Morsa Images/DigitalVision via Getty Images

Although many investors may view the medical field as being highly technology-oriented, namely between the complex devices produced and the drugs cooked up that are used to treat patients, not all aspects of the medical space are as complicated to understand. One company that focuses on producing a very valuable portfolio of goods for the medical space that are, by definition, much more simplistic, is West Pharmaceutical Services (NYSE:WST). Management has demonstrated the company’s quality and, in all likelihood, the business would do well for shareholders in the long run. But when you factor in how shares are priced today, the company does look to be a bit expansive. So while I have no doubt that the company will continue to expand and create value for its investors, I do think that the premium demanded by the market in order to participate in this upside might not be worth it to many investors. For now, that has led me to rate the business a ‘hold’, indicating my belief that the firm’s returns are more likely to match the broader market’s returns moving forward.

A unique corner of the medical industry

According to the management team at West Pharmaceutical Services, the company operates as a manufacturer of a variety of integrated containment and delivery systems that are used for injectable drugs and other health care products. The company’s line of products is vast, requiring some detail in order to grasp. To best understand the company, it would be helpful to break down its two different segments.

The first and largest of the company’s segments is referred to as Proprietary Products. Through this segment, the company offers proprietary packaging, containment, and drug delivery products for its customers. Its packaging products include stoppers and seals for injectable packaging systems, while its product portfolio includes syringe and cartridge components and other technologies associated with administering drugs. The segment also produces films, coatings, washing, vision inspection, and sterilization processes and services for its customers.

The company also provides drug containment solutions like Crystal Zenith, which is a cyclic olefin polymer that can take the form of vials, syringes, and cartridges. The company’s self-injection devices are designed to address the needs of customers for at-home delivery of injectable therapies. Outside of the physical product, the company also provides various solutions like analytical lab services, pre-approval primary packaging support and engineering development, regulatory expertise, and after-sales technical support. During the company’s 2021 fiscal year, this segment was the company’s largest, accounting for 81.8% of revenue and 92.2% of profits.

The other, much smaller, segment is referred to as Contract-Manufactured Products. This unit focuses on the design, production, and automated assembly of complex devices, most of which are used for pharmaceutical, diagnostic, and medical device customers. The technologies used in this segment include multi-component molding, in-mold labeling, ultrasonic welding, clean room molding, and device assembly. The components and devices that this segment is responsible for producing are often used in surgical, diagnostic, injectable, and other delivery systems, as well as in a wide array of consumer products. Last year, this segment was responsible for 18.2% of the company’s revenue and for seven point 8% of its profits.

In terms of revenue composition, the company is fairly diverse. 45% of its revenue comes from the Americas. Another 45% is attributable to Europe, the Middle East, and Africa combined. And the remaining 10% comes from the Asia Pacific region. It would also be helpful to note how the company categorizes its products. For instance, 54% of the net sales the company generates come from high-value product components. 23% is attributable to standard packaging products, while high-value product delivery devices make up 5% of sales. The rest of its revenue is all combined together under the aforementioned Contract-Manufactured Products segment.

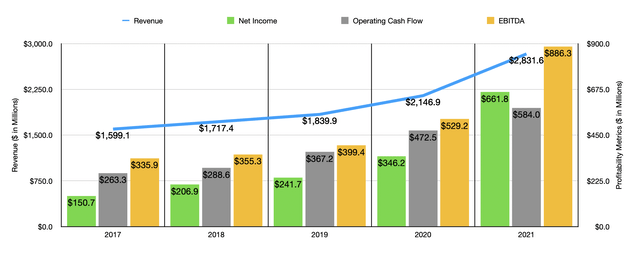

Over the past few years, the management team at West Pharmaceutical Services has done a really great job growing the company’s top line. Revenue increased in each of the past five years, climbing from $1.60 billion in 2017 to $2.83 billion last year. The largest increase came from 2020 to 2021, when revenue surged by 31.9%. For that year alone, the vast majority of the increase in sales came from its Proprietary Products segment, which saw revenue skyrocket by 40.6%. Some of this was due to foreign currency fluctuations. However, the company also benefited from an estimated $459 million in COVID-19-related activities associated with vaccines, antiviral treatments, and the treatment of underlying COVID-19 symptoms. That compared to just $99 million associated with those activities one year earlier.

On the bottom line, the picture has looked very similar. Net income rose from $150.7 million in 2017 to $346.2 million in 2020 before jumping to $661.8 million last year. Other profitability metrics followed a similar path. Operating cash flow went from $263.3 million to $584 million over the past five years, while EBITDA grew from $335.9 million to $886.3 million. Just as was the case with net income and revenue, much of this increase occurred between 2020 and 2021. Clearly, the demand for its medical products allowed shareholders to reap immense profits.

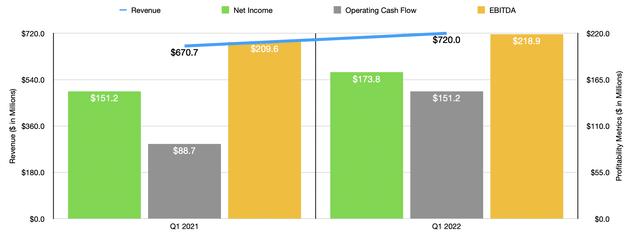

When it comes to the 2022 fiscal year, results so far have been encouraging. Revenue in the first quarter of the year totaled $720 million. That represents an increase of 7.4% compared to the $670.7 million generated just one year earlier. Just as was the case between 2020 and 2021, the heavy lifting for revenue so far this year has come from the company’s Proprietary Products segment. Growth there came in at 10.6%, despite foreign currency fluctuations hitting the business to the tune of $20.6 million. Without that, revenue would have grown by 14.4%. This increase in sales was driven largely by growth in the company’s high-value product offerings like NovaPure and Westar, with some of that growth offset by the recognition of $15 million in one-time fees due to COVID supply agreements recorded one year earlier. Meanwhile, revenue for the Contract-Manufactured Products segment contracted by 6.6%, with almost half of that attributed to foreign currency fluctuations.

From a profitability perspective, the picture continued to improve. Net income in the latest quarter came in at $173.8 million. That’s up from the $151.2 million reported for the first quarter of 2021. Operating cash flow jumped from $88.7 million to $151.2 million, while EBITDA increased from $209.6 million to $218.9 million. When it comes to the 2022 fiscal year as a whole, management expects top and bottom line performance to continue to improve. Sales should come in at between $3.05 billion and $3.075 billion. Earnings per share, meanwhile, should be between $9.30 and $9.45. At the midpoint, this would translate to net income of $694.5 million. No guidance was given when it came to other profitability metrics. But if we assume that those will increase at the same rate the earnings should, then we should anticipate operating cash flow of $612.9 million and EBITDA of $930.1 million.

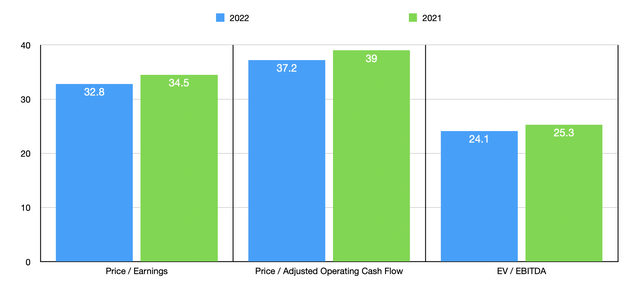

Using this data, I was able to value the company on a forward basis. The price-to-earnings multiple should be 32.8. That’s down from the 34.5 reading that we get using the 2021 results. The price to operating cash flow multiple, meanwhile, should drop from 39 last year to 37.2 this year. And the EV to EBITDA multiple should fall from 25.3 to 24.1. As part of my analysis, I also decided to compare the company to five similar firms. On a price-to-earnings basis, these companies range from a low of 23.7 to a high of 86.9. Two of the companies were cheaper than our prospect, while another one was tied with it. Using the price to operating cash flow approach, the range was from 14.2 to 32.6. In this case, West Pharmaceutical Services was the most expensive of the group. And when it comes to the EV to EBITDA approach, the range was from 14.5 to 28. In this scenario, four of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| West Pharmaceutical Services | 34.5 | 39.0 | 25.3 |

| Waters Corporation (WAT) | 29.7 | 28.8 | 21.3 |

| Avantor (AVTR) | 35.4 | 20.0 | 18.9 |

| Mettler-Toledo International (MTD) | 34.5 | 32.6 | 24.8 |

| PerkinElmer (PKI) | 23.7 | 14.2 | 14.5 |

| ICON Public Limited Company (ICLR) | 86.9 | 17.2 | 28.0 |

Takeaway

Based on the data provided, I have no doubt that West Pharmaceutical Services is a high-quality company that will almost certainly continue to perform well for the long run. Although the company benefited tremendously from the COVID-19 pandemic, it is still demonstrating growth past that thanks to its high-growth product lines. Profitability is robust and growing. All of this is great for investors. However, shares of the business do look rather pricey on both an absolute basis and relative to similar firms. Because of this, I cannot help but to rate the business a ‘hold’ at this time, though I don’t blame investors who would feel comfortable paying a premium for such a great company.

Be the first to comment