It’s A Steal! Just 11x FY12/22 revenue for SAIL.

Antonio_Diaz/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Zero Emotion Wins The Day, Every Day

If you manage large sums of money on behalf of the Retired Janitors of Idaho (other retirement schemes also are available) and have done so for a long time, nothing much spooks you. Your first rodeo was a long time ago and you’ve ridden maybe 10 rodeos since then. Market goes up, market goes down. Market down? Buy stuff. Market up? Sell stuff. In between raise more money from the janitors, send them a boatload of money back every few months, and along the way, keep a couple bucks for yourself to buy, you know, a new Honda every now and then. Keeping it on the down low. Like that.

Your advantages in the market are, one, you manage a wall of other people’s money and they pay you for the privilege; two, your time horizon is different to public market investors who are marked to market every day, every quarter, every year; and, three, you don’t spook easily whereas most public market investors spook real easy which is why the market is crazier than an angry hyena most of the time.

Today’s sale of SailPoint Technologies (NYSE:SAIL) to the Retired Janitors of The Transamerica Pyramid is in our view an exceptionally well-judged purchase. At a time when most everyone is convinced that the market is headed for the abyss, SAIL shareholders were just offered an all-time high price, in cash, with little or no regulatory risk from here to completion, and probably limited opportunity for a better bid to come along. What’s not to like? … wonders Joe P. Retail and his luckier cousin Sam T. Smallcap, who used his family connections to snag a small job at a big insurance company a while back and was given a bunch of never-heard-of-them software company portfolios to manage because “he knows technology,” being under the age of 65. “Woot!” said both Joe and Sam to each other in their DMs today (don’t tell Sam’s Compliance Officer, who has told Sam to quit with the untracked messaging platforms at least seven times). “All Time High Baby, Yeah!! Sell!!!”.

See If You Can Guess How The Buyout Offer Price Was Calculated By The Buyers (TradingView, Cestrian Analysis)

Now, we don’t know, but we would speculate, that the folks not saying “Woot,” because they are better controlled than that, but who are certainly thinking, “Woot”, are, Thoma Bravo, their investors (once they see the deal presented for their delectation), and those members of the SAIL management team who will be staying with the private company, loaded up on newly-created incentive equity, and working extra hard for the next three years to pay down the big ol leveraged loans and then collect the big ol payday when the whole shebang – after it’s rolled up with a buncha other cybersecurity plays, made to make 30% unlevered pretax free cashflow margins at way bigger scale – is sold to whichever slow-on-the-uptake corporate who decides in 2025 that, you know, cyber is gonna be big and they need to get into it, big style. Raytheon maybe, who by then will be lamenting the sale of their ForcePoint unit. Or Lockheed Martin (LMT) which will have been neurolinguistically programmed into believing that cyber is the new frontier.

We called Buy on SAIL in our Growth Investor Pro service some time back. And we moved to Sell in Growth Investor Pro earlier today. And then in staff accounts we sold our SAIL positions because Mr Market cares not a fig what we think, so, might as well take the money, because last time we looked, squealing “Hey, That’s Too Cheap Buster” when you own like three shares isn’t likely to result in a better outcome. So we have some nice gains in the back pocket as do any of our subscribers who followed the Buy and Sell ideas.

We still think it’s too cheap a sale though. Here’s how you can see that SAIL shareholders have allowed their emotions to get the better of them (we assume, safely we think, that this deal will complete).

SAIL is in the process of moving from an upfront revenue model to a subscription model – we’ve talked about it in previous Seeking Alpha articles and we don’t propose to bore you on the topic yet again. (Although, newsflash, keep your eyes on Splunk (SPLK) to repeat the SAIL trick, for the same reasons). You can read our notes on SAIL here, and on SPLK here.

Here’s the numbers.

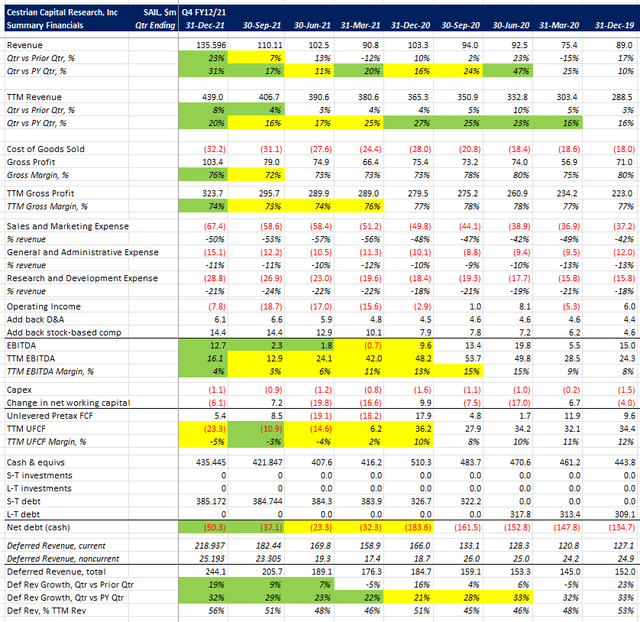

SAIL Financials I (Company SEC filings, YCharts.com, Cestrian Analysis)

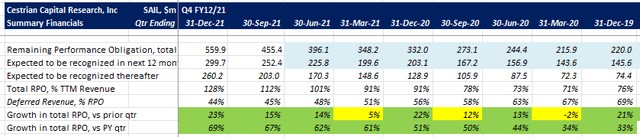

SAIL Financials II (Company SEC filings, YCharts.com, Cestrian Analysis)

The key points are:

- Recognized revenue growth is accelerating, on the fast-twitch quarterly line and the slow-burn TTM line.

- Remaining performance obligation – the total forward contracted book of business – is on fire, growing at 69% vs. PY and that book of business represents 1.3x TTM revenue so that is a big ol chunk of change rolling in the front door in the future.

Know who never bothers to look at RPO? Joe P. Retail and Sam T. Smallcap. Too hard. Not in the earnings release. You have to CTRL-F the 10-K or 10-Q or, God[s] Forbid, read the dang 10-Ks or 10-Qs. Yikes. Too difficult. Best look at EPS instead, that’s in the release, and, you know what? It’s negative. Unprofitable tech. Bad. Sell!

You know who spends a lot of time looking at RPO? The retired janitors. If you look at companies formerly owned by the janitors, RPO is used front and center as bragging rights. Dynatrace (DT) being the poster child. And Dynatrace was forged from many bodies corporate in a crucible in the basement of… the Transamerica Pyramid. C’mon Joe and Sam, do the work properly – know your buyer!

Oh and it gets better (for the buyer).

- Accounting profit in the form of EBITDA just turned positive – that means the thing can be levered all the way to Berkeley, and…

- Unlevered pretax free cash flow is likely to turn positive very soon in our view, which means servicing the newly-assembled big ol pile of acquisition loans will be no problemo.

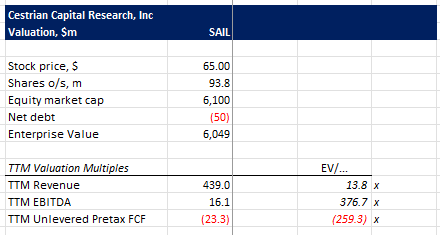

The headline price is $65/share which is equivalent to 13.8x FY12/21 revenue.

SAIL Valuation Analysis (Company SEC filings, YCharts.com, Cestrian Analysis)

Stock market mavens everywhere will scream “Sell! TAKE THE MONEY DUMMIES!” But, look at it. Remember that this thing is about to become cash generative. Remember that 1.3x last year’s revenue is already contracted for the future, and remember that the contract book is growing at 69% p.a.. And then remember that the deal won’t close until the second half of 2022.

Then let’s speculate that growth continues to accelerate – fueled by that RPO we talked about – such that by the 30 June 2022 quarter, TTM revenue is growing at say 25% pa, which would mean TTM revenue of $488 at that point. So right away your price is down to 12.5x TTM revenue at closing time. And then bear in mind that for leverage purposes, buyout shops work on a current year basis ie. it’s the FY12/22 number that will be underpinning the valuation. So even if growth remains at 25% for all of FY12/22, which we think is conservative, that means FY12/22 revenue of $549m, so now your EV of $6bn is just 11x TTM revenue, for a soon-to-be cash generative business growing revenue at 25% p.a. with more than a year’s revenue for FY12/23 already in the bag.

And that ladies and gentlemen is worthy of a “Woot!” But in the buyer’s breakout room, not the sellers’.

We predict with some confidence that this will prove to be a wonderful deal for Thoma Bravo’s investors and for SAIL management. We think SAIL shareholders are selling out way low. That’s their lookout of course – who knows, maybe this whole thing is about to crash faster than the firmware in the Fed’s money-printer and our bullishness will prove to be misguided nonsense. But our take? The buyers have it here. And we expect to see more buys like this take place. Again – look to Splunk next, maybe NewRelic (NEWR) too. So you have to ask yourself – if the barbarians running $100bn of retiree money are buying, and Joe P. Retail and Sam T. Smallcap are selling, who do you want to run with? The big dogs? Or the small fellas? We will say it again. Don’t be like Joe P. Retail – or Sam T. Smallcap. Be like Big Money. Zoom out, be bold, control emotion, and if you see something you think is a bargain? Do the work. Do the work again. Still look like a bargain? It probably is a bargain because everyone is too scared to look for bargains right now.

We’re now at Sell on SAIL because… well, might as well take the money.

Joe and Sam are at Sell on most things they own.

We’re at Buy on most of the tech names we cover.

Big money is hunting for bargains, and finding them.

Your move.

Cestrian Capital Research, Inc – 11 April 2022.

Be the first to comment