Luke Sharrett

Introduction

Readers who have been with me for a while won’t be shocked by what I have to say next: I bought more Norfolk Southern (NYSE:NSC) shares for my dividend growth portfolio. In April, I wrote that the company was in troubled waters due to economic weakness. Back then I suggested that investors break up investments to buy in intervals. Right now, the stock is more than 10% below levels in April, which means I listened to my own advice and bought more.

In this article, I will once again look at NSC from a dividend-growth investor’s point of view and dive into current economic developments, the company’s better risk/reward, but also the biggest potential risks as well as analyst opinions.

At the end of this article, you will understand why I bought more and be in a better position to decide if this Atlanta-based railroad is the right fit for your strategy.

Buying Supply Chain Dividends

I like businesses that dominate certain supply chains and or the segments they operate in. I own three railroad stocks: Union Pacific (UNP), Canadian Pacific (CP), and Norfolk Southern because this gives me coverage of the West, the East, Canada, and Mexico.

In the case of Norfolk Southern, it dominates everything between the Midwest and East Coast with its Florida-based peer CSX Corp. (CSX).

Norfolk Southern

Headquartered in Atlanta, Norfolk moves most of its freight on the following routes:

- New York City area to Chicago (via Allentown and Pittsburgh)

- Chicago to Macon (via Cincinnati, Chattanooga, and Atlanta)

- Central Ohio to Norfolk (via Columbus and Roanoke)

- Birmingham to Meridian

- Cleveland to Kansas City

- Memphis to Chattanooga

The company has no operating rights in Florida (beyond the border part with Georgia). However, it has trackage/haulage rights, so it’s not uncommon to spot an NSC train in the Sunshine State – besides what is known as “foreign power”, of course (railroads borrowing each other’s engines).

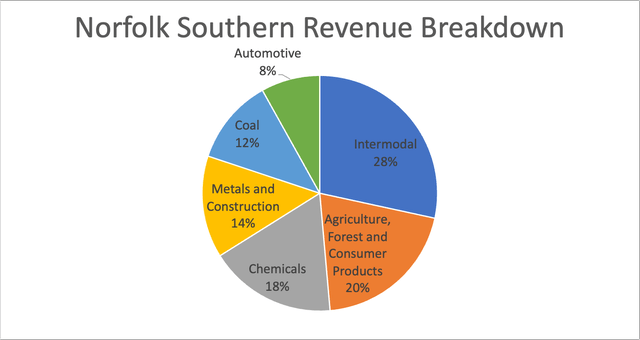

Anyway, what makes Norfolk Southern special is its focus on intermodal. It generates roughly 28% of its revenues in intermodal. Norfolk Southern is the second-largest intermodal railroad behind Buffett-owned BNSF.

Coal has shrunken to just 12% of total revenues, which means that like its major peers, it’s not a coal play anymore like it was in the 20th century and the first years of this century.

Author (Norfolk Southern)

It’s now an industrial/consumer play. Higher industrial growth and consumer demand automatically translate to higher freight revenue if we ignore the somewhat limited competition. Norfolk remains a “macro play” thanks to its relationship with economic growth. I will elaborate on that in this article.

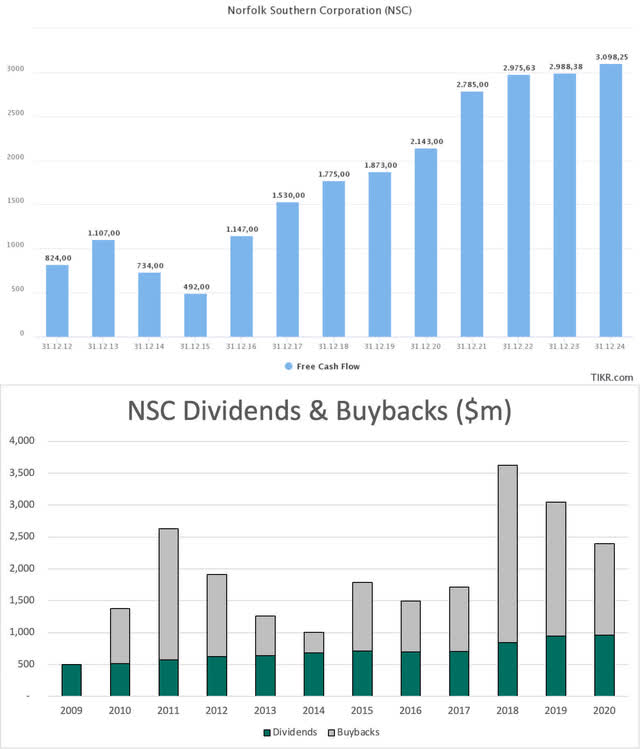

One of the factors that got me to invest in railroads is the fact that they generate high free cash flow. This used to be different in the early years of this century (and prior to that) as capital investments were high.

Capital investments are still high, but not relative to what these railroads make in terms of free cash flow.

Free cash flow is basically net income adjusted for non-cash operating items (operating cash flow) minus capital expenditures. It’s money a company can spend on dividends, buybacks, and debt reduction without having to worry that it impacts its day-to-day operations.

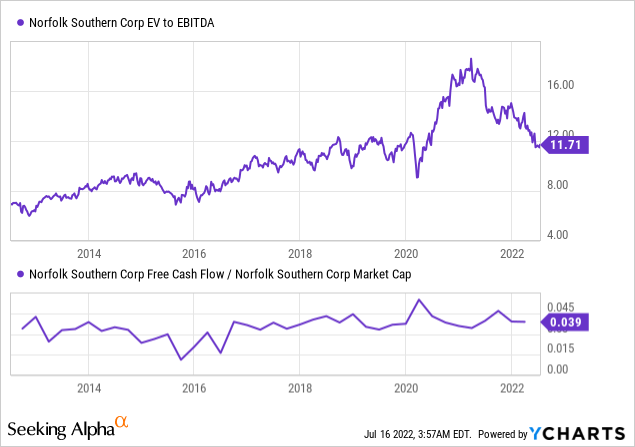

The charts below show that the company did roughly $1.1 billion in free cash flow in 2016, the first year after the 2014/2015 manufacturing recession. This year, estimates are that NSC will do $3.0 billion in FCF – despite ongoing economic difficulties. The lower part of the chart below shows what NSC spends its money (FCF) on.

TIKR/Author

While dividend growth has been steady, the company spends its excess cash on buybacks. Buybacks are favored by the tax system as dividends are taxed on multiple levels. Moreover, buybacks are flexible. While a dividend isn’t officially a commitment, it feels like a commitment. Investors tend to dump stocks that cut dividends. Cutting dividends is also a sign of defeat. It’s like a military retreat for the lack of a better example.

Hence, companies are gradually building the dividend while using buybacks to “get rid of” excess cash, which benefits shareholders as well due to a lower share count. It enhances the value per share.

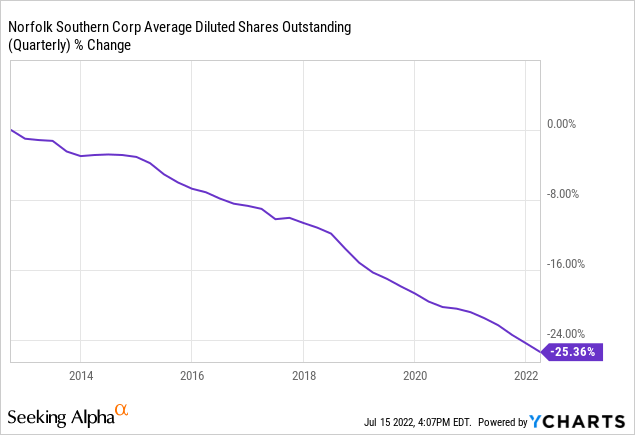

Over the past 10 years, NSC has bought back one in four outstanding shares. During the past 5 years, the number of diluted shares outstanding has dropped by 17%.

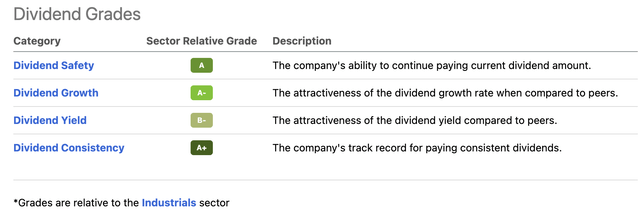

With regard to the dividend, the company has one of the best dividend scorecards in its industry. According to the scorecard provided by Seeking Alpha, the company scores very high (compared to industrials) on safety, growth, and consistency. Its yield is a B minus.

Seeking Alpha

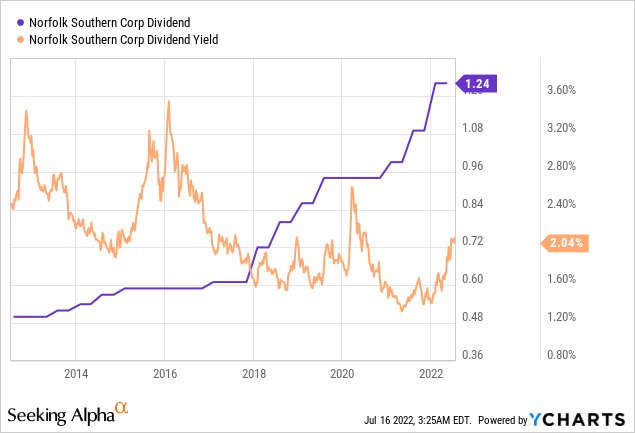

Norfolk Southern is paying a $1.24 dividend per share per quarter. This translates to $4.96 per year or 2.2% of the company’s stock price. This is now back to “normal” levels if we exclude spikes during steep sell-offs and the recent slump caused by an outperforming stock price.

Over the past 10 years, the dividend has been hiked by 150%.

The most “recent” dividend hikes are listed below:

- January 2022: 13.8%

- July 2021: 10.1%

- January 2021: 5.3%

- July 2019: 9.0%

Dividend safety – as the scorecard indicated already – is fantastic. If the company can do $3.0 billion in free cash flow, it translates to an implied yield of 5.5%. This covers the 2.2% dividend with a wide margin and paves the way for both buybacks and debt reduction.

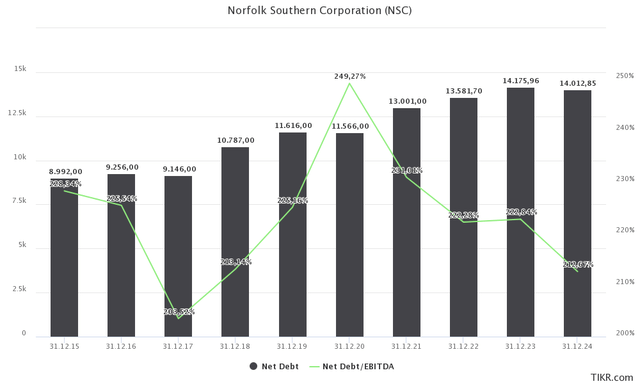

The reason why Norfolk is buying back shares so eagerly is that its debt is sustainable. The company is expected to end this year with $13.6 billion in net debt, roughly 2.2x EBITDA.

TIKR.com

In 2021, S&P affirmed Norfolk Southern’s BBB+ rating with a stable outlook.

The Valuation

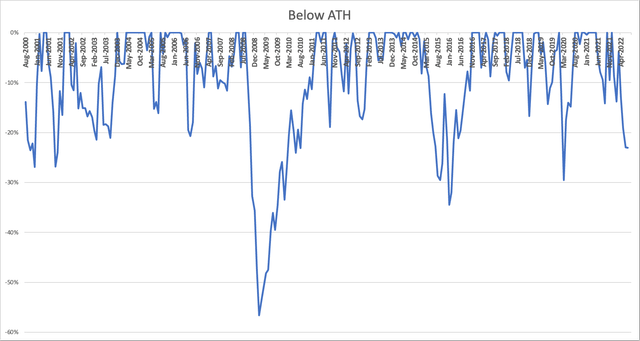

Norfolk Southern is roughly 23% below its all-time high, which makes it one of the steepest sell-offs in recent years. The 2020 pandemic sell-off was worse. The 2014/2015 manufacturing sell-off was also more violent.

Author (NSC drawdowns from all-time high)

While it’s hard to call for a bottom, I agree with Stifel analyst Nolan who noted that a lot of rail stocks have fallen further than they deserve (Seeking Alpha news).

The note pointed to the 2006-2009 cycle as a contrasting point, with the rail freight market remaining far more elastic in the prior period. Additionally, demand remains stronger with valuations likely to hold up better than in the prior recession, especially as higher fuel prices drive share gains over trucking.

As such, the recent selloff in rail stocks is overdone for many of the names, in Nolan’s view.

“Rail equities have re-rated and are now at much more attractive multiples relative to what had been anticipated,” he wrote. “While we are generally making cuts to estimates on lower growth and higher [operating ratios], given the substantial selloff in equities and our view for a modest recession impact on the rails, we are upgrading some of the cheapest names.”

I agree with this. Unlike in the manufacturing recession, pricing isn’t a big issue now. Commodities remain strong, the trucking market is extremely tight, fuel prices are likely to remain high, and the war in Ukraine benefits US export of commodities like grains, coal, and related.

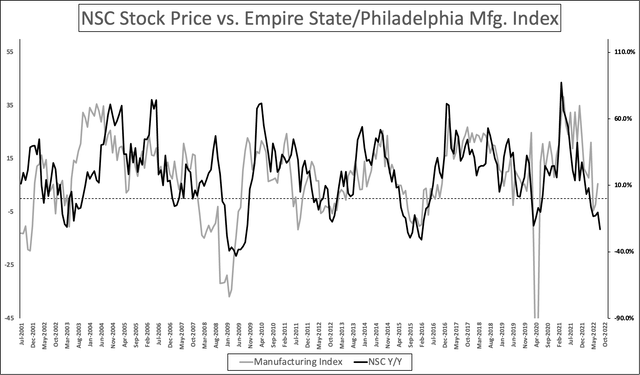

Needless to say, intermodal weakness and general economic headwinds are reasons to be cautious. Hence, it helps that NSC has priced in a lot according to the graph below.

Norfolk shares have priced in a lot of manufacturing weakness as prices fell in lockstep with the manufacturing sentiment. According to the latest data, it looks like manufacturing sentiment could catch a break, which would add to the attractiveness of NSC shares.

Author

With that said, using the company’s $54.1 billion market cap, $14.2 billion in expected 2023 net debt, and $580 million in pension-related liabilities, we’re dealing with a $68.9 billion enterprise value.

That’s roughly 10.8x next year’s expected EBITDA of $6.4 billion. That’s a good valuation as it erased the entire post-2020 surge in the company’s valuation. The same goes for the implied free cash flow yield of 5.5%, which would be the highest number in more than 10 years. In other words, investors aren’t overpaying for EBITDA and free cash flow.

With that said, there are lasting headwinds related to supply chains.

The Supply Chain/Labor Headwind

One of the biggest headwinds facing railroads and their investors is labor and supply chain problems. As FreightWaves wrote in a recent article titled:

“America’s freight railroads are incredibly chaotic right now”

The article mentions that despite earning a six-figure salary, railroads have a very hard time recruiting new, qualified talent. What used to be an 8 or 9-hour workday is now becoming 12-hour shifts with long hours of waiting around for transportation or relief crews with some days lasting up to 19 hours.

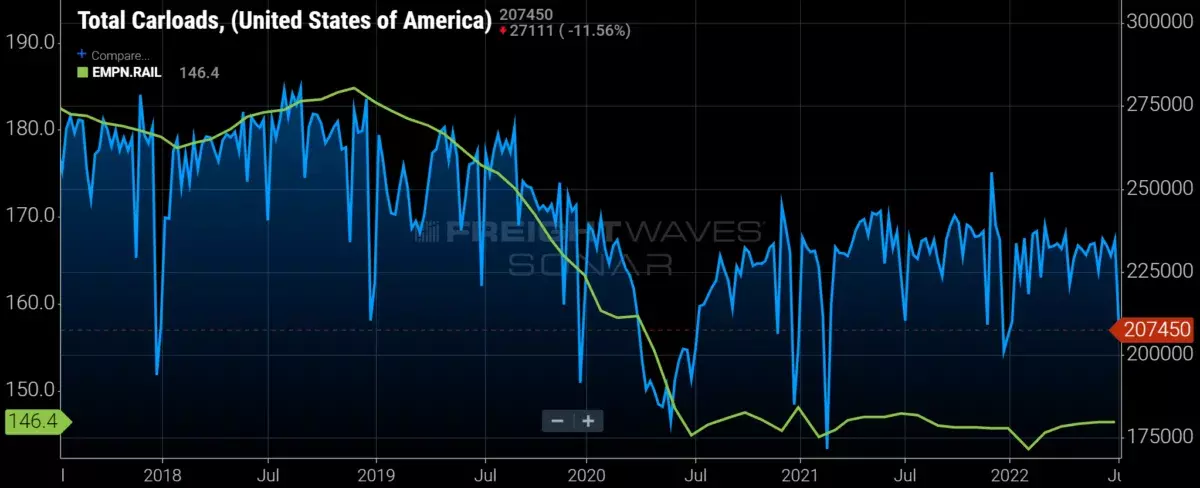

Longtime rail analyst Tony Hatch said there’s something unusual going on with rail headcounts right now. Typically, crews and carloads move in lockstep, with railroaders able to hire up or down in times of increased or decreased traffic. Now, those companies haven’t been able to keep up. Carloads have steadily increased since mid-2020, but employment hasn’t matched that.

FreightWaves

Now, President Biden is tasked with appointing a “Presidential Emergency Board” to work on new labor contracts. If he fails to get meaningful negotiating going, the US rail industry could see the first nationwide strike since 1992. Besides that, this is bad news for rails, it’s a worst-case scenario for already broken supply chains.

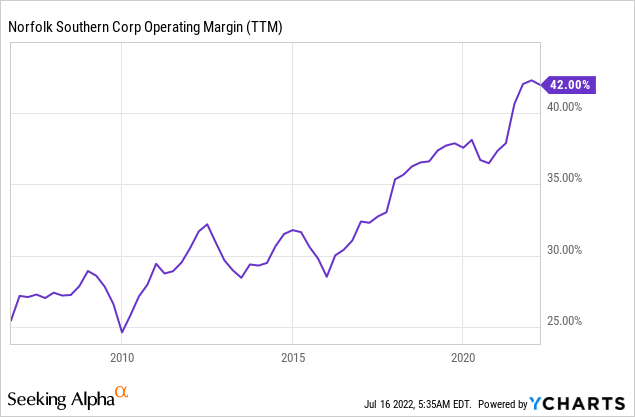

One of the reasons why railroads did so well in the past 12 years is because of something called precision-scheduled railroading (“PSR”). According to FreightWaves:

PSR means that railroads have set times for when they pick up cargo from their customers, not unlike a commercial airline. Before, railroads would wait for the cargo.

There are endless implications that come from this system, some of which my colleague Mike Baudendistel delved into in this 2020 article. PSR allowed railroads to reduce capital budgets, slash headcount and merge internal operations with glee. But its biggest boon to the railroaders was how much it boosted their cred on Wall Street, creating billions in shareholder value.

Between 2006 and 2022, NSC operating margins have soared from roughly 27% to more than 40%. This is caused by PSR among other things.

I’m not saying this trend is going to reverse – it won’t – but the pressure is rising. After all, finding new trainees is hard and the government (i.e., the STB) is going ballistic when it comes to addressing railroad issues.

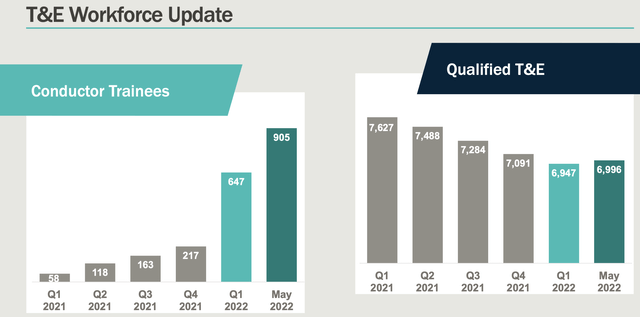

Norfolk, for example, saw a steep decline in qualified labor, even after the pandemic lockdowns. NSC started this year with fewer than 7 thousand qualified T&E. As a result, the company is accelerating hiring. It had 905 conductor trainees as of May 2022. However, it needs to be seen how successful the hiring process will turn out to be.

Norfolk Southern

Personally, I’m not worried. However, this is far from perfect. As I approach these investments with a business-ownership mentality, I assume that railroads will not be able to maintain the steep increase in profitability they showed prior to the pandemic. Supply chains are still a mess (regardless of railroad operations) as lockdowns and ongoing difficulties across countries have made shipments unreliable. Railroads will have to deal with that while addressing customer needs at home. If the employee count rises, we’ll likely see shorter trains and less efficient KPIs (key performance indicators).

Nonetheless, none of the good news I’ve given you in this article is void. Railroads will remain great sources of free cash flow and long-term growth is looking good. The situation in trucking is even worse. Labor, fuel, and environmental regulations make railroads way more attractive.

On top of that, NSC is rather cheap at current levels. It makes incorporating these headwinds a lot more feasible.

Takeaway

I bought more Norfolk Southern. The company is one of three railroads in my portfolio and one of my all-time favorite investments. This railroad gives me industrial exposure as it covers more than half of the US economy. It benefits from its ability to generate high free cash flow used for aggressive buybacks and satisfying dividend hikes.

Thanks to the most recent sell-off, Norfolk has reached a favorable valuation. While I cannot guarantee that the market has bottomed, I bought more as the yield is now close to 2.2%.

Unfortunately, headwinds exist. On top of economic uncertainty, we’re dealing with a new era of railroad operating efficiency. All major Class I railroads will have to figure out how to boost hiring efforts and customer satisfaction without damaging operating profitability.

While I believe that this will result in weaker margin growth in the year(s) ahead, it does not keep me from buying more railroads – especially not at these prices.

In the weeks and months ahead, we will get to discuss these developments as well as quarterly results and the impact of changing economic growth on Norfolk and its peers.

(Dis)agree? Let me know in the comments!

Be the first to comment