Torsten Asmus

Introduction

Western Midstream Partners (NYSE:WES) restarted their distribution growth during 2021 and appeared set to accelerate in 2022, as my previous article predicted. Thankfully this was proven correct with the year seeing a more than 50% increase, thereby leaving their yield at a high 7.07%. Since almost a year has now elapsed after my previous analysis, it seems timely to provide a refreshed analysis, especially because a very high 12%+ distribution yield could be coming soon.

Executive Summary & Ratings

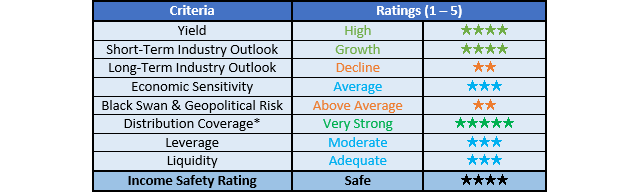

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

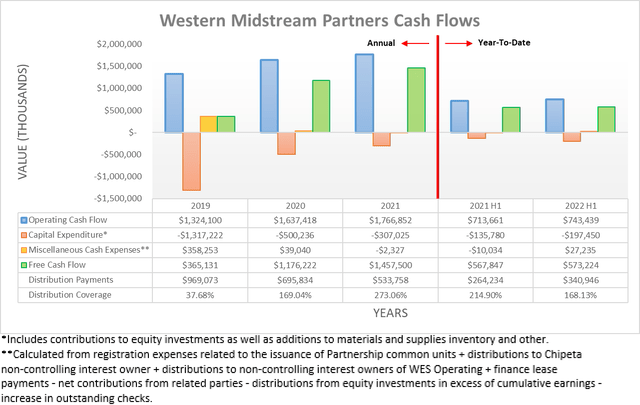

Following their surprisingly strong cash flow performance during 2020 that saw their operating cash flow increasing despite the pressure of the Covid-19 pandemic, thankfully, this was not merely a blip on the radar with their result from 2021 of $1.767b edging higher year-on-year versus their result of $1.637b from 2020. This continued into 2022, with the first half seeing operating cash flow climb 4.17% year-on-year to $743.4m versus their previous result of $713.7m during the first half of 2021. Despite already producing otherwise strong cash flow performance, it was actually held back by a sizeable working capital build during the first half of 2022 of $182.6m. If removed, it lifts their underlying result to $926m and thus a very impressive 24.42% higher year-on-year versus their previous equivalent result of $744.3m during the first half of 2021.

Even when including this working capital build, they were still able to generate $573.2m of free cash flow during the first half of 2022, which had zero issues covering their $340.9m of distribution payments. Although if removing its impact, the additional $182.6m would flow through to their free cash flow and thereby boost their distribution coverage to a very strong 222% and thus it seems that higher distributions could be coming soon, as per the commentary from management included below.

“Considering our debt-to-EBITDA leverage ratio is already below our year-end net leverage threshold of 3.4 times gives us financial flexibility to evaluate other opportunities to return additional capital to our unitholders whether through additional buybacks or an enhanced distribution.”

-Western Midstream Partners Q2 2022 Conference Call.

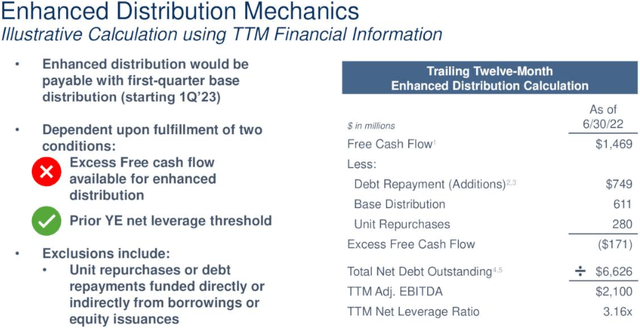

Very interestingly, thanks to their strong free cash flow, they have more than reached their leverage target, which opens the door for higher unitholder returns and in particular, their new enhanced distributions. In effect, their enhanced distributions are essentially what is more commonly referred to as variable distributions that are calculated from excess free cash flow, as the slide included below displays.

Western Midstream Partners Second Quarter Of 2022 Results Presentation

Generally speaking, their approach is straight forward with their excess free cash flow determining any enhanced distributions, which thus far was a negative $171m, and as a result, they have not declared any of these distributions. Rather oddly, instead of only subtracting their base distributions and unit buybacks from their free cash flow, they calculate excess free cash flow by also subtracting their debt repayments, which is not too common, speaking from my experience.

If they were to cease debt repayments going forwards, which is realistic given they are already below their leverage target, their excess free cash flow from the last trailing twelve months would see a $749m boost, thereby lifting it from negative $171m to positive $578m. Since their current market capitalization is approximately $11b, if they were to direct another $578m towards distributions, it would equate to a circa 5% yield on top of their already high 7% yield, thereby making for a very high circa 12% yield on current cost, which still sees the same $280m directed towards unit buybacks.

Obviously, their cash flow performance may vary going forwards but the risk of prolonged weak results does not appear significant given their strong history and solid outlook on the back of the global energy shortage, which stands to help oil and gas producers in the United States and therefore boost demand for their midstream operations. Since they are already below their leverage target, I would have hoped this situation to be a simple open-and-shut case with clear guidance for higher distributions but alas, this was not necessarily the case. Even though their enhanced distributions certainly appear on the table, their language was rather ambiguous when asked during their second quarter of 2022 results conference call, as per the commentary from management included below.

“The decision to pay an enhanced distribution will partially depend on our financial performance in the second half of 2022.”

“Said differently, we only intend for permanent reductions in outstanding debt and equity in the aggregate to be considered in the enhanced distribution calculation.”

“And we’d certainly, like to be in a place to be able to pay an enhanced distribution.”

-Western Midstream Partners Q2 2022 Conference Call (previously linked).

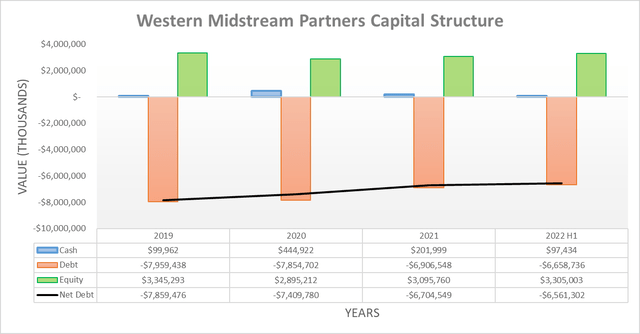

Even though their sizeable working capital build during the first half of 2022 hindered their free cash flow, their otherwise strong cash flow performance still kept their net debt trending lower with its latest level at $6.561b. Apart from marking a modest improvement versus its level of $6.705b at the end of 2021, it also makes for a large improvement since they embarked on deleveraging following the end of 2019 when their net debt peaked at $7.859b. When looking ahead, their net debt is unlikely to decrease significantly since they have already more than reached their leverage target, although this depends upon whether management follows through with their enhanced distributions.

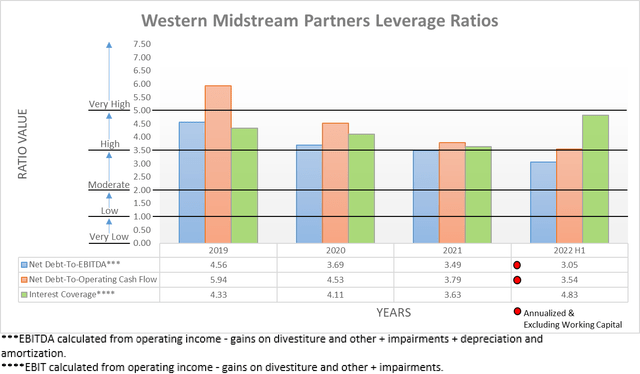

Quite unsurprisingly, their stronger financial performance and lower net debt have translated into lower leverage with their net debt-to-EBITDA down to 3.05 and net debt-to-operating cash flow down to 3.54. Unlike in the past, the former is now easily within the moderate territory of between 2.01 and 3.50, whilst the latter is only slightly above the upper threshold, but given their solid outlook, it should drop beneath this point before the year ends. Similar to their net debt, the extent they continue deleveraging will heavily depend upon whether they provide their enhanced distributions or not, although given they are already below their leverage target and thus have no requirement to deleverage, it seems more likely than not that higher distributions are coming soon.

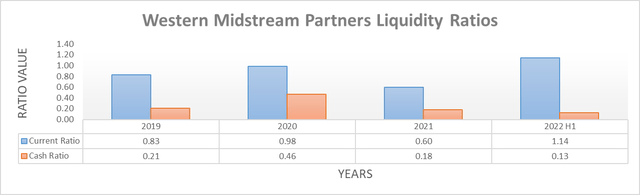

Upon turning to their liquidity, thankfully, it also houses no issues with their current ratio of 1.14 and cash ratio of 0.13 supporting an adequate rating. When looking ahead, their strong free cash flow should continue providing sufficient cash to run their partnership, but if required, they retain a further $1.7b of availability under their credit facility, which recently had its maturity extended until February 2026. Even though they face almost $2b of debt maturities during the short to medium-term, as the table included below displays, these should not prove problematic to refinance as necessary given their solid outlook and only moderate leverage.

Western Midstream Partners Second Quarter Of 2022 Results Presentation

Conclusion

It would have been preferable to see clear guidance around their enhanced distributions, especially considering they are already below their leverage target and thus can easily safely boost their unitholder returns. At the end of the day, it seems more likely than not that management will follow through with higher distributions in the coming quarters, which could provide a very high double-digit yield on current cost and thus following this analysis, I believe that upgrading my buy rating to a strong buy rating is now appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Western Midstream Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment