Agor2012

Introduction & Thesis

You may have already read Evercore ISI’s note, in which the investment house suggests that Apple Inc. (NASDAQ:AAPL) could be moving forward with a series of “moonshot projects.” These, along with Apple Pay’s increasing scale, “temporary” supply issues in China, and more buybacks, will help the company grow EPS by $7 or more next year.

In my humble opinion, Evercore’s analysts are too optimistic – the company as a whole is pricing in the consequences of a potential recession too softly. It is not enough to focus only on the supply side – Apple, despite its brand power, is likely to feel a weakening of demand for its products, which are not the first necessity under current macro conditions.

Apple stock is a Hold currently, and I recommend fishing better entries for averaging down somewhere in the middle of the next year, not now.

Why do I think so?

This is my 5th article on Apple stock, and it’s again Hold-rated. I try to assess what is happening in the market and what various analysts are saying as realistically as possible to see the degree of reasonableness of the consensus forecasts.

That note from Evercore plunged me into bewilderment. Analyst Amit Daryanani wrote that Apple could add $7 earnings per share next year:

- 1) boosting its “moonshot projects” (by which it may primarily mean the mixed reality headset);

- 2) normalization of supply chains from China and in general thanks to the grand reopening steps;

- 3) additional share buybacks, new products, and iPhone contributions;

- 4) the company’s advertising business, which [he believes] is likely to grow in importance;

- 5) Apple Pay continues to gain scale.

In the headline of my article, you can see the word “moonshot” – this is an allusion to how the analyst describes the project MR [mixed reality], about which rumors are circulating but nothing is really known yet:

As the months have rolled on, Apple’s headset has never seemed to move closer over the horizon. That’s probably to be expected with a product as ambitious as a mixed-reality headset, but it means we shouldn’t expect it any time soon.

Source: DigitalTrends.com [December 06, 2022], emphasis added by the author.

Even if we assume that Apple will launch its MR project next year, how relevant will it be and how much additional OPEX/CAPEX will it need to move forward? In times of rising capital costs, additional spending with no obvious benefit becomes an unforgivable waste that shareholders will be the first to pay for.

The second point Evercore brings to our attention is the discovery of China as a major catalyst. However, as the recent performance of China-listed stocks in Hong Kong shows, investors have likely used the recent news about China reopening as an opportunity to sell the rip. Morgan Stanley strategists – Min Dai and Gek Teng Khoo – recommended investors hold back on reopening trades on Tuesday, given the sharp rise in infections. Lu Ting, Nomura’s chief China economist, wrote in a note that the road to a full reopening could still be painful and bumpy and that the rise in covid infections will offset some of the positive impacts of easing in the near term.

Even if Apple’s Foxconn returns to near full capacity, I expect there could be more worker strikes or another factory closure due to various “fever outbreaks” – at least this risk is not off the table yet as we see from the above data.

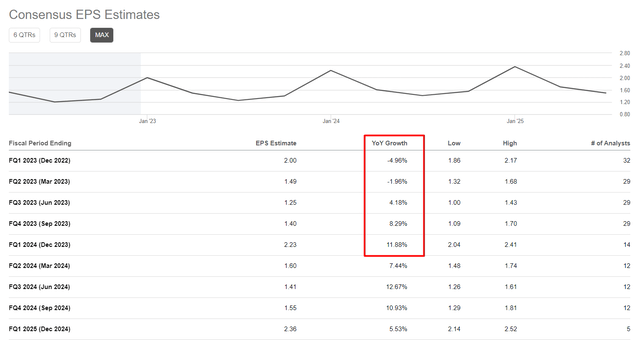

Moreover, Foxconn itself warned a month ago that Its consumer electronics sales in Q4 will be lower than a year ago, while the analyst consensus puts Q3 net income at T$31.73 billion – down 14.2% from Q2. Surprisingly, analysts who estimate Apple’s performance several quarters in advance still expect a positive picture for the company – in their opinion, earnings per share should decline by only 4.96% in Q1 2023 and by another 1.96% in Q2 2023, and already in calendar mid-2023, earnings per share will start to grow again and reach a double-digit growth rate in Q1 2024 (December 2023):

Apple’s EPS estimate still looks “too colorful” in my opinion, especially considering that the company generated 18% of its total revenue in Greater China in FY2022, while this region grew 9% year-over-year – above the average of the rest of the segments. And according to the latest Bloomberg data [link above], we see a cooling of general retail demand in China – retail sales contracted for the second time this year (-5.9% YoY) amid weakening industrial output:

Another point Evercore makes is about Apple’s advertising business, the growth of which should turn the tide partly in the company’s favor. I can agree on the importance of this segment. However, its development will also require quite high CAPEX – the analysts from Citi agree with me on this point:

Citi Research, [December 16, 2022], author’s notes![Citi Research, [December 16, 2022], author's notes](https://static.seekingalpha.com/uploads/2022/12/18/49513514-16714259606668682.png)

In general, all the positivism that now surrounds Apple and many other tech mega-cap stocks is a consequence of the argument around improving the supply side, because so far, the demand side has been in a pretty strong position.

I think the price elasticity of demand for Apple’s products – despite all the brand power – is seriously threatened now and especially next year. In Europe, on which 24.1% of Apple’s total revenue depends [as of FY2022], gas and electricity bills have risen by double, so amid China (18% of AAPL’s revenue) where the situation looks no better in its own way, I expect a demand disruption, which to date is difficult to track using just lead times.

Precisely because of the growing risk of demand disruption, I am more inclined to Morgan Stanley’s bear case scenario set out in the bank’s recent report [December 7, 2022]:

Morgan Stanley [Erik W Woodring, et al.], December 07, 2022, author’s notes![Morgan Stanley [Erik W Woodring, et al.], December 07, 2022, author's notes](https://static.seekingalpha.com/uploads/2022/12/19/49513514-16714284365764332.png)

Note that a price of $5.23 per share (-14.4% YoY) is not “unattainably low” for Apple given current macro conditions. In any case, we have already seen EPS decline by 10.06% and 9.91% (YoY) in 2013 and 2017, respectively, and back then the situation was not nearly as bleak as it is today.

Bottom Line

In this article, I have tried to take a critical look at the thesis of Evercore analysts and many other bulls who believe that if Apple performed below last year’s expectations this year, everything will definitely be different next year. My impression is that this is not the case.

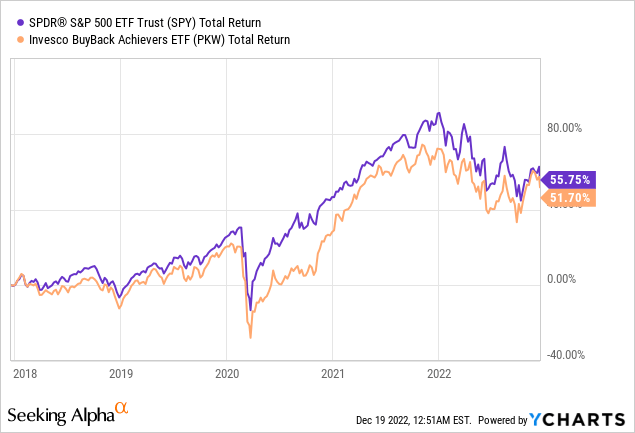

I also do not expect the company’s buybacks to help generate significant outperformance because this factor – when considered in isolation – does not usually lead to a significant result in terms of generating alpha over the long term:

At the same time, I really like Apple over the long term – the stock grew its free cash flow (“FCF”) per share at an annual CAGR of about 26%, and revenue grew 24% over the same period. Operating margin improved twofold, as did ROIC. Book value per share increased from 0.6x to 3.12x. Basically, Apple is a quality multi-bagger that nevertheless experiences difficult years from time to time – and that’s perfectly normal.

2023 will be such a difficult year in my opinion. As the consensus Apple Inc. estimates and separate research papers by various banks and investment boutiques show, the “difficult 2023” with all its attributes (revenue decline or multiple declines – sometimes both) is not yet priced in. Yes, Apple’s EPS numbers have been revised down 36 out of 38 times in the last 3 months, but the Street still expects positive growth for the full 2023 calendar year. Once the challenges I described above start to impact the company’s operations, we will see a continuation of negative earnings revisions – this cannot but affect AAPL stock.

As in my previous articles where I assumed good levels to buy AAPL 15-20% lower, I think investors should be patient and wait until the stock reaches the $105-110 level. Until that happens, Apple is a Hold for me.

Thanks for reading!

![Bloomberg [December 16, 2022]](https://static.seekingalpha.com/uploads/2022/12/18/49513514-16714242877264397.png)

![Bloomberg [December 16, 2022]](https://static.seekingalpha.com/uploads/2022/12/18/49513514-16714256398200002.png)

Be the first to comment