G0d4ather

Broadcom (NASDAQ:AVGO) has multiple positive catalysts to drive the stock higher over the long-term. The stock’s low valuation and strong expected long-term growth could drive the stock to outperform the S&P 500 (SPY) over the next several years. The catalysts are not fully priced in as Broadcom is trading below its industry and the broader market.

Broadcom designs and supplies a variety of semiconductors for numerous applications. The company’s focus is on complex digital and mixed signal complementary metal oxide semiconductor-based devices and analog-based products. Broadcom’s products are used in set-top boxes, 5G, smartphones, Wi-Fi, Bluetooth, GPS systems, digital subscriber lines, passive optical networking central office SoCs (system-on-a-chip), ethernet switching, routing, satellite system SoCs, custom touch controllers, enterprise and data center networking, broadband access, data center servers & storage systems, and more.

Catalyst #1: The CHIPS and Science Act

The recently passed CHIPS and Science Act is designed to increase semiconductor design, research, and manufacturing in the United States. This law designates $280 billion to help reduce foreign dependence on semiconductor production from areas such as Taiwan and China. Ultimately, the goal of the CHIPS and Science Act is to improve the supply chain and to help ensure that the United States maintains its economic and technological dominance.

The law is set to benefit the U.S. semiconductor industry. The manufactured capacity of semiconductor’s supplied from the United States decreased from 25% in 1990 to the current level of just 12%. East Asia currently accounts for 75% of the world’s semiconductor manufacturing capacity. This new law provides incentives for U.S. based semiconductor manufacturers to expand. The law provides funds that can offset the high construction and investment costs associated with expansion and research & development [R&D].

Broadcom is set to benefit from the CHIPS and Science Act. The company spent over $4.8 billion on R&D over the past 12 months. The extra funds from the new law can help provide more R&D funding, giving the company a bigger bang for its invested bucks. The law’s funds can also help boost profitability as R&D spending represents over 16% of Broadcom’s total revenue.

Of course, Broadcom would also have more funds available as part of the CHIPS Act to expand existing facilities and to consider investing in new facilities. This can allow the company to ramp up production to meet demand. Frankly, the entire semiconductor industry needs to increase production capacity to resolve the chip shortage.

While Broadcom’s stock did rise about 10% after the CHIPS and Science Act was announced, I think this law was not fully priced in for AVGO. It seems to be overshadowed by the Inflation Reduction Act. Some solar stocks such as Enphase Energy (ENPH) doubled in price as the Inflation Reduction Act was being discussed. The CHIPS and Science Act didn’t get the same amount of press and attention as the Inflation Reduction Act. So, I think there is plenty of room for Broadcom’s stock to move on this new law once the benefits to the company are realized.

Catalyst #2: The VMware Acquisition

Broadcom announced in May 2022 that it will strive to acquire VMware (VMW) for about $61 billion in cash and stock. I see this as a good deal for Broadcom as VMware is a leading provider of software solutions for various applications, cloud management/infrastructure, data center infrastructure, networking, and storage. If the deal is completed successfully, VMware would give Broadcom an additional $13 billion in annual revenue. VMware would also provide Broadcom with an additional $1.6 billion in annual net income and $4 billion in annual operating cash flow.

VMware can bring more business stability to Broadcom. The chip business tends to have sharp positive and negative market conditions which occur more frequently than the broader market. This leads to sharp moves in the stock price. VMWare held the number one position for market share in the global virtualization infrastructure software market in 2021. VMware had a 72% market share with $5.9 billion in revenue in 2021. VMware’s software-based business can help offset the negative effects of a chip-based slowdown.

The acquisition would also likely increase Broadcom’s profit margins. VMware has a gross margin of 82% as compared to Broadcom’s gross margin of 75%. This makes sense since VMware is software-based which tends to have high profit margins, while Broadcom has lower-margins because most of the company’s revenue comes from its lower-margin hardware business.

VMware shareholders can benefit between now and when the deal closes with M&A arbitrage. The deal was already approved by shareholders but needs regulatory approval and is expected to close in 2023. The takeout stock price is estimated to be $138. This is 13.5% higher than the current price of $121.58. So, investors in VMware have the potential to profit if the deal closes successfully.

Catalyst #3: Growth in Market’s Served

Broadcom operates in numerous growing markets. These markets can provide ongoing growth for AVGO for multiple years. These growth markets can act as a long-term positive catalyst for Broadcom even without the CHIPS and Science Act and the VMware acquisition.

One large growth market for Broadcom is 5G. The 5G technology market is expected to grow at a fast 72% annual pace to reach $248 billion by 2028. This includes smart manufacturing, connected automotive, connected energy/utilities, smart cities, the internet of things [IoT], wireless broadband services, cloud solutions, etc.

Another large growing market that AVGO serves includes the global passive optical network [PON] market. This market is projected to grow at 21% annually to be worth over $115 billion by 2028. The PON market involves telecommunications technology that uses dedicated optical fiber to provide limitless bandwidth. This enables service companies to deliver personal credentials bandwidth to transmit audio, video, and data on a network simultaneously. A PON can allow multiple customers to share the same connection without the use of active components.

The global data center infrastructure management market is projected to grow at a strong 11% annual pace to reach over $3.1 billion by 2028. Drivers for this market include increases in internet users, cloud computing, and government initiatives.

The ethernet switches market is projected to grow at about 9% annually to reach $96 billion by 2028. This technology is used for imaging in global pathology departments.

The global broadband services market is expected to increase by about 9% annually to reach $707 billion by 2028. This growth is being driven by multiple factors including: advancing technology for increased user convenience, government initiatives, increased use of devices (smartphones, tablets, etc.), and growing availability of internet services.

I could go on and on with every market that Broadcom serves, but I covered the largest ones. The other markets that Broadcom are also growing which can help drive Broadcom’s growth. Of course, many of these markets work together with each other.

Broadcom provides various semiconductor solutions that are essential to make these growing technologies work properly. As a result, these growing markets are likely to act as a tailwind for long-term sustainable growth for Broadcom.

Attractive Valuation

Broadcom is currently trading at a 19% discount to the Semiconductor industry on a PEG ratio basis. Broadcom trades with a forward P/E of 14.8 and a PEG ratio of 0.90. The Semiconductor industry is trading higher with a forward P/E of 16 and PEG ratio of 1.11.

For additional context, Broadcom and its industry are also trading below the S&P 500’s forward P/E of 18.9 and PEG of 1.54. So, I see Broadcom as a good value within its industry and as compared to the broader market. The potential catalysts do not appear to be fully priced in yet.

Broadcom is estimated to grow earnings at an annual pace of 16% over the next 3 to 5 years. VMware is expected to grow earnings at about 19% annually over the same period. Broadcom’s stock has the likely potential to outperform the S&P 500 over this period with a lower valuation and higher growth. The S&P 500 is expected to grow earnings at a lower annual pace of about 12% over the next 3 to 5 years.

Balance Sheet/Cash Flow

Broadcom has about $9 billion in cash and $39 billion in total debt. While the large amount of debt looks ugly, the rest of the balance sheet and cash flow look strong. The company has 2.1x more current assets than current liabilities and 1.4x more total assets than total liabilities for stockholders’ equity of $21 billion.

Broadcom’s cash flow looks strong as the company had $14.8 billion in operating cash flow over the past 12 months. AVGO was then left with $12 billion in levered free cash flow after paying dividends, repurchasing shares, paying down debt, paying CapEx, etc.

While the large amount of debt looks concerning on the surface, it shouldn’t be an issue if the business remains strong and growing. The healthy cash flow will allow Broadcom to pay down the debt.

Keep in mind that if the VMware acquisition successfully closes, Broadcom would take on another $13 billion in total debt or $9 billion in net debt. It is also important to note that VMware’s balance sheet is not as strong as Broadcom’s. VMware has 1.34x more current assets than current liabilities on its balance sheet. VMware also has about $411 million more total liabilities than total assets. Since both companies are profitable and growing with positive cash flow, VMware’s balance sheet shortfalls are not likely to be detrimental to the combined company.

High SA Ratings

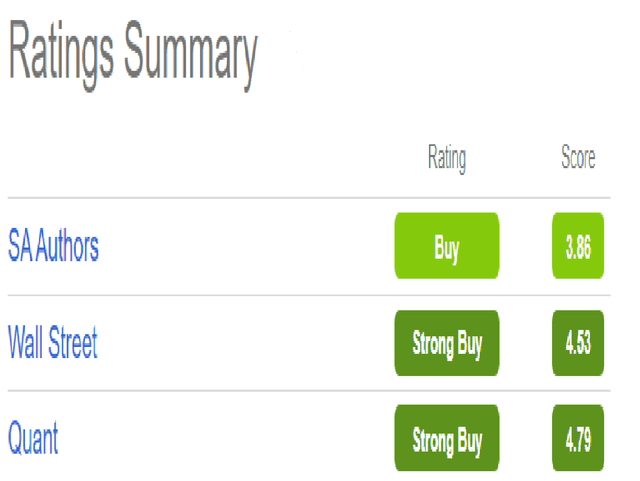

Stocks that have a ‘strong buy’ quant rating from Seeking Alpha’s stock ranking system tend to outperform the S&P 500. Here’s how Broadcom is ranked:

Broadcom’s SA Ratings (Seeking Alpha)

As you can see from the ratings summary above, Wall Street agrees with SA’s quant ratings system and SA authors are close with a regular buy rating. SA’s quant ratings system ranks stocks based on valuation, growth, profitability, momentum, and earnings revisions. With a strong buy quant rating, Broadcom is likely to outperform the S&P 500. Broadcom is ranked #4 out of 65 companies in its industry.

The Risks

One of the main risks with Broadcom is the highly cyclical nature of the semiconductor market. The semiconductor industry has downturns that are more frequent than the broader market. As a result, the stock can experience significant declines that occur more frequently than the S&P 500’s corrections.

Another risk is the possibility of the VMware acquisition not being approved by regulators. While I wouldn’t put a high probability on that occurring, it does remain a possibility. The failure of the acquisition to be approved, could lead to a sharp sell-off for AVGO.

Other risks include more supply chain constraints. If the company is unable to obtain the proper amounts of raw materials to produce semiconductors, it could have a negative impact on sales.

Broadcom’s Long-Term Outlook

Broadcom is poised to benefit at the very least from the CHIPS and Science Act and from growth in the numerous markets that the company serves. The approval of the VMware acquisition would be a rich, thick, buttercream icing on the cake for Broadcom’s future.

Broadcom’s attractive valuation leaves room for further upside as the company grows earnings at an above-average pace over the next 3 to 5 years. The broader market looks iffy over the next 6 months to a year as the Federal Reserve continues to increase interest rates to reduce inflation. So, I think investors don’t have to jump into the stock right now. With some patience, it would probably be best to wait for another market correction or selloff.

Overall, Broadcom has a good chance to outperform the S&P 500 over the next 3 to 5 years as the company grows at an above-average pace from its below-market valuation. The full benefits of the growth catalysts are not priced into the stock as AVGO trades below the industry and the broader market.

Be the first to comment