ronniechua

Introduction

“This time is different” are supposed to be the four most dangerous words on the stock market. It may be true with regard to risk management, but it certainly applies to economic cycles. While a lot of economic cycles are alike when it comes to GDP growth, the underlying factors are always different. That makes back-testing economic scenarios so difficult.

In this case, we’re dealing with slowing economic growth. That has happened a “million” times before. However, in this case, it’s on top of ongoing supply chain problems and high inflation. Moreover, unlike high inflation in the early 2000s, this time it isn’t caused by an accelerating economy in China. To make things worse, the Federal Reserve likely isn’t about to help the economy. No, it is doing everything in its power to crush demand as that’s the easiest way to get inflation down.

Hence, on the one hand, we’re dealing with a market that isn’t expected to get any Fed support – at least not anytime soon – while it needs to be seen how successful the Fed can fight inflation.

On the other hand, every investor knows that if the economy gets too bad, the Fed will probably have to act.

The result is a very tricky investing/trading environment, which we will discuss in this article.

So, let’s get to it!

It All Started In 2020

For the sake of simplicity, we can ignore everything that happened before 2020 – for now. As everyone knows, the world was hit by bad news at the start of 2020 when a novel virus became a global pandemic.

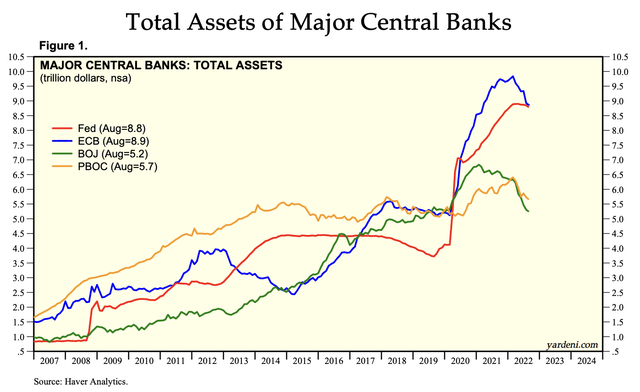

Almost immediately, countries around the globe started to lock down while engaging in both fiscal and monetary stimulus. The graph below shows what happened to the balance sheets of the world’s major central banks. We were dealing with an unprecedented easing of monetary conditions. Combining the central banks below, their assets rose from roughly $20 trillion in early 2020 to more than $31 trillion in early 2022. That’s an increase of more than 50% in roughly 2 years!

On top of that, governments started spending like there was no tomorrow. This includes direct stimulus checks of $1,200 in April 2020, followed by more direct cash in early 2021.

In mid-2020, the first countries started to reopen. People had figured out that COVID wasn’t the end of the world and that life would continue, albeit with restrictions in many areas.

The problem was that supply chains were broken. Companies did not reorder new products as nobody could predict demand. Inventories were empty and demand came back roaring. Moreover, because of stimulus, an increasing amount of money was chasing a lower number of products. The result was inflation.

There was a shortage of energy commodities, metals, finished products, electronics, you name it. Global transportation chains were suffering as too many containers were meeting a limited number of ships. On top of that, China locked down again, causing supply to weaken again.

And, to make things worse, a lot of commodities are seeing structural shortages. Oil and gas, for example, are seeing subdued supply growth as I wrote in this article (and many others).

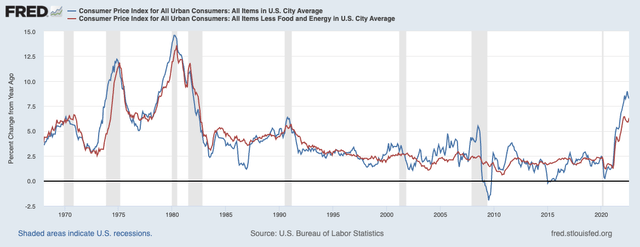

The result of everything mentioned above can be seen below. Consumer prices in the US are now 8.2% higher compared to August 2021. Core inflation (adjusted for volatile food and energy prices) is at 6.3%. That’s more than three times the Fed’s 2% target.

Inflation is now so hot that it dwarfs the inflationary trend prior to the Great Financial Crisis. The closest thing we have to compare this to is the inflationary wave in the 1970s and 1980s, which also had its roots in supply chain issues.

The Fed: Hawkishness Followed By Dovishness

It gets worse as high inflation and ongoing supply issues are hurting economic demand.

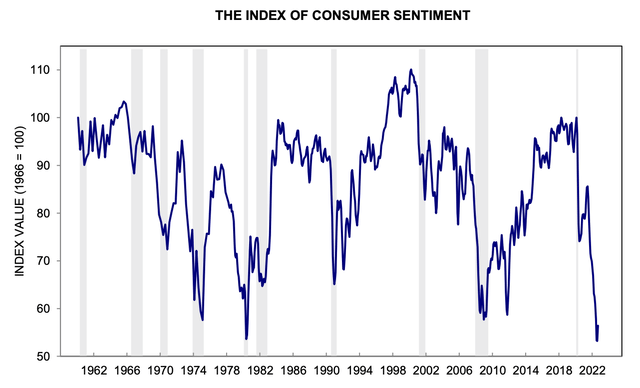

For example, consumer confidence is now at levels well below the Great Financial Crisis lows. Given that consumer spending accounts for more than 68% of nominal GDP in the US, that’s a big issue. That said, it’s always a problem when poorer households struggle to make ends meet.

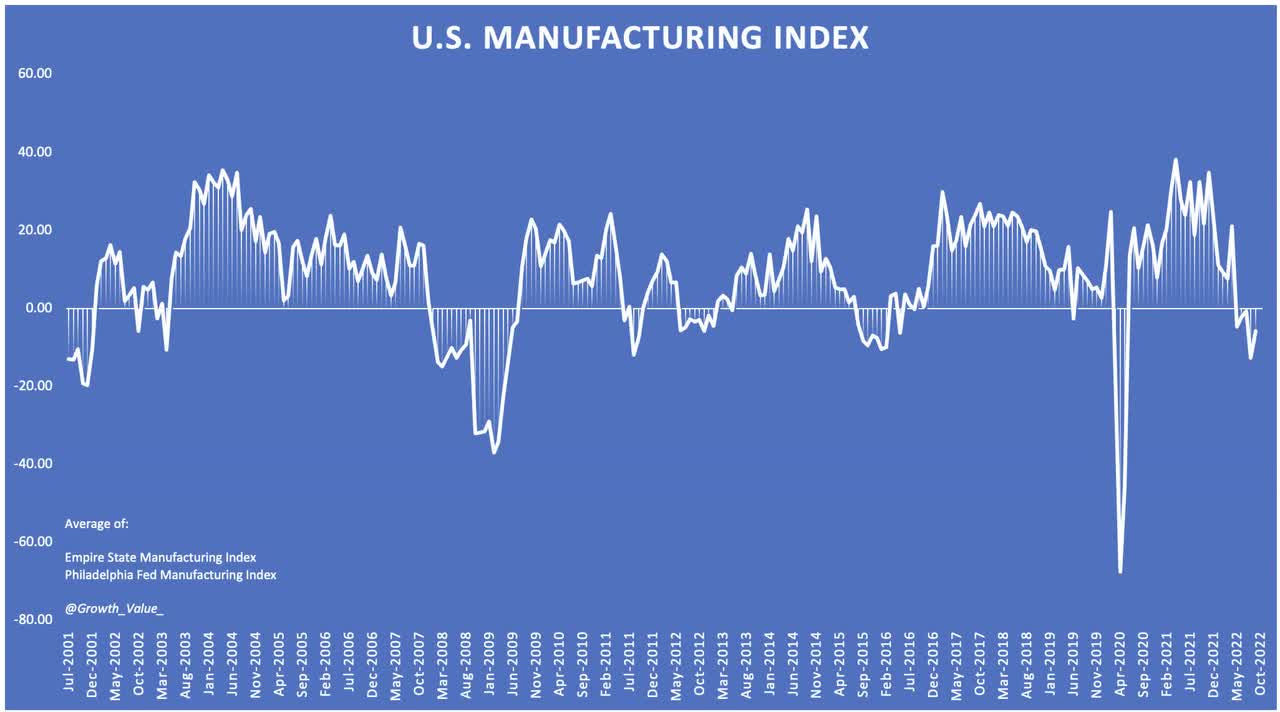

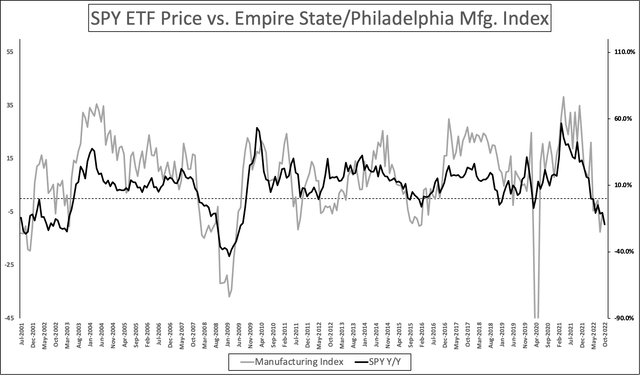

On top of that, but highly related, manufacturing sentiment is weakening as well. As I discussed in a recent article, the risks of a manufacturing recession are rising as both the Philadelphia Fed and the New York Fed show that manufacturing sentiment is now in contraction territory.

Author

While economic slowing cycles are bad, in general, this one is worse as the Federal Reserve is not expected to come to the economy’s rescue. After all, it has a job to do, which is to contain inflation.

Earlier this month, Wells Fargo (WFC) hit the nail on the head:

Federal Reserve Chair Jerome Powell gave a forceful speech in Jackson Hole, WY, on August 26 in which he emphasized that the FOMC’s “overarching focus right now is to bring inflation back down to our two percent goal.” In our view, the FOMC does not want to put the economy into recession. But it appears willing to risk one in order to bring inflation back down to the 2% target.

As inflation has deep supply roots, the Fed is in a pickle, to put it mildly. The Fed cannot influence supply directly. It can, however, hurt demand. In other words, the Fed needs to somehow slow demand with tighter monetary policy without risking a (deep) recession.

According to Jerome Powell at Jackson Hole (via Wells Fargo):

Restoring price stability will likely require maintaining a restrictive policy stance for some time.

Reducing inflation is likely to require a sustained period of below-trend growth.

Fast forward to this week when the Federal Reserve hiked by another 75 basis points to the new target range of 3.00% to 3.25%, Bloomberg ran a headline that perfectly sums up the bigger picture and the market reaction afterward.

Seema Shah of Principal Global Investors said that:

Powell’s admission that there will be below-trend growth for a period should be translated as central bank speak for “recession”.

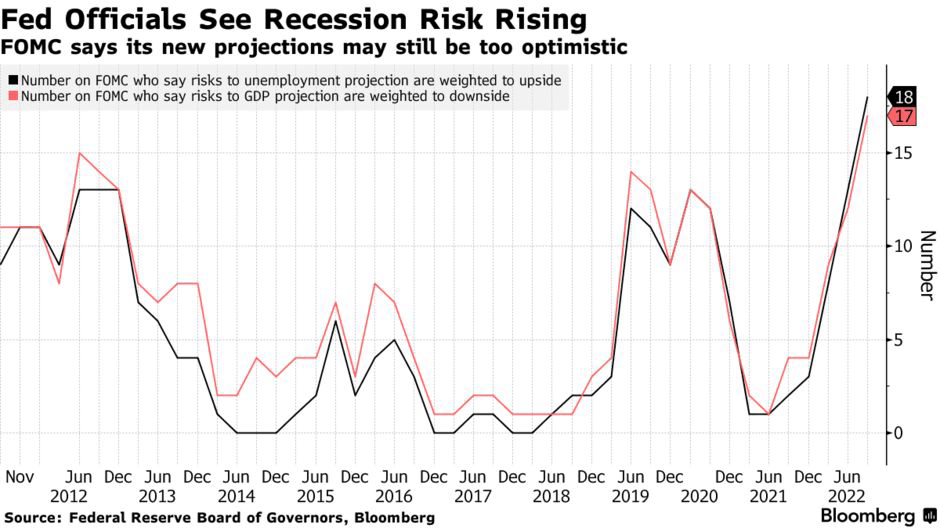

While the Fed isn’t explicitly projecting a recession, the outlook from Fed officials paints a somewhat dark picture, making a so-called “soft landing” quite impossible in my opinion.

Bloomberg

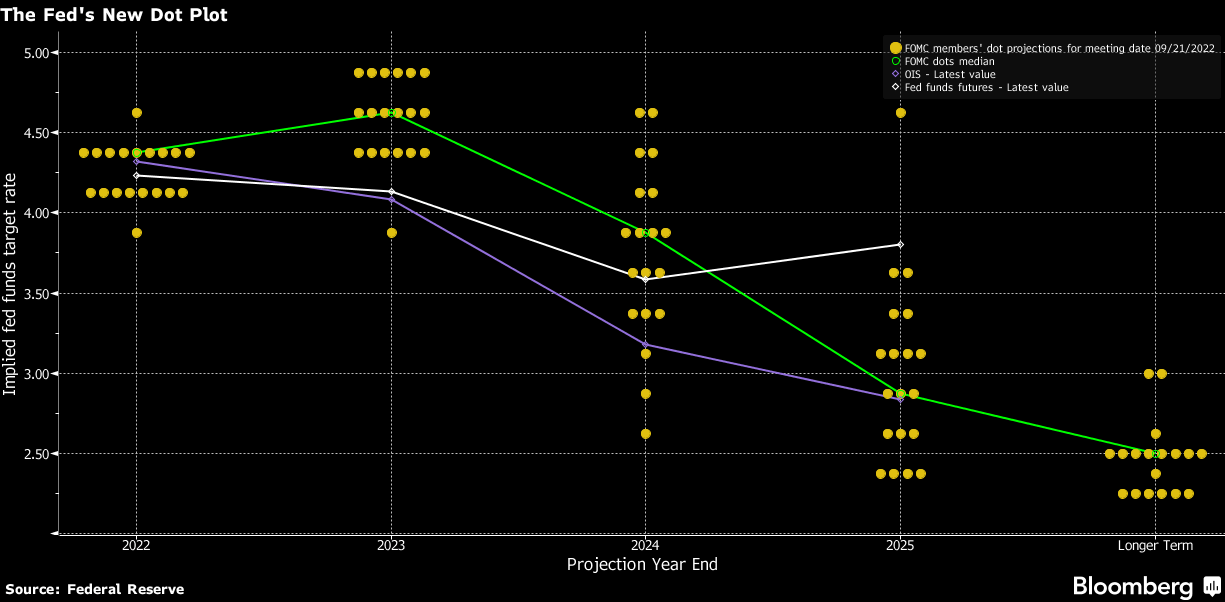

The median unemployment forecast among the 19 Fed officials is now 4.4% for both 2023 and 2024. That’s up from the current 3.7% rate. Moreover, the projected interest rate path is now more hawkish than previously expected as the dot plot below shows:

Bloomberg

The same is happening now among sell-side participants (investment bank analysts). Bank of America (BAC) sees a 75 basis points hike in November, a 50 basis points hike in December, and two 25 basis points hikes in early 2023. Amherst Pierpont Securities now sees a terminal rate of 5.25%.

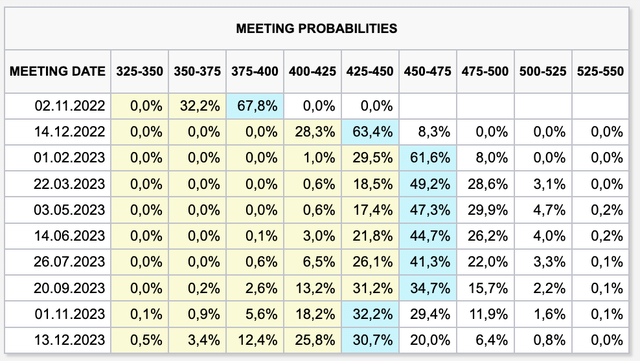

Looking at Federal Funds futures below, we see that the implied terminal rate is 4.25% to 4.50%, which is expected to be hit in early 2023, followed by a rate cut in late 2023 as these numbers imply that the Fed will be forced to react to weakening economic growth. Please bear in mind that these expectations are subject to change. If inflation remains higher than expected, we will likely see a temporary shift towards a terminal rate close to 5.00%.

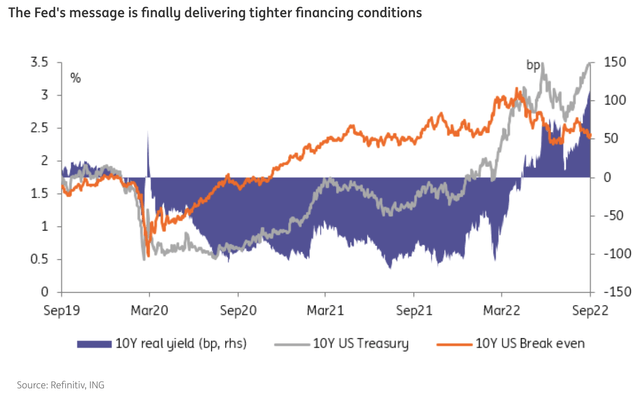

ING shared my comments that the dot plot is important, but not critical as expectations vary over time.

The Fed’s dot plot does print a longer-run rate at 2.5%, which is deemed to be their neutral rate, and is broadly where the funds rate is now. So the 75bp hike, when delivered, moves the policy rate into a tightening stance for the first time in this cycle. The calls for 100bp area partly premised on the notion of pitching the funds rate 1% tight versus neutral in one go. But 75bp also tightens policy reasonably aggressively, and avoids unnecessary market consternation with respect to future intentions.

Moreover, the Dutch bank agrees that the Fed will start to ease in 2023, based on good arguments that perfectly fit my own outlook.

We think the Fed could swing aggressively to policy easing in 2H 2023. The average period of time between the last rate hike in a cycle and the first Federal Reserve rate cut has averaged just six months over the past 50 years. Given the risks to growth and the potential for lower inflation, we are forecasting rate cuts throughout the second half of 2023 with our best guess for where the Fed funds rate ends the year being 3-3.25% – more than 100bp below where the Fed is indicating.

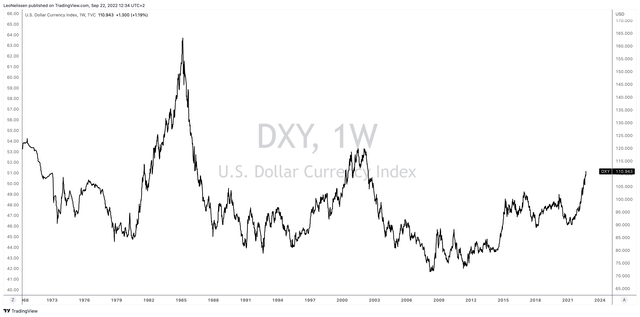

We also need to talk about the dollar (index) working its way up to 110 as it even broke parity versus the euro.

The euro, the biggest component of the index is getting crushed as Europe isn’t just dealing with cyclical economic weakness, but an unprecedented energy crisis that is set to do lasting damage to its industrial and chemical heart. This is very bullish for the dollar.

On top of that, the hawkish Fed draining liquidity from the system is also bullish as higher dollar demand meets declining dollar supply.

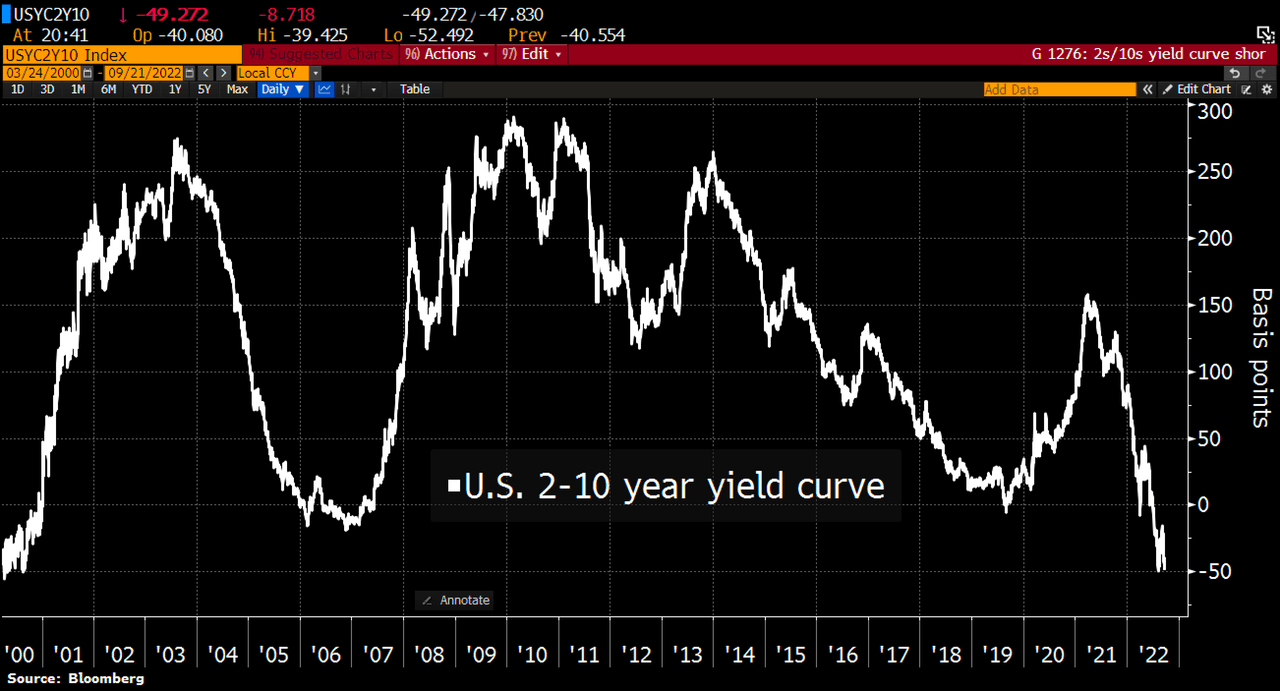

This is now bringing back memories of the 1980s (for people who were trading back then). Back then, Paul Volcker was at the helm of the Fed. He, too, had to deal with massive yield curve inversion as he sent the economy into a recession while the dollar soared.

The current yield curve is the most inverted since the start of the century, indicating high recession risks (as longer-term bonds are yielding less than shorter-term bonds).

Bloomberg

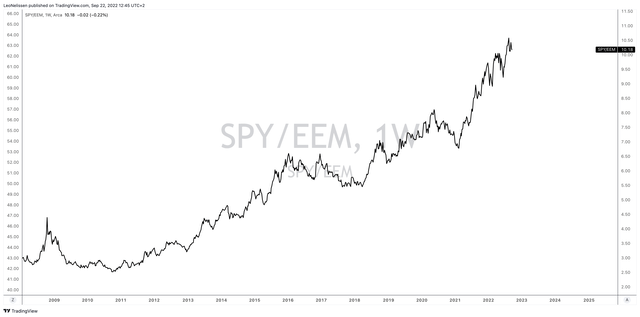

Moreover, despite strong commodities, the higher dollar is causing US stocks to hit new highs versus emerging markets as the chart below shows (S&P 500 versus emerging markets ratio). A strong dollar hurts companies and countries that have dollar-denominated debt. It’s basically a global wrecking ball as it hurts emerging markets and US exports. In other words, a stronger dollar is a “nice” bonus for the Fed as it is pressuring demand.

With all of this in mind, here’s how I’m dealing with this market.

Game-Plan

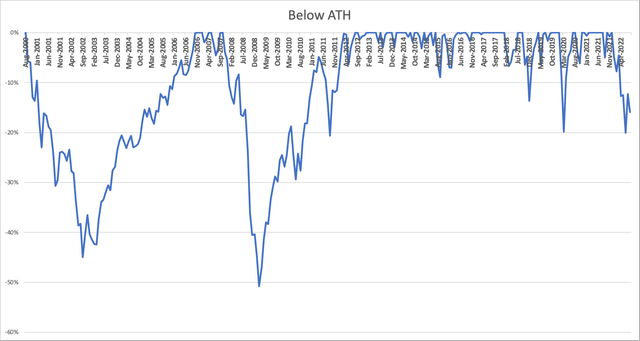

The market is roughly 20% below its all-time high.

Using monthly closing prices, it’s the worst sell-off since the pandemic crash.

The good news is that a lot of weakness has now been priced in when comparing the performance of the S&P 500 to the aforementioned manufacturing surveys from the Philly and New York Feds.

At this point, I still have roughly 94% of my entire net worth invested in the stocks listed in my Seeking Alpha bio. I have sold zero shares during the downswing and I won’t sell anything regardless of how far stocks fall.

My strategy is simple. I have increased my savings rate a bit to make larger investments while I am gradually adding to positions using my dividends.

I am especially looking to buy great stocks in beaten-down industries like housing (and related) where I’m aiming to buy more Home Depot (HD) and initiate a position in Extra Space Storage (EXR). For more information on my housing view, I just finished an in-depth article on housing, which you can read here.

After talking to my contacts who work with people with much better intel than myself, I get that the Fed is likely going for a quick and painful hiking cycle over a slow one. So far, it’s looking to be the case. If the Fed crushes demand on a short-term basis, it could technically pivot in the first half of 2023 (instead of the second half, which is the consensus as I discussed in this article).

I believe this strategy would come with a political benefit. The economy could potentially be on an upswing going into the next General Election cycle in the United States, which would benefit Democrats. After all, economic woes on top of high inflation (I know these are related) are toxic for the incumbent party.

Unfortunately, this comes with new risks as easing will come with a rebound in demand. So far, commodities markets are not prepared for that as I discussed recently. It could trigger a prolonged period of higher and lower inflation compared to the 70s. Hence, I would also advise investors to incorporate high-yield in dividend portfolios as I discussed in this article.

If I absolutely had to give a price target, I would say the market has about 10% more downside until the Fed gets worried.

However, as I already said, the best way to play this is to remain calm. Be prepared for more downside and work on a list of stocks you like. Look for valuations where you would want to buy these stocks and slowly use weakness to build your portfolio, which will be a big benefit when stocks enter a new bull market.

Takeaway

In this article, we discussed the current economic situation, which is a mix of interrelated issues like economic growth slowing, persistent inflation at too high levels, and a Fed eager to fight inflation.

This week’s press conference and 75 basis points rate hike show that the Fed is sticking to its strategy. The bank is likely looking to soften demand in order to fight inflation, even as it is already adjusting its expectations for higher unemployment.

As a result, it now seems that the hiking cycle will be more hawkish than previously expected with risks of the terminal rate breaching 5.00%.

Hence, a recession in 2023 is now a base case.

Moreover, the base case sees rate cuts in the second half of 2023 as the Fed probably won’t be able to keep hiking if economic fundamentals are too weak. I agree with that. However, I expect the Fed to pivot in the first half of the year as I see a steeper hiking cycle than the consensus.

I also believe that inflation will come back roaring once the Fed pivots.

My strategy is unchanged. I have a list of existing holdings and stocks I want to buy. I have increased my savings rate to buy larger positions on weakness. While stocks have priced in a lot of weakness, I believe we could see more downside before the Fed is forced to change its course.

If people own stocks they are comfortable holding in tough economic times, I think there really isn’t a lot to worry about.

So, to end this article, here’s a quote from Bobby McFerrin with “Don’t Worry, Be Happy”.

(Dis)agree? Let me know in the comments!

Be the first to comment