Scott Olson/Getty Images News

Whirlpool (NYSE:WHR) has lost over 20% of its value in the past year. It now offers a good dividend and long-term growth opportunity. In a world where growth is becoming scarce, Whirlpool may be uniquely positioned to deliver growth that exceeds the U.S. GDP. The price you pay for an investment is the most critical determinant of long-term returns, and dividends can contribute over 30% of the annual gains in a stock. Whirlpool is currently attractively priced and offers a dividend above 4%. I am eager to add more Whirlpool at close to $160 and reinvest the dividends.

Long-term Value Creation Goals

Whirlpool delivered a great Q1 FY 2022. Marc Bitzer, Whirlpool’s CEO, mentioned that Q1 FY 2022 was among the ten strongest quarters in the company’s history. But, the Q1 EPS was $5.31 – down by $1.89 compared to the same quarter in 2021, but up by 86% against 2020 and 70% in 2019. Just like any other company, Whirlpool is grappling with inflation-related costs. But, despite increasing costs and reduced margins, the company delivered a 16% EBIT margin in North America and a 9% overall EBIT margin. The 9% EBIT margin is less than its long-term value creation goal of achieving EBIT margins of 11%-12%. The company now says that the annual inflation-related costs will be $1.8 billion.

In 2017, the company set its long-term value creation goals. At the end of 2021, the company increased its long-term value creation goals (Exhibit 1). It increased its sales growth to 5% to 6% from 3%, EBIT margin of 11% to 12% (increased from 10%), free cash flow of 7% to 8% of net sales (increased from 6%), and ROIC of 15% to 16% (increased from 12% to 14%).

Exhibit 1: Whirlpool’s Long-term Value Creation Goals

Whirlpool’s Long-term Value Creation Goals (Source: Whirlpool Annual Report)

In its 2021 annual report, the company had forecasted between $27 and $29 in diluted EPS. In their Q1 FY 2022 earnings call, the company revised its earnings with its new diluted EPS range of between $24 and $26. Wall Street is expecting an EPS of $24 for FY 2022. When the EPS estimate was $27, the company traded at a PE of 8.8. With the EPS at $24, the PE is at 6.9x. Wall Street may be signaling that there could be further cuts to Whirlpool’s EPS due to higher inflation and recession fears.

Consumers are still flush with cash that could prop up discretionary spending for the rest of 2022. Jim Peters – Whirlpool’s CFO – said this about the strength of the consumer on the Q1 FY 2022 earnings call:

“Underlying consumer demand remained strong even with the impact from continued supply constraints and disruptions alongside the spillover effects stemming from greater geopolitical events. We remain very confident that the fundamental strength of consumer demand trends will remain intact over multiple years.”

If inflation starts to drop, the Federal Reserve could go easy on the interest rate hikes. Lower inflation may stabilize consumer spending and prevent a recession in 2023. We will get the Personal Consumption Expenditure Price Index inflation data on June 30, 2022. If that shows a slowdown in inflation, that may be a bullish sign. I will closely watch the following three Consumer Price Index inflation reports (June, July, and August) from the U.S. Bureau of Labor Statistics. June’s inflation report is scheduled to be reported on July 13, 2022. The month-to-month price change may be an essential metric to watch in that report. If there is a deceleration in inflation in the month-over-month data, that would be a bullish sign for the markets and a welcome relief for Federal Reserve Chairman Jay Powell and his team. That could mark the beginning of the end of aggressive interest rate hikes by the Federal Reserve board.

The company has divested its China investments and is “embarking on a strategic review of its EMEA business.” It is expanding in India. As income levels increase, the company should be able to sell appliances with much higher price points and profit margins. If they succeed in doing so, the company’s EBIT margin should increase, thus alleviating some pressure on its North American segment to help achieve its long-term EBIT goals. In Q1 FY 2022, Asia delivered a low EBIT margin of 4.8% compared to 16% for the North American division. Marc Bitzer [CEO, Whirlpool] said this about his company’s growth prospects in India:

“At the same time, we will drive our high growth and profitable business in India as penetration rates accelerate growth. And then not too distant future, India will be among the three largest global markets and we are well positioned to win there.”

The company increased its stake in Elica PB in India – a maker of kitchen appliances – to 87%, giving it control of the company.

With or without the COVID lockdowns currently hampering China, that country may have entered a decade of slow growth. Since the Chinese Communist Party has set a target of growing faster than the U.S. and surpassing America in terms of GDP, the party will try and spur growth. But, any artificially stimulated growth in China will come at the cost of increased debt and bad loans. China is already grappling with non-performing loans at its banks. Meanwhile, Japan is in a permanent low-growth or no-growth mode.

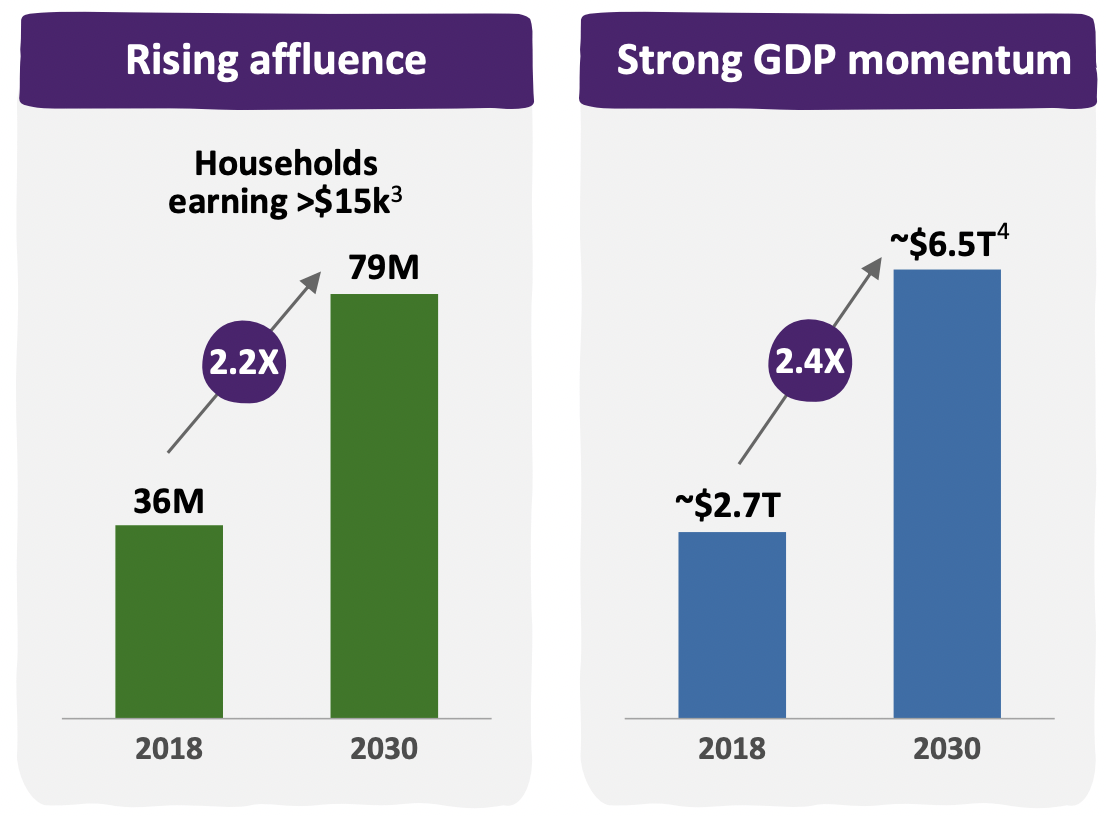

Southeast Asian countries will grow fast, but India offers growth at a massive scale. The broadcasting and streaming rights auction for the Indian Premier League [IPL] for cricket in June 2022 ranked among the most expensive media rights deals in world sports history. It has now surpassed America’s National Hockey League. IPL rights were valued at $6.3 billion, while English Premier League raked in $5.3 billion and NHL at $4.43 billion. In an investor presentation, Mondelez International (MDLZ) projected that the rising affluence in India will see households earning more than $15,000 increase by 2.2x, and GDP increase by 2.4x to $6.5 trillion by 2030 (Exhibit 2). This growth opportunity is before Whirlpool in India.

Exhibit 2: Rising Affluence and GDP Growth Momentum in India

Rising Affluence and GDP Growth Momentum in India (Mondelez International Investor Presentation)

I am a long-time skeptic of the growth prospects of India. But, things are changing that could improve the lives of millions and bring new customers to Whirlpool. As the Economist put it (Exhibit 3): this growth opportunity “is India’s and Mr. Modi’s to squander.”

Exhibit 3: India’s Moment

India’s Moment (The Economist)

Price Return Comparison

Whirlpool’s daily price return data between June 6, 2019, and June 24, 2020, showed an average return of 0.086% or 8.6 basis points (Exhibit 4). Since Whirlpool sells consumer discretionary products, one would expect a positive correlation in the daily returns between the Vanguard Consumer Discretionary ETF and Whirlpool. The daily return correlation between the consumer discretionary ETF and Whirlpool is 0.63 – a good positive correlation. But, Whirlpool correlates strongly with the SPDR Homebuilders ETF (XHB) and the iShares U.S. Home Construction ETF (ITB). The daily return correlation over the past three years between SPDR Homebuilders ETF and Whirlpool is a strong 0.78; with iShares U.S. Home Construction ETF, the correlation is 0.73. Whirlpool’s returns are closely tied to the U.S. market and, more specifically, the U.S. housing market. The Whirlpool stock has dropped 22.5% over the past year, while the iShares U.S. Home Construction and SPDR Homebuilders ETF are down 21.3% and 21.5%, respectively. The challenge for investors is that the pain in the U.S. housing market may be beginning, which means there may be more downside to Whirlpool in the short term. But, I am using any weakness in the stock to add to my portfolio.

Exhibit 4: Whirlpool Daily Price Change (%) [June 6, 2019 – June 24, 2022

WHR Daily Price Change (%) [June 6, 2019 – June 24, 2022] (iexcloud.io, author compilation)![WHR Daily Price Change (%) [June 6, 2019 - June 24, 2022]](https://static.seekingalpha.com/uploads/2022/6/27/28462683-1656345233281066.png)

Financial Performance and Dividend

The company offers an excellent dividend yield of 4.2% at its current price of $166.35. The company’s payout ratio is a manageable 24%. The company spent $1.04 billion in share repurchases in 2021, $121 million in 2020, and 148 million in 2019. The 2021 share repurchase is excessive, and the company has done that at a high valuation. Just like for ordinary investors, the price the company pays for its shares is essential to maximizing shareholder value. Companies need to be accountable for the misuse of shareholders’ cash. Companies cannot speak about their ESG credentials and, at the same time, be reckless with the company’s capital. As Warren Buffet once wrote:

“The continuing shareholder is penalized by repurchases above intrinsic value.”

The company generated an excellent 16% return on invested capital [ROIC] and a 35% return on equity [ROE]. The company has a debt to EBITDA ratio of just 1.7x. This ratio indicates that the company’s debt levels are manageable.

Selling Covered Calls

The July 15, 2022, $155 strike price call last traded at $2.65 – a 1.59% yield. The $155 strike price has an open interest of 137 contracts. If the call gets assigned at $155, the dividend yield would be 4.5%, a nearly 3x greater dividend yield than the S & P 500. Either way, you will get to keep any premium you earn when you sell a covered call on Whirlpool, especially at an attractive strike price of $155 and with a premium of over 1%.

Conclusion

Whirlpool is a great company currently trading cheaply and offering an excellent dividend yield. The company has good long-term growth prospects and can create tremendous value for the patient investor. I now own shares at an average price of $166.31. Although the company is very attractively priced at its current price of $166, I would add closer to $160 or below to my portfolio.

Be the first to comment