Sakorn Sukkasemsakorn

Westport Fuel Systems Inc. (NASDAQ:WPRT) recently reported successful tests of H2 HPDI applications with a well-known corporation. As a result, in my view, the demand for the company’s components will likely increase. I also believe that WPRT has a significant amount of cash, which management could use to make new acquisitions as well as to enhance revenue generation. Putting everything together, my discounted cash flow models reported a valuation that appears more significant than the current market price. In my view, WPRT is a stock to follow.

Westport Fuel Systems

Westport Fuel Systems is a supplier of advanced fuel delivery components which include low-carbon fuels like natural gas, propane, or hydrogen to the global transportation industry.

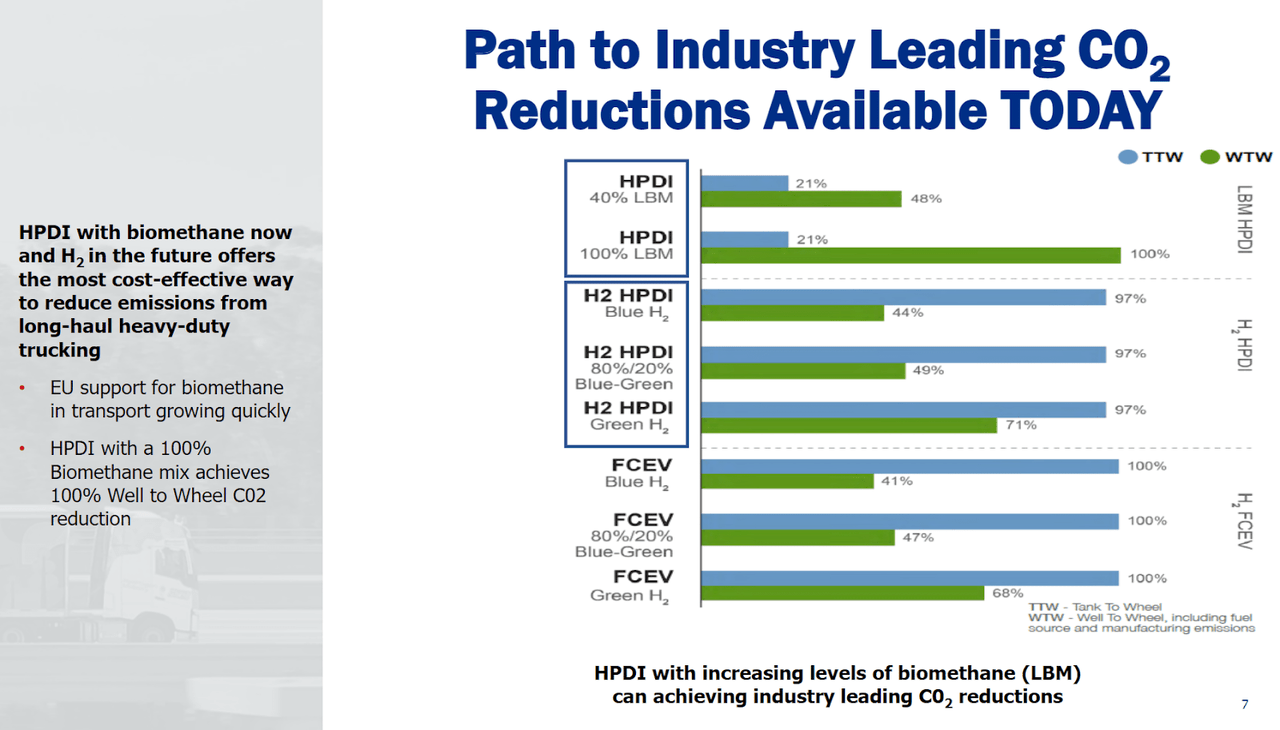

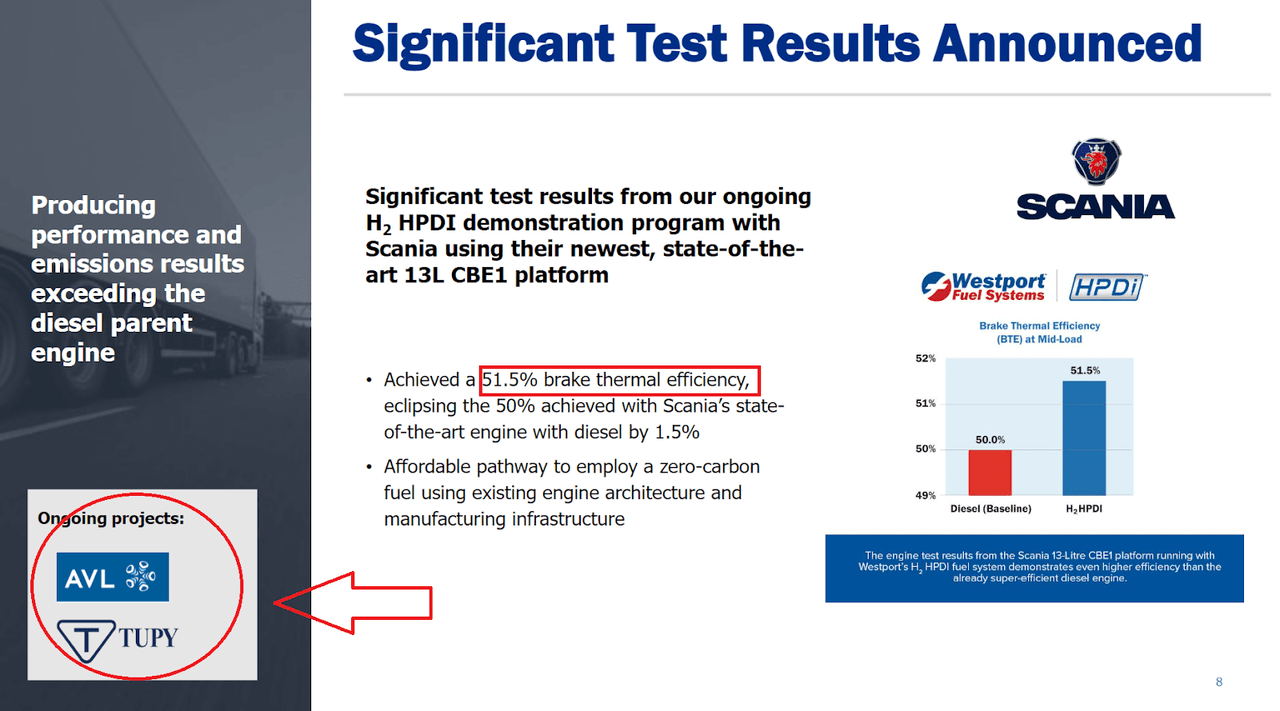

I believe that it is worth having a look at WPRT because of the new tests announced with Scania. The company’s H2 HPDI applications showed impressive performance with a peak Brake Thermal Efficiency of 51.5% complemented by 48.7% at road load conditions.

Source: Quarterly Presentation

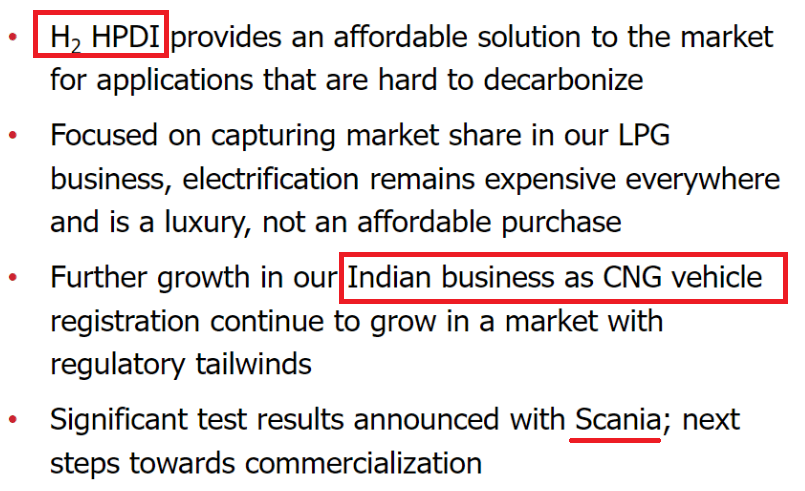

With that about the recent tests announced with Scania, it is worth mentioning that WPRT has two more ongoing projects. Successful information about the results of these new projects would most likely move the share price up.

Source: Quarterly Presentation

Besides, management recently showed significant optimism with respect to the company’s operations in India. In my view, further internationalization of the business model will likely bring more revenue growth generation.

Source: Quarterly Presentation

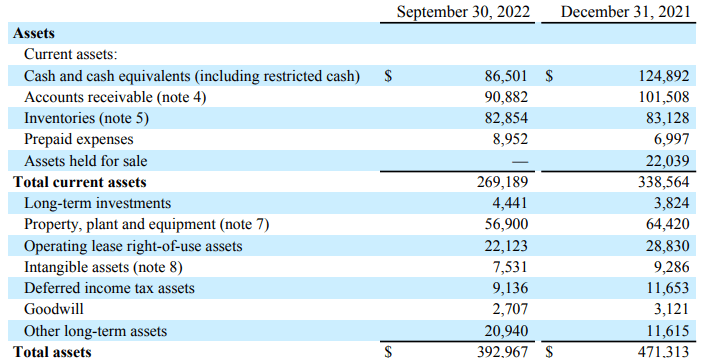

Balance Sheet: WPRT Continues to Report A Significant Amount Of Cash

As of September 30, 2022, cash was equal to $86 million, with property, plant and equipment worth $56 million, and total assets worth $392 million. Even considering the decline in cash and liquidity, WPRT appears to have sufficient money to conduct further projects and tests. In my view, the balance sheet looks quite stable.

Source: Quarterly Presentation

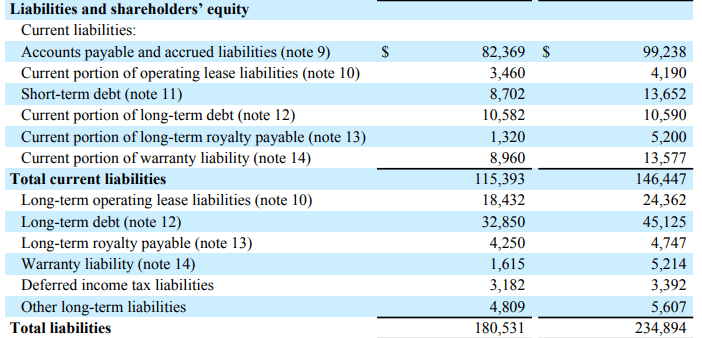

WPRT also reports short-term debt worth $8.7 million and long term debt and royalties payable worth close to $49 million. With these figures, the net debt would stand at -$29 million.

Source: Quarterly Presentation

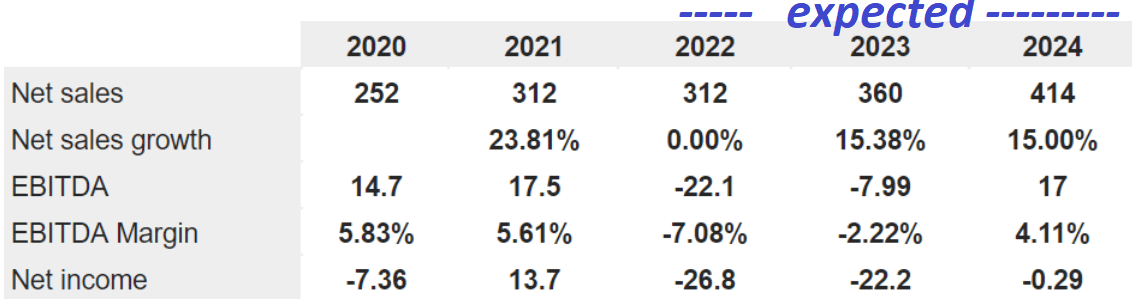

Analysts See Double Digit Sales Growth In 2023 And 2024 Along With Growing Free Cash Flow

For 2024, analysts expect net sales of $414 million with a growth of net sales of 15%. In addition to an EBITDA of $17 million with an EBITDA margin of 4.11%, the net income would be -$0.29 million. Finally, estimates also include an increase in the free cash flow. From 2021 to 2024, FCF is expected to grow from -$58 million to -$8 million.

Source: marketscreener.com

Source: marketscreener.com

More Products, More Efficiency, And Emerging Markets Could Bring The Fair Price To $1.41 Per Share

Under normal conditions, I believe that WPRT’s diversified portfolio of technology and products will likely bring revenue growth. Besides, if management continues to commercialize more products, or designs new components, more clients may be interested in WPRT’s portfolio. Finally, I also believe that economies of scale would enhance WPRT’s FCF margins.

If we include that management intends to unlock new and emerging markets like India, I would be expecting an increase in the company’s target markets. If we also include an eventual increase in efficiency thanks to new projects, I believe that the demand for WPRT’s products will likely increase.

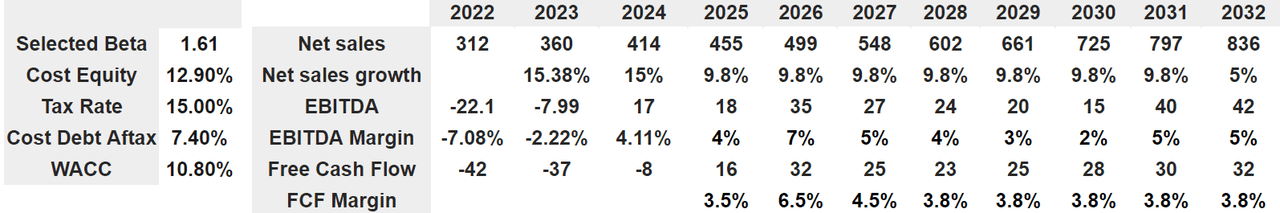

From 2022 to 2028, the global alternative fuel market size is expected to grow at a CAGR of close to 9.8%. Under normal circumstances, I believe that WPRT may grow at close to the same sales growth.

Global Alternative Fuel market size is estimated to be worth US$ 118030 million in 2022 and is forecast to a readjusted size of US$ 206480 million by 2028 with a CAGR of 9.8% during the forecast period 2022-2028. Source: Alternative Fuel Market Size

With the previous figures in mind, I assumed, by 2032, net sales of $836 million with a net sales growth of 5%. Also, I assumed 2032 EBITDA of $42 million with EBITDA margin of 5%. In addition, free cash flow is estimated at $32 million with an FCF margin of 3.8%. I used a beta of 1.61x, which resulted in the cost of equity of 12.90%, cost of debt after tax of 7.40%, and a WACC of 10.80%.

Source: Bersit’s DCF Model

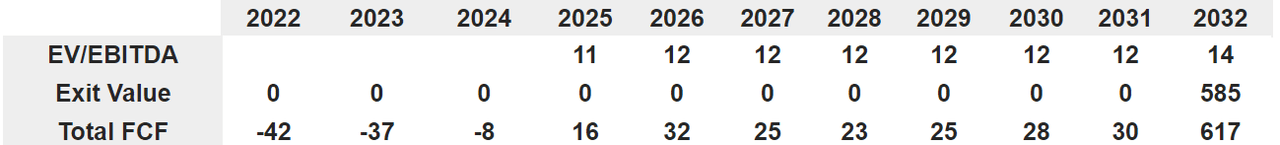

With EV/EBITDA close to 14x, I obtained an exit value of $585 million with a total FCF of $617 million in 2032. Note that I am assuming 2025 free cash flow close to $16 million and 2031 FCF of $30 million. I believe that my figures are quite realistic in this particular case.

Source: Bersit’s DCF Model

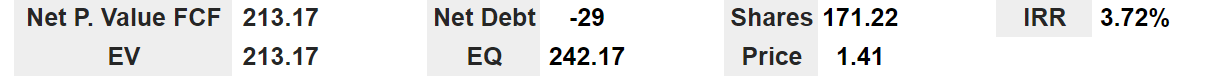

The previous figures imply an enterprise value of $213 million, an equity valuation of $242 million, and a fair price of $1.41 per share. The internal rate of return would be close to 3%-4%.

Source: Bersit’s DCF Model

My Best Case Scenario

I saw several acquisitions executed by WPRT, so I believe that management has expertise in the M&A markets. With cash in hand, I believe that the company could obtain significant inorganic growth, which may be a catalyst for both revenue and free cash flow.

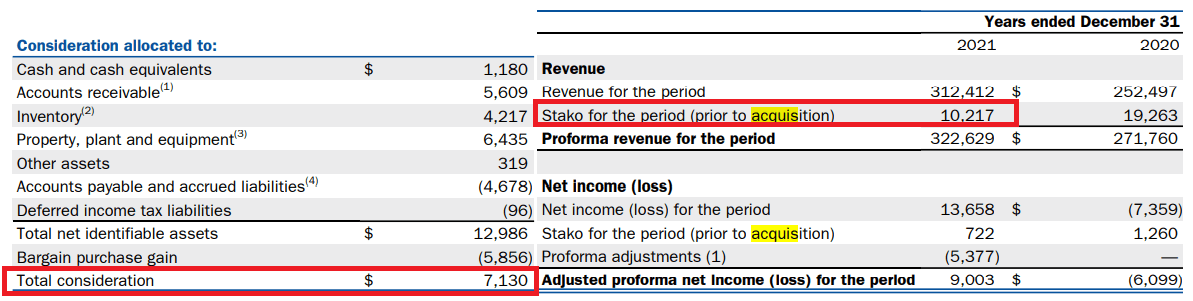

I studied a bit the acquisition of Stako, which was made, in my view, at an attractive price. The total consideration was close to 0.7x 2021 revenue. I believe that new acquisitions like that of Stako will likely generate further interests from investors.

On May 28, 2021, the company entered into an agreement to acquire all of the issued and outstanding shares of Stako from Worthington Industries Inc. for a total purchase price of $7,130. The transaction was completed on May 30, 2021. Source: Annual Report

Source: Annual Report

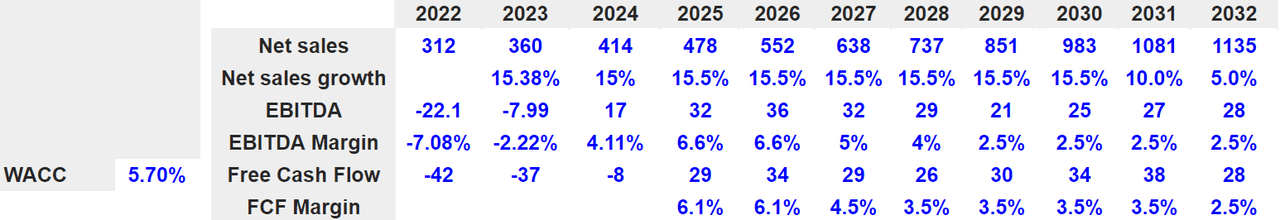

In the best case, I foresee 2032 net sales of $1.135 billion together with a net sales growth of 5%, in addition to an EBITDA of $28 million and an EBITDA margin of 2.5%. The free cash flow would be $28 million with a FCF margin of 2.5%. Finally, under this case, I used WACC of 5.70%, which is lower than that in the base case scenario. Note that better figures would most likely bring demand for the stock, which may lower the cost of equity.

Source: Bersit’s DCF Model

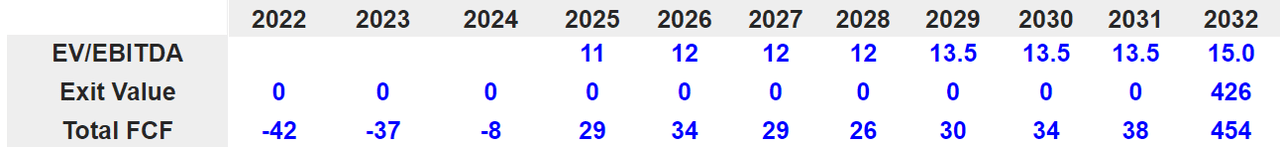

If we also assume an EV/EBITDA of 15x, the exit value would stand at $426 million with FCF of $454 million. The free cash flow would accelerate a bit more than that in the previous case scenario. Free cash flow would grow from $29 million in 2025 to close to $38 million in 2031.

Source: Bersit’s DCF Model

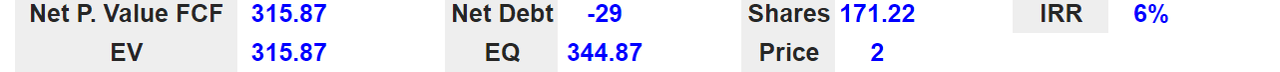

The previous figures imply an enterprise value close to $315 million, equity valuation around $345 million, and a fair price of $2 per share. The internal rate of return would remain at close to 5.5%.

Source: Bersit’s DCF Model

Risks Would Include Failed Payments From Customers

Among the risks that may lower future free cash flow, there is the risk from customer receivables. Management noted clearly in the annual report that this risk must be taken seriously. In my view, if clients can’t pay or don’t pay for whatever reason, WPRT may have to reduce its balance sheet, which may lead to lower stock valuation.

As at December 31, 2021, 83% of accounts receivable relates to customer receivables. In order to minimize the risk of loss for customer receivables, the Company’s extension of credit to customers involves review and approval by senior management as well as progress payments as contracts are executed. Source: Annual Report

I also believe that supply chain challenges and inflation in the semiconductors could lower the company’s production levels. As a result, investors making investments in WPRT would most likely experience lower net revenue growth and lower free cash flow growth. In sum, the stock price would most likely decline.

Although sales orders and production levels for trucks equipped with HPDI 2.0 fuel systems increased significantly, the risk of production delays due to supply chain challenges remain. Further, we are experiencing supply chain challenges and high price inflation sourcing semiconductors, raw materials and parts for our other OEM and IAM businesses. Source: Annual Report

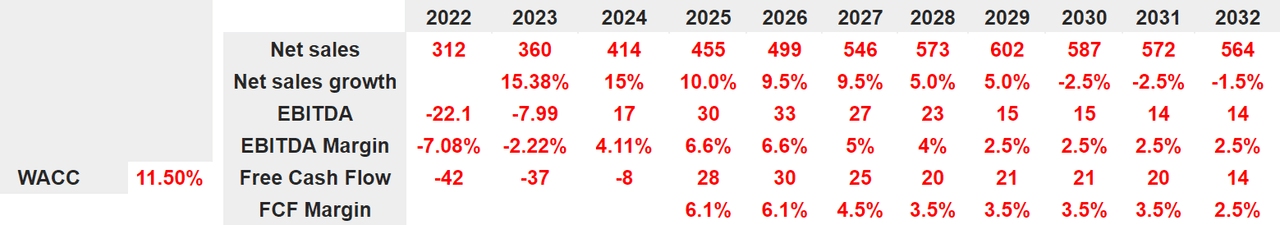

In the worst case, I foresee a net sales of $564 million and a net sales growth of -1.5%, together with an EBITDA of $14 million with its EBITDA margin of 2.5%. In addition to a free cash flow of $14 million and its FCF margin of 2.5%, I anticipate a WACC of 11.50%.

Source: Bersit’s DCF Model

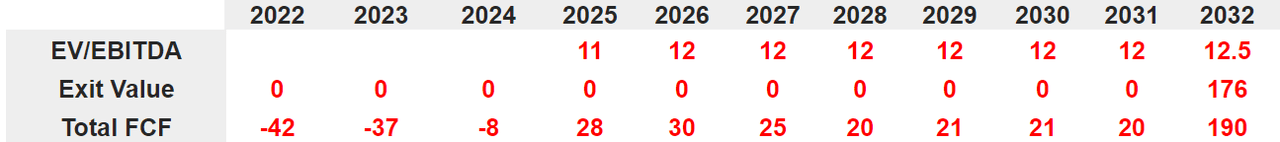

An EV/EBITDA of $12.5 million is estimated with an exit value of $176 million. My results would also include a total FCF of $190 million in 2032 with FCF around $28 million and $20 million.

Source: Bersit’s DCF Model

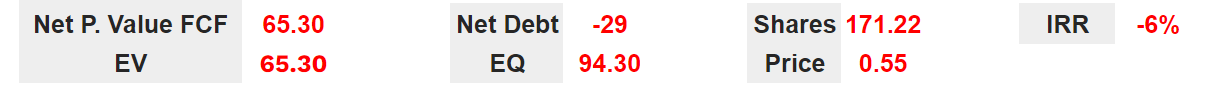

Finally, I also obtained an implied enterprise value of $65.3 million, equity of almost $95 million, and an implied valuation of $0.55 per share. The internal rate of return would stand at -6%.

Source: Bersit’s DCF Model

Takeaway

WPRT recently reported successful tests with Scania about the company’s H2 HPDI applications. In my view, the company may receive further attention in the coming future and more demand for these particular components. Management also reported a significant amount of liquidity, which could serve to acquire new targets. Considering previous acquisitions, in my view, WPRT does have enough expertise in the M&A markets to generate inorganic growth. I obviously see risks from supply chain issues and inflation. However, under my DCF models, WPRT appears undervalued.

Be the first to comment