franckreporter/iStock via Getty Images

This week is going to be a market tester.

Investors seem to be more convinced that the Federal Reserve is really going to be serious about tightening up the loose strings of its monetary policy.

The impact: first, rising interest rates.

Second: falling stock prices.

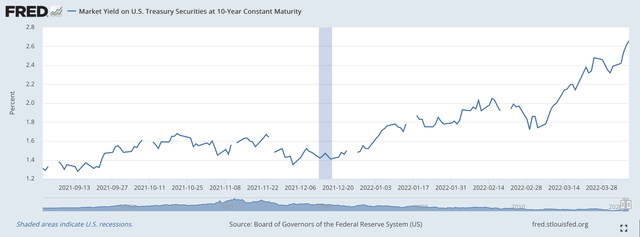

Monday morning, April 11, the yield on the 10-year U.S. Treasury note opened close to 2.80 percent.

Only one week ago, the 10-year was around 2.40 percent.

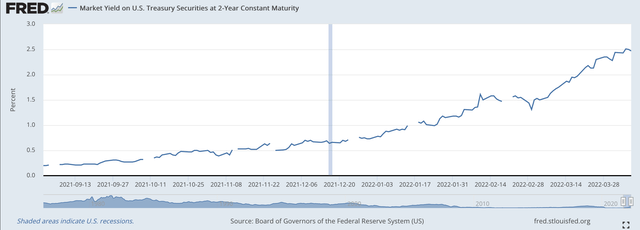

As for the 2-year Treasury note, the yield on Monday morning April 11, was 2.60 percent, up from around 2.45 percent, one week ago.

Much of last week saw Federal Reserve officials talk up about how the Fed was going to raise rates this year, and even talked about several 50 basis point increases.

The immediate reaction on the part of stockholders was to take tech stocks, very sensitive to where interest rates are, to lower prices.

This movement is expected to continue this week as Treasury yields are expected to continue to rise.

How far this decline in stock prices impacts all stocks is another question, but the general feeling is that stock prices are expected to continue to fall.

The Fed appears to be moving to tighten, and it seems serious in its intent.

Real Rates Of Interest

The real problem analysts see, however, is that the real rate of interest, the nominal rate of interest minus the current rate of inflation, remains negative.

With inflation up above 5.00 percent, by almost every measure you look at, a yield of 2.80 percent does not seem to be very restrictive.

So where are nominal interest rates going to go?

yield on 10-year U.S. Treasury note (Federal Reserve)

I have been using September 1, 2021, as the date that the Federal Reserve really got serious about raising its policy rate of interest. On September 1, 2021, the Fed began to hole the effective Federal Funds rate constant at 0.08 percent.

The Fed held this rate constant until the middle of March.

As you can see, not much happened to yield on the 10-year Treasury up until the first of January in 2020. This is where investors really got with the Fed and the Fed’s effort to tighten up its monetary policy.

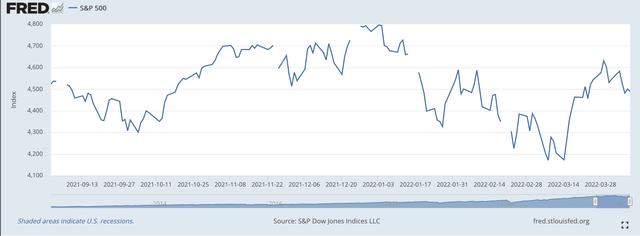

On January 3, 2022, the Standard & Poor’s 500 Stock index hit its last historic high and began to decline.

As we can see from this chart, the yield on the 10-year Treasury note really began to rise.

Taking a look at the yield on the 2-year U.S. Treasury note we observe a similar pattern, although much more rapid in its increase.

Yield on 2-year Treasury note (Federal Reserve)

On April 1 and April 4, the yield on the 2-year security actually closed at a higher rate than what was achieved on the 10-year security.

That is, the term structure inverted.

To many analysts, this was a sign of a potential economic recession might take place in the near future.

That spread has turned back to a positive number, but the term structure curve remains relatively flat.

Now, What Happens?

So, where do these interest rates go from here?

Well, the best guess is up!

And, for many, in the current environment, the up, in order to fight inflation, must be rather significant.

Hence, the call for the Fed to make several 50 basis point moves in its policy rate of interest.

That could be a pretty hefty effort.

A lot could happen on the way to these higher rates.

And, what is going to happen to the stock market?

Here is what has happened since September 1, 2021.

Standard & Poor’s 500 STock Index (Federal Reserve)

Note, that the S&P 500 peaked on January 3, 2022.

Note, too, that the latest rise in the S&P 500 came at the time the Fed announced that the FOMC had just raised the target range of the Federal Funds rate.

The stock market rose after this announcement???

Yes, the immediate reaction to the Fed’s announcement was that investors did not really seem to believe that the Fed was really going to tighten up its monetary policy.

And, so we get the jump in stock prices.

This is when Fed officials began to flood the news with statements supporting the announced policy statement and started talking about making 50 basis point changes in the policy rate of interest, not just 25 basis point increases.

As can be seen, the stock market eventually began to decline.

That is where we are today.

The Future?

Right now, it seems as if the Fed is really going to continue to raise its policy rate of interest and will, in May, begin to reduce the size of its securities portfolio.

But, and this is what investors want to know right now, just how far is the Fed going to go.

Fed Chair Jerome Powell and the Board at the Federal Reserve seem to be overly concerned about not making a policy error.

Consequently, Mr. Powell and his colleagues have constantly erred on the side of being too loose.

So, will this tendency continue during this time of monetary restriction?

Remember, the interest rates discussed above are going to have to exceed the real rate of inflation in the economy for policy to really be considered restrictive.

The point to watch is when stock prices really start to drop.

What will the Fed do?

Will the Fed back off and stop its tightening?

Or, will it “stay the course,” like Paul Volcker did when the Fed tightened up on monetary policy in the early eighties?

Right now, this is what investors have to look out for.

I think we are in for some sensitive times.

Be the first to comment