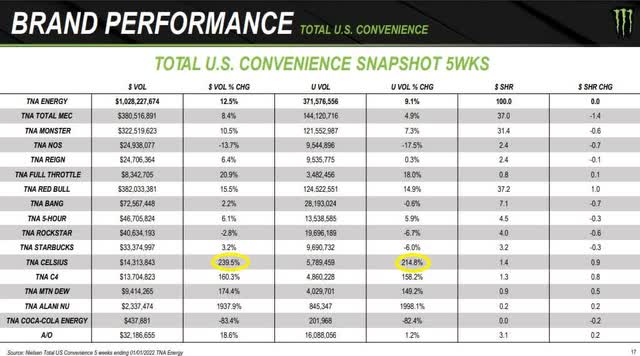

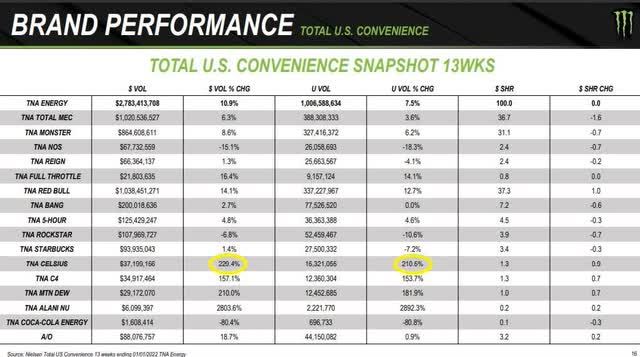

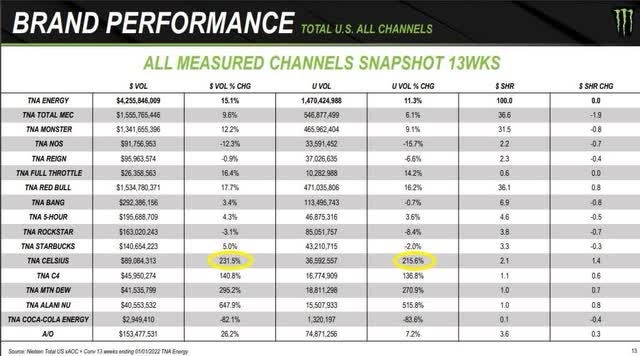

Now, let’s take a look at the Investor Presentation found on the Monster Beverage Corporation website, dated January 13, 2022, to see how CELH sales momentum compares to MNST.

Monster Brand Performance – Convenience Channel 5 weeks (Monster Beverage Corporation)

Monster Brand Performance – Convenience Channel 13 weeks (Monster Beverage Corporation)

Monster Brand Performance – All Channels 13 weeks (Monster Beverage Corporation)

Across the board, Celsius is beating Monster Beverage Corporation hands down in both the convenience channel, which is where the energy drink category seems to sell best, as well as across all other channels of distribution.

The momentum of Celsius energy drinks has been increasing steadily over the past few years at double-and triple-digit rates.

Now that PepsiCo has taken an 8.5% equity stake, on an as converted basis, in the company, we think that Monster Beverage CEO Rodney Sacks could be hearing footsteps closing in behind him.

We remember reading the Monster Beverage conference call transcript from Q2 of 2019, when Mr. Sacks mentioned that he expected to see other energy drink brands, including Celsius, gaining ground, and taking shelf space from Monster and the other Big Beverage players in the space.

Now there are a number of other performance energy drinks, there’s Bang, and there are also some other performance energy drinks that are seeking to obtain listings in space in the convenience channel, such as Celsius and C4 and others. And so we think that they will ultimately be an additional space allocated to the performance energy drinks. As part of the broader energy drink category, the existing space or probably you will start seeing some additional space being allocated in C stores and coolers in alongside or adjacent to the energy space. We think there will be some development of a sort of subset or category of performance-based drinks that will be lumped together. They will also take into account product. We think like Hydro and other performance, energy drinks that just generally fall outside of the pure carbonated sparkling sort of traditional energy drinks.

The Research Process to Find The Best Micro-Cap Ideas

Our research methods for finding investable micro-cap ideas always starts with identifying a growing global macro-trend. We then look for promising young companies that have strong leadership and management talent.

The management team must be able to move the company forward, from early developmental-stage status to early revenue generation and then towards more meaningful revenue growth.

Profitability, IS NOT a prerequisite for us to take a sizable equity position in high risk, speculative micro-caps.

Our primary investment objective has always been revenue generation, and the ability to grow those revenues over time. Profits should follow, at some point, if the company has a solid management team, with the ability to raise capital, on reasonable terms, to fund company growth.

Many of our followers understand that we play in a very speculative sandbox, which is not suitable for many, if not most, investors.

The Risks of Micro-Cap Investing

The micro-cap investment arena is fraught with many risks, many of which are not found in the securities of more established companies. Many of our ideas are non-revenue producing developmental-stage companies, which adds another level of risk to a micro-cap investment.

We encourage readers to familiarize themselves with the risks of micro-cap investing and penny stocks, which include the following:

Micro-cap stocks carry additional risks beyond those of higher classes of securities including, but not limited to trading outside of a listed exchange, potential liquidity issues, dealing with penny-stock rules, lack of margin eligibility, a possible absence of transparency regarding BBBO quotes, a limited number of Market Makers willing to provide depth to the order book, potential issues regarding financing activities, inadequate capital to execute on the company’s business plan, going concern caveats, and the potential inability to compete with larger companies due to limited financial and personnel resources. Please invest responsibly. We encourage individuals to only invest what they can afford to lose, up to a maximum of 100% of their investment.

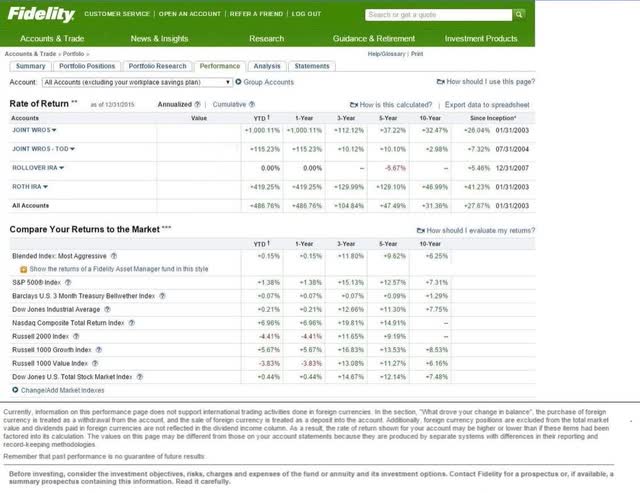

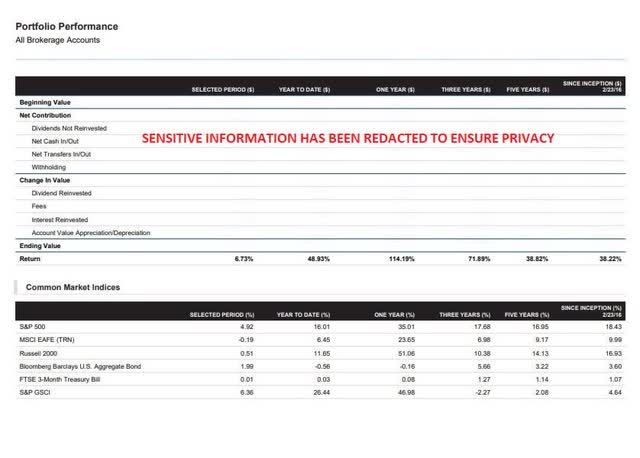

Performance History Over the Past 20 Years

There is one, and only one, reason why you should consider following a Seeking Alpha contributor —- Their ideas are profitable and make money.

Altitrade Partners has been able to achieve success, over the past 20 years, by putting together a portfolio of investment ideas, most of them highly- speculative micro-cap companies, that have produced meaningful returns from 2003 to 2015, when our accounts were with Fidelity, as well as the period after we moved our accounts over to Charles Schwab & Co. in early 2016.

All dollar amounts, in the screen shots below, have been redacted to ensure the privacy of sensitive personal information.

Screen Shot of Fidelity Accounts 2003-2015 (Fidelity Investments)

Screen Shot of Charles Schwab Accounts 2016-2021 (Charles Schwab & Co., Inc.)

You should not assume that the account performance illustrated below, can be replicated going forward. Past performance is not an indication of future results. We manage our portfolios with a high level of concentration. This means that we often invest substantial amounts of money in a small number of individual stocks across a very limited number of sectors and industries. This type of concentration has the effect of dramatically increasing the risks in a portfolio, due to a lack of diversification and single-stock exposure.

We have often experienced very large drawdowns in the value of accounts that we manage. This means that losses may be extremely large for undetermined periods of time. During these times, it is difficult to sell these illiquid micro-cap stocks, which may result in an investor being unable to raise funds for other financial needs and purposes.

Summary & Conclusion

Celsius Holdings, Inc. has gone from being a tiny, little South Florida company with a rogue beverage brand, that many thought would never be able to make significant headway against competitors like Coca-Cola, Keurig Dr. Pepper and PepsiCo.

At Altitrade Partners, we had a contrarian vision, which clearly identified a growing global mega-trend which we felt was destined to change the existing landscape of energy drinks in the future.

At the time, we felt that CELH was in a unique position to exploit this new underlying global mega-trend, which was taking place despite not being fully recognized by some of the beverage industry’s largest and most established marketing organizations.

Very early, in a Seeking Alpha Editor’s Choice article, published on January 28, 2015 we made the case for why Big Beverage should be keeping their eyes on Celsius Holdings, Inc. and their foray into a new energy drink category —–healthy energy.

Shortly thereafter, in another Seeking Alpha article, published on February 12, 2015, we made the case for why we felt that Celsius energy drinks could become the next big and important beverage industry trend.

There are 44 other Seeking Alpha articles that we authored over a span of 7 years. Many of them made the case for either an eventual buy-out, takeover, joint venture, or some other kind of business combination between Celsius and one of the established giants in the beverage industry.

The news that PepsiCo would purchase an equity stake in Celsius, three weeks ago, was the culmination of years of hard work, and served to validate our case for why we felt that the company would eventually attract one of the bigger beverage industry players.

It feels good to see the Celsius team receive the respect and recognition that they rightfully deserve, not only as a beverage industry contender, but as a meaningful competitor.

At one point, we even referred to CELH, in one of our Seeking Alpha articles, as the Rodney Dangerfield of Wall Street.

With PepsiCo’s marketing muscle behind them, we believe that Celsius will become a major force to be reckoned with.

In fact, we are of the opinion that the PepsiCo/Celsius business combination could one day earn the title of being the #1 energy drink company, effectively knocking Monster Beverage Corporation off of its throne.

In the beverage industry, it is always “easier to buy it, than it is to build it”.

While CELH shares may be due for a pullback in the short-term, along with the general market, we remain very bullish on the company for those with a long-term time horizon. If, in fact, there is a pullback in the major stock averages, it could provide a buying opportunity to pick up CELH shares at lower prices.

Please, remember to invest wisely. Stay safe and be well.

Be the first to comment