Huang Evan

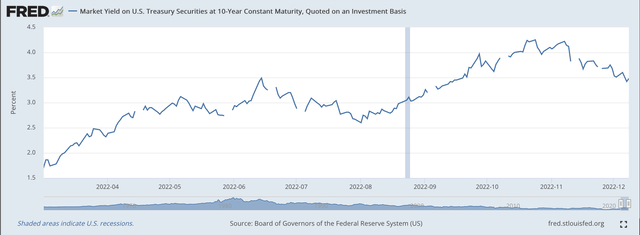

The yield on the 10-year U.S. government note is now around 3.60 percent.

On October 24, it was around 4.25 percent and on November 7 it was around 4.22 percent.

Early in March, just before the Federal Reserve began its battle against inflation, the yield on the 10-year U.S. government note was around 1.75 percent.

Here is the picture of this time.

Yield on 10-year U.S. Treasury note (Federal Reserve)

The pathway has been up…but not without rebounds.

Like the stock market, the yield on the longer-term interest rate has been bumpy. Investors are still waiting for the Federal Reserve to pivot from its monetary tightening.

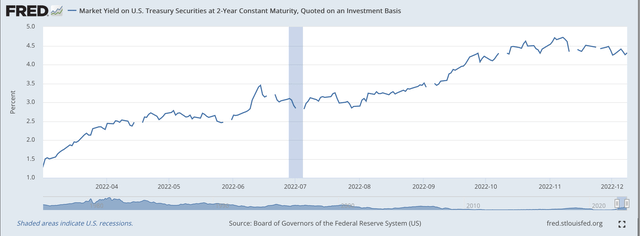

The yield on the U.S. Treasury note is now around 4.30 percent. This is down from a near-term peak of around 4,75 percent on November 7.

In early March, the yield on the 2-year note was about 1.3 percent.

Yield on 2-year U.S. Treasury Note (Federal Reserve)

Note that the upward movement of the 2-year yield has been much steadier, perhaps because it is more closely associated with the policy rate of the Federal Reserve, the Federal Funds rate.

Inversion Of The Yield Curve

During this time period, the Treasury yield curve became more and more inverted.

In early March, the spread between the yield on the 10-year note and the yield on the 2-year note was a “positive” 45 basis points.

On November 7th, the yield curve was inverted and the yield on the 10-year note was about 52 basis points “below” the yield on the 2-year U.S. Treasury note.

The Federal Reserve’s tightening of monetary policy seemed to be working and the bond market seemed to be projecting that a recession was somewhere in the future.

But, longer-term yields dropped off, and by the end of the past week, the yield spread was around a “negative” 80 basis points.

The probability of a recession in the eyes of the bond market had increased since early in November.

However, the cause of the decline seemed to be because the bond market was now expecting less inflation in the future.

Inflationary expectations dropped from around 2.60 percent compounded per year for the 10-year time horizon in early November to around 2.30 currently.

This is quite a significant drop!

The Change

It seems that in the last month, bond investors saw inflation dropping off substantially in the near future as the economy went into a mild recession.

That is, inflation was to drop off quite a bit while economic growth did not drop off much at all.

The very severe recession that many had been expecting was not going to happen.

With such a picture of the future, investors could see the Federal Reserve “backing off” earlier than many had predicted.

And, it such was the case, then the damage done to the stock market would end up being less than many analysts had originally expected.

But, it must be stated that the yield curve is not a perfect forecaster of recessions or the depth of recessions.

Many other analysts believe that the bond market does not have everything priced in.

If anything, they believe that the expectation that inflation will drop off as rapidly as implied in the market yields is “overly optimistic.”

Inflation just does not go away that rapidly.

Furthermore, monetary policy works slowly so that the “tightening effects” that have now been injected into the economy will take several months to have their full impact felt and so, the tightening effects will go on at least through the summer of 2023.

If the Fed fails to back off soon, the tightening effects will go on into the fall.

My Guess

It is my belief that we still have a ways to go.

First, I don’t think that inflation is going to reside as quickly as the bond market seems to think it will.

A major reason for this is that the economy is so deeply in disequilibrium that markets and sectors will be working out their dislocations for quite some time into the future.

Second, there is still so much money around that inflationary pressures will have the liquidity to find higher prices for some time into the future.

Furthermore, the Federal Reserve is not going to remove all the reserves it has so generously pumped into the economy over the past three years.

So, a lot of this liquidity is going to remain in the economy even after the Fed does “pivot.”

Third, inflation remains a problem around the world. We cannot discuss a lessening of inflation in the U.S. without commenting upon all the disequilibrium in the world today and the vast amount of money and debt that exists in foreign markets.

Conclusion: We still have a lot of unsettling times ahead of us, with inflation presenting lots and lots of difficulty as nations try to reach stability.

Be the first to comment