Roberto Galan

Investment Thesis: While I take the view that the stock could prove to be good value under the right conditions, investors are likely to wait until earnings growth becomes more vibrant once again.

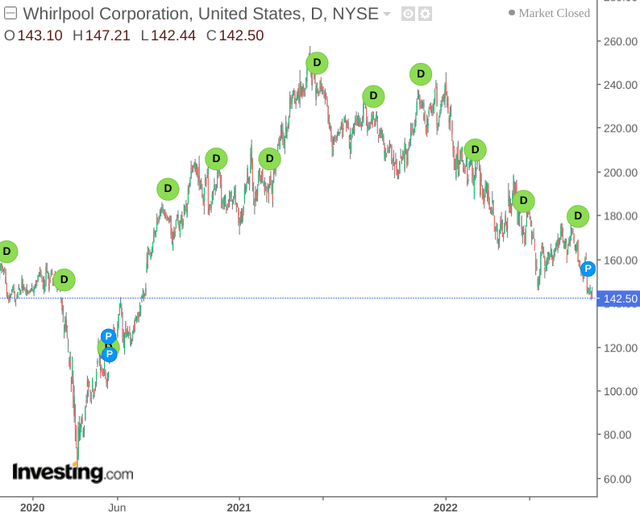

As one of the leading suppliers of home appliances worldwide, Whirlpool Corporation (NYSE:WHR) has seen a decline in line with the broader market since mid-2021.

With COVID lockdowns having ended and inflation becoming the primary macroeconomic concern, there is a possibility that the company has seen a plateau in demand as consumers might potentially seek to delay home appliance purchases.

The purpose of this article is to analyze whether Whirlpool Corporation could see scope for a rebound in upside from here.

Performance

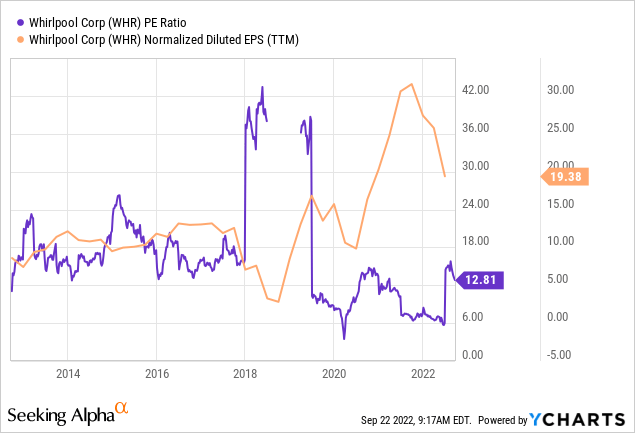

When analyzing the company’s P/E ratio and earnings over the past ten years – we can see that while the ratio is still trending below levels seen pre-2018 – earnings per share has still come down significantly from the highs seen in 2021.

ycharts.com

To get a better overview of the company’s longer-term cash position, I decided to calculate the quick ratio (cash plus accounts receivable all over total current liabilities) for both Q2 2019 and Q2 2022.

| Q2 2019 | Q2 2022 | |

| Cash and cash equivalents | 1178 | 1642 |

| Accounts receivable | 2387 | 2723 |

| Total current liabilities | 10094 | 7592 |

| Quick ratio | 0.35 | 0.57 |

Source: Figures sourced from Whirlpool Corporation Q2 2019 and Q2 2022 Financial Results. All figures in millions of US dollars. Quick ratio calculated by author.

With the company’s quick ratio having risen from 0.35 to 0.57, Whirlpool is in a comparatively better position to meet its short-term debt obligations.

With that being said, it is also noteworthy that Whirlpool’s long-term debt has also risen over this period by over 16% – from $4.155 billion in Q2 2019 to $4.831 billion in Q2 2022.

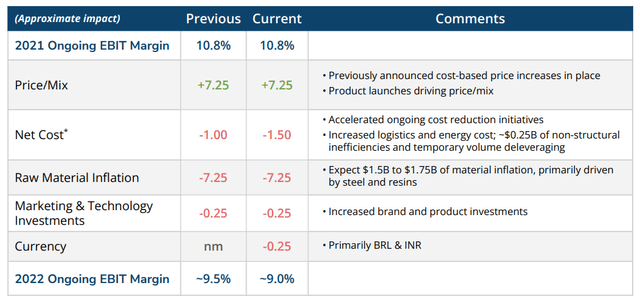

In terms of the company’s EBIT margin guidance for 2022 – we can see that the effects of raw material inflation is expected to result in a lower ongoing EBIT margin for 2022 as compared to last year, even with cost-based price increases:

Whirlpool: Second Quarter 2022 Earnings Presentation

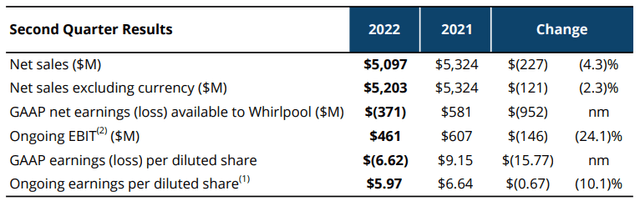

Moreover, overall net sales and earnings were down this year as compared to the same quarter last year:

Whirlpool Corporation: Q2 2022 Press Release

Specifically, sales in North America and EMEA were down by 2.3% and 10.3% respectively (excluding the currency impact). While sales in Asia were up by 30.5% as compared to the same quarter last year (also excluding the currency impact) – this is largely down to strong volume growth in India as compared to last year during the country’s COVID shutdowns.

Looking Forward

While Whirlpool has shown some resilience in the face of a decline in sales across key markets along with a relatively stronger short-term cash position as compared to Q2 2019 – inflation and demand are likely to be concerns going forward.

On the supply side, the higher costs of production and raw materials may place pressure on earnings in the short to medium-term.

On the demand side, higher inflation could reduce the demand for home appliance purchases by homeowners – while a potential drop in home demand across the real estate market would in turn reduce the demand for home appliances as well.

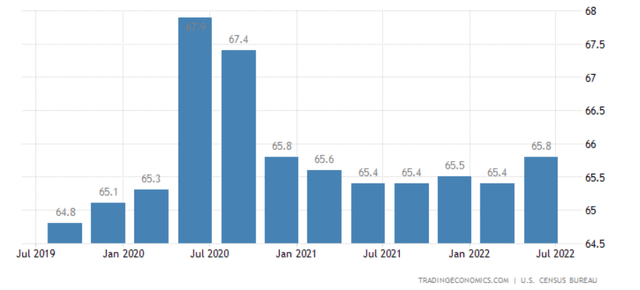

When looking at the United States, for instance – we can see that while the home ownership rate increased slightly in the past quarter – the overall rate is still significantly below that which we saw in summer 2020 – as low interest rates and the pandemic increased the rate of home purchases.

Ultimately, it remains to be seen whether demand will still remain vibrant in the face of inflationary pressures. However, I take the view that investors will pay significant attention to whether sales growth rebounds across the Americas and EMEA, along with the potential impact of the real estate market on home appliance demand.

Conclusion

To conclude, Whirlpool Corporation has seen a decline in net sales across North America and EMEA, and inflation is expected to lower EBIT margin guidance. While I take the view that the stock could prove to be good value under the right conditions, investors are likely to wait until earnings growth becomes more vibrant once again.

Be the first to comment